October 2025

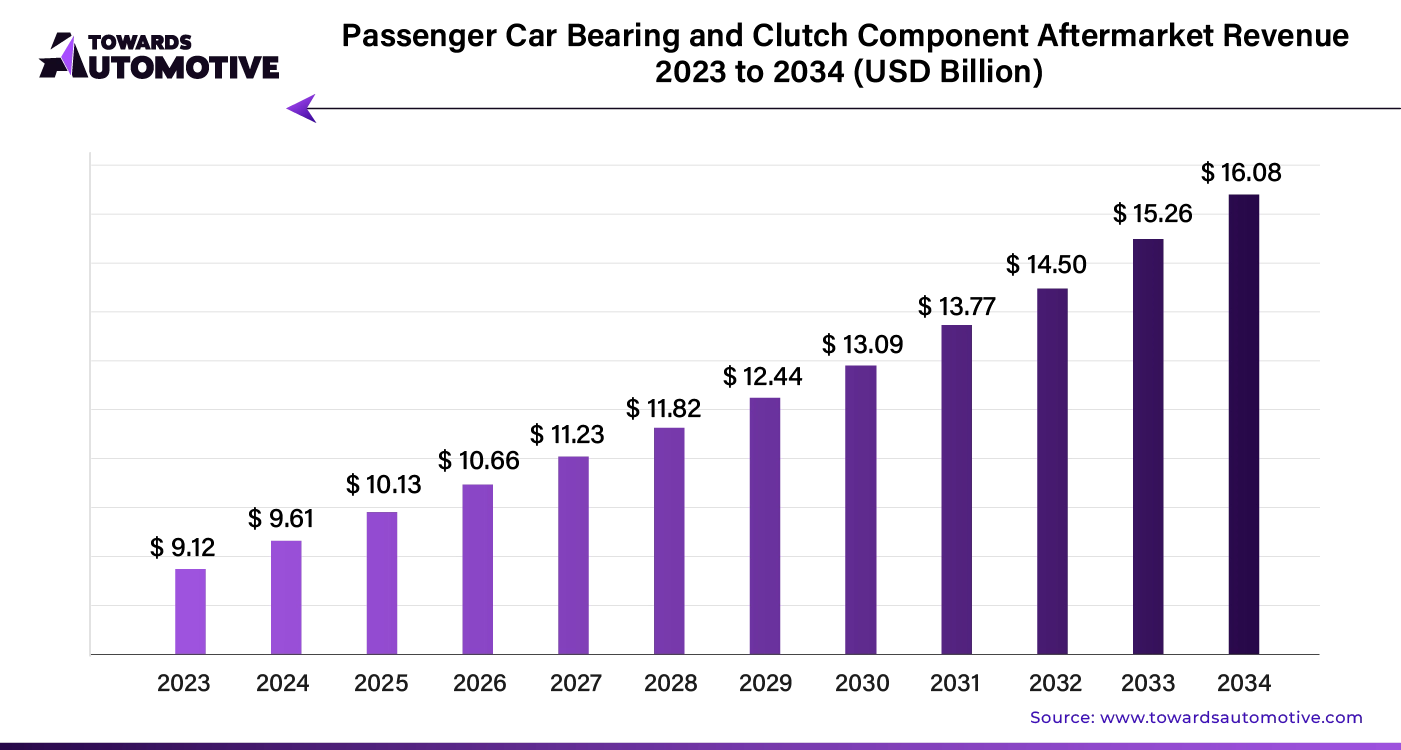

The passenger car bearing and clutch component aftermarket is anticipated to grow from USD 10.13 billion in 2025 to USD 16.08 billion by 2034, with a compound annual growth rate (CAGR) of 5.26% during the forecast period from 2025 to 2034. The growing sales and production of passenger cars in India and China coupled with rapid investment by automotive brands for integrating high-quality components in passenger cars is playing a vital role in shaping the industrial landscape.

Moreover, the rising demand for luxury cars from HNIs along with partnerships among automotive companies and clutch manufacturers has boosted the market expansion. The increasing use of sustainable materials for manufacturing automotive components is expected to create ample growth opportunities for the market players in the future.

