October 2025

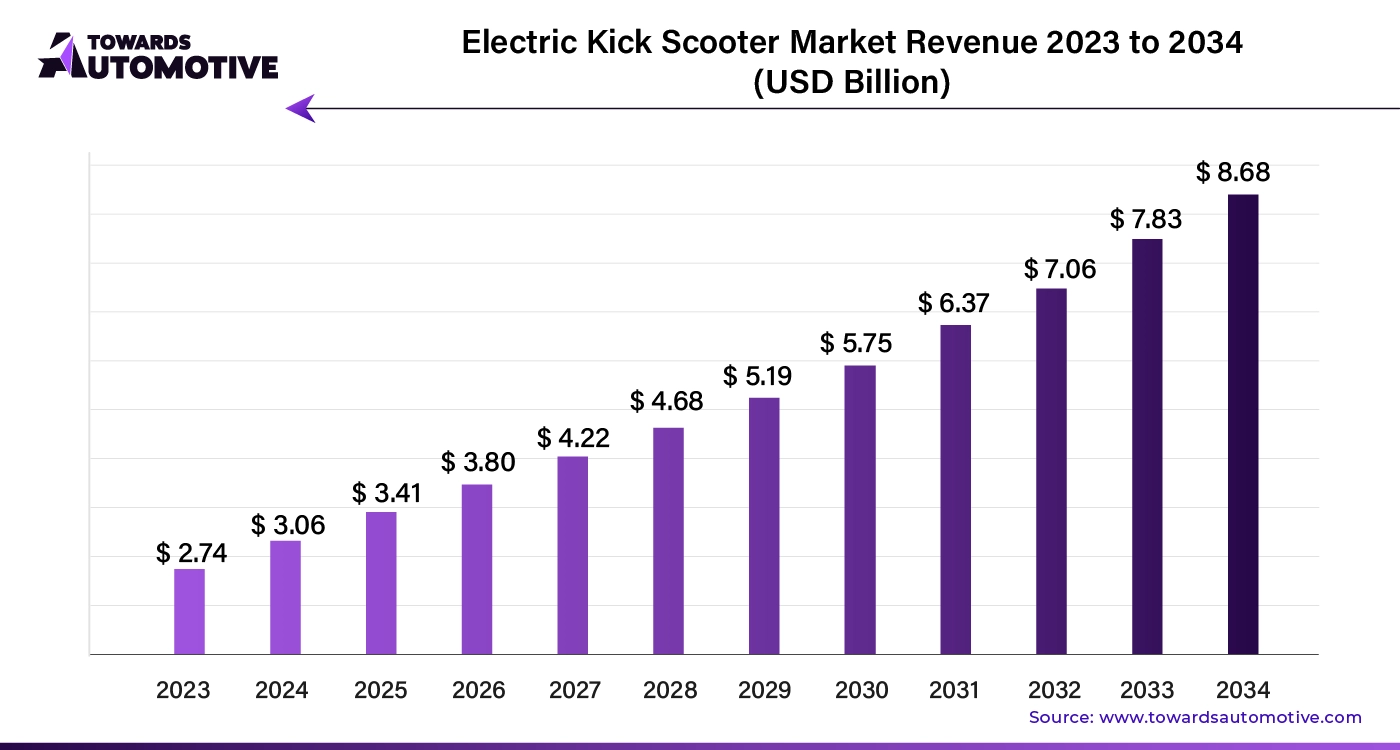

The electric kick scooter market is forecasted to expand from USD 3.41 billion in 2025 to USD 8.68 billion by 2034, growing at a CAGR of 11.60% from 2025 to 2034.

The electric kick scooter market has experienced rapid growth in recent years as a sudden shift towards affordable, clean, and convenient transportation globally. Moreover, several global governments' push for an eco-friendly environment has played a major role in the market expansion in recent years. Furthermore, several major automotive companies are seen in launching rental and sharing services, which are immensely contributing to industry growth. Consumers are heavily promoted the kick scooters through rental services, as per the recent industry observation.

The rise of electric kick scooters signals a broader societal shift toward shared and sustainable mobility, positively impacting the environment. This trend has fueled optimism among electric kick scooter companies about the industry's sustained growth and long-term viability, with expectations for continued expansion.

Sales Analysis of Electric Kick Scooters

Electric kick scooter sales have surged across various consumer segments, including students, professionals, and individuals seeking efficient last-mile connectivity. This widespread appeal and versatility underscore the growing demand for these mobility devices.

