September 2025

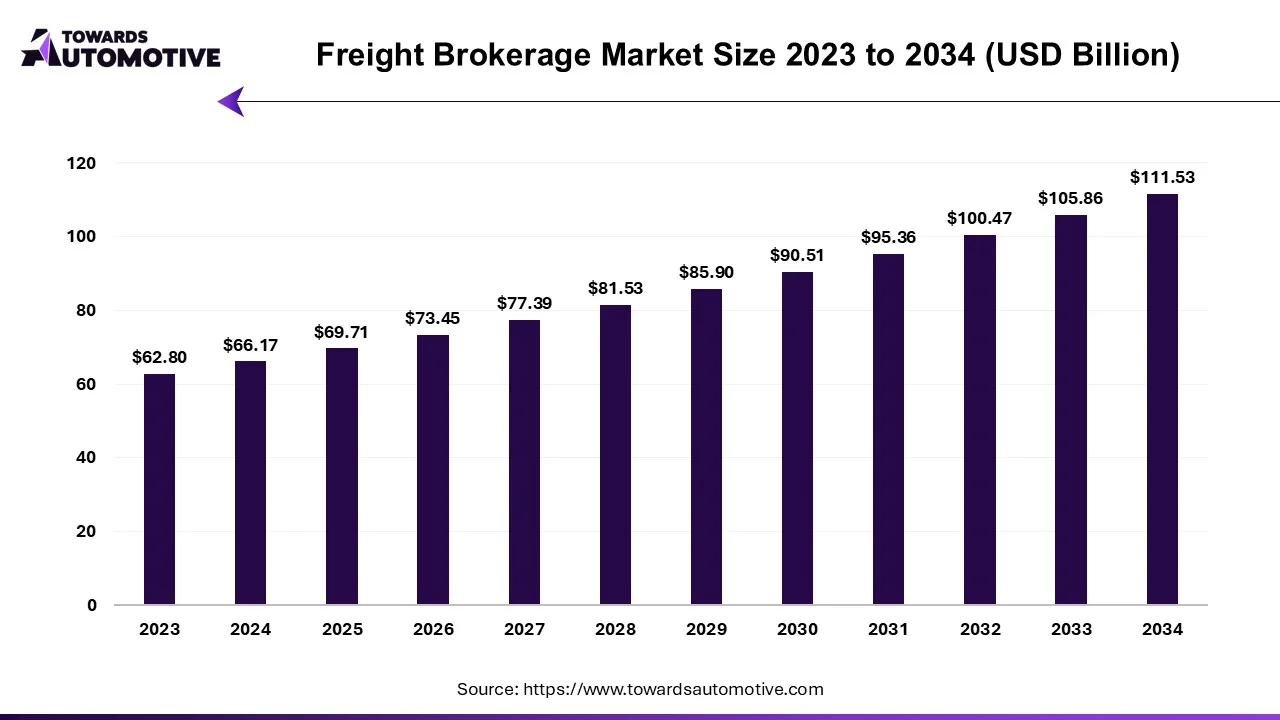

The freight brokerage market is projected to reach USD 111.53 billion by 2034, growing from USD 69.71 billion in 2025, at a CAGR of 5.36% during the forecast period from 2025 to 2034.

Unlock Infinite Advantages: Subscribe to Annual Membership

Freight brokerage plays a pivotal role in the global logistics and transportation industry by bridging the gap between shippers and carriers. As intermediaries, freight brokers facilitate the efficient movement of goods by leveraging their networks and expertise to match shippers’ transportation needs with the capacity of carriers. This service not only optimizes supply chain operations but also helps reduce costs and improve delivery timelines, making it indispensable in industries ranging from retail and manufacturing to agriculture and healthcare. With globalization driving trade volumes and e-commerce reshaping consumer expectations, freight brokerage has evolved into a highly dynamic and technology-driven market.

The increasing complexity of supply chains and the need for real-time visibility have propelled the adoption of digital freight platforms and advanced technologies such as artificial intelligence (AI) and blockchain. These innovations enable brokers to enhance operational efficiency, optimize route planning, and provide predictive analytics for better decision-making. Furthermore, freight brokerage has become a critical solution for small and medium-sized businesses, offering them access to logistics expertise and a vast carrier network without significant infrastructure investments.

As the demand for efficient freight solutions rises, the freight brokerage market continues to grow, supported by trends like the surge in e-commerce, cross-border trade expansion, and the emphasis on sustainability in transportation. Whether addressing the challenges of last-mile delivery or ensuring timely cross-continental shipments, freight brokerage is a cornerstone of modern logistics, playing a vital role in ensuring the seamless flow of goods across supply chains globally.

Artificial Intelligence (AI) is transforming the freight brokerage market by optimizing processes, improving decision-making, and enhancing overall efficiency. In a highly competitive and dynamic sector, AI enables brokers to streamline operations through automation and predictive analytics. One of the primary applications of AI is in route optimization, where algorithms analyze vast datasets, including traffic patterns, weather conditions, and fuel costs, to determine the most efficient and cost-effective delivery routes.

