December 2025

A revenue surge in the automotive active aerodynamic devices market is on the horizon, with growth expected to reach hundreds of millions by 2034, revolutionizing the transportation landscape. The growing sales of sports cars in developed nations coupled with technological advancements in the automotive component industry has driven the market expansion.

Additionally, rising popularity of racing sports among youths along with increasing demand for fuel-efficient vehicles in mid-income countries is playing a vital role in shaping the industrial landscape. The rising use of carbon fibers for manufacturing high-quality automotive aerodynamic components that delivers superior performance is expected to create ample growth opportunities for the market players in the upcoming days.

The automotive active aerodynamic devices market is a crucial branch of the automotive industry. This industry deals in manufacturing and distribution of active aerodynamic devices in different parts of the world. There are several types of components developed in this sector comprising of active grille shutters, active spoiler, active rear wings, active diffusers, active side skirts, active air dams, underbody panels, wind deflectors and some others. These devices are designed for numerous vehicles comprising of passenger cars, light-duty vehicles (LDVs), heavy commercial vehicles, racing & high-performance vehicles, sports utility vehicles (SUVs), electric vehicles (EVs) and some others. This market is expected to rise significantly with the growth of the automotive component industry in different parts of the world.

| Metric | Details |

| Key Growth Drivers | Rising sports car sales, increasing fuel efficiency demand, carbon fiber usage, and popularity of racing sports |

| Leading Region | North America |

| Market Segmentation | By Component Type, By Mechanism, By Vehicle Type / Application, By Technology, By Drive Type and By Region |

| Top Key Players | Aisin Seiki, Continental AG, BorgWarner, Webasto, Magna International, Schaeffler, ZF, TRW, Valeo, Delphi Automotive |

The major trends in this market consists of rising sales of hybrid cars, popularity of racing sports and partnerships.

The sales of hybrid cars have increased rapidly in numerous countries such as India, the U.S., Canada and some others due to rising consumer preference towards lowering vehicular emission.

The popularity of numerous events such as Formula one, DTM, Intercontinental GT Challenge and some others has increased the demand for racing cars.

Numerous market players are partnering with each other for developing high-quality aerodynamic components to cater the needs of the automotive consumers.

The active grille shutters segment led the market. The growing use of active grill shutter in vehicles to regulated air flow in vehicles for enhancing performance and improving fuel efficiency has boosted the market expansion. Additionally, the increasing application of these automotive components to improve aerodynamic drag coefficient in vehicles is expected to propel the growth of the automotive active aerodynamic devices market.

The active rear wings segment is expected to witness with the highest CAGR during the forecast period. The growing use of deployable rear wing in luxury vehicles to enhance aerodynamic performance and improve the driving experience has boosted the market growth. Moreover, the increasing application of these wings in sports cars to generate downforce and reduce drag is expected to boost the growth of the automotive active aerodynamic devices market.

The active systems segment dominated the market. The rising use of active aerodynamics components such as active grille shutters, active rear diffusers, active spoilers in modern cars to enhance driving experience has boosted the market expansion. Moreover, numerous advantages of active aerodynamic systems including high-fuel efficiency, enhanced stability, reduced drag and some others is expected to drive the growth of the automotive active aerodynamic devices market.

The passive systems segment is expected to grow with the highest CAGR during the forecast period. The growing adoption of passive aerodynamics due to its ability to control airflow without the need of external energy has boosted the market expansion. Additionally, numerous advantages of passive aerodynamics in automotive to enhance drag reduction, improve stability, lowering noise reduction and some others is expected to boost the growth of the automotive active aerodynamic devices market.

The passenger cars segment led the market. The rising production of passenger vehicles in several countries such as India, Japan, Canada and some others has boosted the market growth. Additionally, the increasing demand for affordable hatchbacks in mid-income countries is playing a vital role in driving the growth of the automotive active aerodynamic devices market.

The sports utility vehicles (SUVs) segment is expected to rise with the fastest CAGR during the forecast period. The rising sales of SUVs in developed nations such as the U.S., UK, Germany and some others is contributing to the market expansion. Moreover, the growing use of active air dams and underbody panels in SUVs to enhance off-roading capabilities is expected to boost the growth of the automotive active aerodynamic devices market.

The electromechanical systems segment held the highest share of this industry. The increasing use of electromechanical aerodynamic devices in off-roading vehicles to improve driving experience has boosted the market expansion. Moreover, numerous advantages of electromechanical systems including reduced operational costs through automation, high accuracy and precision, increased efficiency and some others is accelerating the growth of the automotive active aerodynamic devices market.

The hydraulic systems segment is expected to grow with the highest CAGR during the forecast period. The rising adoption of hydraulics-based aerodynamic devices in supercars to maintain stability during high-speed driving has boosted the market expansion. Moreover, numerous benefits of hydraulic systems including reduced drag, high fuel efficiency, enhanced stability and some others is expected to drive the growth of the automotive active aerodynamic devices market.

The internal combustion engine (ICE) vehicles segment dominated the market. The growing sales of diesel-powered muscle cars in the U.S. and Mexico has driven the market expansion. Also, the increasing demand for petrol hatchbacks in developing nations such as Thailand, India, Vietnam, Indonesia and some others is expected to drive the growth of the automotive active aerodynamic devices market.

The battery electric vehicles (BEVs) segment is expected to expand with the fastest CAGR during the forecast period. The growing adoption of BEVs in different nations such as the U.S., India, Canada, Germany and some others for reducing vehicular emission has bolstered the market expansion. Moreover, numerous government initiatives aimed at developing the EV charging infrastructure is expected to boost the growth of the automotive active aerodynamic devices market.