Strategic partnerships with e-commerce platforms and retail networks have broadened market access and strengthened distribution channels. This increased visibility has driven sales growth across different regions. The automotive market valued at USD 4,070.19 billion in 2023, is experiencing growth and is projected to surpass USD 6,678.28 billion by 2032, with a significant CAGR of over 5.66%.

Sales patterns for electric kick scooters often vary seasonally and regionally. Demand typically peaks during favorable weather and in densely populated urban areas, where high commuter traffic and supportive infrastructure enhance micro-mobility adoption.

Consumer education and awareness programs have effectively highlighted the benefits of electric kick scooters, such as cost savings, reduced environmental impact, and enhanced urban mobility. These initiatives have been crucial in boosting sales and fostering a positive perception of these innovative transportation solutions.

Technological advancements in battery efficiency and charging infrastructure are speeding up the adoption of electric kick scooters, offering longer battery life and greater convenience for users. The rise of smart connectivity features and IoT-enabled functionalities is expected to further boost sales in the mid-term. Additionally, collaborations between manufacturers and ride-sharing platforms are enhancing the availability of shared mobility services, driving market penetration and improving consumer access.

AI and machine learning are enhancing predictive maintenance and offering personalized user experiences, increasing the technological appeal of electric kick scooters for tech enthusiasts.

Artificial Intelligence (AI) is transforming the electric kick scooter market by driving innovation and growth. AI technologies enhance scooter performance through advanced analytics and predictive maintenance. By integrating AI, manufacturers can optimize scooter design for better battery life, improved safety features, and enhanced user experience.

AI-driven systems enable real-time monitoring of scooter conditions, detecting issues before they escalate. This proactive approach reduces downtime and maintenance costs, making scooters more reliable for users. AI also supports smart navigation, allowing scooters to avoid obstacles and adapt to changing traffic conditions, increasing rider safety.

Moreover, AI-powered data analytics offer insights into user behavior and preferences. This information helps manufacturers tailor products to meet market demands and identify new opportunities for growth. By leveraging AI, companies can streamline supply chains and improve inventory management, reducing costs and enhancing profitability.

The supply chain for electric kick scooters is pivotal in meeting growing consumer demand and ensuring market efficiency. It starts with the procurement of raw materials, including batteries, motors, and lightweight frames. Suppliers of these components must deliver high-quality materials on time to maintain production schedules and meet safety standards.

Manufacturers assemble these components into finished scooters, focusing on quality control to ensure durability and performance. They rely on a network of logistics partners to handle transportation from factories to distribution centers. Efficient inventory management at these centers is crucial to balance supply with fluctuating demand.

Retailers then distribute scooters to end-users, often leveraging e-commerce platforms for broader reach. After-sales services, including repairs and maintenance, are managed through dedicated service centers. Effective communication across all stages of the supply chain helps prevent delays and enhances customer satisfaction.

As the electric kick scooter market grows, supply chain optimization will be essential. Integrating advanced technologies and adopting sustainable practices will further drive efficiency, ensuring a reliable and responsive market.

The electric kick scooter market thrives on a dynamic ecosystem where key players drive innovation and growth. Major companies like Xiaomi, Segway-Ninebot, and Razor contribute significantly by introducing advanced features and enhancing user experience. Xiaomi leads with high-performance models, integrating smart technologies for improved safety and efficiency. Segway-Ninebot focuses on robust, reliable scooters that appeal to both personal and commercial users, often incorporating AI for better control and navigation.

Razor, known for its durable and affordable options, attracts budget-conscious consumers and youth markets. Meanwhile, companies like Bird and Lime are reshaping urban mobility with their shared electric scooter services, expanding market reach and adoption. These firms invest in infrastructure and technology to ensure a seamless integration of scooters into urban transit systems.

In addition, battery and component suppliers like LG Chem and Panasonic are crucial, providing high-quality batteries that ensure long-range and safety. Their advancements in battery technology help improve performance and reduce charging times. Together, these players form a robust ecosystem, fostering innovation and driving the growth of the electric kick scooter market.

How did the lithium-ion battery Segment Dominate the Market in 2024?

The lithium-ion battery segment held the largest share of the market in 2024, due to its unique offerings such as longer battery capacity, faster charging, and energy efficiency. Moreover, having the lightweight, the lithium-ion batteries gained immense industry attention in recent years. Furthermore, individuals are actively preferring lithium-ion batteries due to their low maintenance and better performance in recent years, as per the observation.

The lead acid batteries segment is expected to grow at a notable rate during the predicted timeframe owing to having cost-effectiveness. Furthermore, these batteries are likely to gain market share in the developing or cost-effective market, where cheaper scooters are the priority. Also, having qualities such as easy recycling and local manufacturing suitability, the lead acid batteries are expected to gain a wide consumer base in the coming years.

