August 2025

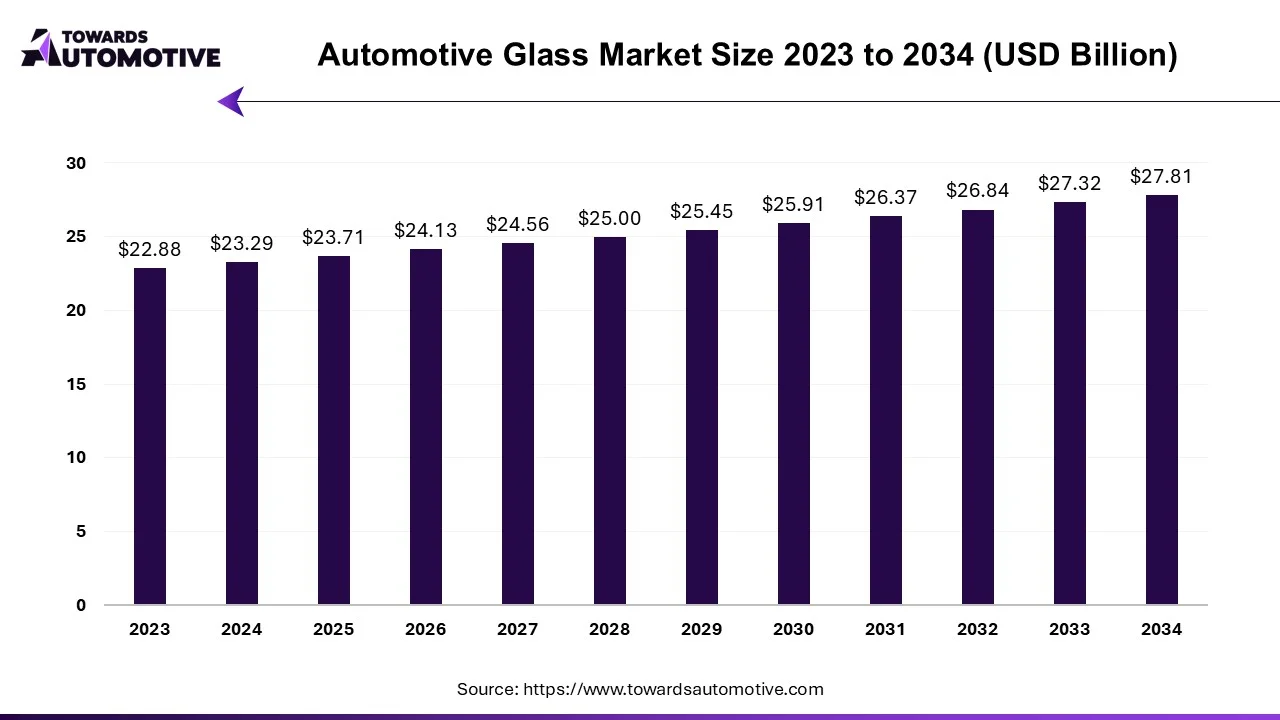

The automotive glass market is forecasted to expand from USD 23.71 billion in 2025 to USD 27.81 billion by 2034, growing at a CAGR of 1.79% from 2025 to 2034.

Unlock Infinite Advantages: Subscribe to Annual Membership

The automotive industry experienced significant disruption due to the COVID-19 pandemic, leading to temporary shutdowns of automotive operations and glass manufacturing facilities worldwide. Despite these challenges, the rapid growth of the electric car market is expected to drive swift recovery in demand for automotive glass products. Manufacturers are increasingly focusing on innovation to enhance the energy efficiency of their glass products, with chemically strengthened glass emerging as a superior alternative to traditional soda-lime glass.

Chemically strengthened glass offers enhanced strength and safety characteristics while simultaneously reducing weight, thereby contributing to improved fuel efficiency—a feature particularly sought after in premium and sports cars. Moreover, there is a growing trend towards larger automotive glass products, with some manufacturers exploring the possibility of incorporating entire glass roofs into vehicles. These advancements underscore the importance of performance, functionality, safety, and comfort in modern automotive design.