AI also plays a crucial role in demand forecasting, allowing brokers to anticipate market fluctuations and optimize capacity planning. Machine learning models analyze historical data, industry trends, and real-time market conditions to predict shipping demands, enabling better negotiation of rates and efficient allocation of carrier resources. Moreover, AI-powered chatbots and virtual assistants enhance customer experience by providing real-time updates, instant quotes, and round-the-clock support.

Fraud detection is another area where AI is making a significant impact. By analyzing transactional data and identifying anomalies, AI helps mitigate risks associated with fraudulent activities in freight transactions. Additionally, AI-powered platforms facilitate dynamic pricing models, ensuring competitive rates for shippers and optimal profitability for brokers.

In the era of digital freight matching, AI serves as the backbone of platforms that automatically match loads with available carriers, minimizing empty miles and maximizing asset utilization. As the freight brokerage market increasingly embraces technology, AI stands out as a key driver of innovation, helping the industry adapt to evolving customer demands and operational challenges.

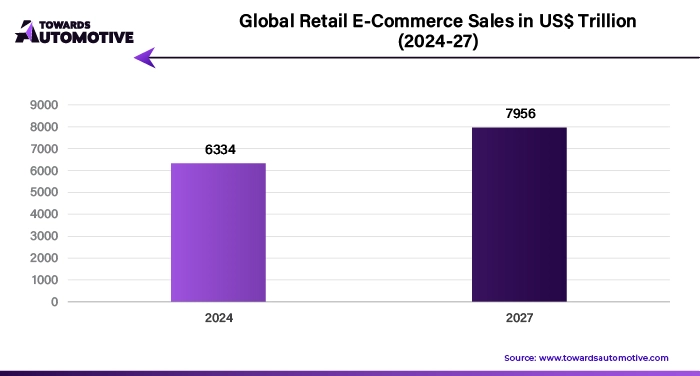

The rapid growth of the e-commerce industry has significantly driven the expansion of the freight brokerage market. As online shopping continues to flourish, there is an increasing demand for efficient and cost-effective logistics solutions to meet customer expectations for quick and reliable deliveries. Freight brokers play a crucial role in managing the complexity of shipping products from various sellers to consumers by connecting businesses with transportation providers. This has led to an upsurge in demand for freight brokerage services, especially for last-mile delivery solutions, which are essential for ensuring timely deliveries in the e-commerce space.

Furthermore, the rise in e-commerce has prompted the need for global supply chains, with companies sourcing products from various parts of the world. Freight brokers facilitate international trade and logistics by offering services that help businesses navigate customs, tariffs, and different shipping regulations across countries. The increased need for inventory management and optimized delivery routes has also encouraged the integration of technology, such as AI and data analytics, to streamline operations. Additionally, the convenience and scalability offered by freight brokers allow e-commerce companies to handle fluctuating shipping volumes effectively, especially during peak seasons like holidays or sales events. As e-commerce growth continues, freight brokers are well-positioned to capitalize on this demand, providing tailored solutions that enhance the speed and reliability of deliveries.

The freight brokerage market faces several restraints, including regulatory challenges, as brokers must comply with varying laws across regions, leading to complex operations. Price volatility in fuel costs and fluctuating market rates can also impact profitability. Additionally, the reliance on third-party carriers makes brokers vulnerable to service reliability issues and capacity constraints, especially during peak demand periods. Moreover, the market is constrained by the lack of skilled professionals and cybersecurity risks associated with digital platforms and technologies.

The adoption of ele (TaaS) is opening up new opportunities in the freight brokerage market by transforming how transportation services are delivered and managed. TaaS enables on-demand, technology-driven solutions for freight management, allowing brokers to offer more flexible and efficient services to their clients. One key advantage is improved operational efficiency, as TaaS platforms allow freight brokers to access real-time tracking, automated route optimization, and digital freight matching. This reduces manual work, streamlines processes, and speeds up delivery times, which appeals to businesses looking for quicker, more reliable logistics.

Additionally, cost reduction is a significant benefit of TaaS adoption. By leveraging third-party transportation providers and on-demand services, companies can reduce their capital expenditures on fleet management and maintenance. Freight brokers can thus offer more competitive pricing, attracting a broader customer base. The ability to match available carriers with the right shipments dynamically also maximizes fleet utilization, further optimizing costs for both brokers and clients.

Moreover, scalability and flexibility become key drivers of growth. As global trade and demand for logistics services increase, TaaS allows freight brokers to expand their reach without the need for large infrastructure investments. This scalability enables brokers to cater to diverse customer needs, from small businesses to large enterprises, offering a wide range of transportation solutions.

The manufacturing segment led the industry. The manufacturing segment plays a crucial role in driving the growth of the freight brokerage market due to its significant demand for efficient, reliable, and cost-effective transportation solutions. As manufacturing businesses continue to grow and expand globally, they require consistent and optimized freight services to move raw materials, components, and finished products across vast supply chains. Freight brokers are essential in this ecosystem, acting as intermediaries between manufacturers and carriers, ensuring timely and cost-effective transportation.