The passenger car bearing and clutch component aftermarket is a prominent branch of the automotive industry. This industry deals in manufacturing and distribution of clutch and bearing components to cater the needs of passenger vehicles. There are different types of clutches developed in this sector comprising of single-plate clutch, multi-plate clutch, cone clutch, hydraulic clutch, electromagnetic clutch and some others. These clutches are manufactured using various types of materials including steel, plastic, composites, ceramic and some others. It is available in a well-established distribution channel consisting of online platforms and retail outlets.

The major trends in this market consists of partnerships, business expansions and increasing sales of SUVs.

The bearings segment dominated the market. The growing application of ball bearings and roller bearings in automotive transmission systems has boosted the market growth. Additionally, the increasing use of high-quality steels for manufacturing automotive bearings is contributing to the industry in a positive manner. Moreover, partnerships among car companies and automotive component manufacturers to develop a wide range of bearings is expected to propel the growth of the passenger car bearing and clutch component aftermarket.

The clutches segment is expected to grow with a considerable CAGR during the forecast period. The growing use of multi-plate clutches in luxury cars has driven the market expansion. Additionally, rapid investment by automotive component companies for opening new clutch manufacturing facilities is playing a vital role in shaping the industrial landscape. Moreover, collaborations among supercar manufacturers and clutch brands to develop superior transmission systems is expected to drive the growth of the passenger car bearing and clutch component aftermarket.

The steel segment held the largest share of the market. The growing use of stainless steel for manufacturing high-quality clutch assemblies has driven the market expansion. Additionally, the rising application of steel for production of automotive clutch plates and bearings is playing a vital role in shaping the industrial landscape. Moreover, numerous advantages of steel-based automotive components including superior strength, high durability, good formability and some others is expected to boost the growth of the passenger car bearing and clutch component aftermarket.

The plastic segment is expected to expand with a notable CAGR during the forecast period. The increasing use of plastic for manufacturing master cylinder of automotive clutches has driven the market growth. Also, the rapid investment by market players for using bio-degradable plastics to manufacture automotive transmission systems is contributing to the industry in a positive manner. Moreover, various benefits of plastic-based automotive components including cost-effectiveness, reduced wear and tear, corrosion resistance and some others is expected to drive the growth of the passenger car bearing and clutch component aftermarket.

The sedans segment led the market. The growing demand for luxury sedans from elite-class consumers in several countries such as UK, the U.S., Germany, Italy and some others has boosted the market expansion. In addition, the rising investment by automotive companies for developing mid-range sedans to cater the needs of developing nations such as India, Vietnam, Thailand and some others is playing a vital role in shaping the industrial landscape. Moreover, partnerships among automotive brands and engine manufacturers to develop hybrid engines for sedans is expected to boost the growth of the passenger car bearing and clutch component aftermarket.

The SUV segment is expected to grow with a robust CAGR during the forecast period. The rising demand for luxury SUVs in developed nations such as Australia, France, Denmark and some others has driven the market expansion. Additionally, the growing use of multi-plate clutches in mid-ranged SUVs coupled with rapid investment by automotive brands for developing numerous SUVs is contributing to the industry in a positive manner. Moreover, the increasing adoption of high-performance SUVs by off-roading enthusiasts is expected to foster the growth of the passenger car bearing and clutch component aftermarket.

North America led the passenger car bearing and clutch component aftermarket. The growing demand for luxury cars in the U.S. and Canada has driven the market expansion. Additionally, rapid investment by automotive component manufacturers for opening new production facilities coupled with rise in number of automotive workshops is playing a vital role in shaping the industrial landscape. Moreover, the presence of various market players such as CENTERFORCE, BorgWarner Inc, NORAM Clutch, Cook Bonding & Manufacturing Co., Inc and some others is expected to boost the growth of the passenger car bearing and clutch component aftermarket in this region.

Asia Pacific is expected to expand with a significant CAGR during the forecast period. The increasing sales of hybrid vehicles in several countries such as India, China, Japan, South Korea and some others has boosted the market expansion. Additionally, the growing demand for high-performance SUVs along with availability of essential raw materials such as steel, plastic, composites and some others is contributing to the industry in a positive manner. Moreover, the presence of several market players such as JTEKT, Minebea Mitsumi Inc, Nachi-Fujikoshi Corp, AISIN and some others is expected to drive the growth of the passenger car bearing and clutch component aftermarket in this region.

