September 2025

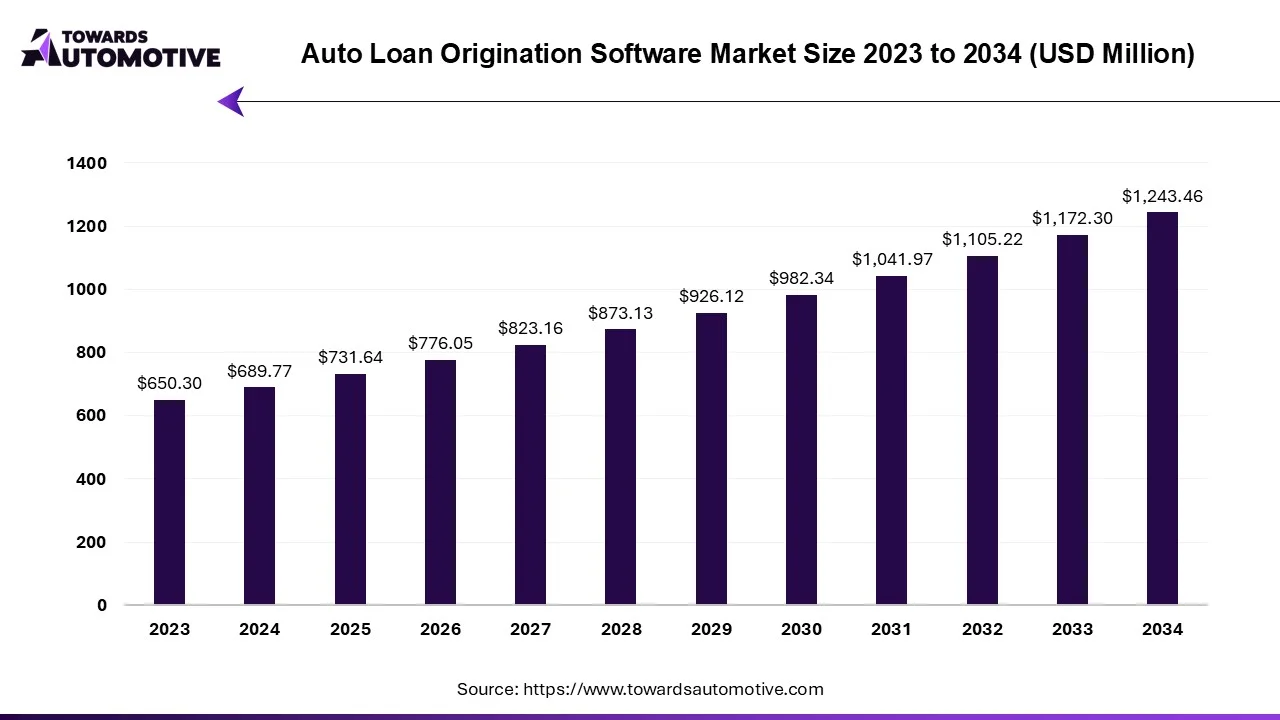

The auto loan origination software market is set to grow from USD 731.64 million in 2025 to USD 1.243.46 million by 2034, with an expected CAGR of 6.07% over the forecast period from 2025 to 2034. The rising disposable income of the people in mid-income countries coupled with increasing emphasis of BFSI sector for providing low-rate automotive loans to the people has driven the market expansion.

Additionally, rise in number of NBFCs engaged in providing vehicle loans along with flexible repayment options offered by commercial banks is further adding to the overall market growth. The integration of advanced technologies such as blockchain and Bigdata analytics in loan processing platforms is expected to create ample growth opportunities for the market players in the future.

