August 2025

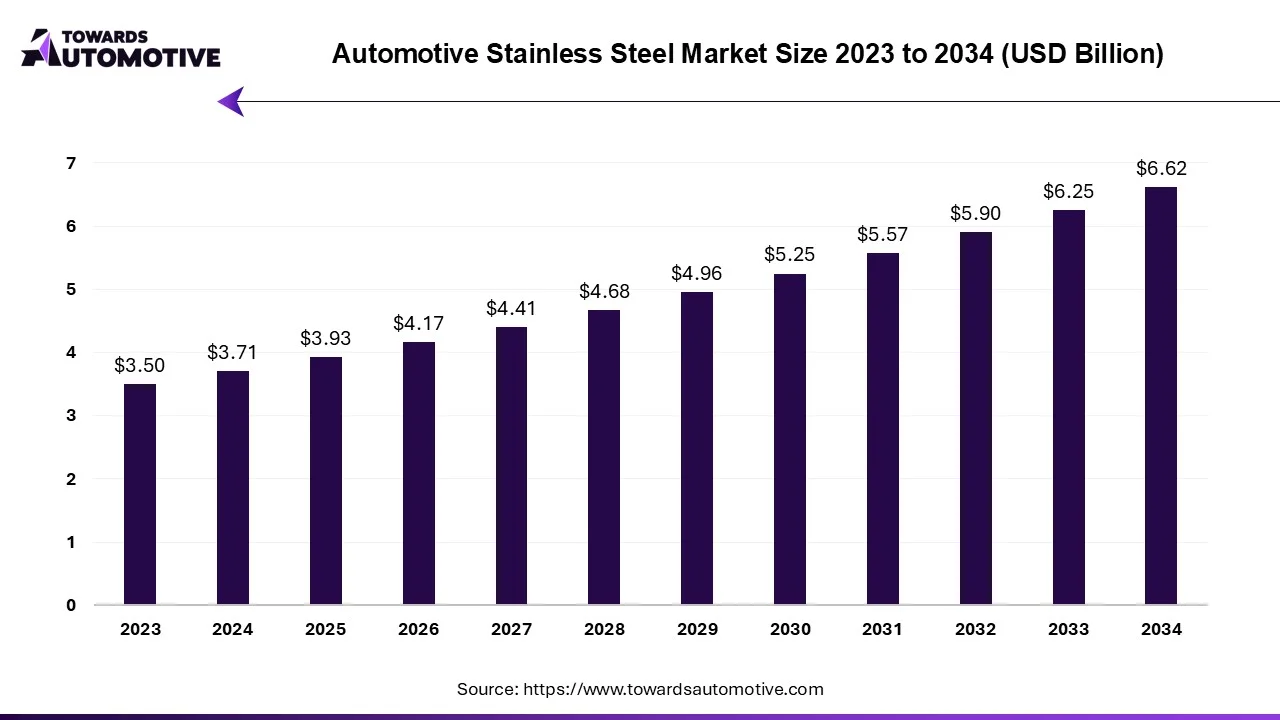

The automotive stainless steel market is expected to increase from USD 3.93 billion in 2025 to USD 6.62 billion by 2034, growing at a CAGR of 5.97% throughout the forecast period from 2025 to 2034. The growing sales of electric vehicles in developed nations coupled with integration of advanced technologies such as AI and IoT in the steel manufacturing sector is playing a vital role in shaping the industrial landscape.

Moreover, rapid investment by automotive companies for using high-grade steels in modern cars to enhance safety along with increasing demand for martensitic stainless steel from the EV industry has driven the market expansion. The research and development related to nanotechnology as well as technological advancements in 3D printing is expected to create ample growth opportunities for the market players in the future.

Unlock Infinite Advantages: Subscribe to Annual Membership

The automotive stainless steel market is a prominent segment of the heavy metal industry. This industry deals in manufacturing and distribution of stainless steel for the automotive sector. These steels find application in several automotive components including exhaust systems, fuel and brake lines, heat exchangers, structural components and some others. There are numerous types of tube used in this sector comprising of straight tubes, U-bends, coilded tubes and some others. It is designed for various types of vehicles consisting of passenger cars and commercial vehicles. The growing application of stainless steel in commercial vehicles has contributed to the overall industrial expansion. This market is expected to rise significantly with the growth of the automotive sector in different parts of the world.

