December 2025

The automotive smart glass market is forecasted to expand from USD 2.67 billion in 2025 to USD 16.41 billion by 2034, growing at a CAGR of 22.38% from 2025 to 2034.

The automotive smart glass market is a crucial segment of the automotive industry. This industry deals in manufacturing and distribution of smart glasses for the automotive sector. The smart glasses are developed using various technologies comprising of electrochromic technology, polymer dispersed liquid device technology, suspended particle device technology and some others. These glasses find application in several automotive components including windows, sunroofs, rearview mirrors, windshields and some others. It is designed for numerous types of vehicles consisting of passenger vehicles and commercial vehicles. The growing adoption of smart glasses in passenger vehicles has boosted the market expansion. This market is expected to rise significantly with the growth of the smart glass industry across the world.

| Metric | Details |

| Market Size in 2024 | USD 2.18 Billion |

| Projected Market Size in 2034 | USD 16.41 Billion |

| CAGR (2025 - 2034) | 22.38% |

| Leading Region | North America |

| Market Segmentation | By Technology, By Application, By Vehicle Type and By Region |

| Top Key Players | AGC Corporation, Gentex Corporation, Corning Inc, Compagnie de Saint-Gobain S.A., Nippon Sheet Glass Company |

The major trends of automotive smart glass market consist of collaborations, rising production of automotive, integration of advanced features in vehicles and trend of switchable glass films.

Numerous automotive brands have started collaborating with AR providers to enhance in-vehicle experience of the drivers and passengers. For instance, in January 2025, BMW collaborated with XREAL. This collaboration is done for integrating AR-based entertainment system in BMW cars using smart glasses. (Source: PR Newswire)

