September 2025

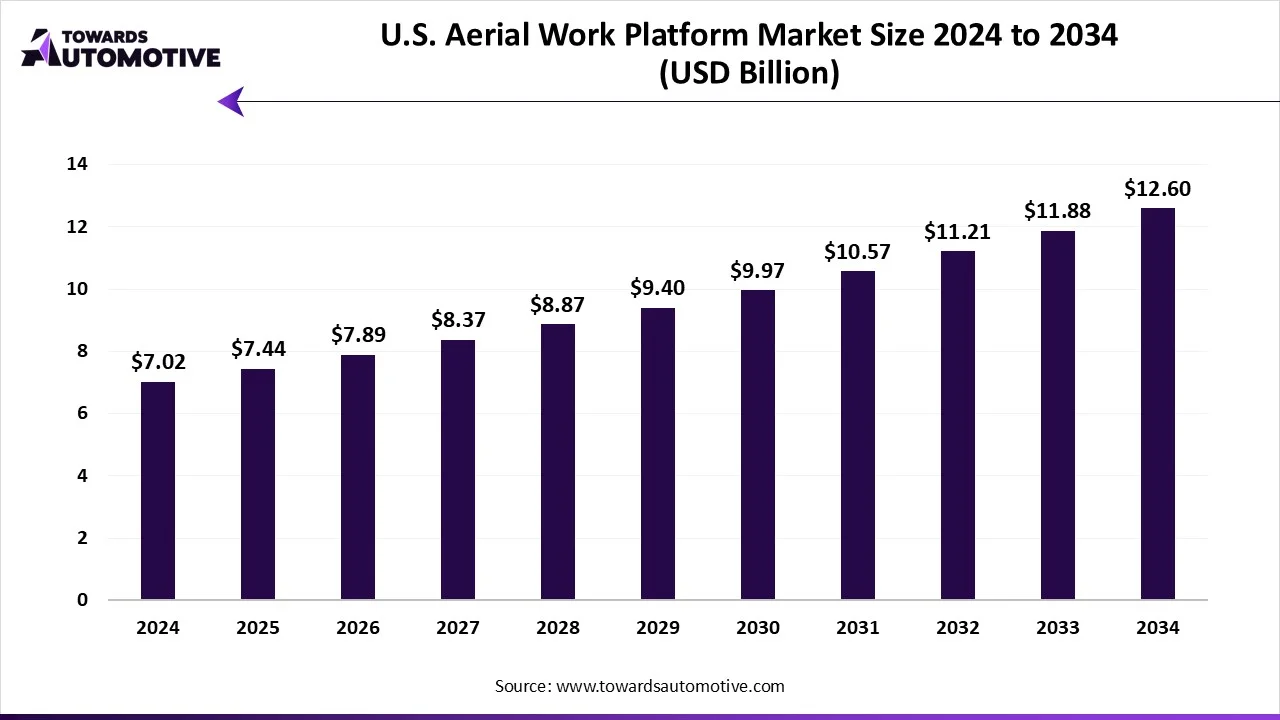

The U.S. aerial work platform (AWP) market is predicted to expand from USD 7.44 billion in 2025 to USD 12.60 billion by 2034, growing at a CAGR of 6.02% during the forecast period from 2025 to 2034. The drivers of the U.S. aerial work platform market are an increase in construction projects (urban and rural), the rising popularity of e-commerce, and stricter government safety regulations that have led companies to choose AWPs over traditional ladders or scaffolding.

Moreover, increased noise restrictions and environmental regulations are leading more organizations to prefer electric AWPs as they are clean and quiet. Strong growth opportunities arise in the market with the rise in the rental market and electric AWPs.

Aerial work platforms (AWPs) are mechanical devices used to provide temporary access for people or equipment to inaccessible areas, usually at height. Workers utilize AWPs across a diverse range of industries within the U.S. construction, maintenance, warehousing, logistics, transportation, and utilities. AWPs assist construction professionals with roofing, cladding, finishing projects, and on-site work. The type of products in the market comprises boom lifts, scissor lifts, vertical mast lifts, spider lifts, and other specialized lifts. The market is segmented into propulsion types such as internal combustion engines, electric, and air powered. The end-users in the market include construction companies, rental & leasing firms, maintenance service providers, government & municipalities, and a few others. AWPs have also become a modern solution to inventory management in warehouses, accompanied by facility repair work. The aerial work platform market is growing due to increasing requirements of AWPs across several industries, rising infrastructure investment, and government regulations.

The trend in the U.S. aerial work platform market are various innovations in product types to provide enhanced safety, maneuverability, and efficiency.

The scissor lifts segment captured around 46.9% of the market share. Scissor lifts are the most popular aerial platforms because they are very economical, user-friendly, and prevalent in the market for handling maintenance, construction, and even warehousing tasks. Scissor lifts can be compact in size, work well in tight spaces, and offer a significant level of load capacity that makes them applicable in many U.S. industries. Moreover, versatility and advanced safety features are why scissor lifts continue to be in demand across the U.S.

