December 2025

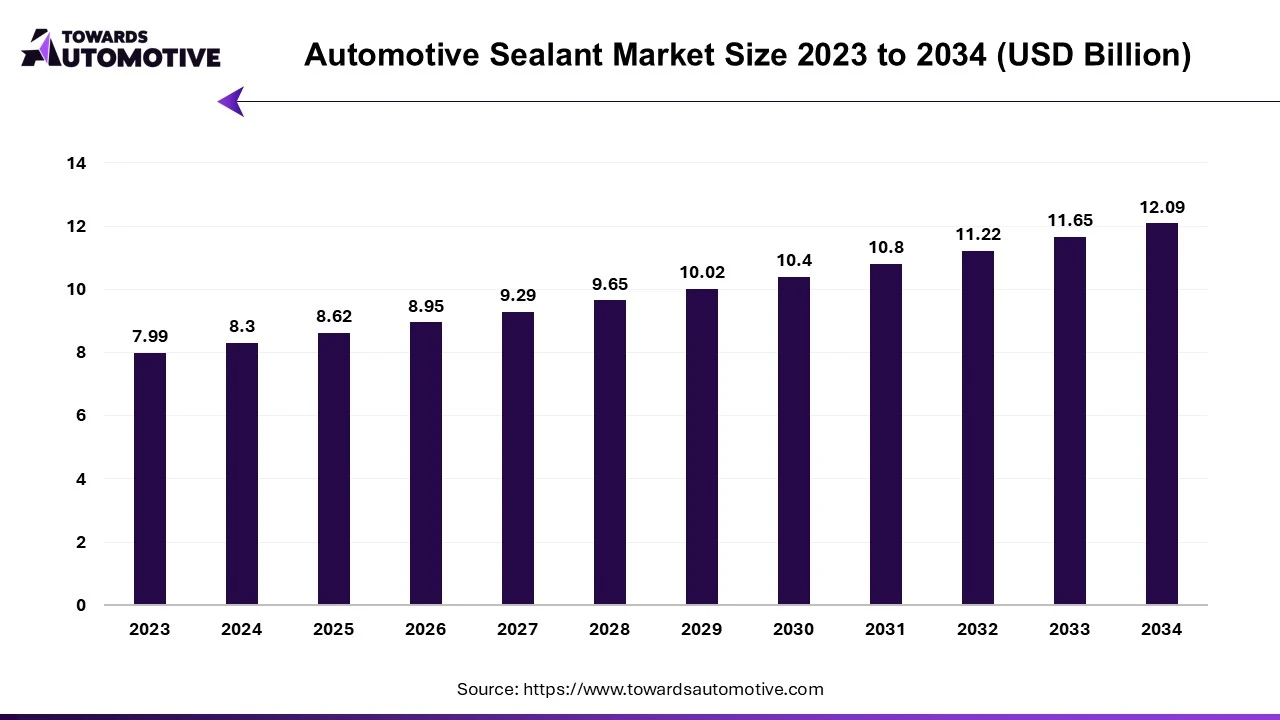

The automotive sealant market is forecast to grow from USD 8.62 billion in 2025 to USD 12.09 billion by 2034, driven by a CAGR of 3.84% from 2025 to 2034. The growing sales of commercial vehicles in the U.S. and Germany coupled with technological advancements in sealant manufacturing is playing a vital role in shaping the industrial landscape.

Additionally, surge in demand for light-weight automotive materials along with rapid adoption of autonomous vehicles has contributed to the overall industrial expansion. The advancements in nanotechnology as well as integration of AI and IoT in automotive materials industry is expected to create ample growth opportunities for the market players in the upcoming years to come.

The automotive sealant market is a prominent segment of the automotive materials industry. This industry deals in manufacturing and distribution of automotive sealants across the world. There are several types of sealants developed in this sector consisting of silicone sealants, polyurethane sealants, butyl sealants, acrylic sealants, anaerobic sealants and some others. It finds application in manufacturing several automotive components including gasket making, seam sealing, body assembly, windshield installation, interior sealing and some others. These sealants are designed for several types of vehicles comprising of passenger cars, commercial vehicles, two-wheelers and some others. This market is expected to rise significantly with the growth of the electric vehicles industry in different parts of the world.

| Metric | Details |

| Market Size in 2024 | USD 8.3 Billion |

| Projected Market Size in 2034 | USD 12.09 Billion |

| CAGR (2025 - 2034) | 3.84% |

| Leading Region | Asia Pacific |

| Market Segmentation | By Vehicle Type, By Sealant Type, By Application, By Curing Mechanism, By End Use and By Region |

| Top Key Players | Huntsman International LLC, Sika AG, Bostik, Avery Dennison Corporation |

The major trends in this market consists of partnerships, rising sales of EV and growing demand for fuel-efficient vehicles.

Several automotive brands are partnering with sealant manufacturers for developing high-grade sealants to cater the needs of the automotive sector.

With the increasing sales of electric vehicles, the application of non-silicone sealants has drastically grown to protect batteries and other electronic components.

The demand for fuel-efficient vehicles has rapidly increased due to rising fuel prices, thereby increasing the need for automotive sealants.

The silicone sealants segment dominated the market. The growing use of silicone-based sealants for providing additional resistance to several automotive parts such as engine components, body, windshields and some others has boosted the market expansion. Additionally, numerous benefits of these sealants including durability, flexibility, resistance and some others is expected to drive the growth of the automotive sealant market.