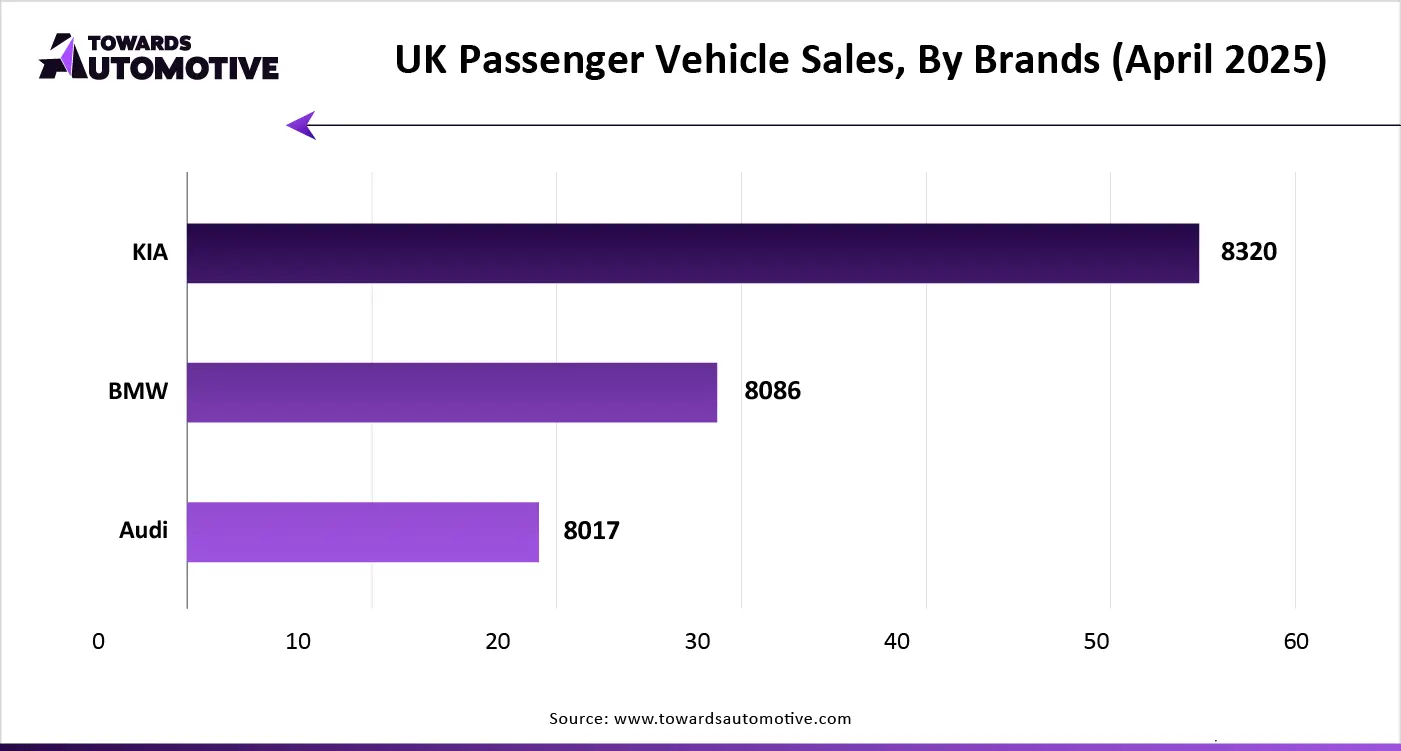

The growing production of several types of passenger cars including sedans, hatchbacks, SUVs and some others has increased the demand for smart glass to enhance the aesthetics in vehicles. According to the OICA, around 277926 passenger vehicles were manufactured in South Korea during 2024. (Source: OICA )

Nowadays, the car manufacturers are integrating advanced features in modern cars to improve vehicle performance and enhance the overall driving experience. The smart glasses are used for enhancing several features such as vehicle inspection, infotainment control, accessing the navigation system, intelligent dimming and some others. For instance, in June 2023, Nio launched ET5T. ET5T is an electric car that comes with an intelligent dimming sunroof which enhance the overall travel experience. (Source: NIO)

The trend of integrating switchable glass films in automotive due to several advantages such as enhanced privacy, energy efficiency, reduced glare and some others has gained prominent attraction of the automotive industry in recent times. For instance, in April 2024, LG Chem Ltd joined hands with Webasto SE. Through this joint venture, LG Chem will deliver switchable glazing films to Webasto SE for developing smart sunroofs. (Source: The Korea Economic Daily )

The electrochromic segment held the largest share of the market. The growing demand for HVAC systems and artificial lighting has increased the demand for electrochromic glasses, thereby driving the market expansion. Additionally, the increasing use of these glasses in automotive due to numerous advantages such as improved visibility, enhanced comfort, increased safety for drivers and passengers and some others is driving the growth of the automotive smart glass market.

The windows segment dominated the industry. The growing demand for enhancing in-vehicle experience along with the increasing use of self-dimming windows in automotive has boosted the market expansion. Also, the rapid integration of automotive self-cleaning windows in modern cars for improving aesthetics and enhancing maintenance is playing a vital role in shaping the industrial landscape. Moreover, the increasing use of smart windows in luxury vehicles is anticipated to propel the growth of the automotive smart glass market.

The sunroofs segment is predicted to rise with a significant CAGR during the forecast period. The increasing demand for luxury SUVs in developed nations such as France, U.S., Germany and some others has boosted the market growth. Additionally, the growing production of electric sedans along with increased adoption of panoramic sunroofs in modern cars is contributing significantly to the industrial expansion. Moreover, numerous partnerships and collaborations among automotive brands and sunroof manufacturers for developing smart sunroofs is projected to foster the growth of the automotive smart glass market.

The passenger vehicles segment led the industry. The growing production and sales of passenger vehicles has increased the demand for smart glasses, thereby driving the market growth. Additionally, rapid investment by luxury car brands for integrating advanced features in vehicles coupled with constant research and development for designing smart glasses for passenger vehicles has further played a prominent role in shaping the industrial landscape. Moreover, surge in demand for autonomous vehicles along with increasing use of AR systems in modern cars is expected to propel the growth of the automotive smart glass market.

The commercial vehicles segment is projected to grow at a considerable rate during the forecast period. The increasing demand for driverless trucks in developed nations such as the U.S., UK, China, Germany and some others has contributed to the industrial expansion. Also, the growing use of double-glazing glasses and laminate glasses in commercial vehicles along with rapid integration of ADAS in LCEVs has boosted the market growth. Moreover, the increasing sales of commercial vehicles coupled with technological advancements in smart glasses is likely to propel the growth of the automotive smart glass market.

