December 2025

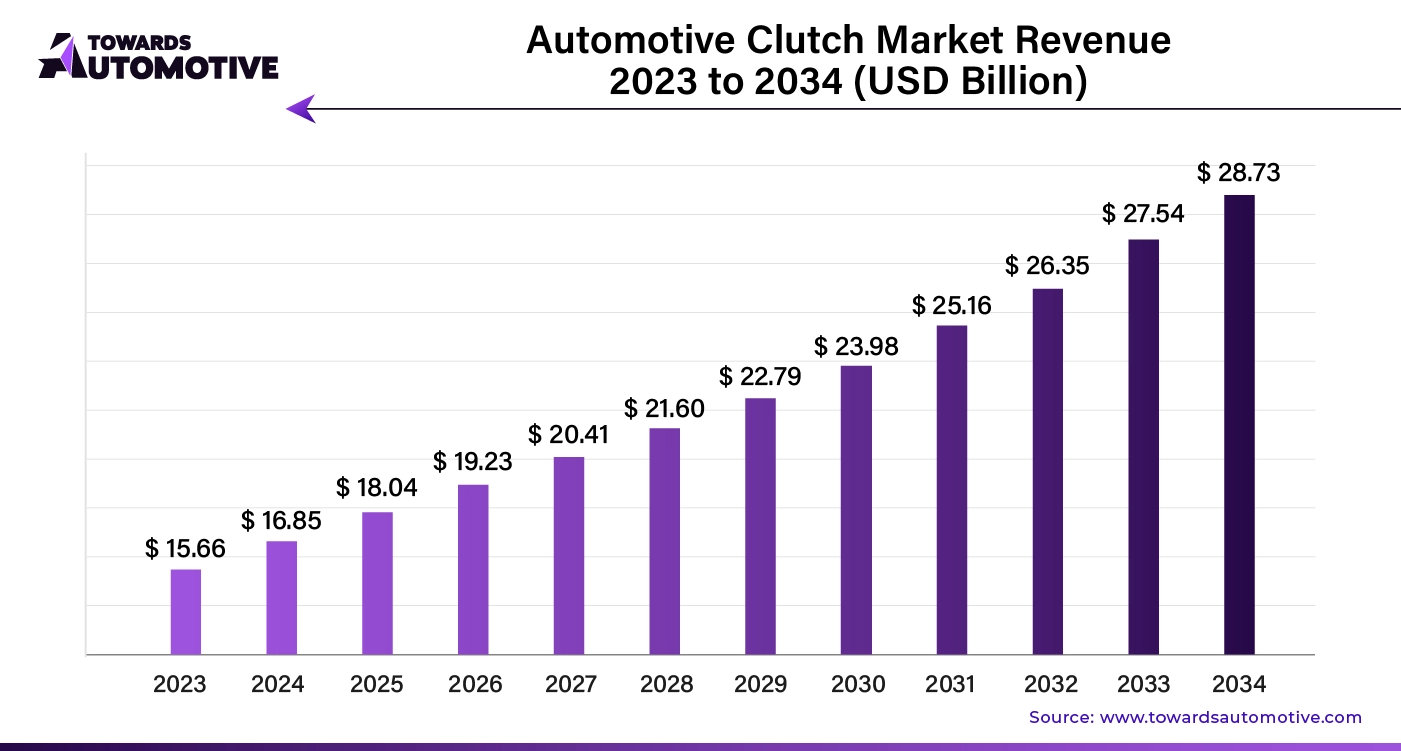

The automotive clutch market is set to grow from USD 18.04 billion in 2025 to USD 28.73 billion by 2034, with an expected CAGR of 5.59% over the forecast period from 2025 to 2034.

The automotive clutch market is a crucial segment of the automotive industry. This industry deals in manufacturing and distribution of clutches for the automotives sector. There are several types of clutches developed in this sector consisting of manual clutch, automatic clutch, semi-automatic clutch and dual-clutch. These clutches are manufactured using different materials comprising of organic materials, ceramic materials, metallic materials, graphite materials and some others. It is designed for numerous types of vehicles including passenger vehicles, light commercial vehicles, heavy commercial vehicles and others. The growing sales and production of commercial vehicles in different parts of the globe has significantly contributed to the industrial expansion. This market is expected to rise significantly with the growth of the automotive components industry around the globe.

