December 2025

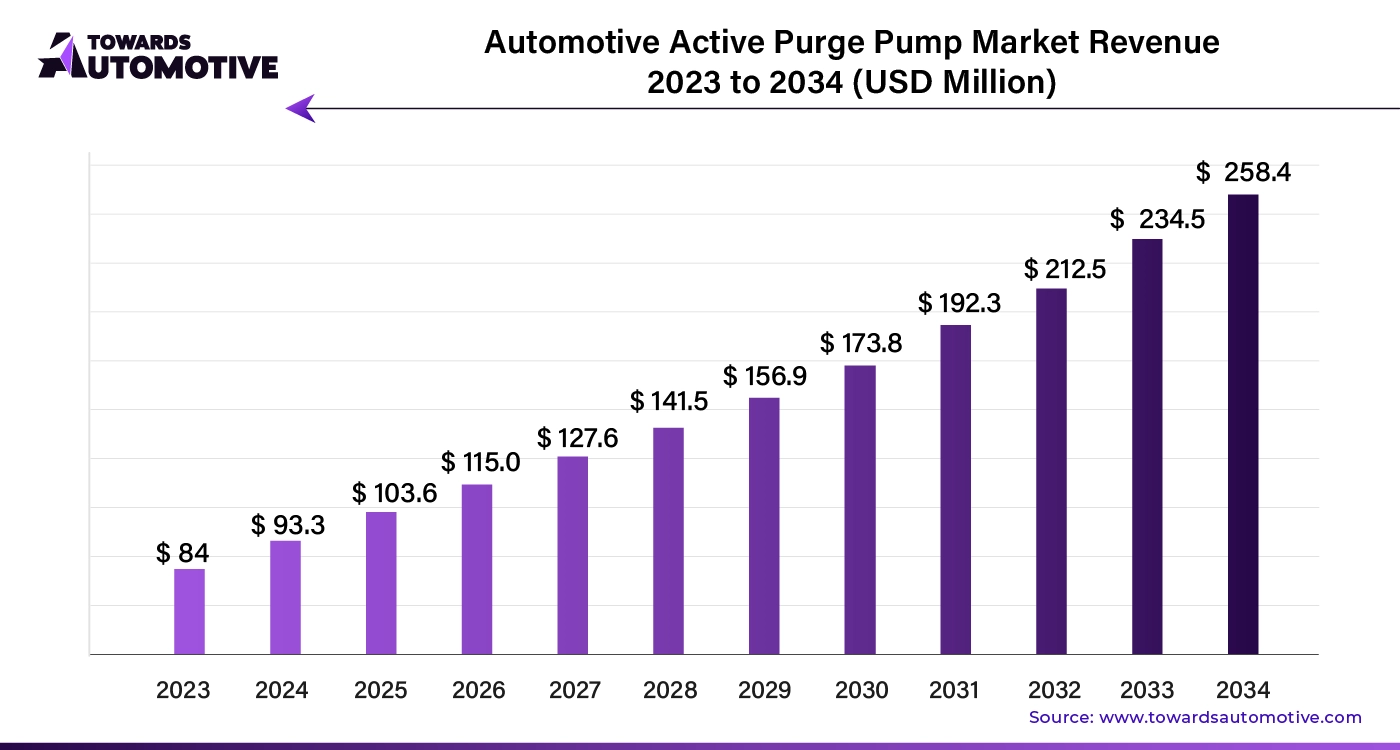

The global automotive active purge pump market size is calculated at USD 84 million in 2023 and is expected to be worth USD 258.4 million by 2034, expanding at a CAGR of 10.95% from 2024 to 2034.

The automotive active purge pump market is an integral segment of the automotive industry, focusing on devices designed to manage and control fuel vapor emissions from vehicles. Active purge pumps play a crucial role in the evaporative emission control system (EVAP), ensuring that fuel vapors are effectively captured and recirculated to the engine for combustion rather than being released into the atmosphere. This process not only enhances vehicle efficiency but also helps meet stringent environmental regulations aimed at reducing greenhouse gas emissions.

