September 2025

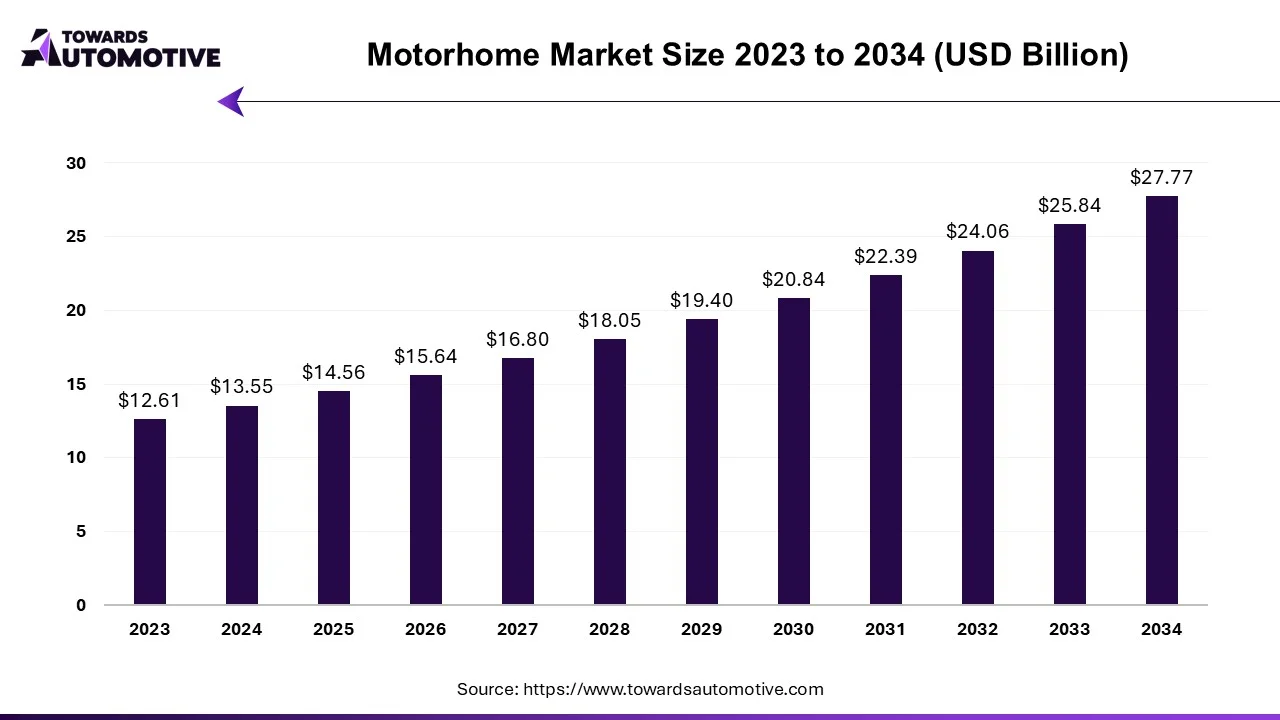

The motorhome market is projected to reach USD 27.77 billion by 2034, expanding from USD 14.56 billion in 2025, at an annual growth rate of 7.44% during the forecast period from 2025 to 2034.

Unlock Infinite Advantages: Subscribe to Annual Membership

The motorhome market is a prominent segment of the automotive industry. This industry deals in manufacturing and distribution of motorhomes around the world. There are numerous types of motorhomes developed in this sector consisting of class A motorhomes, class B motorhomes, class C motorhomes, truck campers and some others. These motorhomes are powered by various types of fuels including gasoline, diesel, propane, electric and some others. It is available in different sizes comprising of small (up to 20 feet), medium (20 to 25 feet), large (over 25 feet) and some others. The motorhomes are integrated with several amenities such as slide-outs, generator, solar panels, awning, kitchenette, bathroom, air conditioning and some others. This market is expected to rise significantly with the growth of the tourism industry in different parts of the globe.

| Metric | Details |

| Market Size in 2024 | USD 13.55 billion |

| Projected Market Size in 2034 | USD 27.77 billion |

| CAGR (2025 - 2034) | 7.44% |

| Leading Region | North America |

| Market Segmentation | Tabbert, Elddis, Lichtsinn RV, Camping World Holdings, Jayco, Carthago, AutoTrail, Entegra Coach |

| Top Key Players | By Type, By Fuel Type, By Size, By Amenities and By Region |

The major trends in this industry consists of electric motorhomes, government initiatives and rental platforms.