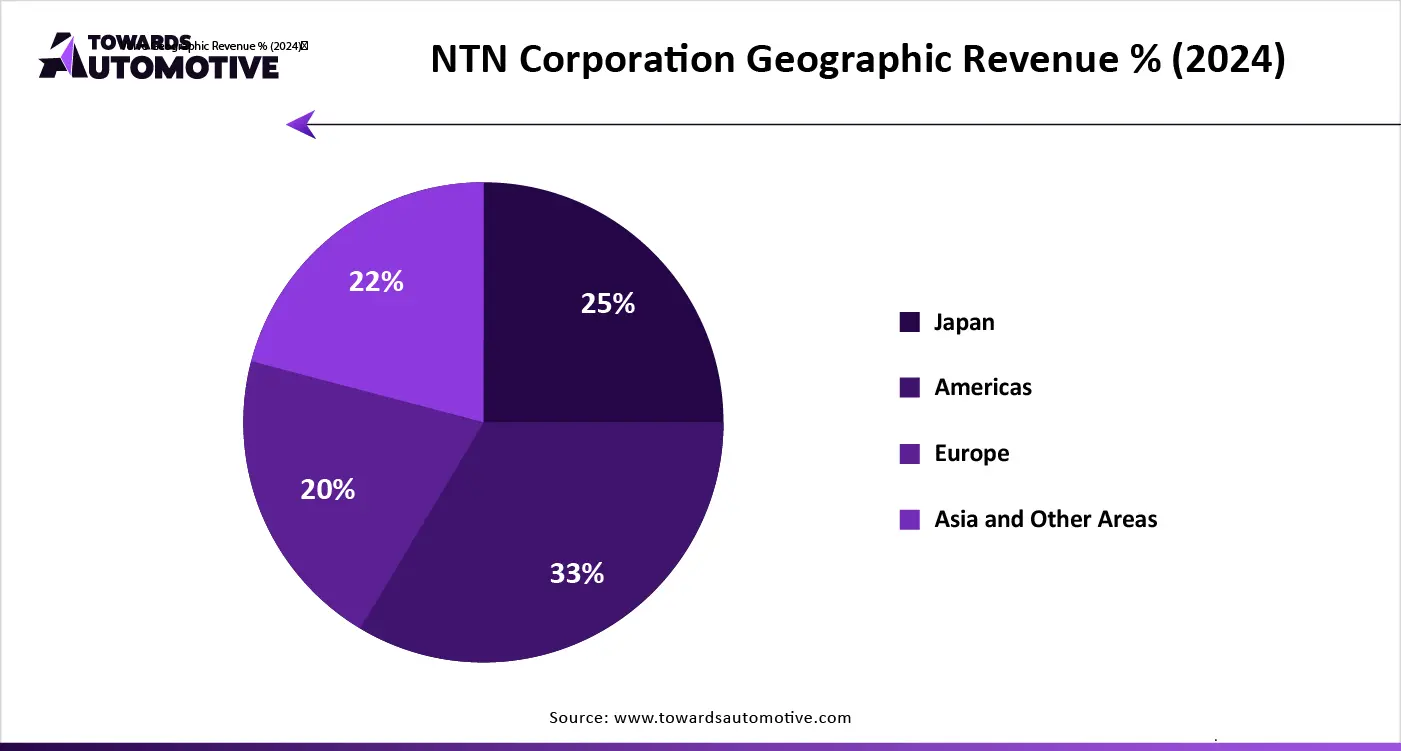

The passenger car bearing and clutch component aftermarket is a highly competitive industry with the presence of several dominating players. Some of the prominent companies in this industry consists of RBC Bearings, C and U Group, SKF, Tsubakimoto Chain, NSK, NTN Corporation, Valeo, Timken, Schaeffler, SNL, GMB Corporation, Koyo, JTEKT, FederalMogul, Meyer Gage and some others. These companies are constantly engaged in manufacturing bearing and clutch components for passenger vehicles and adopting numerous strategies such as business expansions, acquisitions, partnerships, collaborations, launches, expansions, joint ventures and some others to maintain their dominance in this industry.

By Component Type

By Material

By Vehicle Type

By Sales Channel

October 2025

October 2025

October 2025

October 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us