December 2025

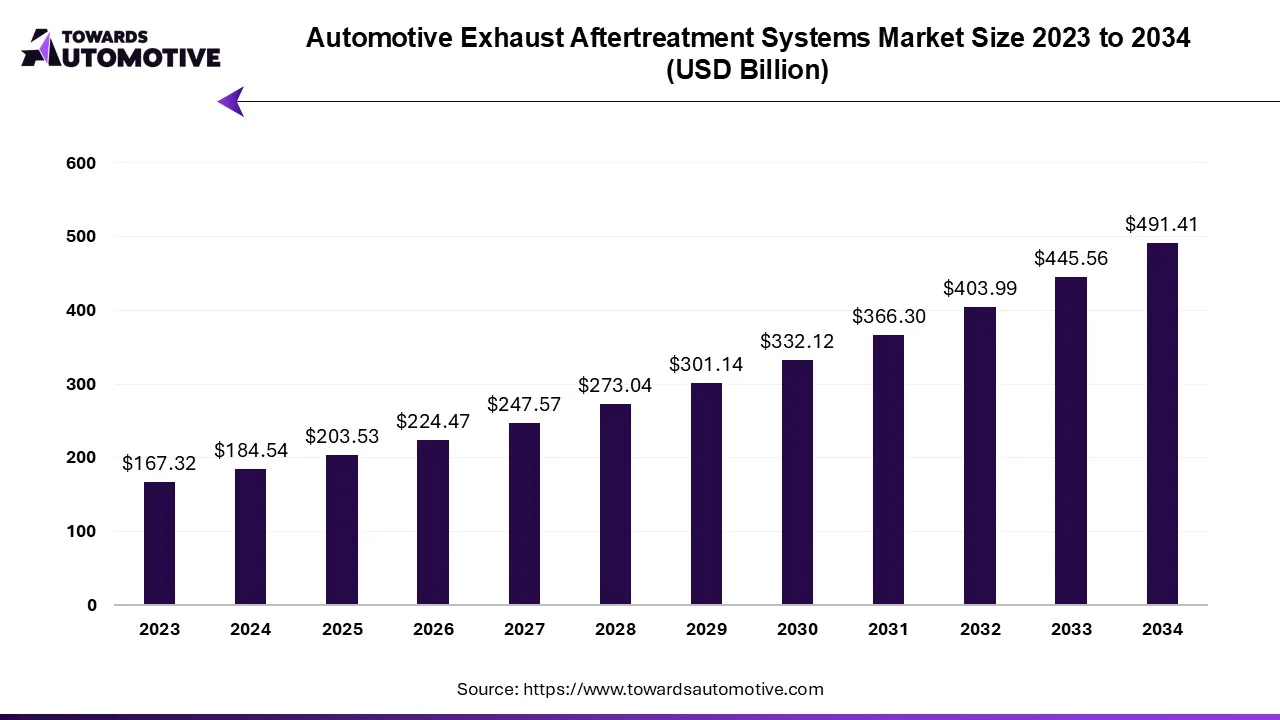

The automotive exhaust aftertreatment systems market is expected to grow from USD 203.53 billion in 2025 to USD 491.41 billion by 2034, with a CAGR of 14.38% throughout the forecast period from 2025 to 2034.

The COVID-19 pandemic has significantly impacted the market, with global passenger and vehicle sales declining. This decline had a significant impact on the demand for post-treatment care and the post-marketing decline due to quarantines and social security measures. However, with restrictions gradually decreasing and increasing focus on reducing vehicle emissions and complying with stricter government regulations worldwide, the prospects of commercial copying appear to be successful.

Technical challenges include the high-pressure filtration system required to push exhaust gas, limited biodiesel systems, passive regeneration systems requiring highway driving to clear accumulated soot, and the system's complexity. Urea injection hindered economic growth. However, the revival of the global automotive industry and the emergence of new production facilities in developing countries such as Mexico and India have created new opportunities for the economy to expand by 2032.

This section summarizes the key market trends identified by our researchers as affecting the automotive industry's aftermarket emissions:

Demand for diesel engines is forecast to be driven by increasing business expansion and growth, especially the positive impact of sales in the auto market due to the increase in e-commerce.

Emission standards for diesel engines are becoming increasingly stringent, forcing companies to improve emissions after refining.

For example,

Strong economic growth in the Asia-Pacific region has increased consumer spending and accelerated business growth.

Diesel engines typically convert 40% to 46% of fuel into thrust, with the remainder lost as heat through exhaust emissions.

Use of Euro VI emission standards Engine weight is increasing for automobile manufacturers. Therefore, companies are looking for the best filters installed in the electric generator after treatment, designed to reduce or eliminate the relevant problem and meet the emission standards set by various governments.

In 2021, the Asia-Pacific region will become a significant force in the global automotive industry. China is essential as a central automotive hub, making it easier for OEMs to set up factories within its borders. The Chinese government has played an essential role in promoting electric vehicles (EVs) to prevent carbon emissions and reduce dependence on non-renewable energy sources. Many countries in the region have implemented strategies to encourage the development of electric vehicles, provide financial support for companies to establish new factories, and encourage consumers to purchase electric vehicles. Despite these efforts, demand for gasoline-powered cars continues, especially in industrial sectors such as public transportation and mining.

China is the world's largest automobile market, accounting for more than 35% of the global automobile market. It constitutes 15% of international passenger car sales and foreign vehicle sales. Due to the large number of vehicles on the roads, the Chinese government has implemented strategies to reduce emissions. For example, according to China's VI emission standards, the main target is to reduce hydrocarbons, nitrogen oxides (NOx), and other minor pollutants by 50%, 40%, and 33%, respectively. New petrol vehicles must comply with these regulations. The sale of cars with the National 5 emissions standard will be banned from January 2021 in preparation for compliance with the National 6 standard.

India has also implemented stringent emission standards encouraging growth in the aftermarket maintenance market. India's growing automobile industry further fuels this growth.

The exhaust after-treatment market will witness significant growth in the years leading up to the forecast period, given the stringent emission standards in the region.

Some of the key players include Delphi Technologies PLC, Continental Reifen Deutschland GmbH, Tenneco Inc., CDTi Advanced Materials Inc., and Donaldson Company Inc. It is located. These companies are preparing to take advantage of the market by introducing new products or expanding their existing products. Increasing pressure from emissions regulators is forcing companies to innovate and develop new technologies to reduce the amount of pollutants in vehicles. Therefore, manufacturers have increased their R&D investments to create a more effective finishing technology.

For example:

The increase in post-purification gas suppliers and collaborations with local partners have expanded production and overall business.

The automotive aftermarket is segmented by fuel type (gasoline and diesel), vehicle type (cars and commercial vehicles), and region (North America, Europe, Asia Pacific, and other worlds). The report provides market size and estimates, both volume and value (in billions of USD), for Automotive Exhaust Gas treatment for all the above segments.

By Fuel Type

By Vehicle Type

By Geography

December 2025

October 2025

October 2025

October 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us