Unlock Infinite Advantages: Subscribe to Annual Membership

The auto loan origination software market is a crucial branch of the automotive industry. This industry deals in developing advanced software to enhance the loan processing activity for purchasing vehicles. There are several components of this sector comprising of software and services. These solutions are deployed by different modes including on-premises and cloud-based. The end-user of these software consists of banks, credit unions, mortgage lenders and brokers and some others. The rising consumer preference to purchase vehicles through loans has contributed to the industrial expansion. This market is expected to rise significantly with the growth of the BFSI sector across the world.

| Metric | Details |

| Market Size in 2025 | USD 731.64 Million |

| Projected Market Size in 2034 | USD 1.243.46 Million |

| CAGR (2025 - 2034) | 6.07% |

| Leading Region | North America |

| Market Segmentation | By Component, By Deployment, By Application, By Enterprise Size, By End Use and By Region |

| Top Key Players | Inovatec Systems, Black Knight, Finastra, Byte Software, Fiserv, Softdocs, Lendsnap, Hyundai Capital America, DealerSocket, Novantas |

The major trends in this market consists of partnerships, rising sales of vehicles and AI-based loan origination software.

Numerous market players are partnering credit unions to deploy advanced software in loan processing activity. For instance, in February 2025, Mantl partnered with SouthPoint Credit Union, Embers Credit Union, Minnco Credit Union, and The Atlantic Federal Credit Union. This partnership is done for deploying Mantl’s loan originating software in these credit unions. (Source: Business Wire)

The sales of vehicles have increased rapidly in several countries such as India, the U.S., UK, Germany, UAE and some others that in turn increases the demand for automotive loans. According to the SMMT, around 150070 vehicles were registered in the UK during May 2025. (Source: SMMT)

The software companies have started integrating AI in their loan originating platforms to enhance credit assessment and improve fraud detection. For instance, in June 2025, Rapid Finance launched SPADE. SPADE is an AI-based platform designed to accelerate the loan processing in small banks. (Source: Business Wire)

The software segment dominated the market. The rise in number of software startups in numerous countries such as India, Malaysia, Ireland, UAE, Germany and some others has driven the market expansion. Additionally, the deployment of cloud-based loan origination software in the BFSI sector coupled with integration of AI in banking software is contributing to the industrial growth. Moreover, rapid investment by market players for developing advanced software for enhancing automotive loan processing is expected to drive the growth of the auto loan origination software market.

The services segment is expected to expand with a significant CAGR during the forecast period. The rising adoption of SaaS in the banking sector to simplify complex tasks has boosted the market expansion. Also, the growing use of automated services for credit assessment and loan processing is playing a vital role in shaping the industrial landscape. Moreover, numerous subscription-based services provided by market players to cater the needs of the banking sector is expected to boost the growth of the auto loan origination software market.

The cloud-based segment dominated the market. The growing adoption of cloud-based loan origination software in the BFSI sector to enhance scalability and improve workflow efficiency has boosted the market expansion. Additionally, rising emphasis of software companies towards developing cloud-based software with additional security to provide protection against online frauds is playing a vital role in shaping the industry in a positive direction. Moreover, numerous advantages of cloud-based software including cost savings, high security, enhance flexibility, real-time insights, data loss prevention and some others is expected to foster the growth of the auto loan origination software market.

The on-premises segment is expected to rise with a considerable CAGR during the forecast period. The rising adoption of on-premises software by NBFCs to enhance the loan processing activity is driving the market growth. Also, low cost of these software as compared to cloud-software coupled with less threat of cybercrime associated with on-premises software has boosted the industrial expansion. Moreover, various benefits of these software including data sovereignty, low latency, long-term cost savings, custom security protocols and some others is expected to drive the growth of the auto loan origination software market.