The manual clutch segment held a dominant share of the market. The growing demand for affordable vehicles in mid-income nations such as India, Vietnam, Indonesia and some others has boosted the market expansion. Also, the growing investment by automotive manufacturers to develop advanced clutches for manual transmission vehicles is shaping the industry in a positive direction. Moreover, numerous advantages of these clutch systems including high fuel efficiency, superior control, low maintenance cost, enhanced driving experience and some others is likely to boost the growth of the automotive clutch market.

The automatic clutch segment is likely to rise with a significant growth rate during the forecast period. The rising integration of automatic clutches in luxury vehicles has boosted the industrial expansion. Also, the automotive components manufacturers are constantly engaged in research and development of automatic clutch systems that provides superior performance, thereby driving the market in a positive direction. Additionally, the rapid adoption of these clutch systems due to various advantages including ease of use, reduced driver fatigue, improved safety, smoother transitions, stalling prevention and some others is likely to proliferate the growth of the automotive clutch market.

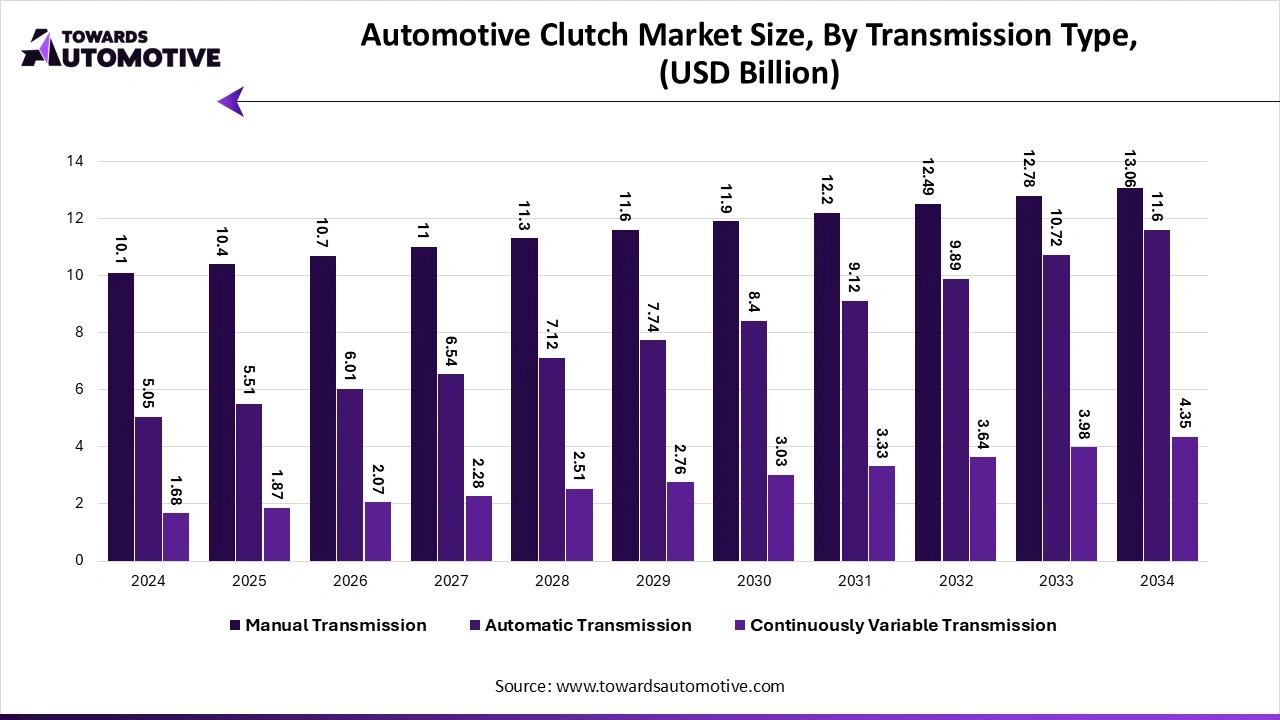

The manual transmission segment held the largest share of the market. The growing adoption of manual transmission in low-range vehicles has boosted the market expansion. Also, the rising sales of SUVs has increased the demand for manual transmission system as it enhances off-roading experience, thereby propelling the industry in a positive direction. Moreover, numerous collaborations among clutch manufacturers and automotive brands along with several advantages of manual transmission systems including low purchase and maintenance costs, enhanced control, potentially better fuel efficiency and some others is projected to boost the growth of the automotive clutch market.