The boom lifts segment is expected to grow at with the highest CAGR during the forecast period. This is because boom lifts have a primarily large reach that offers flexibility of use to workers. Demand for the boom lifts in the U.S. is driven by infrastructure upgrades, utility maintenance, and urban construction projects. Additionally, articulating and telescopic boom lifts are helping workers to access hard-to-reach areas and adding value to contracted services that requires reliable and safe vertical access options.

The Internal Combustion Engine (ICE) segment captured around 63.6% of the total market share. ICE-powered aerial platforms are the dominating aerial platform type due to their high-powered productivity and durability for outdoor construction sites in the U.S. Moreover, ICE-powered aerial platforms are superior in handling rough terrains, long hours of operation, and heavy lifting. In many cases, ICE-powered lifts are preferred on large construction, oil, and infrastructure projects due to their ability to perform continuous operation without recharging.

The electric segment is expected to be the fastest-growing segment in the U.S. aerial work platform market. The electric category is rapidly evolving as U.S. industries look toward sustainability and emission laws. Electric aerial lifts, being quieter and producing zero emissions on-site, have a strong fit for indoor environments, such as warehouses and logistics buildings. They are cheaper to operate and support clean energy initiatives and often help companies in construction to move towards and encourage their own environmentally friendly operating methods.

The 21-50ft segment dominated with 46.19% of the total market share. The 21–50ft segment dominated the market as it delivers several product options and meets the average reach requirement of the U.S. construction, warehousing, and facility maintenance industries. The 21–50ft lifts offer sufficient height for multi-story buildings along with maintaining a small footprint and price range. Moreover, these lifts offer flexibility for indoor or outdoor projects such as commercial building maintenance, retail facilities, and medium-scale construction work in the U.S.

The above 120ft lift segment is expected to grow with the highest CAGR during the forecast period. It is the fastest-growing segment due to the rising demand in large-scale infrastructure projects in the U.S. In the U.S., the development and maintenance of the power transmission lines require work at extreme heights, and contractors are increasingly reliant on high-reach platforms to efficiently perform work at high elevation.

The construction segment led the U.S. aerial work platform market, holding around 57.8 % of the total market share. This is because AWPs are essential for all construction projects for working at height. In the U.S., AWPs are employed across all levels of building projects and are used for structural installation, cladding, roofing, and finishing work. Moreover, they provide substantial improvements in safety of workers and efficiency for projects. Additionally, the rising number of construction projects around the U.S. creates opportunities for the application of AWPs in construction.

The logistics and transportation segment is expected to be the fastest-growing segment in the forecast period. Logistics and transportation are the fastest-growing end-use applications due to rapid e-commerce expansion and the launch of distribution centers across the U.S. Additionally, warehouses and cargo hubs are utilizing aerial work platforms for inventory, maintenance, and facility upkeep needs.

The construction companies segment captured 40% of the total market share. Construction companies are dominating the aerial work platform market since they utilize aerial lifts in every project during initial phase. The use of AWPs enhances worker safety during construction. Moreover, the U.S. construction companies are more likely to own AWPs for minimizing long-term ownership costs.

The rental & leasing firms are expected to grow with the highest CAGR during the forecast period. Rental and leasing companies are growing rapidly because many contractors and small companies in the U.S. prefer to rent AWPs to eliminate the heavy cost of ownership. Renting requires less money up front and provides flexibility in fleet selection without worrying about maintenance. Moreover, the increasing number of short-term projects, coupled with changing height requirements, requires a continued strong demand for rental AWPs.

The raw material required for making aerial work platforms are steel, aluminum, rubber, glass, and hydraulic fluids.

The components required in aerial work platforms are hydraulic systems, electric motors, safety sensors, control panels, and batteries.

In this stage the aerial work platforms are built using the raw materials and components. The companies ensure compliance with U.S. safety before shipping out the assembled AWPs.

The U.S. aerial work platform market is highly competitive. The market comprises several prominent players such as JLG Industries, Inc., Terex Corporation, Haulotte Group, Skyjack Inc., Manitou Group, Aichi Corporation, Tadano Ltd., LGMG Group, MEC Aerial Work Platforms, Hangcha Group Co., Ltd., Palfinger AG, Genie Industries (Terex), Snorkel (Acquired by Tadano), Niftylift Ltd., Manitou Americas, JCB Lift & Load, Doosan Industrial Vehicle, Mitsubishi Logisnext, KUKA Robotics (for automation integration), and Hyundai Construction Equipment. These companies are focusing on building high-quality lifts with enhanced safety features to gain dominance in the market. Moreover, several companies are introducing electric or hybrid-powered models to meet U.S. emission rules.

By Product Type

By Propulsion Type

By Lifting Height

By Application

By End-User

By Region

According to market projections, the locomotive industry is expected to grow from USD 8.32 billion in 2024 to USD 17.94 billion by 2034, reflecting a ...

September 2025

September 2025

September 2025

October 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us