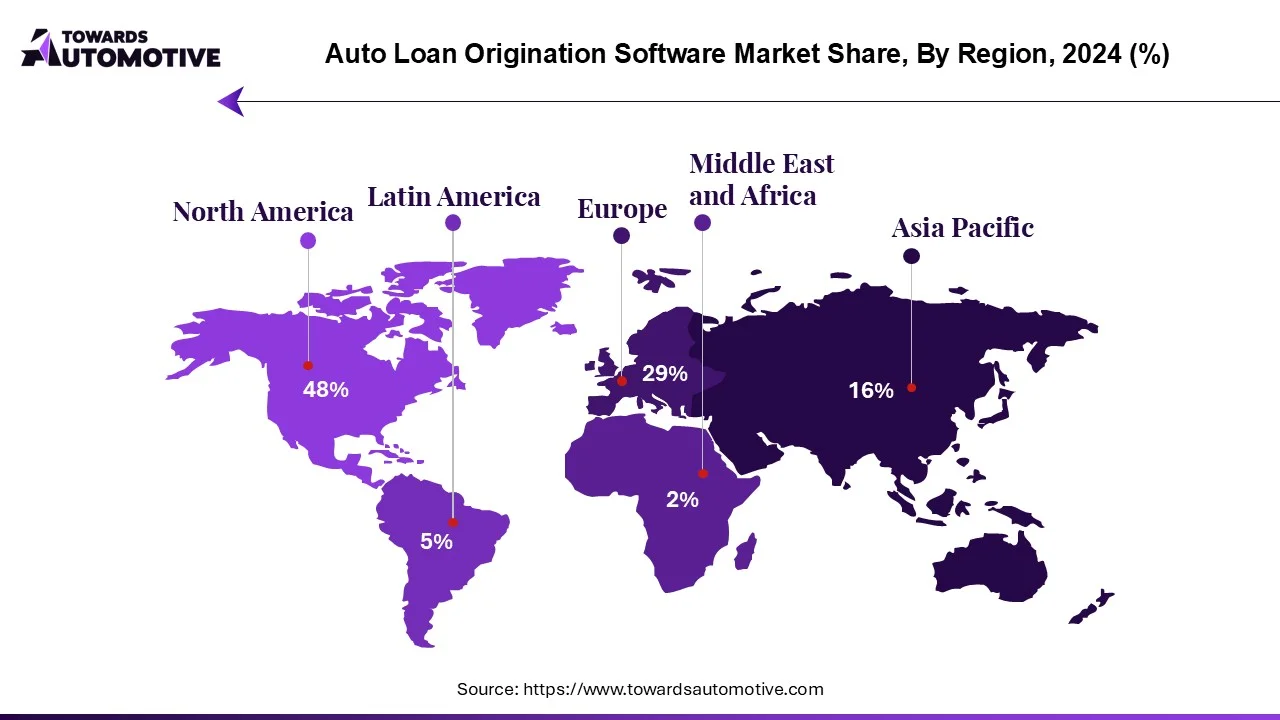

North America led the auto loan origination software market. The rising consumer preference towards purchasing luxury vehicles coupled with numerous loan offers delivered by credit unions for purchasing automotive has driven the market expansion. Additionally, the growing adoption of cloud-based software in the BFSI sector coupled with high purchasing power parity of the consumers across the U.S. and Canada is contributing to the overall development of this industry. Moreover, the presence of numerous market players such as Black Knight Technologies, Inovatec Systems, Calyx Technology, ICE Mortgage Technology and some others is expected to propel the growth of the auto loan origination software market in this region.

Europe is expected to rise with a significant CAGR during the forecast period. The growing demand for BEVs in several countries such as Germany, Italy, UK, Denmark and some others has driven the market expansion. Also, the increasing popularity of connected financial technologies and rapid adoption of digital banking services is contributing to the overall industrial growth. Moreover, technological advancements in software development sector coupled with presence of numerous market players such as HES FinTech, Aryza, SBS Banking Platform and some others is expected to drive the growth of the auto loan origination software market in this region.