The expansion of global manufacturing operations, especially in regions like Asia Pacific and North America, has led to increased demand for freight brokerage services to manage complex logistics networks. As manufacturers aim to streamline their supply chains, brokers facilitate the coordination of multimodal transportation solutions, offering flexibility and speed. This includes managing the movement of goods via road, rail, air, and sea, which is essential for industries such as automotive, electronics, and consumer goods.

Moreover, the increasing trend toward just-in-timee (JIT) manufacturing and inventory systems has heightened the need for reliable and precise freight services. Freight brokers help manufacturers meet tight delivery schedules, reduce inventory costs, and enhance operational efficiency by ensuring that goods arrive on time and in optimal conditions. The rise in e-commerce and demand for faster delivery times also contributes to the growth of freight brokerage services in manufacturing, as companies seek to meet customer expectations for rapid fulfillment. As the manufacturing sector continues to thrive, freight brokers play an integral role in supporting its logistical needs, thereby driving market growth.

The asset-based brokerage segment held the largest share of the market. The asset-based brokerage segment significantly contributes to the growth of the freight brokerage market by providing enhanced control over transportation operations and enabling more reliable, efficient, and cost-effective services. Asset-based brokers own and operate their own fleets of trucks, ships, railcars, or planes, allowing them to directly manage the transportation of goods, which distinguishes them from non-asset-based brokers who only act as intermediaries. This ownership of assets enables them to provide more flexible and tailored solutions to meet the specific needs of their clients.

As businesses across industries demand faster delivery, consistent service, and reduced logistics costs, asset-based brokers play a pivotal role in fulfilling these requirements. They can guarantee capacity availability, which is critical for companies relying on timely deliveries to maintain their supply chains. Additionally, asset-based brokers can optimize routes and transportation methods, resulting in cost savings and improved efficiency.

The growing trend of e-commerce, the need for faster deliveries, and the expansion of global trade have all fueled the demand for asset-based brokerage services. By directly controlling the transportation assets, these brokers can offer more competitive rates, better reliability, and improved customer service, which enhances their appeal to manufacturers, retailers, and distributors.

Furthermore, the trend toward digitalization and the integration of advanced tracking and fleet management technologies enables asset-based brokers to provide real-time updates and improve overall service quality. As the demand for seamless logistics grows, the asset-based brokerage segment continues to play a key role in driving the growth of the freight brokerage market.

North America dominated the freight brokerage market. The freight brokerage market in North America is witnessing significant growth driven by several key factors, including the rising demand for Just-in-Time (JIT) delivery, the expansion of e-commerce, and ongoing technological advancements. Companies are increasingly adopting JIT delivery systems to reduce inventory costs and streamline their supply chains. This model requires precise coordination between manufacturers, suppliers, and llogauroviders to ensure goods arrive on time and in the right quantities. Freight brokers play a critical role in facilitating JIT operations, connecting shippers with reliable carriers to meet strict delivery schedules. As businesses increasingly rely on JIT delivery for efficiency, the demand for freight brokerage services continues to rise.

The explosive growth of e-commerce, especially in North America, has significantly impacted logistics. Online retailers and marketplaces require fast, flexible, and reliable shipping solutions to meet consumer expectations for quick deliveries. Freight brokers help businesses navigate complex shipping needs, from warehousing to last-mile delivery, thus supporting the expanding e-commerce sector and driving the growth of freight brokerage services. Technological innovations like real-time tracking, AI-powered route optimization, and automated freight matching are revolutionizing the freight brokerage industry. These advancements enable brokers to offer better visibility, reduce transit times, improve efficiency, and lower costs for their clients. As technology continues to evolve, freight brokers can deliver more value to businesses, driving further market growth.

Asia Pacific is expected to grow with a significant CAGR during the forecast period. The freight brokerage market in Asia Pacific (APAC) is experiencing significant growth, driven by the rising demand for global trade, infrastructure development, and favorable regulatory support and trade agreements. APAC is a hub for international trade, with countries like China, India, Japan, and South Korea playing key roles in global supply chains. As demand for cross-border goods continues to rise, freight brokers facilitate the smooth movement of goods across countries by connecting shippers with carriers. The increased need for efficient transportation solutions to handle both import and export logistics fuels the growth of the freight brokerage market in the region.

APAC countries are heavily investing in modernizing and expanding their logistics infrastructure, including ports, airports, highways, and railways. This development enhances the efficiency and capacity of the region's supply chain networks, offering more opportunities for freight brokers. Improved infrastructure facilitates smoother and faster transportation, creating an optimal environment for the growth of the freight brokerage market. Governments in the region are introducing favorable policies and trade agreements to promote economic growth. These agreements, such as the Regional Comprehensive Economic Partnership (RCEP), create a conducive environment for trade by reducing tariffs, simplifying customs processes, and improving cross-border cooperation. Freight brokers play an essential role in helping businesses navigate these regulations and leverage trade agreements for more efficient operations.

By Service Type

By Industry Vertical

By Shipment Size

By Business Model

By Region

September 2025

September 2025

September 2025

September 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us