According to the OICA, around 27772650 commercial vehicles were sold globally in 2024. (Source: OICA)

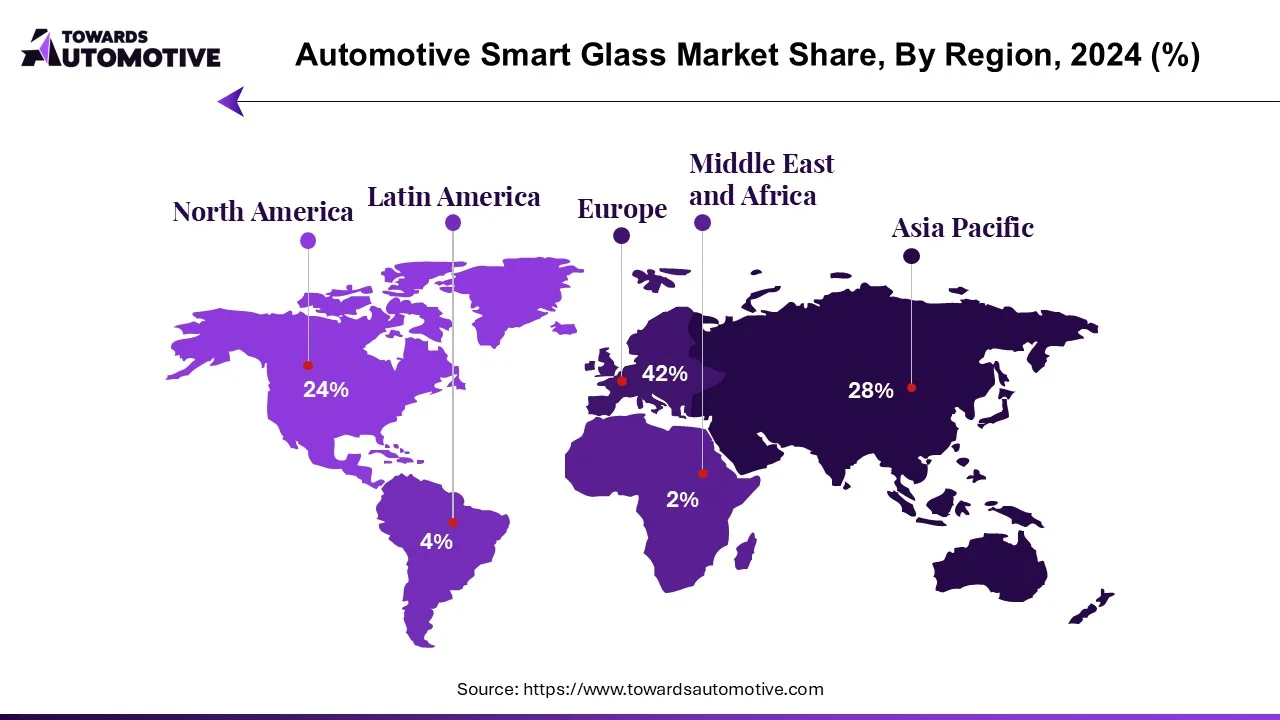

North America held the largest share of the automotive smart glass market. The growing demand for plug-in-hybrid vehicles in countries such as the U.S. and Canada has boosted the market expansion. Additionally, technological advancements in the automotive sector coupled with the increased adoption of panoramic sunroofs in vehicles is further adding to the industrial growth. Moreover, the presence of various market players such as Gentex Corporation, Polytronix INC, PPG Industries, Inc. and some others is expected to propel the growth of the automotive smart glass market in this region.

U.S. dominated the market in this region. The rising sales of SUVs along with increased consumer preference to purchase luxury cars has boosted the market expansion. Also, technological advancements in the smart glass industry coupled with the presence of several automotive brands such as Tesla, Ford, Rivian, General Motors and some others is driving the market growth.

Asia Pacific is expected to grow with the fastest CAGR during the forecast period. The rising sales and production of passenger vehicle in several nations such as China, India, Japan, South Korea and some others is driving the market expansion. Additionally, the growing adoption of eco-friendly vehicles along with rapid investment in the glass manufacturing sector by private companies is likely to boost the industrial growth. Moreover, the presence of several automotive brands such as BYD, Tata Motors, XPENG, Suzuki, Hyundai, Toyota and some others is likely to boost the growth of the automotive smart glass market in this region.

China and India are the major contributors in this region. In China, the market is generally driven by the availability of raw materials used for manufacturing smart glasses along with the presence of skilled workforce. In India, the growing sales of luxury sedans coupled with rapid investment in smart glass industry by various entities has fostered the market expansion.