As automotive technology advances and emissions standards become increasingly rigorous, the demand for sophisticated and reliable active purge pumps is on the rise. Innovations in design, performance, and integration with advanced vehicle systems are driving growth in this market. With the global push towards cleaner and more efficient automotive technologies, the automotive active purge pump market is poised for significant expansion and evolution.

AI plays a transformative role in the automotive active purge pump market by enhancing efficiency, reliability, and performance. Through advanced algorithms and machine learning, AI enables predictive maintenance by analyzing data from purge pump systems to identify potential failures before they occur. This proactive approach minimizes downtime and reduces repair costs. AI-driven systems also optimize the performance of active purge pumps by continuously adjusting operations based on real-time conditions and driving patterns, ensuring optimal fuel vapor management and emission control.

Additionally, AI supports the development of more sophisticated purge pump designs by simulating various operating scenarios and refining components for better efficiency and durability. As the automotive industry increasingly integrates AI into its systems, the active purge pump market benefits from improved diagnostics, enhanced functionality, and greater overall system reliability, contributing to more efficient and environmentally friendly vehicle operation.

The automotive market valued at USD 4,070.19 billion in 2023, is experiencing growth and is projected to surpass USD 6,678.28 billion by 2032, with a significant CAGR of over 5.66%.

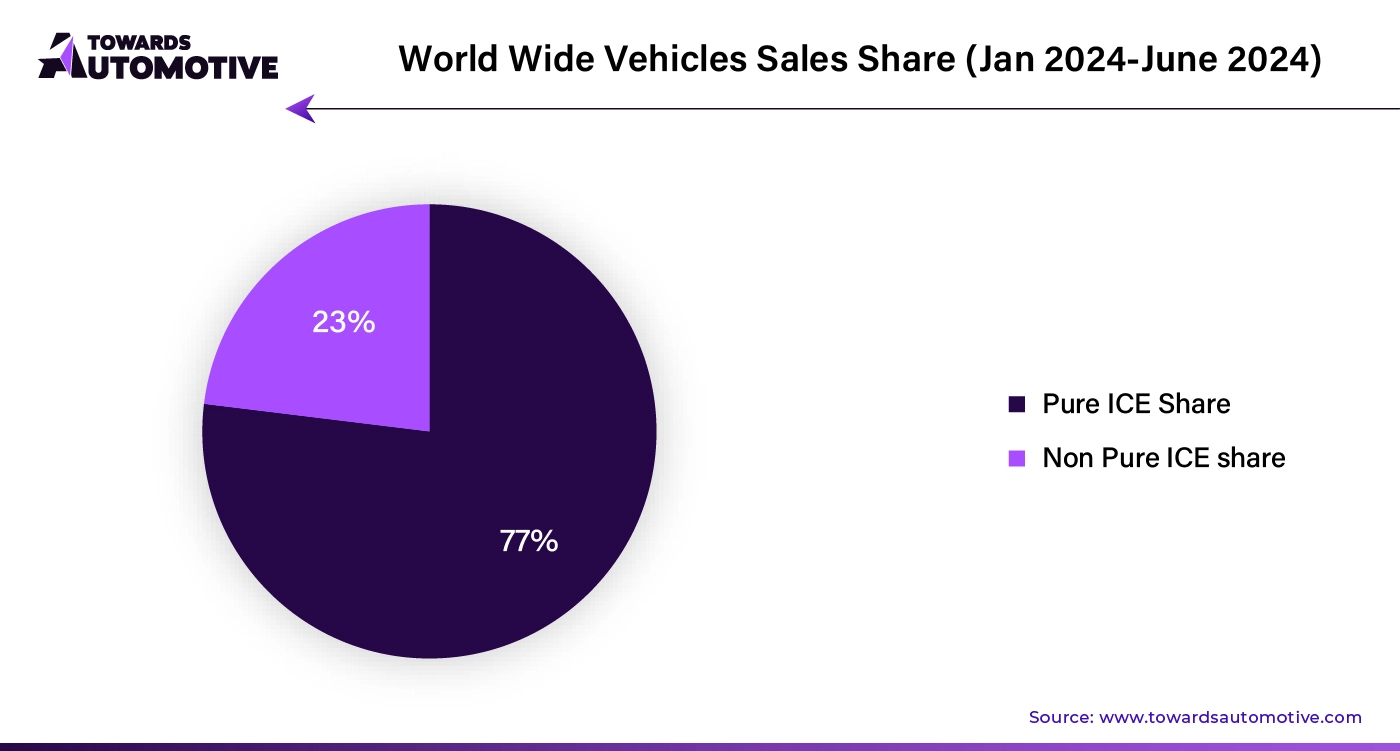

The rising demand for hybrid vehicles is significantly driving the growth of the automotive active purge pump market, as these vehicles require advanced emissions control technologies to meet stringent environmental standards. Hybrid vehicles, which combine internal combustion engines with electric propulsion, are designed to be more fuel-efficient and environmentally friendly. To optimize their performance and minimize emissions, hybrid vehicles rely heavily on sophisticated evaporative emission control systems, where active purge pumps play a crucial role. These pumps manage and direct fuel vapors from the fuel tank to the engine, ensuring efficient vapor recovery and preventing the release of harmful emissions into the atmosphere.

As hybrid vehicle adoption increases, driven by consumer preferences for greener transportation options and regulatory pressures for reduced emissions, the need for effective and reliable active purge pumps grows accordingly. Additionally, the development of hybrid vehicles often involves the integration of advanced technologies that require precise control of vapor management systems, further boosting demand for high-performance active purge pumps. This synergy between the rise of hybrid vehicles and the advancement of emissions control technologies is propelling the automotive active purge pump market forward, aligning with the global push towards cleaner and more sustainable automotive solutions.

The automotive active purge pump market faces restraining factors such as high development and manufacturing costs, which can limit affordability and market accessibility. Additionally, the complexity of integrating advanced purge pump systems with existing vehicle designs may pose challenges. Stringent regulatory requirements and potential issues with system reliability and maintenance also contribute to market constraints.