The automatic transmission segment is anticipated to witness rapid growth during the forecast period. The rapid integration of automatic transmission systems in luxury vehicles to enhance driving experience has boosted the market expansion. Also, several automotive brands are partnering with clutch companies to develop automatic transmission systems, thereby propelling the industrial growth. Moreover, numerous advantages of automatic transmission systems including high convenience, low maintenance, enhanced safety, superior acceleration and some others is likely to propel the growth of the automotive clutch market.

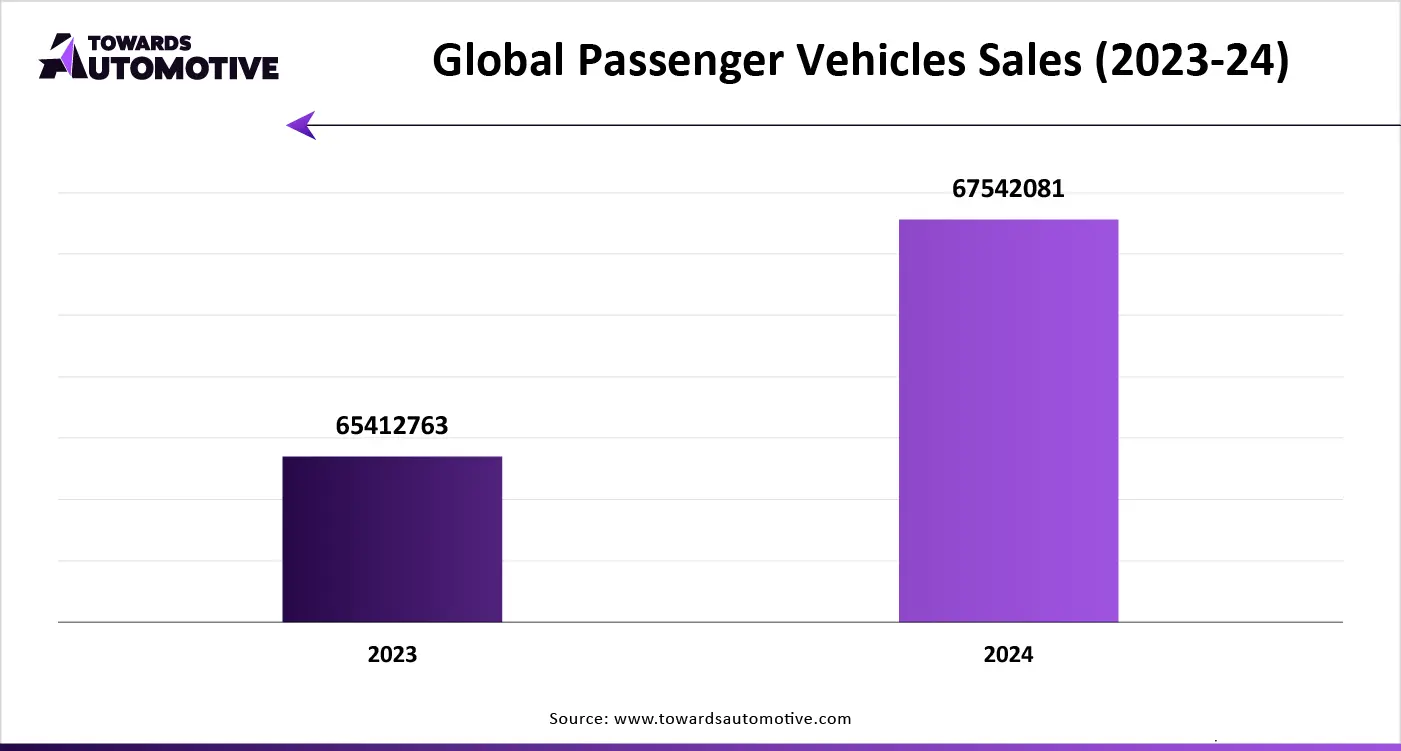

The passenger vehicles segment dominated this industry. The growing demand for SUV among off-roading enthusiasts has increased the demand for manual transmission systems, thereby driving the industrial expansion. Additionally, the rising sales and production of passenger vehicles in countries such as US, India, China, Japan, UK and some others has further played a crucial role in shaping the industrial landscape. Moreover, the increasing adoption of PHEVs to combat pollution along with technological advancements in clutch industry has driven the growth of the automotive clutch market.