Electric Motorhomes

The rising awareness of consumers for adopting eco-friendly transportation has pushed market players to develop electric motorhomes for reducing emission. For instance, in September 2024, BEDEO launched a new range of electric motorhomes. This range consist of X550 ElectriX, X650 ElectriX, X150 ElectriX and X250 ElectriX. (Source: Van Life Matters)

Government Initiatives

Government of numerous countries such as India, the U.S., Australia, New Zealand, UK and some others have launched various initiatives to develop the tourism sector. In February 2025, the government of India announced to invest around Rs 2541.06 crores. This investment is done for developing 50 tourist destinations across this country. (Source: Business Standard)

Rental platforms

The rise in number of motorhome rental platforms has enabled international travelers to rent motorhomes according to their requirement for exploring any region. For instance, in February 2024, Campiri partnered with FreewayCamper. This partnership is done for enhancing the motorhome rental services across Europe. (Source: Shorttermrentalz)

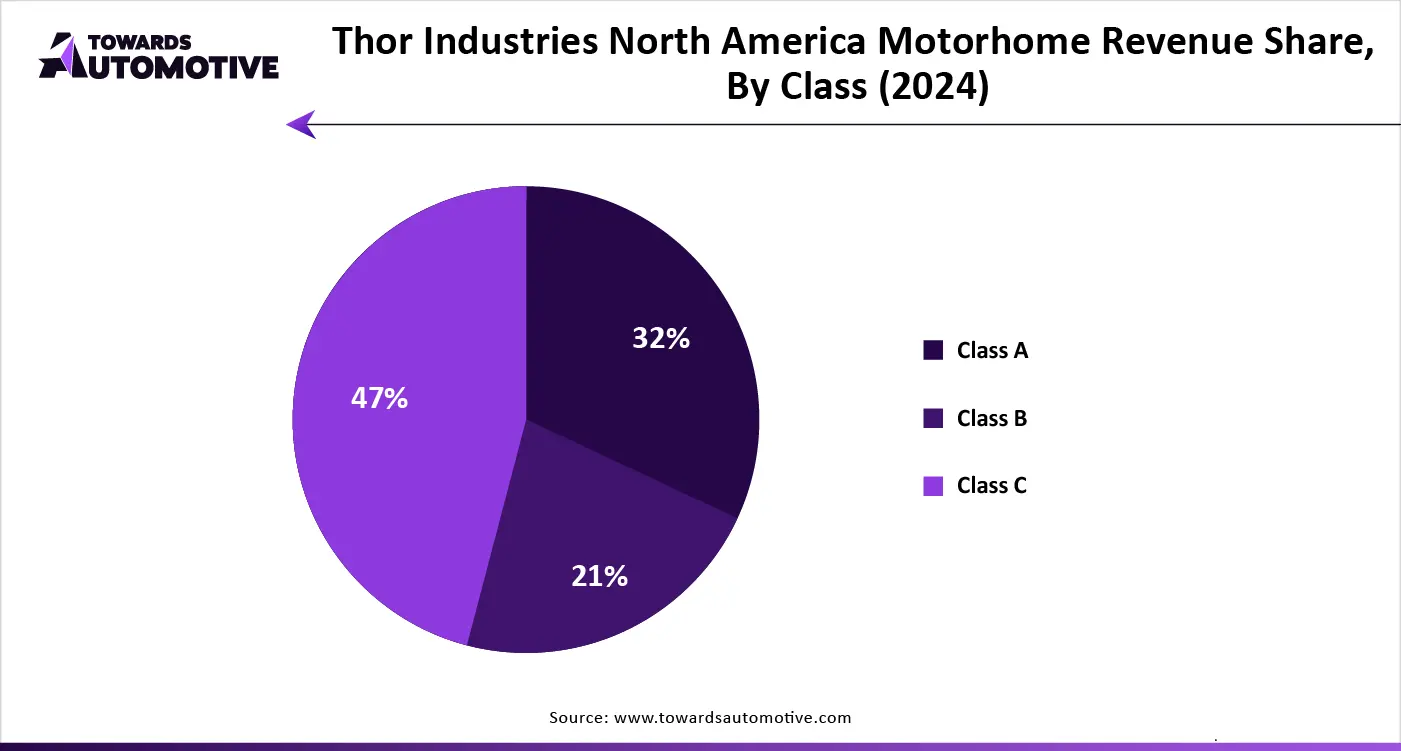

The class A motorhomes segment dominated the industry. The growing sales of large recreational vehicles in numerous countries such as New Zealand, Australia, the U.S., and some others has boosted the market growth. Additionally, the rising adoption of class A motorhomes among big travel groups to explore new places with enhanced comfort is expected to drive the growth of the motorhome market.