The automotive glass industry is witnessing a surge in demand driven by improvements in safety standards and consumer preferences for enhanced passenger experience. This trend has led to the integration of electronic sensors, cameras, and rear-view mirrors into automotive glass, further elevating the functionality and safety of vehicles.

For instance,

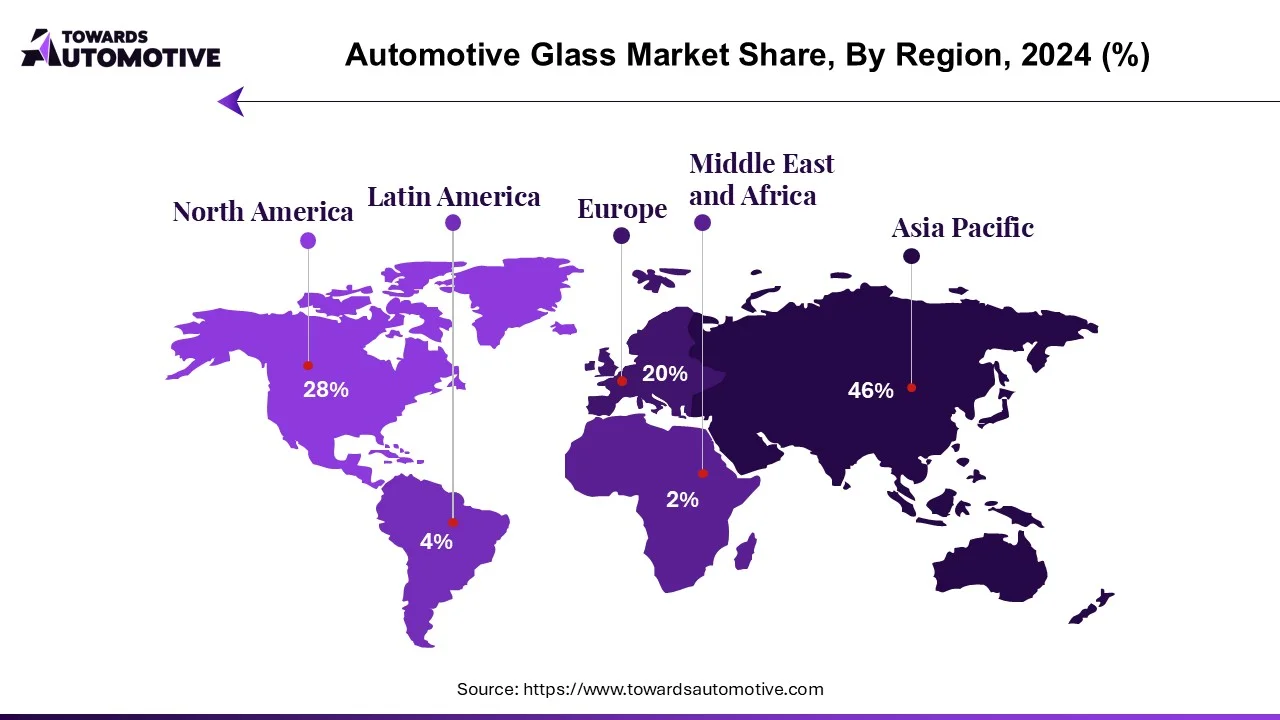

In terms of market dynamics, the Asia-Pacific region is poised to dominate the global automotive glass market, driven by increasing consumer concerns about safety, comfort, and aesthetic appeal. Europe is expected to follow closely, benefitting from the burgeoning automotive industry in various countries across the region. Meanwhile, the North American market is projected to exhibit steady growth, despite recent declines in passenger car production across several countries. These trends highlight the evolving landscape of the automotive glass industry and the opportunities it presents for manufacturers to innovate and meet the evolving needs of consumers worldwide.

Automotive glass plays a pivotal role in modern vehicles, experiencing growth driven by continuous innovation. Notably, the automotive smart glass sector has garnered significant attention, particularly in upscale automotive applications. This material promises enhanced passenger comfort while simultaneously delivering top-tier features in terms of security, privacy, and temperature control.