The commercial vehicles segment is predicted to rise with a significant CAGR during the forecast period. The rising demand for heavy-duty trucks from several industries such as mining, construction, e-commerce, food and beverage, and some others has boosted the market expansion. Additionally, the growing adoption of luxury buses in countries such as UK, U.S., Germany, India, Singapore and some others has increased the demand for advanced clutch systems, thereby fostering the industrial growth. Moreover, the increasing sales of vfor operating logistics purposes is likely to propel the growth of the automotive clutch market.

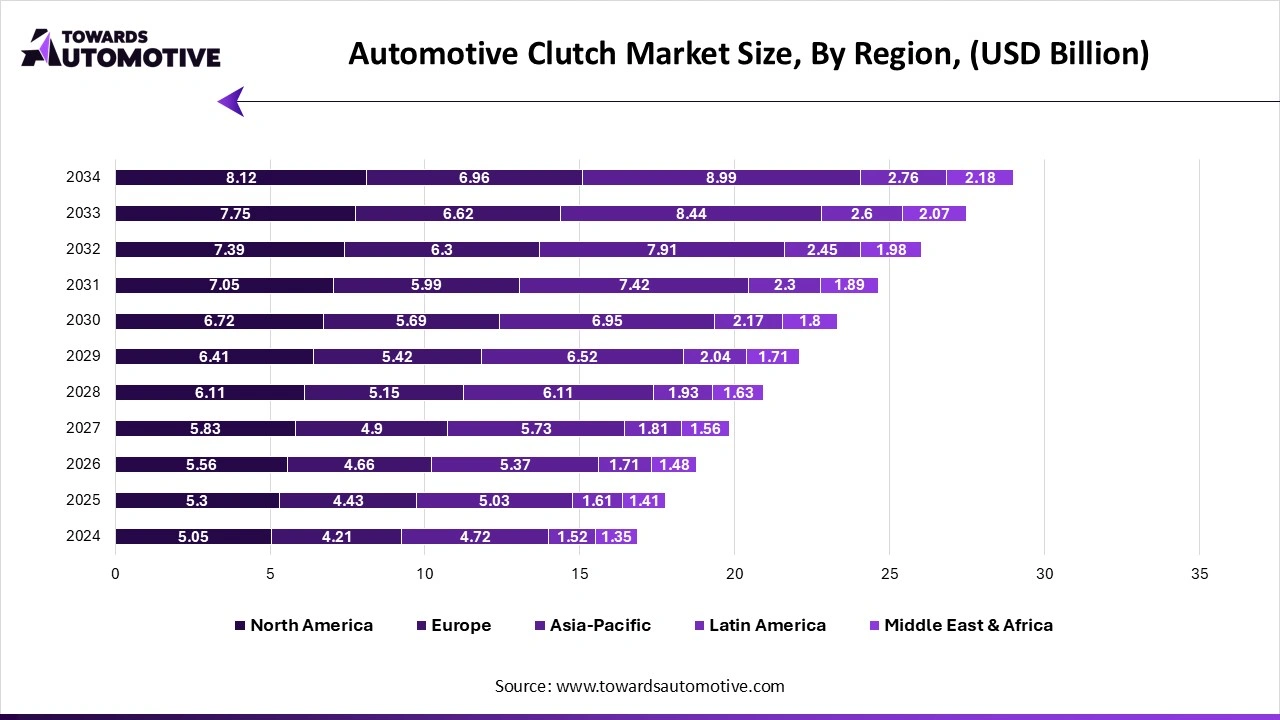

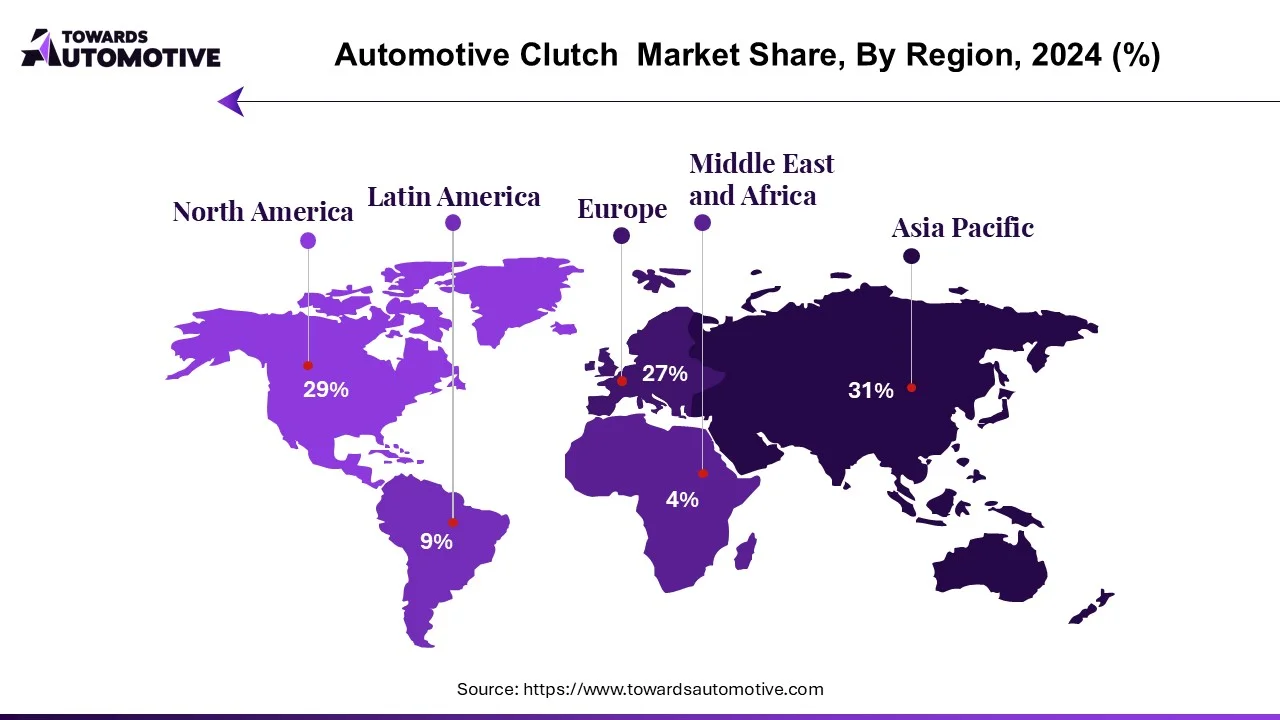

North America held the highest share of the automotive brake system market. The growing demand for sports car in countries such as the U.S. and Canada has increased the demand for superior transmission systems, thereby fostering the industrial expansion. Also, rapid investment by automotive component manufacturers for developing high-quality clutch systems has further bolstered the market growth. Moreover, the increasing development in the automotive sector due to the presence of several companies such as Ford, General Motors, Cadillac and some others is expected to drive the growth of the automotive clutch market in this region.

U.S. dominated the market in this region. The growing sales of commercial vehicles along with rise in number of automotive component manufacturers has boosted the market growth. Additionally, the rising demand for luxury cars among elite-class people is playing a positive role in shaping the industrial landscape. Moreover, the presence of various market players such as BorgWarner, Alto Products Corp, Mechanical Power Inc and some others further propels the market expansion.

Europe is expected to grow with a significant growth rate during the forecast period. The rising demand for hybrid vehicles in countries such as France, UK, Germany, Italy and some others has boosted the industrial expansion. Additionally, surge in demand for SUVs among youths along with increasing trend of hyper cars among the people of Europe is further adding to the market growth. Moreover, the presence of various automotive brands such as BMW, Audi, Mercedes, Volvo, Ferrari, Lamborghini and some others has increased the demand for clutch systems, thereby driving the growth of the automotive clutch market in this region.

Germany is the major contributor in this region. In Germany, the market is generally driven by the growing demand for commercial vehicles along with technological advancements in automotive sector. Moreover, rapid investment by automotive components manufacturers to open new production facilities coupled with presence of various automotive clutch companies such as Schaeffler, ZF Friedrichshafen, FTE automotive GmbH and others is likely to propel the market growth in this nation.