The polyurethane sealants segment is expected to rise with the highest CAGR during the forecast period. The rising application of polyurethane-based sealants for sealing and bonding applications in the automotive sector has boosted the market growth. Also, several advantages of these sealants comprising of flexibility, high elasticity, enhanced durability and some others is expected to boost the growth of the automotive sealant market.

The gasket making segment led the industry. The growing use of gasket making for preventing and sealing leaks in electric components in automotives has boosted the market expansion. Additionally, numerous benefits of gasket masking including chemical resistance, durability, temperature resistance, and some others is expected to propel the growth of the automotive sealant market.

The seam sealing segment is expected to expand with a notable CAGR during the forecast period. The rising use of seam sealing for preventing water to enter automotive structures has boosted the market expansion. Also, partnerships among automotive material companies to manufacture advanced sealing materials for the automotive sector is expected to drive the growth of the automotive sealant market.

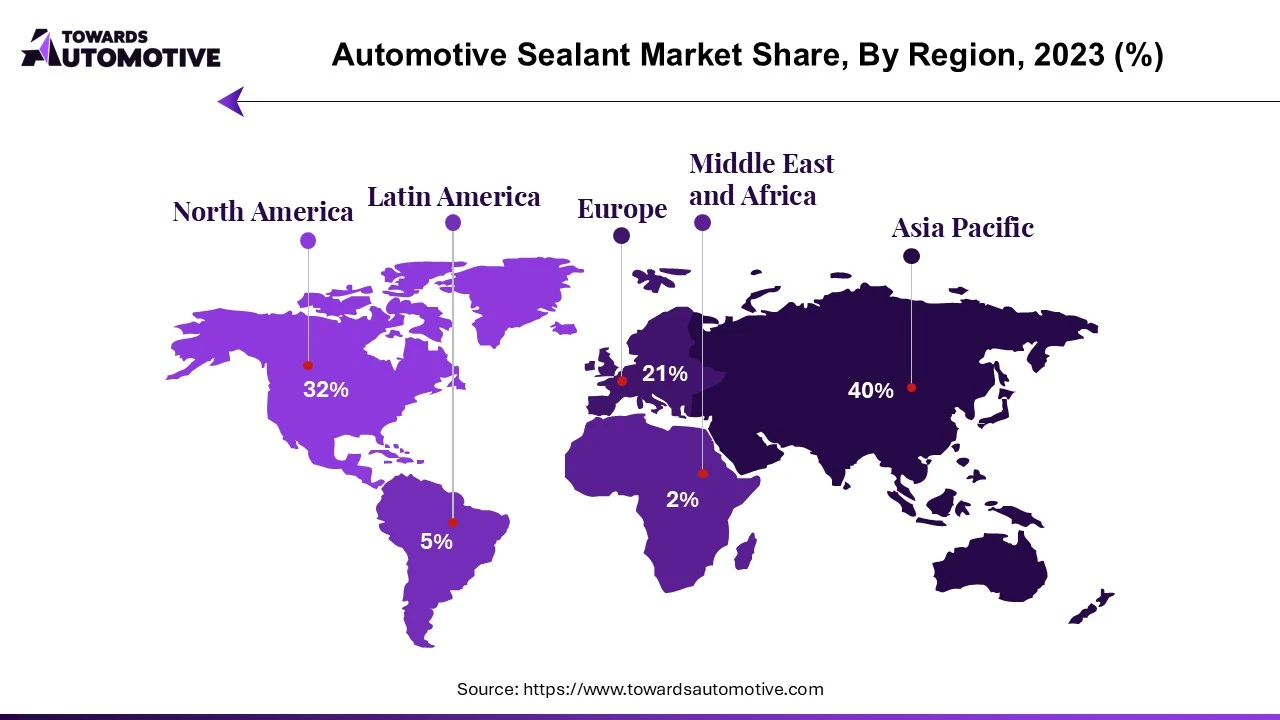

Asia Pacific held the highest share of the automotive sealant market. The increasing production of automotives in several countries such as India, China, Japan, South Korea and some others has boosted the market expansion. Additionally, rise in number of automotive startup companies coupled with technological advancements in materials science sector is playing a vital role in shaping the industrial landscape. Moreover, the presence of several market players such as Hubei Huitian New Materials, Pidilite Industries, Supex and some others is expected to drive the growth of the automotive sealant market in this region.

North America is expected to grow with a significant CAGR during the forecast period. The growing adoption of electric vehicles in the U.S. and Canada has driven the market expansion. Additionally, numerous government initiatives aimed at strengthening the sealant manufacturing sector coupled with rise in number of automotive detailing shops is contributing to the overall industrial expansion. Moreover, the presence of various automotive sealant manufacturers such as Avery Dennison Corporation, Lord Corporation, Permatex and some others is expected to propel the growth of the automotive sealant market in this region.

The automotive sealant market is a highly fragmented industry with the presence of several dominating players. Some of the prominent companies in this industry consists of Huntsman International LLC, Sika AG, Bostik, Avery Dennison Corporation, Permatex, MacDermid Performance Solutions, Lord Corporation, BASF SE, Ashland Global Holdings Inc., Henkel AG Co. KGaA, 3M, Evonik Industries AG and some others. These companies are constantly engaged in manufacturing sealants for the automotive sector and adopting numerous strategies such as collaborations, launches, partnerships, acquisitions, joint ventures, and some others to maintain their dominance in this industry.

By Vehicle Type

By Sealant Type

By Application

By Curing Mechanism

By End Use

By Region

December 2025

October 2025

October 2025

October 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us