A notable trend observed, particularly in Europe, is the escalating preference for smart glass in sunroof construction, reflecting shifting consumer and automotive manufacturer preferences. For instance, General Motors unveiled its new electric vehicle, the Cadillac Celestiq, featuring a smart glass roof in January 2021. Furthermore, advancements in Advanced Driver Assistance Systems (ADAS) in new vehicles are poised to further invigorate the market.

The growing adoption of solar glass, particularly in larger vehicles, is anticipated to positively impact the automotive glass market's growth trajectory. With increasing consumer interest in solar-powered vehicles, the utilization of glass is on the rise. While solar panel installations have primarily been limited to the luxury car segment, automakers like Honda and Toyota are extending this technology to other vehicle segments. Additionally, advancements in vehicle manufacturing have led to larger window and side window sizes, contributing to overall industry expansion.

Smart glasses are widely regarded as the future of the automotive industry, with significant research efforts focused on their development and adaptation for use in larger vehicles. These glasses hold the potential to offer innovative features such as head-up displays and glass cockpits at elevated altitudes, simplifying vehicle controls and enhancing the overall in-car ambiance. Manufacturers like Mercedes and Volvo are actively investing in realizing this vision within the automotive.

Asia Pacific is poised to exhibit the highest Compound Annual Growth Rate (CAGR) during the forecast period, fueled by the robust presence of emerging markets such as Japan, China, and India. These countries are driving business activity in the region, propelled by rapid technological advancements in transportation due to evolving legislation and the burgeoning population.

China stands as the world's largest automobile manufacturer, with significant investments in auto parts assembly, glass manufacturing, and research and development capabilities. The country's burgeoning demand for electric vehicles has spurred the establishment of numerous new factories, further propelling growth in the global automotive glass industry. For instance, Volkswagen inked a business agreement with SAIC Motor in November 2019, marking its entry into the Chinese market with the opening of its first production facility in Anting.

The automotive industry in India is also poised for expansion, driven by regulatory initiatives such as the implementation of BS-VI regulations. Kia Motors commenced production trials at its new facility in Andhra Pradesh in January 2019, boasting an expansive area of 536 acres and an annual production capacity of 300,000 vehicles. Additionally, the Indian government's approval of the FAME-II project in February 2019, with a substantial allocation of $1.4 billion from 2019 to 2022, is expected to further bolster the automotive sector.

These strategic initiatives are anticipated to bolster commercial vehicle production in the coming years, consequently driving demand for automotive glass in the region. Moreover, emerging economies in Asia such as Vietnam, Indonesia, and the Philippines are also poised to contribute significantly to the growth of the automotive glass market.

The automotive glass industry operates within a competitive commercial landscape, with leading players commanding approximately 75% of the market share. Key industry participants such as Asahi Glass, Fuyao Glass, Nippon Glass, Saint-Gobain, and Xinyi Glass play pivotal roles in shaping industry dynamics. The competitive terrain is undergoing transformation through strategic maneuvers such as mergers, acquisitions, and partnerships with regional automakers, aimed at enhancing market presence and competitiveness.

For instance,

Automotive glass manufacturers are actively engaged in innovation and market penetration strategies to navigate the complexities of the global market landscape. Efforts are directed towards the generation and implementation of innovative ideas, coupled with investments in capacity expansion and geographic diversification to cater to the increasing demand in vehicle production worldwide.

As an illustration of this proactive approach, Asahi Glass Co. Ltd announced plans for the construction of a state-of-the-art floating glass factory in Taloja, India, with a production capacity of 550 tonnes per day. This facility is strategically designed to cater to the automotive and construction sectors, reflecting the company's commitment to meeting regional demand while ensuring operational excellence.

Overall, these strategic endeavors underscore the dynamic nature of the automotive glass industry, characterized by innovation-driven growth strategies and a relentless pursuit of excellence in meeting evolving market demands.

The automotive glass market report encompasses the most recent trends and industry technology developments related to COVID-19, focusing on the diverse types of glass utilized in automobiles to ensure driver protection and enhance the overall driving experience.

By Type

By Application Type

By Vehicle Type

By Geography

August 2025

August 2025

August 2025

July 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us