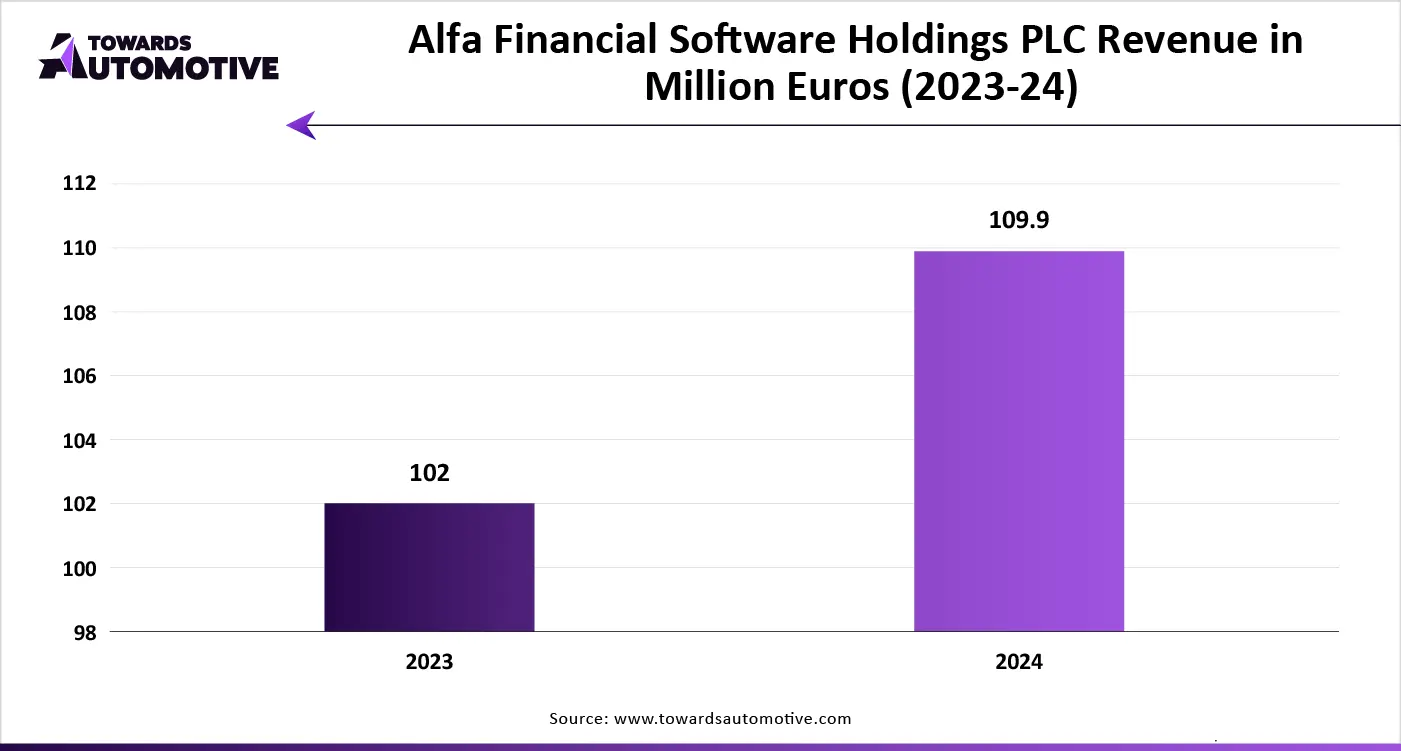

The auto loan origination software market is an evolving industry with the presence of numerous dominating players. Some of the prominent companies in this industry consists of Inovatec Systems, Black Knight, Finastra, Byte Software, Fiserv, Softdocs, Lendsnap, Hyundai Capital America, DealerSocket, Novantas, Alfa Financial Software Holdings PLC, KeyStone Lending Solutions, Total Expert, Sirius Computer Solutions, DataClusive AI, FIS and some others. These companies are constantly engaged in developing loan origination software for the automotive sector and adopting numerous strategies such as launches, business expansions, joint ventures, acquisitions, partnerships, collaborations and some others to maintain their dominance in this industry.

By Component

By Deployment

By Application

By Enterprise Size

By End Use

By Region

September 2025

August 2025

August 2025

August 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us