December 2025

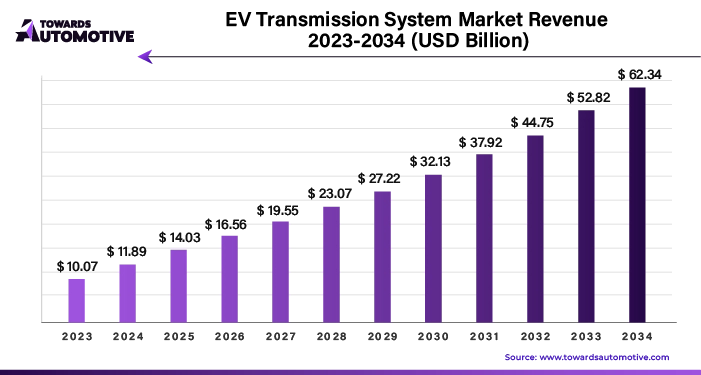

The EV transmission system market is projected to reach USD 62.34 billion by 2034, growing from USD 14.03 billion in 2025, at a CAGR of 18.02% during the forecast period from 2025 to 2034. The increasing demand for EVs in developed nations along with numerous government initiatives aimed at providing incentives to EV purchasers has boosted the market expansion.

Also, rise in number of EV startups coupled with rapid investment by automotive companies for developing advanced transmission systems is playing a vital role in shaping the industrial landscape. The research and development activities related to permanent magnet synchronous motors (PMSM) is expected to create ample growth opportunities for the market players in the upcoming days.

The EV transmission system market is a prominent branch of the automotive industry. This industry deals in development and distribution of EV transmission system in different parts of the world. There are numerous types of transmission system developed in this sector including single-speed transmission system, multi-speed transmission system, dual clutch transmission system and some others. These transmission systems are designed for various types of vehicles consisting of battery electric vehicles, plug-in-hybrid vehicles, fuel cell electric vehicles and some others. The end-users of these transmission systems consist of passenger vehicles, commercial vehicles, two wheelers and some others. This market is expected to rise significantly with the growth of the EV sector around the globe.

The major trends in this market consists of partnerships, rising sales of EVs and government initiatives.

The single speed segment dominated the market. The growing use of single-speed transmission systems in BEVs to operate efficiently across a wide range of speeds has boosted the market expansion. Additionally, numerous advantages of single speed transmission system including sufficient performance, simplicity, cost-effectiveness and some others is expected to propel the growth of the EV transmission system market.

The multi-speed segment is expected to grow with a significant CAGR during the forecast period. The rising use of multi-speed transmission systems in powerful electric vehicles such as Porche Taycan, Audi e-tron, Jeep Magneto and some others has driven the market growth. Moreover, several advantages of multi-speed transmission systems including improved performance, increased efficiency, enhanced versatility and some others is expected to drive the growth of the EV transmission system market.

The battery electric vehicles (BEVs) held the largest share of the market. The increasing adoption of BEVs in numerous countries such as China, the U.S., Canada and some others has boosted the market expansion. Additionally, rising investment by automotive brands for developing powerful BEVs is playing a vital role in shaping the industrial landscape. Moreover, partnerships among EV companies and battery manufacturers to develop high-quality EV batteries is expected to propel the growth of the EV transmission system market.

The fuel cell electric vehicles (FCEVs) is expected to rise with a notable CAGR during the forecast period. The growing demand for hydrogen-powered trucks in several sectors including mining and logistics has driven the market growth. Also, rapid investment by engine manufacturers to develop advanced FCEV powertrain systems is contributing to the industry in a positive manner. Moreover, numerous government initiatives aimed at reducing vehicular emission is expected to foster the growth of the EV transmission system market.

The passenger vehicles segment dominated the industry. The growing sales and production of passenger cars in numerous countries such as China, India, Germany and some others has boosted the market expansion. Additionally, various government initiatives aimed at providing subsidies for purchasing passenger EVs is playing a vital role in shaping the industrial landscape. Moreover, rapid investment by automotive brands for developing wide range of passenger EVs is expected to boost the growth of the EV transmission system market.

The commercial vehicles segment is expected to rise with a considerable CAGR during the forecast period. The increasing adoption of electric trucks in numerous industries such as mining, construction, logistics and some others has driven the market growth. Also, rapid investment by automotive brands to develop high-quality transmission system for commercial EVs is contributing to the industry in a positive manner. Moreover, the integration of advanced technologies such as AI and IoT in FCEVs is expected to propel the growth of the EV transmission system market.

North America led the EV transmission systems market. The growing sales of luxury EVs in the U.S. and Canada has boosted the market expansion. Additionally, rising investment by government for developing the EV charging infrastructure coupled with rapid deployment of EVs by fleet operators is playing a vital role in shaping the industrial landscape. Moreover, the presence of various market players such as BorgWarner Inc., Allison Transmission, Tesla and some others is expected to boost the growth of the EV transmission system market in this region.