Why does the Hub Motors Segment Dominate the Market by Drive Type?

The hub motor segment held the largest share of the electric kick scooter market in 2024, due to the hub motor is considered the reliable, simple, and cost-effective option in the current period. Furthermore, having a unique ability, such as direct integration to the wheel, which can eliminate the need for the belts and chains, the hub motor has gained immense industry trust in recent years.

On the other hand, the belt drive segment is expected to grow at a notable rate due to the increased need for smooth power transmission and the better performance on slopes. Also, the belt drive can create huge industry opportunities by having properties such as durability, where the chain system is not as effective as the belt drive. Moreover, individuals are actively seeking kick scooters that give them a comfortable and efficient ride over long distances, where the belt systems are expected to emerge as the reliable option in the coming years.

Why Did the Standard Segment Dominate the Market in 2024?

The standard segment dominated the market with the largest share in 2024, because it is simple, affordable, and suitable for everyday commuting. These scooters are designed for short to medium distances and are commonly used by students, office-goers, and casual riders. Their ease of use and minimal features make them lighter and more cost-effective, which appeals to a wide consumer base.

On the other hand, the folding segments are expected to grow at a notable rate future because of rising demand for portability and convenience. These scooters are ideal for commuters who use multiple modes of transport, such as buses or trains, as they can be folded and carried easily. Urban residents living in small apartments also prefer folding models due to their compact storage benefits.

The personal segment held the largest share of the electric kick scooter market in 2024 because most electric kick scooters are used by individuals for commuting, leisure, or short-distance travel. Rising urban congestion and increasing fuel costs have pushed people toward affordable personal transportation options. Scooters are easy to ride, require no license in many regions, and are ideal for last-mile connectivity. Students, office workers, and urban dwellers prefer them for their convenience and cost savings.

The commercial segments are expected to grow at a notable rate due to the growing trend of scooter-sharing services and last-mile delivery solutions. Companies are investing in fleets of electric scooters to reduce operational costs and environmental impact. Delivery services, tourism operators, and ride-share platforms see electric kick scooters as a cost-effective and sustainable option.