Integration with advanced emission control systems creates significant opportunities for the automotive active purge pump market by enhancing the effectiveness and efficiency of vapor management. As vehicles become more complex with sophisticated emission control technologies, active purge pumps are crucial in ensuring optimal performance and compliance with stringent emissions regulations. By integrating with systems such as advanced catalytic converters and particulate filters, these pumps can better manage fuel vapor recovery and reduce harmful emissions.

This synergy not only helps manufacturers meet regulatory requirements but also improves overall vehicle efficiency and environmental performance. The demand for vehicles equipped with advanced emission control systems is rising, driven by stricter global emissions standards and increasing consumer awareness of environmental issues. As a result, active purge pump manufacturers have the opportunity to innovate and develop new solutions that cater to these advanced systems, expanding their market presence and driving growth in the automotive sector.

The non-metal segment is observed to grow with a CAGR of 11.7% during the forecast period. Non-metal pumps are driving growth in the automotive active purge pump market by offering several key advantages over traditional metal components. These pumps, often made from advanced polymers or composites, are lighter, more resistant to corrosion, and offer superior durability in harsh operating conditions. The use of non-metal materials helps in reducing the overall weight of the pump, which contributes to improved vehicle fuel efficiency and performance.

Additionally, non-metal pumps can be designed with complex geometries and finer tolerances, enhancing their effectiveness in managing fuel vapor and ensuring better emission control. Their resistance to chemical degradation and lower maintenance requirements also make them more cost-effective over the long term. As the automotive industry increasingly focuses on reducing vehicle weight and improving efficiency while adhering to stringent emission regulations, the adoption of non-metal active purge pumps is expected to grow, driving market expansion and technological innovation.

The passenger vehicle segment is projected to grow with a CAGR of 11.5% during the forecast period. The growth of the automotive active purge pump market is significantly driven by the increasing demand for passenger vehicles, as these vehicles require advanced vapor management systems to meet stringent emission standards. Active purge pumps play a crucial role in controlling and managing fuel vapor emissions from passenger vehicles, ensuring that vapors are effectively recirculated to the engine rather than being released into the atmosphere.

With a rising global focus on reducing vehicular emissions and improving fuel efficiency, automakers are incorporating more sophisticated emission control technologies, including active purge pumps, into their vehicles. The expansion of the passenger vehicle market, fueled by growing urbanization, rising disposable incomes, and a preference for personal transportation, directly boosts the demand for these pumps.

