August 2025

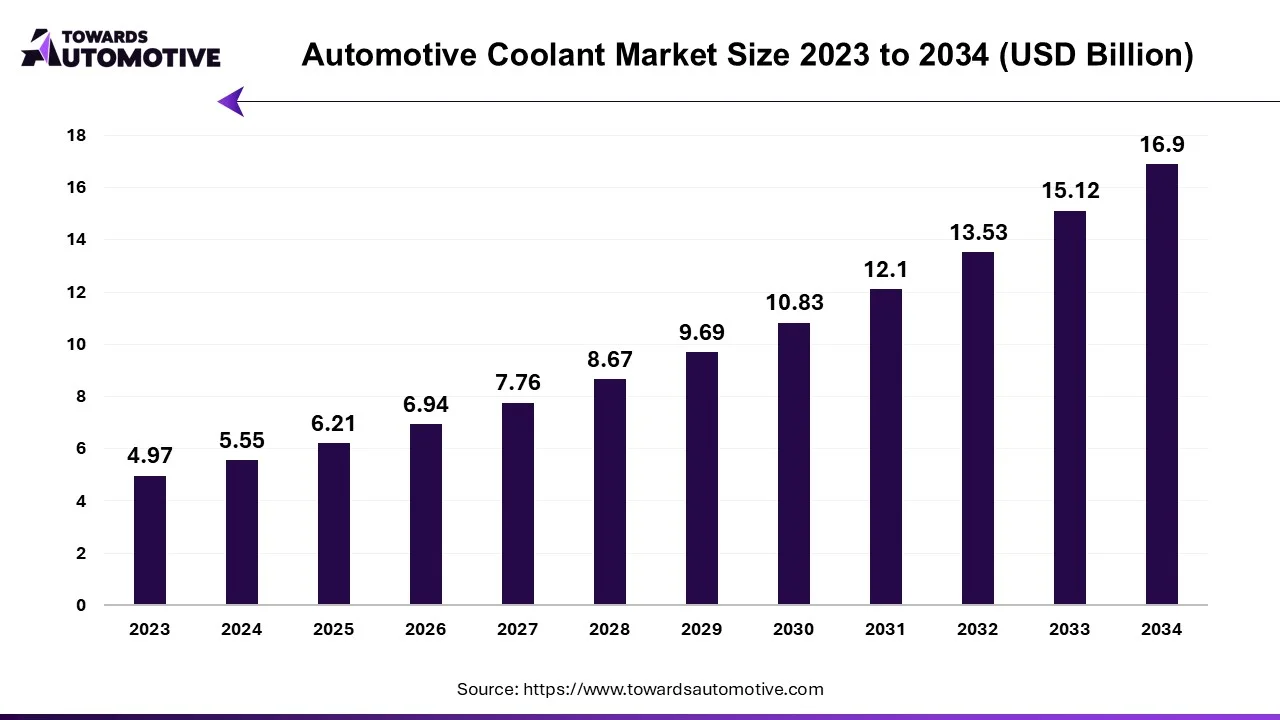

The automotive coolant market is projected to reach USD 16.9 billion by 2034, expanding from USD 6.21 billion in 2025, at an annual growth rate of 11.77% during the forecast period from 2025 to 2034.

Unlock Infinite Advantages: Subscribe to Annual Membership

The automotive coolant market is a rapidly growing industry of the automotive sector. The demand for automotive coolants has increased significantly for regulating engine temperature along with preventing corrosion, overheating, and freezing in vehicles. Coolants are also used for optimizing combustion that in turn retards harmful pollutants such as CO, N20, and CH4 from entering the vehicles. The automotive aftermarket offers a wide range of coolant products such as antifreeze, radiator coolant, and concentrated coolants. The growing use of coolants in commercial vehicles has contributed significantly to the overall industrial expansion.

| Metric | Details |

| Market Size in 2024 | USD 5.55 Billion |

| Projected Market Size in 2034 | USD 16.9 Billion |

| CAGR (2025 - 2034) | 11.77% |

| Leading Region | North America |

| Market Segmentation | By Vehicles, By Chemical Type and By Region |

| Top Key Players | Royal Dutch Shell PLC (Netherlands), TotalEnergies SE (France), Motul S.A. (France), Prestone Products Corporation (United States), FUCHS Petrolub SE (Germany) |

Some of the trends of automotive coolant market includes eco-friendly coolants, advancement in coolant formulations, specialized coolants for EVs and rapid adoption OAT coolants.