Asia Pacific is expected to grow with a significant CAGR during the forecast period. The increasing adoption of electric vehicles in various countries such as China, India, Japan, South Korea and some others has driven the market growth. Also, numerous government initiatives aimed at adopting EVs along with rise in number of EV startups is contributing to the industry in a positive direction. Moreover, the presence of several market players such as Aisin Seiki Co., Ltd., Denso Corporation, Hitachi Automotive Systems Ltd., Hyundai and some others is expected to propel the growth of the EV transmission system market in this region.

In April 2025, Dong Hee Han, the Executive Vice President and Head of Electrified Propulsion Test Center, at Hyundai Motor Group made an announcement stating that, “We have developed an innovative new hybrid system that integrates our long-accumulated engine, transmission and hybrid system development experience with the electrification technology applied to our world-class electric vehicles, we will continue to develop innovative technologies that actively utilize electrification capabilities during the transition to EVs, providing customers with eco-friendly vehicles that offer superior performance."

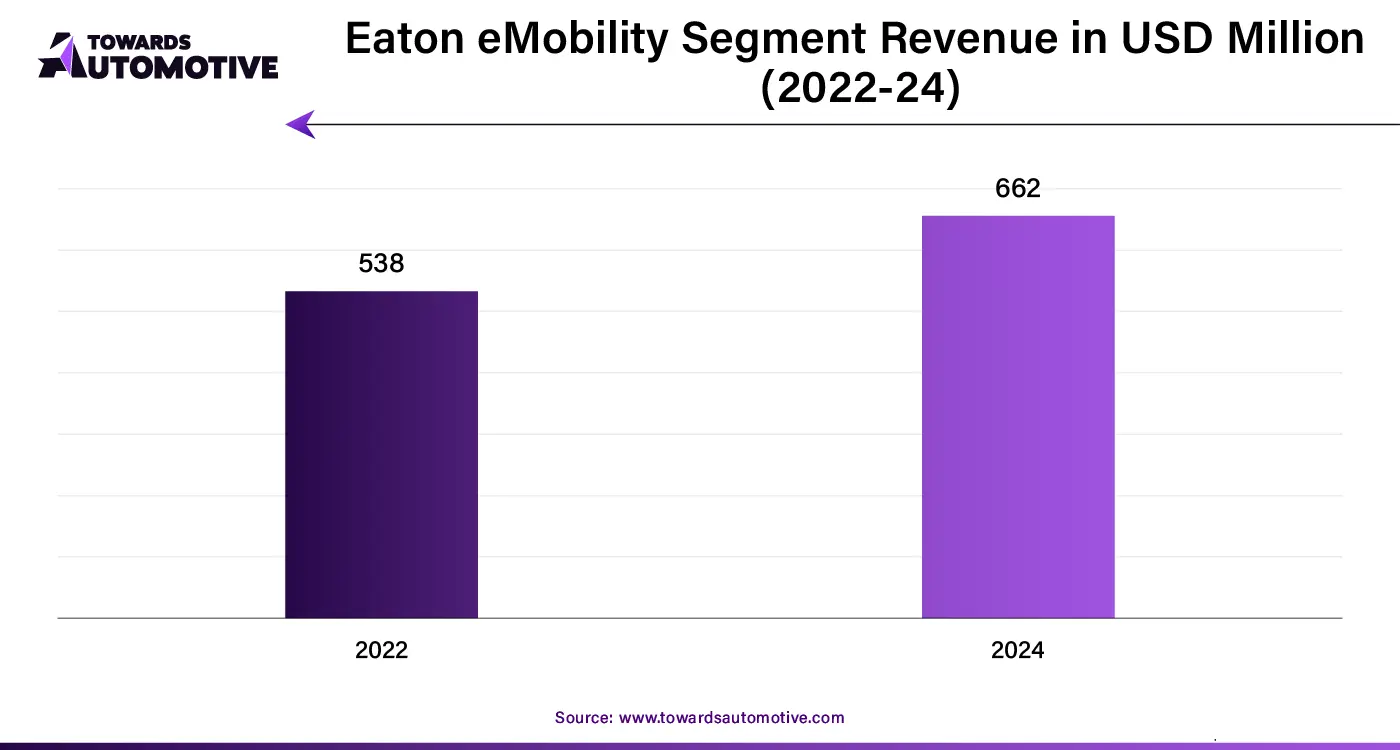

The EV transmission system market is a highly fragmented industry with the presence of several dominating players. Some of the prominent companies in this industry consists of AVL List GmbH, Continental AG, BorgWarner Inc, Allison Transmission Inc., Aisin Seiki Co., Ltd., Dana Incorporated, EATON Corporation, Denso Corporation, GKN Automotive Limited, Hitachi Automotive Systems Ltd. and some others. These companies are constantly engaged in developing EV transmission systems and adopting numerous strategies such as collaborations, acquisitions, partnerships, launches, business expansions, joint ventures and some others to maintain their dominance in this industry.

By Transmission Type

By Vehicle Type

By Powertrain Configuration

By End Use

By Region

December 2025

October 2025

October 2025

October 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us