Additionally, as consumer awareness of environmental issues increases, there is greater pressure on manufacturers to adopt advanced emissions control systems in passenger vehicles. The continual advancement in automotive technology and the introduction of new vehicle models with enhanced emission control systems further drive the need for efficient and reliable active purge pumps, supporting market growth.

United States is expected to grow with a CAGR of 10.84% during the forecast period. The growth of the automotive active purge pump market in the USA is driven by several key factors. Firstly, stringent emissions regulations enforced by the Environmental Protection Agency (EPA) necessitate advanced vapor management technologies, including active purge pumps, to ensure vehicles meet these standards. As regulations become more rigorous, automakers are increasingly incorporating sophisticated purge pumps to manage fuel vapor emissions effectively. Additionally, the growing consumer preference for high-performance and fuel-efficient vehicles drives demand for advanced emission control systems, which include active purge pumps. The rapid expansion of the automotive aftermarket and the rise in vehicle customization also contribute to market growth, as aftermarket parts and performance upgrades often include enhanced purge pump systems. Furthermore, the increase in hybrid and electric vehicle adoption in the US requires advanced vapor management solutions to integrate with new powertrains and emission control systems. The continuous advancement in automotive technology, coupled with rising awareness of environmental issues and the need for compliance with emission standards, further fuels the demand for active purge pumps. Together, these factors support the robust growth and development of the automotive active purge pump market.