Introduction of Eco-friendly Coolants

Eco-friendly coolants are less harmful to the environment compared to traditional coolants. These coolants are safer in case of accidental spills or exposure due to their less toxic nature. It is free from several additives such as silicates, phosphates, nitrites, and borates that causes immense environmental pollution.

Advancements in Coolant Formulation

Advancements in automotive coolant formulations focus on improved heat transfer, corrosion protection, and extended service life. The utilization advanced formulations such as nanofluid, Hybrid Organic Acid Technology (HOAT) coolants, and synthetic coolants in vehicles helps to enhance the shelf-life of vehicles.

Rapid Adoption of OAT Coolants

OAT (Organic Acid Technology) coolants offer superior corrosion protection and extended service life compared to traditional coolants. Multiple automotive companies have started using the blend of OAT coolants to improve the performance of vehicles.

Specialized Coolants for EVs

Electric vehicles (EVs) use specialized coolants primarily to regulate the temperature of the battery and other electric components. Low electrical conductivity, effective heat transfer, and Corrosion protection are some of the key properties of EV coolants. Multiple companies are performing research on coolants to bring advanced formulations for EVs.

The passenger vehicle segment dominated the automotive coolant market. The growing demand for racing cars in developed countries such as the U.S., UK, France, Italy, Japan and some others has boosted the market expansion. Additionally, the growing sales and production of passenger vehicles in APAC region has further increased the demand for coolants, thereby driving the industrial growth. Moreover, several coolant brands are launching new products to cater the needs of passenger vehicles, thereby driving the growth of the automotive coolant market.