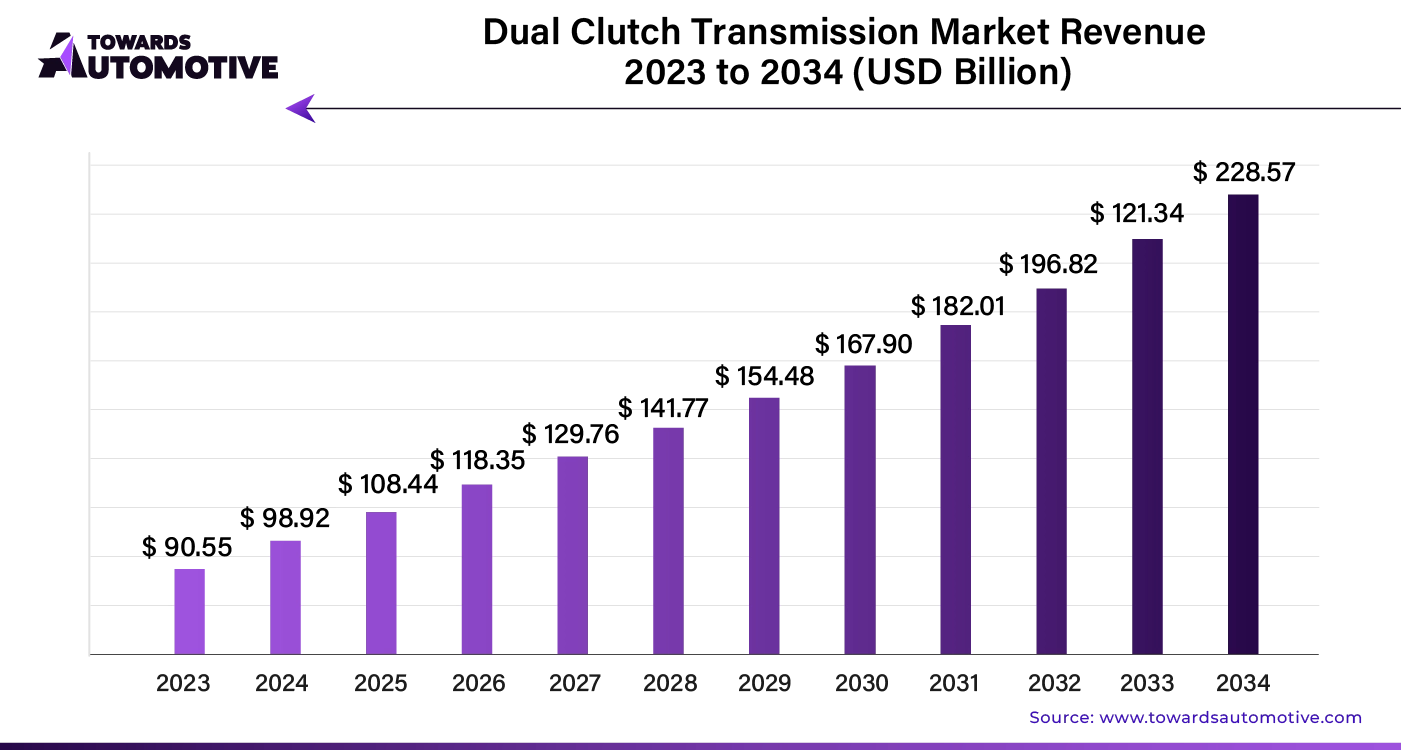

The global dual clutch transmission market is projected to reach USD 228.57 billion by 2034, expanding from USD 108.44 billion in 2025, at an annual growth rate of 9.23% during the forecast period from 2025 to 2034.

Dual Clutch Transmission (DCT) offers significant benefits over traditional manual transmissions. It provides rapid gear shifts and a smoother driving experience. DCT minimizes power loss and enhances acceleration, driving high demand. Additionally, it requires less maintenance and lowers long-term costs, resulting in improved vehicle performance. Wet plate dual-clutch transmissions (DCTs) are increasingly favored over dry plate systems due to their higher durability and performance. Lubricated with oil, these clutches minimize friction and enhance gear shifts, leading to smoother operation and improved reliability.