United States: Leading Expansion

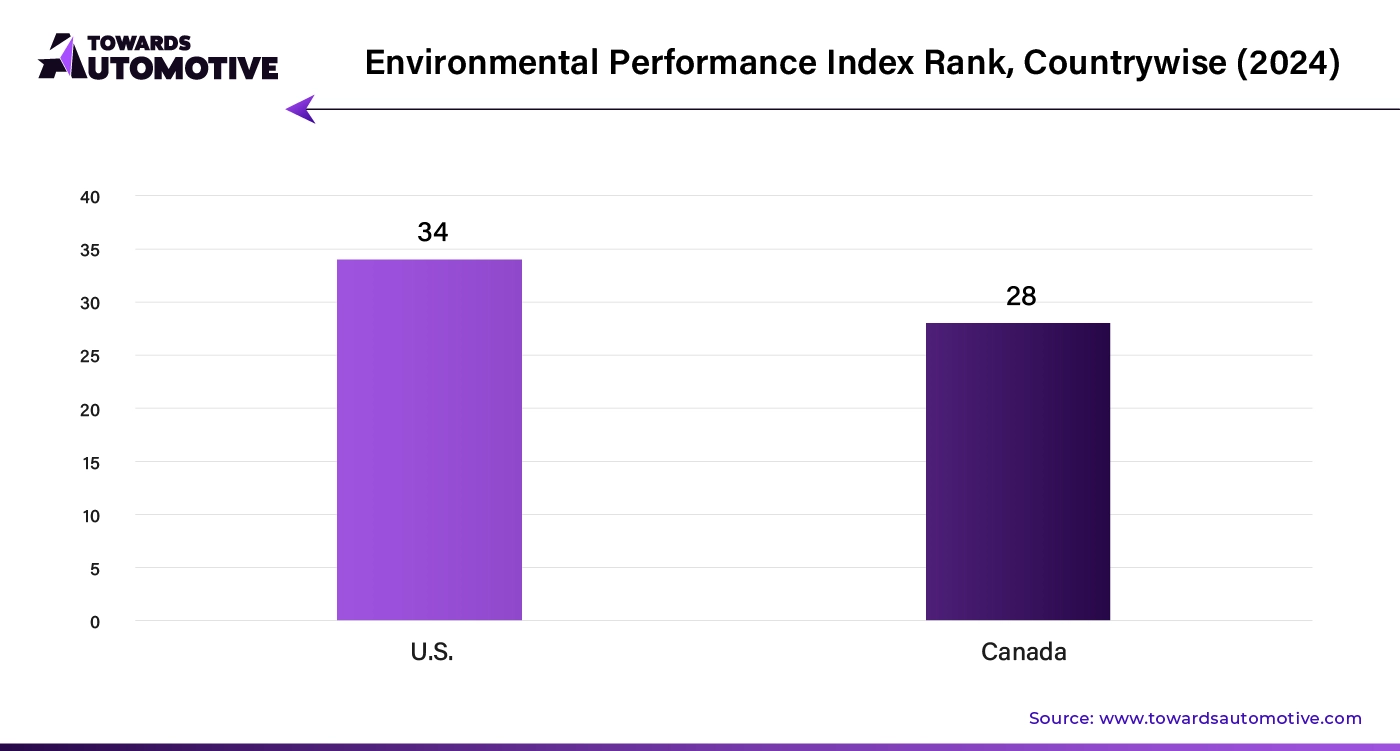

The electric kick scooter market in the United States is projected to grow at a CAGR of 11.30% from 2023 to 2033. This notable increase reflects a shift towards eco-friendly commuting options, driven by a tech-savvy and environmentally conscious population.

As cities expand, the demand for convenient transportation solutions rises, boosting the development of innovative scooter-sharing programs. Supportive policies further enhance the market by nurturing the growth of electric kick scooter startups. Additionally, advancements in battery technology are addressing consumer needs and driving market growth.

Canada: Strong Commitment to Sustainable Mobility

Canada is expected to experience a CAGR of 10.70% in its electric kick scooter market from 2023 to 2033. This growth demonstrates the country’s dedication to green urban solutions amid ongoing urban expansion.

Smart city initiatives are increasing the accessibility of electric kick scooters, promoting them as a sustainable transportation choice. Environmental policies incentivize the use of emission-reducing vehicles, creating a supportive market environment. The rising population of millennials seeking eco-friendly options is also contributing to market growth. Collaborative efforts between public and private sectors are essential in fostering a dynamic market for electric kick scooters.

Germany, France, and the United Kingdom: Key Players

In Europe, Germany, France, and the United Kingdom emerge as major contributors to the electric kick scooter market. These countries lead in market share and growth, supported by stringent environmental regulations and infrastructure development.