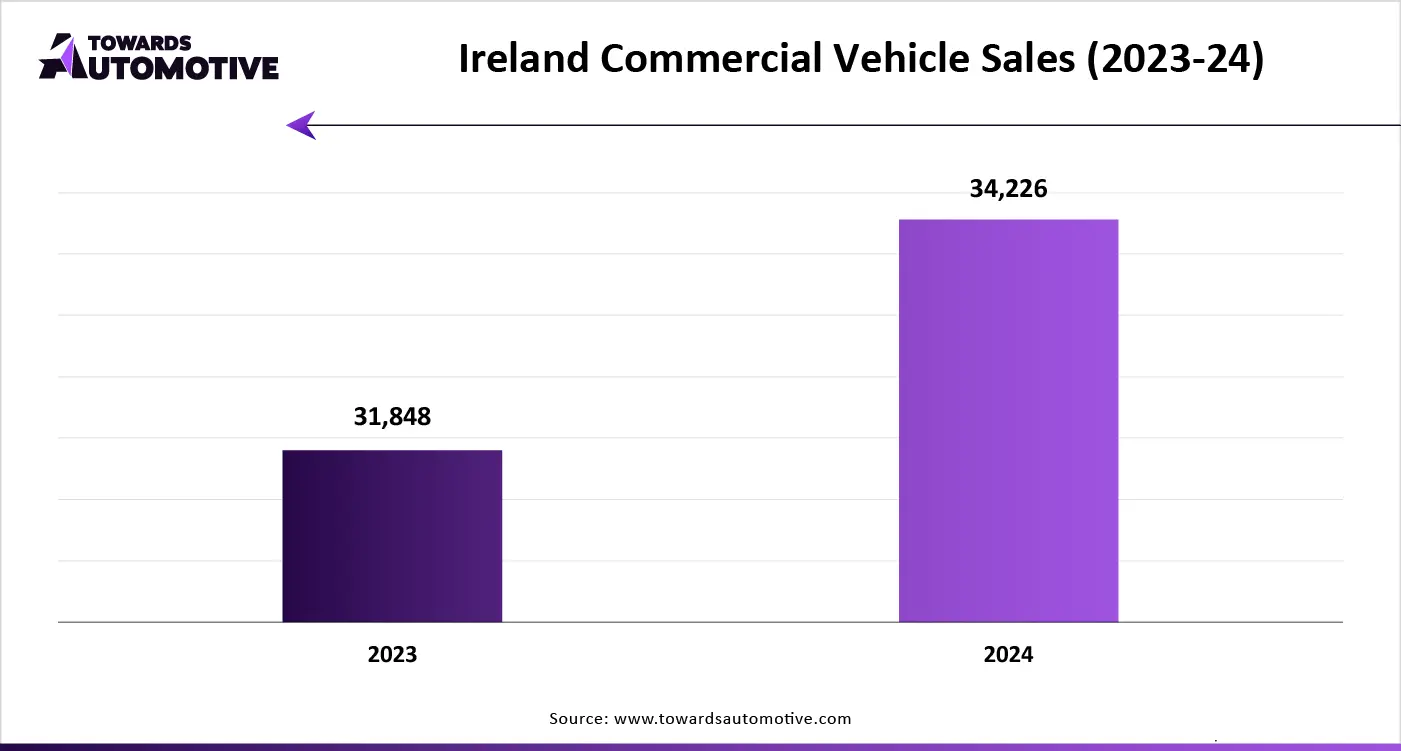

The commercial vehicle segment is growing with the highest CAGR during the forecast period. Prominent growth in the e-commerce sector has increased the demand of commercial vehicles for goods deliveries or last-mile delivery that in turn drives the market growth. Also, the rising adoption of LCEVs in manufacturing sector coupled with rapid investment by automotive brands for developing powerful trucks further adds to the industrial expansion. Moreover, the growing sales of commercial vehicles in different parts of the world is expected to propel the growth of the automotive coolant market.

Ethylene glycol segment dominated the market due to its superior properties such as high boiling point, low freezing point, and corrosion protection. Also, the demand for ethylene glycol-based coolants has increased in the EV industry, thereby driving the market growth. Moreover, rapid investment by coolant companies for manufacturing ethylene glycol-based coolants to cater the needs of the modern vehicles is expected to propel the growth of the automotive coolant market.

The propylene glycol is the fastest-growing segment in the automotive coolant market. The growing demand for propylene glycol antifreeze to protect engines from freezing, overheating, corrosion and some others has boosted the market growth. Additionally, numerous market players are manufacturing propylene glycol-based coolants to cater the needs of the heavy-duty vehicles, thereby fostering the industrial expansion.

North America dominated the automotive coolant market. The growing demand for luxury cars in Canada and the U.S. has boosted the market growth. Additionally, the existence of well-established automotive industry with several companies such as Tesla, Ford, General Motors and some others is playing a vital role in shaping the industry. Moreover, the presence of several coolant manufacturing companies such as Castrol, Valvoline Inc., Kost USA and some others is driving the growth of the automotive coolant market in this region.

U.S. is the dominating country in North America due to numerous EV brands, technological advancements in coolants industry and high aftermarket demand. Moreover, the rising sales of passenger cars coupled with rise in number of car service centers is further accelerating the market growth.

Asia Pacific is the fastest-growing region in the automotive coolant market. The market is generally driven by rapid urbanization, high-scale vehicle production, and adoption of EVs. The rapid urbanization in several countries such as India, China, Japan and some others has increased the demand for passenger vehicles, thereby driving the market growth. Additionally, the rising production of vehicles in China and India has increased the demand for coolants that in turn boost the industrial expansion. Moreover, the growing adoption of electric vehicles has increased the demand for specialized coolants to regulate the temperature of EV batteries, thereby driving the growth of the automotive coolant market in this region.

China led the market in this region. The market is generally driven by the growing demand for passenger vehicles along with rapid investment in automotive materials industry. The presence of strong local manufacturing base leads to high vehicle production resulting in growing demand for coolants. Sinopec Lubricant Company, Beijing Zhonghang Hangte Lubrication Technology Co, and Wuxi Hongsheng Heat Exchanger Manufacturing Co., Ltd. are some of the major players operating in the country.

The automotive coolant market is a highly competitive industry with the presence of several dominating players. Some of the prominent companies in this industry are Royal Dutch Shell PLC (Netherlands), TotalEnergies SE (France), Motul S.A. (France), Prestone Products Corporation (United States), FUCHS Petrolub SE (Germany), Chevron Corporation (United States), AMSOIL Inc. (United States), Recochem Inc. (Canada), Cummins Inc. (United States), BASF SE (Germany), ExxonMobil Corporation (United States), Old World Industries, LLC (United States), Gulf Oil International (United Kingdom), BP PLC (United Kingdom), Zerex (United States), Houghton International Inc. (United States), PEAK Auto (United States) KOST USA, Inc. (United States) and some others. These companies adopt numerous strategies such as product launches, partnerships, business expansion, acquisition, and some others to sustain their position in this industry.

By Vehicles

By Chemical Type

By Region

August 2025

August 2025

August 2025

August 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us