| Metric | Details |

| Market Size in 2024 | USD 3.71 Billion |

| Projected Market Size in 2034 | USD 6.62 Billion |

| CAGR (2025 - 2034) | 5.97% |

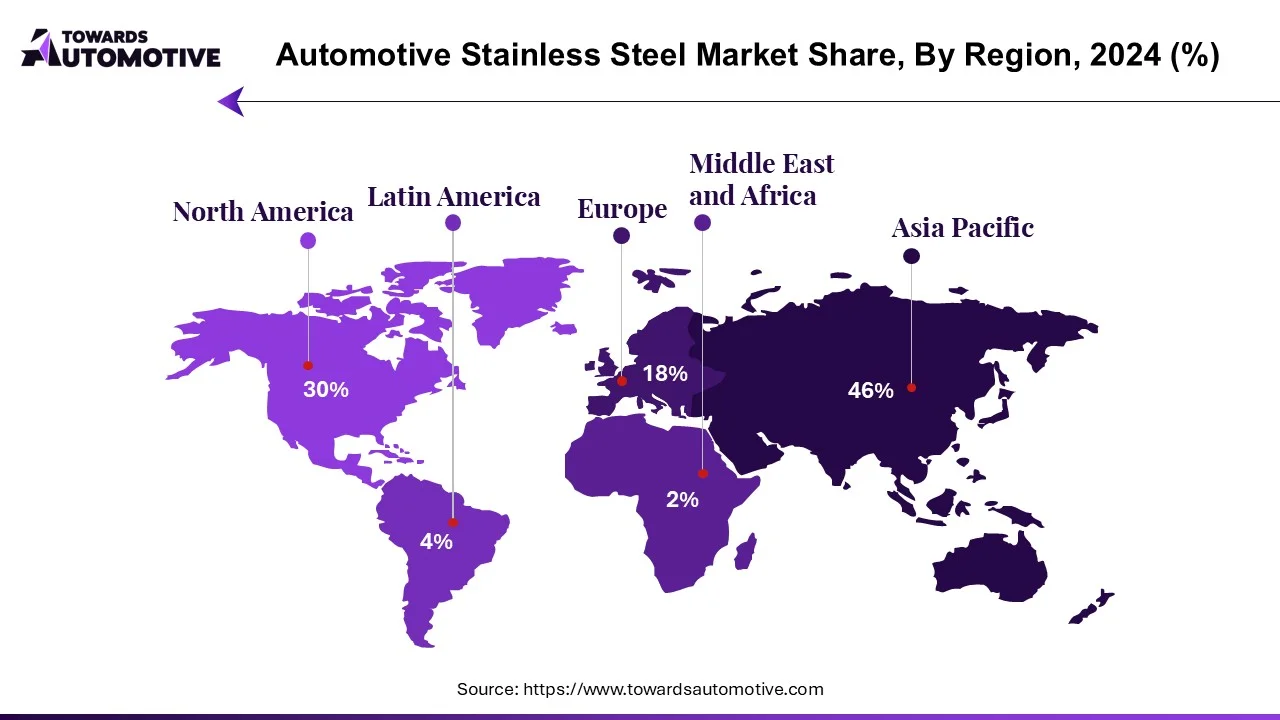

| Leading Region | Asia Pacific |

| Market Segmentation | By Vehicle Type, By Application, By Manufacturing Method, By Tube Type, By Outer Diameter, By End-Use and By Region |

| Top Key Players | AK Steel Holding Corporation, Nippon Steel Corporation, JFE Steel Corporation, POSCO, Acerinox S.A. |

The major trends in this market consists of rising sales of hybrid vehicles, rapid adoption of eco-friendly steel and partnerships.

The sales of hybrid vehicles has increased rapidly in several developing nations due to numerous government initiatives and increasing fuel efficiency.

The automotive sector have started adopting green steel in vehicles with an aim to reduce vehicular emission.

Several automotive brands are partnering with steel manufacturers to use high-grade steels in modern vehicles.

The commercial vehicles segment dominated the market. The growing production of commercial vehicles in several nations such as Japan, Germany, the U.S. and some others has boosted the market expansion. Additionally, the increasing use of advanced steels in LCEVs coupled with increasing sales of electric trucks in different parts of the world is expected to propel the growth of the automotive stainless steel market.

The passenger cars segment is expected to expand with a considerable CAGR during the forecast period. The growing sales of passenger cars in several countries such as China, India, South Korea, UK, France and some others has driven the market growth. Also, rapid investment by automotive brands for developing luxury EVs to cater the needs of the HNIs is expected to drive the growth of the automotive stainless steel market.

The exhaust systems segment held the largest share of the market. The growing use of high-grade steel for manufacturing high-performance exhaust systems has driven the market expansion. Also, availability of wide variety of exhausts in several online platforms such as Ebay, Amazon, Alibaba and some others is expected to propel the growth of the automotive stainless steel market.

The structural components segment is expected to expand with a notable CAGR during the forecast period. The growing use of superior-quality steel for developing several automotive structural components such as chassis, radiator, grill, frames and some others has boosted the market growth. Additionally, partnerships among automotive companies and steel manufacturers for using advanced structural components of automotives is expected to drive the growth of the automotive stainless steel market.

Asia Pacific generated led the automotive stainless steel market. The growing production of passenger cars in several countries such as India, China, Japan, South Korea and some others has boosted the market expansion. Additionally, the availability of crude steel coupled with opening of new steel production facility is contributing to the industrial growth. Moreover, the presence of several market players such as Ta Chen International, Inc., Nippon Steel Corporation, JFE Steel Corporation and some others is expected to drive the growth of the automotive stainless steel market in this region.

North America is expected to grow with a significant CAGR during the forecast period. The rising sales of electric vehicles in the U.S. and Canada has boosted the market expansion. Also, technological advancements in the automotive sector along with numerous government initiatives aimed at developing the steel manufacturing sector is playing a vital role in shaping the industry in a positive direction. Moreover, the presence of several market players such as Nucor Corporation, Cleveland-Cliffs, Steel Dynamics and some others is expected to boost the growth of the automotive stainless steel market in this region.

The automotive stainless steel market is a highly competitive industry with the presence of several dominating players. Some of the prominent companies in this industry consists of thyssenkrupp AG, AK Steel Holding Corporation, Nippon Steel Corporation, JFE Steel Corporation, POSCO, Acerinox S.A., Sandvik AB, Aperam S.A, Ta Chen International, Inc. and some others. These companies are constantly engaged in manufacturing stainless steel for the automotive sector and adopting numerous strategies such as partnerships, joint ventures, collaborations, acquisitions, launches, and some others to maintain their dominance in this industry.

By Vehicle Type

By Application

By Manufacturing Method

By Tube Type

By Outer Diameter

By End-Use

By Region

August 2025

August 2025

August 2025

July 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us