China and India: Rapid Growth

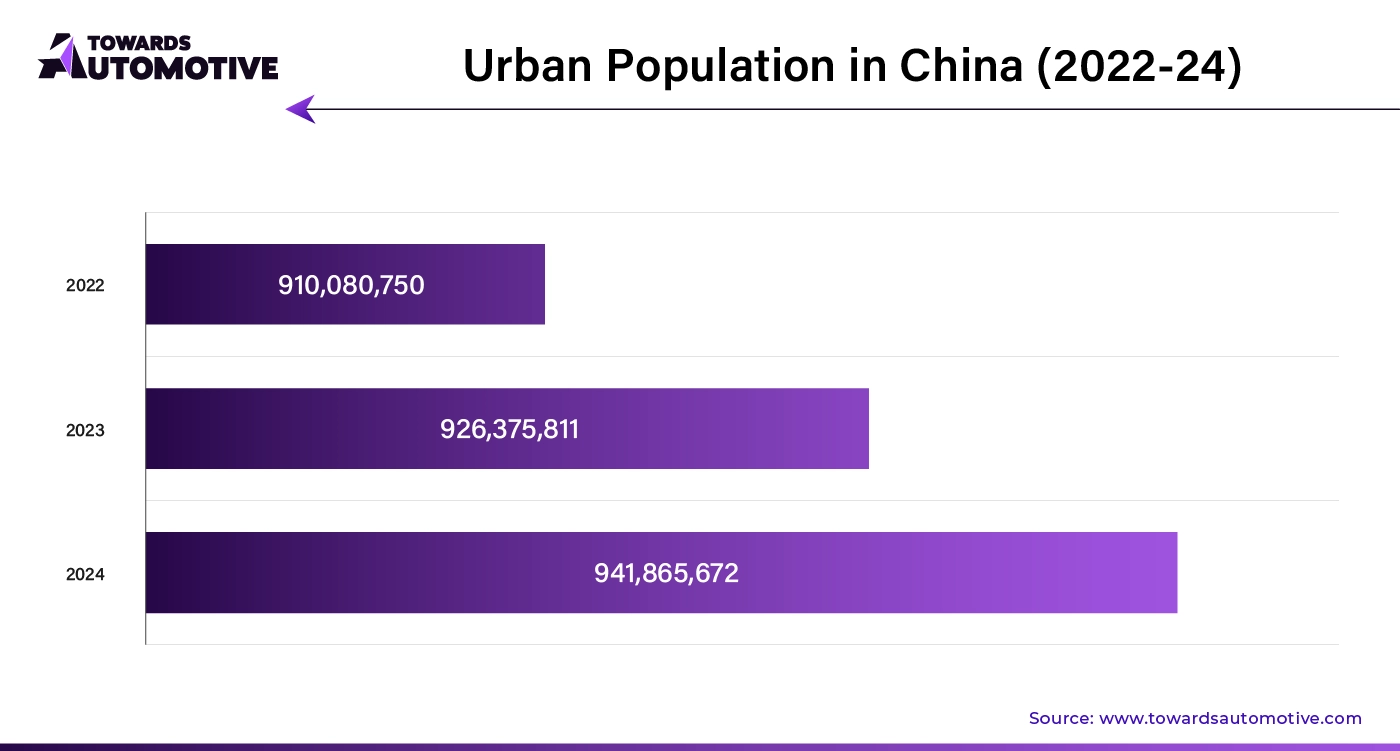

In the Asia Pacific region, China and India are experiencing the fastest growth in the electric kick scooter market. China is driving rapid expansion with its large urban population and favorable government policies, while India's market is expanding due to increased urbanization and a rising preference for sustainable transportation solutions.

Europe Electric Kick Scooter Industry: Germany Leads, France Grows Fastest

In the European electric kick scooter market, Germany is set for notable growth, with an estimated CAGR of 10.70% from 2023 to 2033. The country’s advanced urban infrastructure and strong emphasis on sustainability are driving this expansion. Germany’s dedication to eco-friendly transportation solutions is clear in its support for electric kick scooters as a crucial component of last-mile commuting. Innovations in battery technology and design further boost the sector’s growth, ensuring high-quality products for consumers.

France is experiencing the fastest growth in the region, with a projected CAGR of 10.90% during the same period. The country's leadership in sustainable urban development and green mobility solutions contributes to this rapid expansion. French cities are incorporating electric scooters into their transportation networks to meet evolving mobility demands. Government incentives and rising environmental awareness are accelerating the adoption of electric scooters, driving market penetration and technological progress.

Italy follows with a CAGR of 9.40%, reflecting its efforts to merge sustainable urban transportation with its rich cultural heritage. Italian cities are embracing electric scooters as part of their commitment to eco-friendly travel, supported by government initiatives and a growing preference for green mobility.

The United Kingdom also shows strong growth potential, with an anticipated CAGR of 10.10%. Strategic urban planning and government incentives are enhancing the market, aligning with increasing consumer demand for sustainable commuting solutions. The UK’s focus on improving scooter efficiency and design highlights its commitment to advancing eco-friendly transportation.

Spain, with a CAGR of 9.70%, is integrating electric scooters into its vibrant and culturally rich cities. Government policies and a rising preference for green transportation are driving market growth. Spain’s dedication to enhancing urban mobility through technological advancements underscores its role in the ongoing evolution of sustainable transport solutions.

China Takes the Lead in Asia Pacific Electric Kick Scooter Market with Highest Growth Rate

China is set to lead the electric kick scooter market in Asia Pacific, achieving a notable CAGR of 12.50% through 2033. This growth is driven by the country’s technological progress and a growing demand for eco-friendly transportation. As urban areas in China expand, the integration of electric kick scooters addresses transportation challenges while supporting sustainability goals. Government policies favoring green transportation further enhance market growth, establishing China as the top player in this sector.

India’s electric kick scooter market is projected to experience a CAGR of 9.60% from 2023 to 2033. This expansion is supported by rising urbanization and government initiatives aimed at reducing pollution. Increased awareness of electric kick scooters as an affordable commuting option contributes to steady market growth. Collaborative efforts between private and public sectors are key to fostering a supportive environment for this emerging market.

Japan follows with a robust CAGR of 11.10%, demonstrating its commitment to incorporating sustainable mobility solutions within its urban framework. Japan’s advancements in battery technology and product design underscore its role as a hub for innovation in the electric kick scooter industry.

The ASEAN region is also showing strong market potential with a CAGR of 10.10%. Regional cooperation and supportive policies are driving the adoption of electric kick scooters, promoting sustainable urban mobility across member countries.

Australia and New Zealand are seeing steady growth in the electric kick scooter market, with a CAGR of 9.50%. Urban development projects and government incentives are contributing to the increased adoption of electric kick scooters, reflecting a shift towards sustainable transportation in the region.

Battery Type

Drive Type

Product Type

End Use

By Region

October 2025

October 2025

September 2025

September 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us