North America led the automotive active aerodynamic devices market. The growing demand for muscle cars and luxury cars in the U.S. and Canada has increased the demand for high-quality aerodynamic systems, thereby driving the market expansion. Additionally, the rising popularity of vehicle modification coupled with technological advancements in the advanced material industry is contributing to the industrial growth. Moreover, numerous government initiatives aimed at lowering vehicular emission as well as presence of several local market players such as BorgWarner Inc., Magna International, Dayco Products LLC and some others is expected to drive the growth of the automotive active aerodynamic devices market in this region.

U.S. dominated the market in this region. The rising use of aerodynamic devices in supercars to enhance performance of vehicles coupled with integration of advanced technologies such as AI and IoT in the automotive sector has bolstered the market expansion. Moreover, rise in number of car modification centers along with growing disposable income of the people is further adding to the overall industrial growth.

Asia Pacific is expected to rise with the highest CAGR during the forecast period. The rising sales of passenger vehicles in several countries such as India, Japan, South Korea, China and some others has boosted the market expansion. Additionally, availability of essential raw materials coupled with continuous research and development activities related to production of aerodynamic systems is further adding to the industrial growth. Moreover, the presence of several automotive active aerodynamic devices companies such as Mando, Aisin Seiki, Denso Corporation and some others is expected to propel the growth of the automotive active aerodynamic devices market in this region.

China held the largest share of the market. In China, the market is generally driven by the rising sales of electric vehicles along with technological advancements in the automotive sector. Moreover, the availability of skilled labors coupled with presence of several automotive manufacturers is accelerating the market expansion.

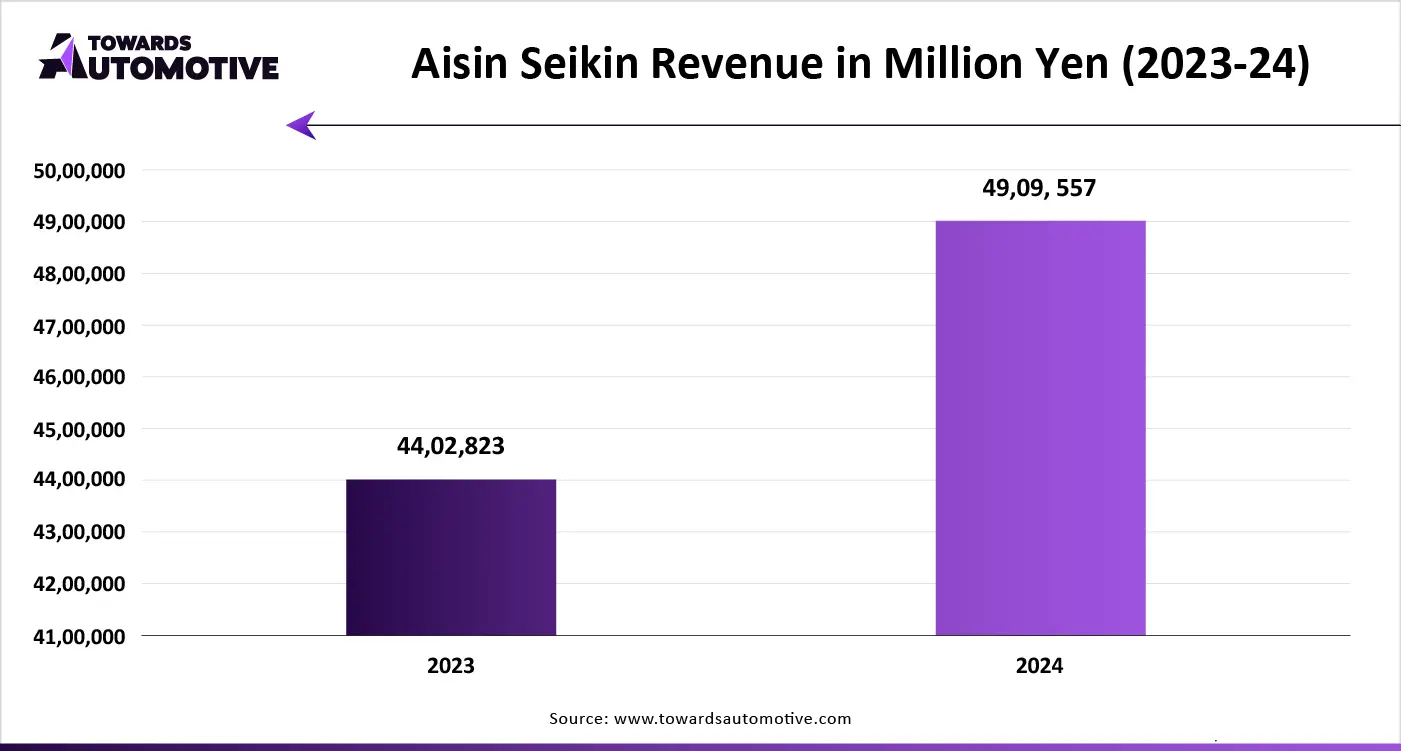

The automotive active aerodynamic devices market is a highly fragmented industry with the presence of numerous dominating players. Some of the prominent companies in this industry consists of Toyota, Aisin Seiki, Continental AG, BorgWarner, Webasto, Magna International, Schaeffler, ZF, TRW, Valeo, Delphi Automotive, ThyssenKrupp, Renesas Electronics Corporation, Mando and some others. These companies are constantly engaged in developing active aerodynamic devices for the automotive sector and adopting numerous strategies such as joint ventures, acquisitions, product launches, business expansions, partnerships, collaborations and some others to maintain their dominance in this industry.

By Component Type

By Mechanism

By Vehicle Type / Application

By Technology

By Drive Type

By Region

From 2025 to 2034, the global biometric technologies in automotive security and access control market is set for a massive revenue upswing, with proje...

December 2025

October 2025

October 2025

October 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us