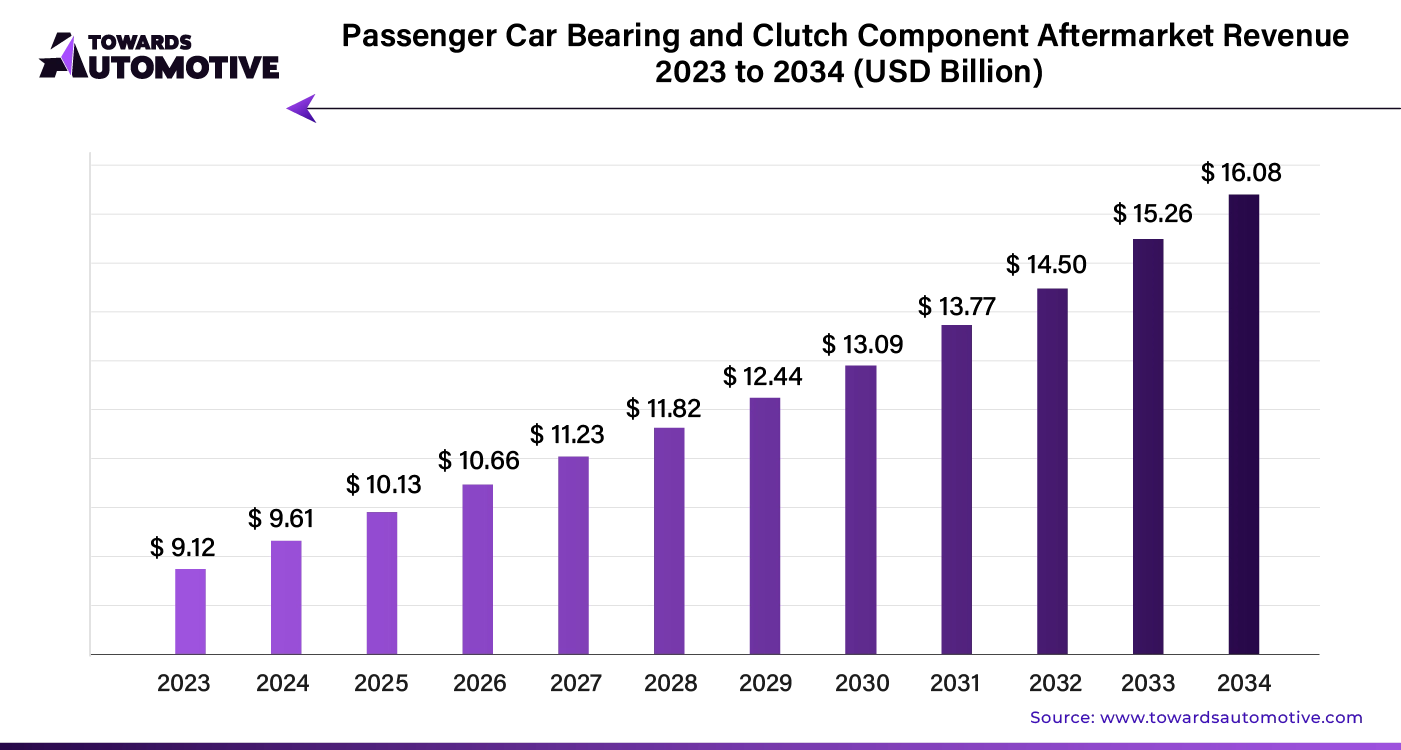

The passenger car bearing and clutch component aftermarket is anticipated to grow from USD 10.13 billion in 2025 to USD 16.08 billion by 2034, with a compound annual growth rate (CAGR) of 5.26% during the forecast period from 2025 to 2034. The growing sales and production of passenger cars in India and China coupled with rapid investment by automotive brands for integrating high-quality components in passenger cars is playing a vital role in shaping the industrial landscape.

Moreover, the rising demand for luxury cars from HNIs along with partnerships among automotive companies and clutch manufacturers has boosted the market expansion. The increasing use of sustainable materials for manufacturing automotive components is expected to create ample growth opportunities for the market players in the future.

The passenger car bearing and clutch component aftermarket is a prominent branch of the automotive industry. This industry deals in manufacturing and distribution of clutch and bearing components to cater the needs of passenger vehicles. There are different types of clutches developed in this sector comprising of single-plate clutch, multi-plate clutch, cone clutch, hydraulic clutch, electromagnetic clutch and some others. These clutches are manufactured using various types of materials including steel, plastic, composites, ceramic and some others. It is available in a well-established distribution channel consisting of online platforms and retail outlets.