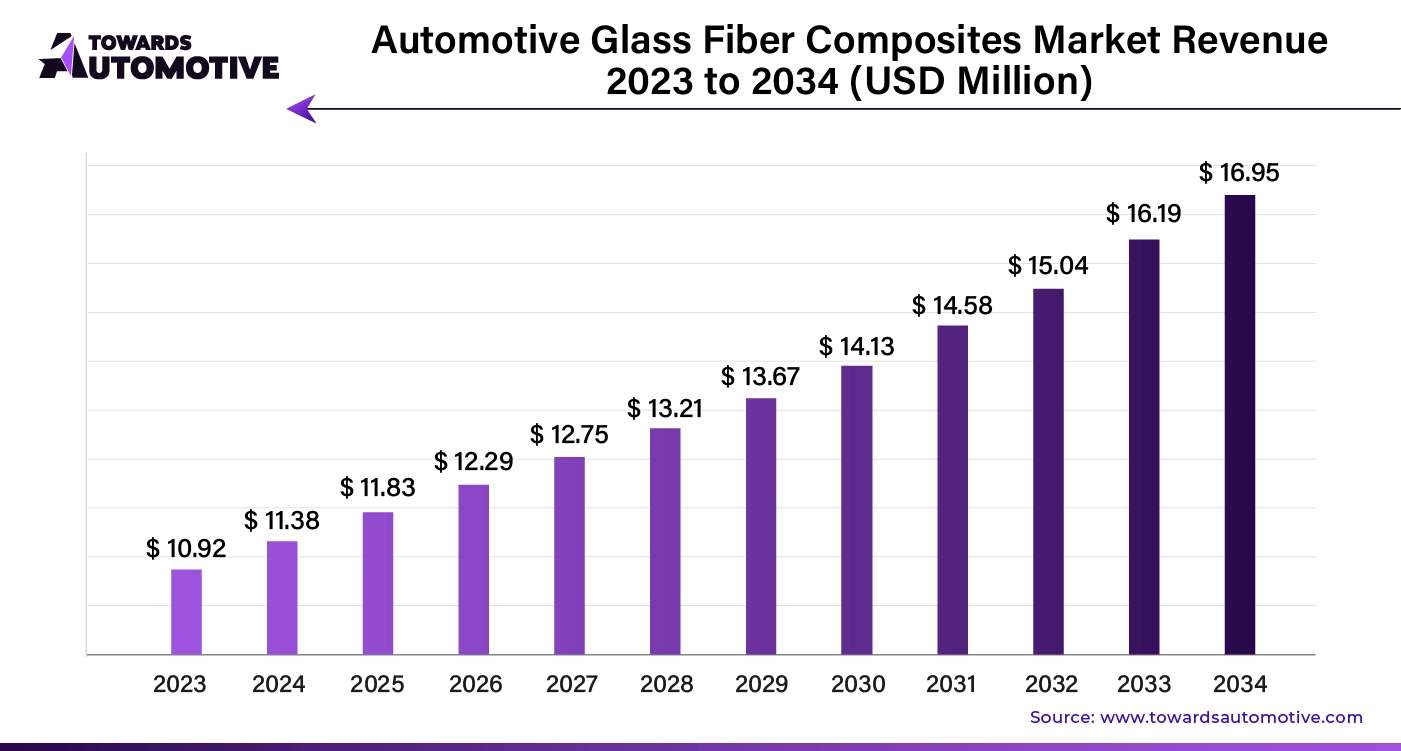

The global automotive glass fiber composites market is anticipated to grow from USD 11.83 billion in 2025 to USD 16.95 billion by 2034, with a compound annual growth rate (CAGR) of 4.65% during the forecast period from 2025 to 2034.

The automotive glass fiber composites market is experiencing notable growth due to the increasing demand for lightweight, high-strength materials that enhance vehicle performance and fuel efficiency. Glass fiber composites, known for their excellent mechanical properties and corrosion resistance, are increasingly being utilized in various automotive applications, including body panels, interior components, and structural reinforcements. As automakers strive to meet stringent emission regulations and improve overall fuel economy, the adoption of lightweight materials like glass fiber composites becomes essential.