The class C segment is expected to rise with the fastest CAGR during the forecast period. The rising demand for affordable recreational vehicles in developing nations such as Thailand, India, Vietnam and some others is driving the market expansion. Moreover, the growing sales of these motorhomes due to numerous advantages such as versatility, fuel-efficiency, flexibility and some others is expected to propel the growth of the motorhome market.

The diesel segment led this industry. The growing demand for heavy-duty motorhomes from adventure travelers has boosted the market growth. Additionally, the rising adoption of fuel-efficient motorhomes by rental providers to maximize their profit margin is expected to propel the growth of the motorhome market.

The electric segment is expected to grow with a significant CAGR during the forecast period. The growing adoption of eco-friendly transportation by traveling enthusiasts has boosted the market growth. Moreover, constant research and development activities related to electric motorhomes is further accelerating the growth of the motorhome market.

The medium (20-25 feet) segment held the highest revenue of the industry. The growing demand for medium-sized motorhomes from small travelling groups comprising of 4-5 travelers has boosted the market growth. Additionally, numerous advantages of these motorhomes including maneuverability, driving ease, enhanced comfort and some others is expected to drive the growth of the motorhome market.

The small (up to 20 feet) segment is expected to grow with a notable CAGR during the forecast period. The rising demand for small-sized motorhomes among individual travelers has driven the market expansion. Additionally, availability of these motorhomes in rental platforms coupled with its various advantages such as easy handling and enhanced fuel efficiency is expected to foster the growth of the motorhome market.