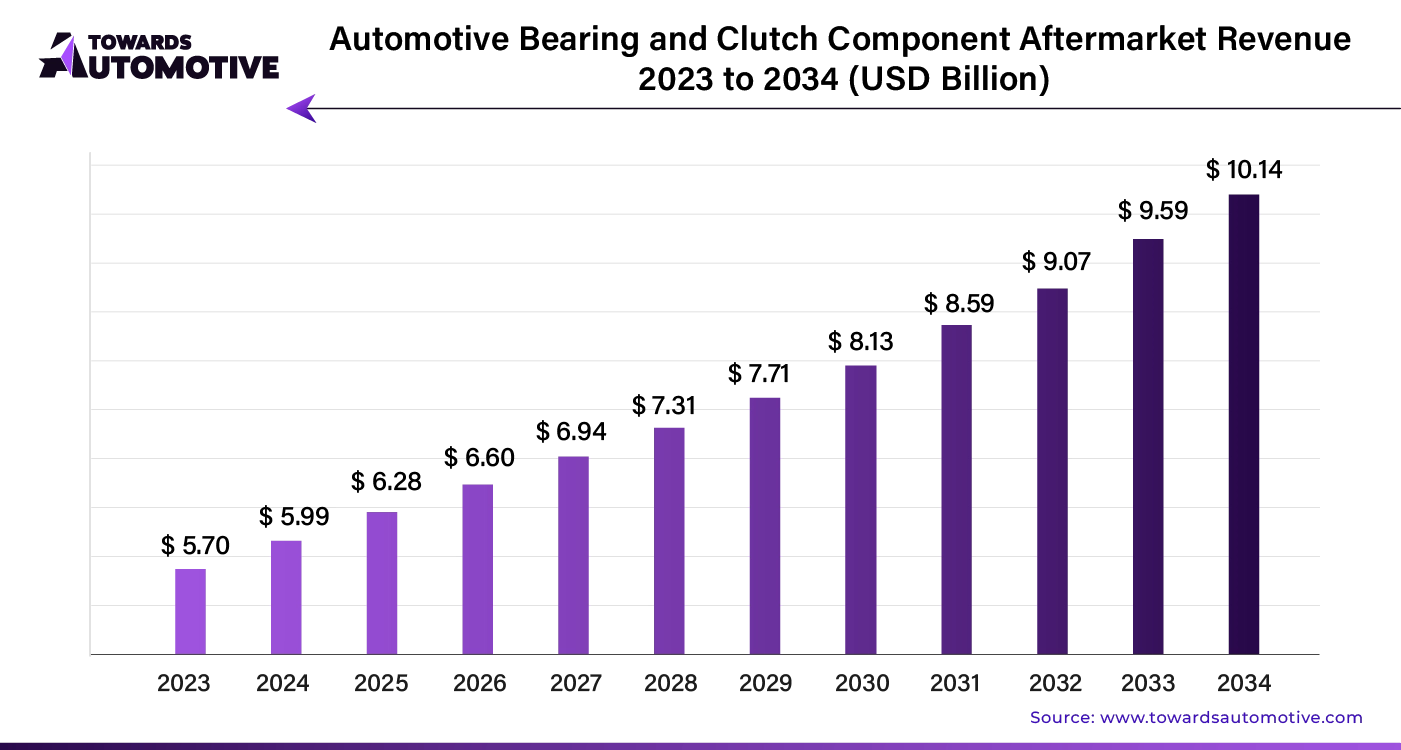

The automotive bearing and clutch component aftermarket is forecast to grow from USD 6.28 billion in 2025 to USD 10.14 billion by 2034, driven by a CAGR of 5% from 2025 to 2034.

The automotive clutch market is a highly competitive industry with the presence of a numerous dominating players. Some of the prominent companies in this industry consists of FTE Automotive, Valeo, Nisshinbo Holdings, Clutch Auto Ltd, Eaton, ICER Brakes, LuK, Maruyasu Industries, BorgWarner, Schaeffler, Sachs, Wabco and some others. These companies are constantly engaged in developing high-quality clutches for automotives and adopting numerous strategies such as partnerships, acquisitions, joint ventures, collaborations, business expansions, launches, and some others to maintain their dominant position in this industry. For instance, in November 2024, Schaeffler announced to manufacture a new series of shiftable one-way clutch systems at its manufacturing facility in Taicang, China. These clutches are designed for all-wheel-drive (AWD) vehicles. Also, in October 2024, Eaton launched a new range of automotive clutches. These clutches are developed using advanced materials that provides enhanced durability and superior performance.

By Type

By Transmission Type

By Vehicle Type

By Component Material

By Region

The global quadricycles and tricycles market, valued at USD 5.54 billion in 2024, is anticipated to reach USD 9.56 billion by 2034, growing at a CAGR ...

Projections indicate the global automotive V2X antenna market will increase from USD 4.7 billion in 2024 to USD 19.3 billion by 2034, experiencing a C...

The global dual clutch transmission market, projected at USD 98.92 billion in 2024, is expected to reach USD 228.57 billion by 2034, growing at a CAGR...

December 2025

October 2025

October 2025

October 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us