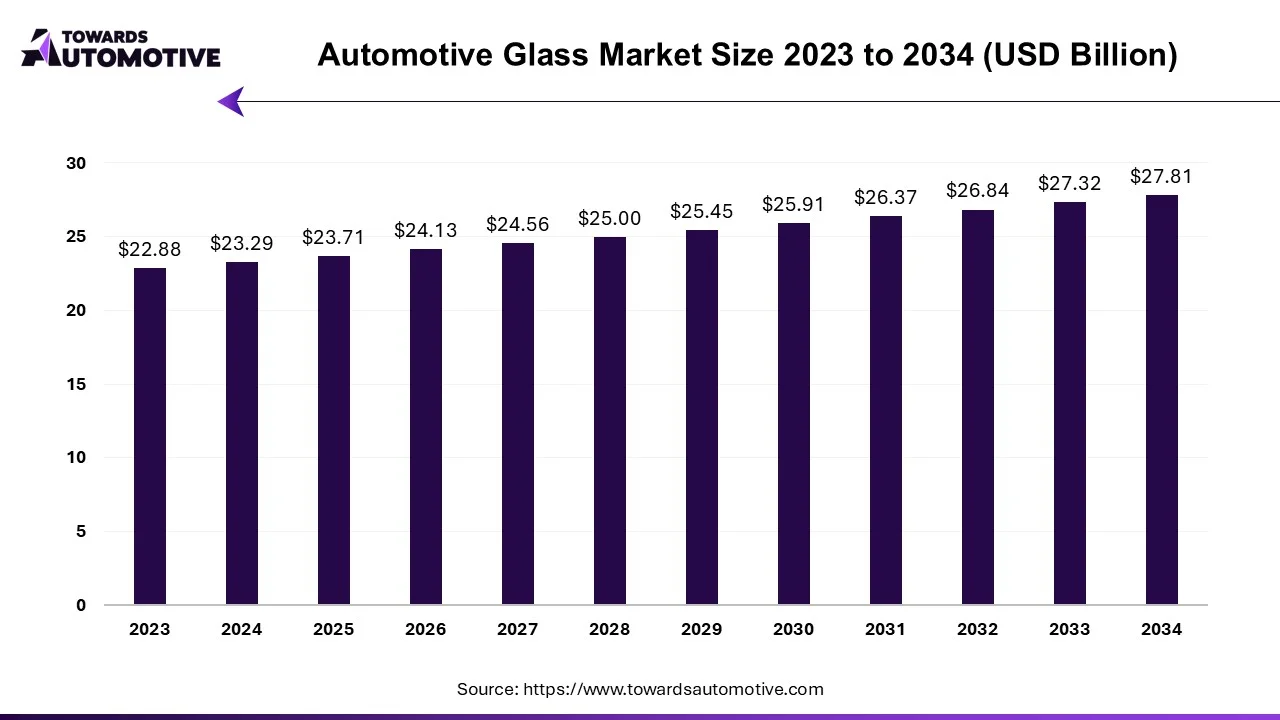

The automotive glass market is forecasted to expand from USD 23.71 billion in 2025 to USD 27.81 billion by 2034, growing at a CAGR of 1.79% from 2025 to 2034.

The automotive industry experienced significant disruption due to the COVID-19 pandemic, leading to temporary shutdowns of automotive operations and glass manufacturing facilities worldwide. Despite these challenges, the rapid growth of the electric car market is expected to drive swift recovery in demand for automotive glass products. Manufacturers are increasingly focusing on innovation to enhance the energy efficiency of their glass products, with chemically strengthened glass emerging as a superior alternative to traditional soda-lime glass.

The global automotive glass film market size is calculated at USD 5.04 billion in 2024 and is expected to reach around USD 8.40 billion by 2034, growing at a CAGR of 4.9% from 2024 to 2034.

The automotive glass film market is experiencing significant growth as advancements in film technology and increasing consumer demand for vehicle aesthetics and protection drive its expansion. Automotive glass films, which include window tints, protective coatings, and heat-insulating films, are becoming essential components for modern vehicles. These films enhance the driving experience by offering benefits such as improved privacy, UV protection, and reduced heat and glare. They also contribute to vehicle safety by increasing shatter resistance and reducing the risk of glass-related injuries in the event of an accident.