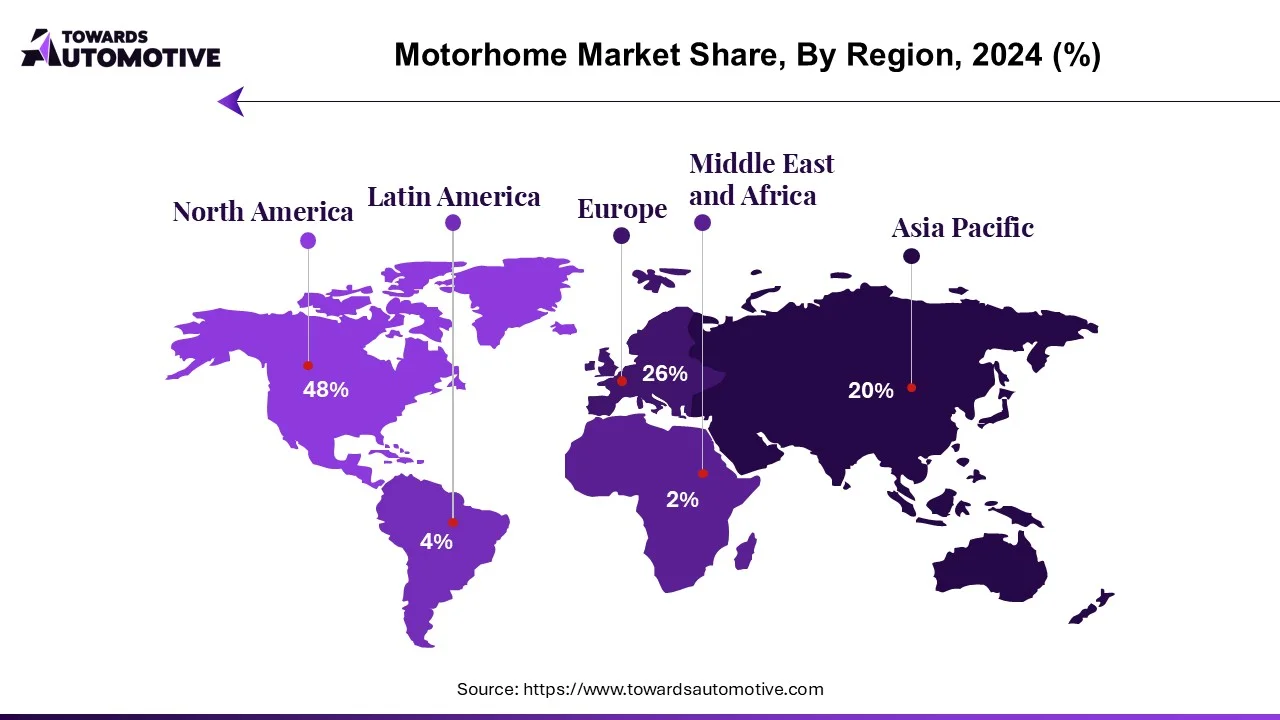

North America led the motorhome market with highest revenue. The growing interest of consumers towards recreational activities along with rapid adoption of sustainable traveling has boosted the market growth. Additionally, numerous government initiatives aimed at developing the tourism sector coupled with rise in number of motorhome finance providers is playing a vital role in shaping the industrial landscape. Moreover, the presence of numerous market players such as Thor Industries, Winnebago, Forest River Industries, Inc and some others is expected to boost the growth of the motorhome market in this region.

U.S. dominated the market in this region. The growing demand for electric motorhomes and rising consumer spending in leisure activities has boosted the market growth. Also, the increasing sales of class C motorhomes in New York and Washington DC is further adding to the industrial expansion.

Asia Pacific is expected to rise with the highest CAGR during the forecast period. The increase in number of motorhome rental companies in several countries such as New Zealand, Japan, Singapore, Thailand and some others has boosted the market growth. Also, rapid investment by government for renovating cultural monuments and tourist sites is further adding to the industrial expansion. Moreover, the presence of various local motorhome brands such as Great Wall Motor Co., Ltd, JCBL, Zhongyu Automobile and some others is expected to drive the growth of the motorhome market in this region.

China and New Zealand are the significant contributors in this region. In China, the market is generally driven by the rising demand for personalized tourism along with presence of numerous market players. In New Zealand, the growing consumer interest towards sight-seeing coupled with availability of motorhomes in rental platforms is adding to the market expansion.

The motorhome market is a rapidly developing industry with the presence of numerous dominating players. Some of the prominent companies in this industry consists of Thor Industries, Tabbert, Elddis, Lichtsinn RV, Camping World Holdings, Jayco, Carthago, AutoTrail, Entegra Coach, Winnebago, Hobby, Grand Design RV, Hymer, Coachmen RV and some others. These companies are constantly engaged in developing motorhomes and adopting numerous strategies such as joint ventures, business expansions, collaborations, launches, partnerships, acquisitions, and some others to maintain their dominance in this industry.

By Type

By Fuel Type

By Size

By Amenities

By Region

September 2025

September 2025

September 2025

September 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us