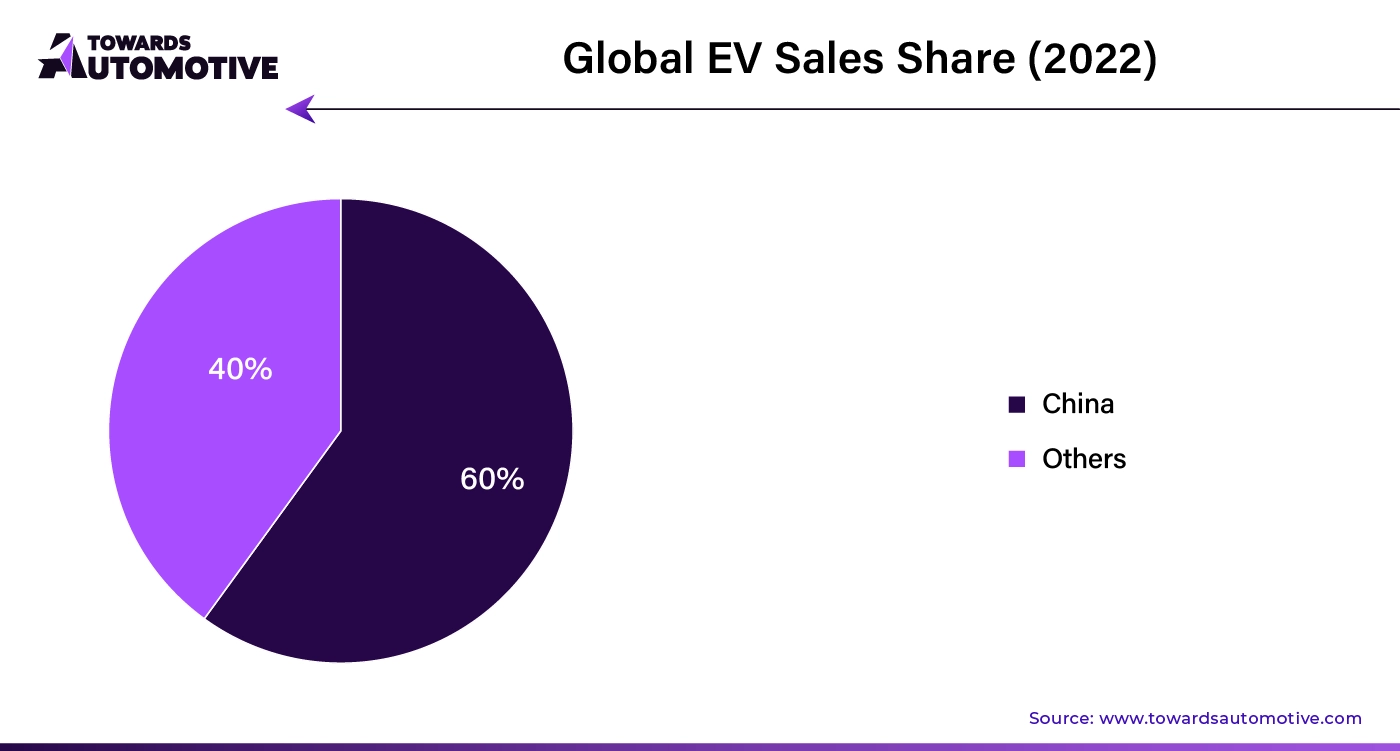

China is assumed to grow at a CAGR of 10.65% during the forecast period. The growth of the automotive active purge pump market in China is driven by several pivotal factors. First, China's rapid urbanization and economic development have led to a significant increase in vehicle ownership, creating a larger market for advanced automotive components, including active purge pumps. Stringent emissions regulations imposed by the Chinese government to combat air pollution are another critical driver, as they mandate sophisticated emission control systems to reduce vehicle emissions.

This regulatory pressure compels automakers to adopt advanced purge pump technologies to ensure compliance. Additionally, the rise of the automotive aftermarket sector in China, fueled by growing consumer interest in vehicle performance and customization, further boosts demand for high-quality purge pumps. The expanding electric and hybrid vehicle market in China also contributes to this growth, as these vehicles require advanced vapor management solutions integrated with new powertrain technologies.

Furthermore, the presence of a robust automotive manufacturing industry and an increasing focus on research and development support the advancement and adoption of cutting-edge purge pump technologies. Collectively, these factors drive the robust expansion of the automotive active purge pump market in this country.

Japan is likely to grow at a CAGR of 10.53% during the forecast period. The growth of the automotive active purge pump market in Japan is influenced by several key factors. Japan's strong automotive industry, renowned for its innovation and quality, drives demand for advanced emission control technologies, including active purge pumps. The country’s rigorous environmental regulations, aimed at reducing air pollution and meeting stringent emissions standards, require the adoption of sophisticated purge pump systems to manage fuel vapor emissions effectively.

Additionally, Japan's car culture and the increasing popularity of high-performance and luxury vehicles create a growing market for aftermarket components, including performance-oriented purge pumps. The rise in hybrid and electric vehicle adoption in Japan further stimulates market growth, as these vehicles often need advanced vapor management systems to integrate with their complex powertrains.

Moreover, Japan's emphasis on technological advancement and research and development supports the continuous innovation of active purge pumps, enhancing their efficiency and reliability. The country’s focus on sustainability and environmental responsibility, coupled with a robust automotive sector and consumer demand for high-quality components, collectively drive the expansion of the automotive active purge pump market in Japan.

South Korea is projected to grow with a CAGR of 10.43% during the forecast period. The growth of the automotive active purge pump market in South Korea is driven by several influential factors. South Korea's rapidly expanding automotive sector, known for its innovation and high-tech manufacturing, fuels the demand for advanced emission control systems, including active purge pumps. Stringent environmental regulations enforced by the South Korean government require automotive manufacturers to integrate sophisticated purge pump systems to manage fuel vapor emissions and comply with emissions standards.

The increasing popularity of hybrid and electric vehicles in South Korea also contributes to market growth, as these vehicles demand advanced vapor management solutions to complement their innovative powertrains. Additionally, the rising interest in high-performance and customized vehicles among South Korean consumers drives the need for enhanced purge pump technologies in the aftermarket sector. South Korea's strong emphasis on technological advancement and research supports the development of more efficient and durable purge pump systems. The presence of major automotive manufacturers and suppliers in the country further stimulates market growth through continuous innovation and the adoption of cutting-edge technologies.

In September 2023, DENSO CORPORATION launched Everycool. Everycool is a new cooling system designed for commercial vehicles designed to provide comfort even when the engine is off, while also saving energy.

By Manufacturing Process

By Material Type

By Sales Channel

By Vehicle Type

By Region

The automotive actuators market is set to reach USD 104.80 billion by 2034, propelled by ADAS/AV features (ACC, adaptive front lighting), electrificat...

December 2025

October 2025

October 2025

October 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us