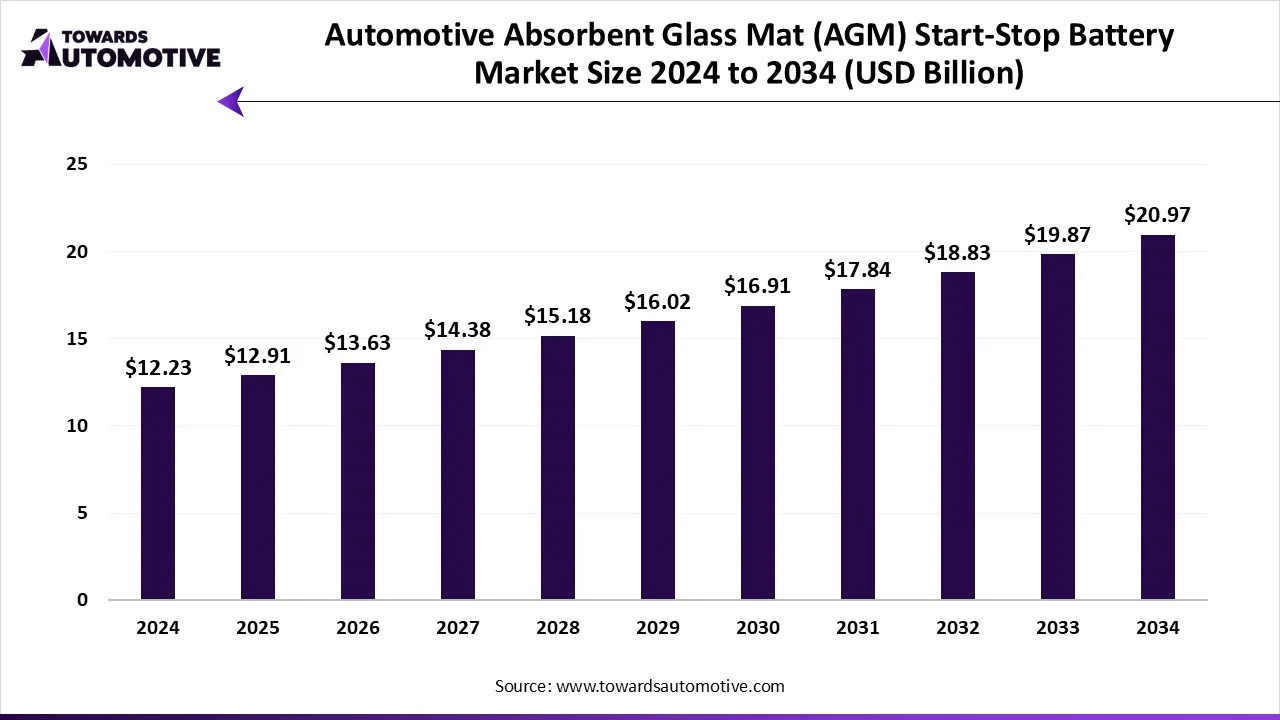

The automotive absorbent glass mat (AGM) start-stop battery market is expected to increase from USD 12.91 billion in 2025 to USD 20.97 billion by 2034, growing at a CAGR of 5.52% throughout the forecast period from 2025 to 2034. The rising use of electronic components in vehicles coupled with rapid investment in battery industry by startup companies drives the market expansion.

Additionally, the growing demand for maintenance-free automotive batteries as well as opening of new battery manufacturing and recycling centers in the APAC region is playing a vital role in shaping the industrial landscape. The growing use of AGM batteries in electric vehicles to enhance performance is expected to create ample growth opportunities for the market players in the upcoming days.

The automotive absorbent glass mat (AGM) start-stop battery market is a crucial branch of the battery manufacturing industry. This industry deals in manufacturing and distribution of AGM batteries for the automotive sector. There are various types of batteries developed in this sector comprising of stationary batteries and motive batteries. These batteries comes with different voltages including 2-4V, 6-8V, 12V and above. It finds applications in numerous vehicles consisting of passenger vehicles, light commercial vehicles, motorcycles, heavy commercial vehicles and some others. The AGM batteries are available in a well-established sales channel comprising of OEMs and aftermarket. The growing sales of commercial vehicles in different parts of the world is a major contributor of this industry. This market is expected to rise significantly with the growth of the automotive sector in different parts of the world.

The automotive smart glass market is a rapidly developing industry with the presence of a several dominating players. Some of the prominent companies in this industry consists of AGC Corporation, Gentex Corporation, Corning Inc, Compagnie de Saint-Gobain S.A., Nippon Sheet Glass Company, Limited, Glass Apps, LLC, Kinestral Technologies, Inc, Polytronix, Inc. and some others. These companies are constantly engaged in developing smart glasses for the automotive sector and adopting numerous strategies such as business expansions, partnerships, joint ventures, collaborations, launches, acquisitions and some others to maintain their dominance in this market.

By Technology

By Application

By Vehicle Type

By Region

December 2025

October 2025

October 2025

October 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us