September 2025

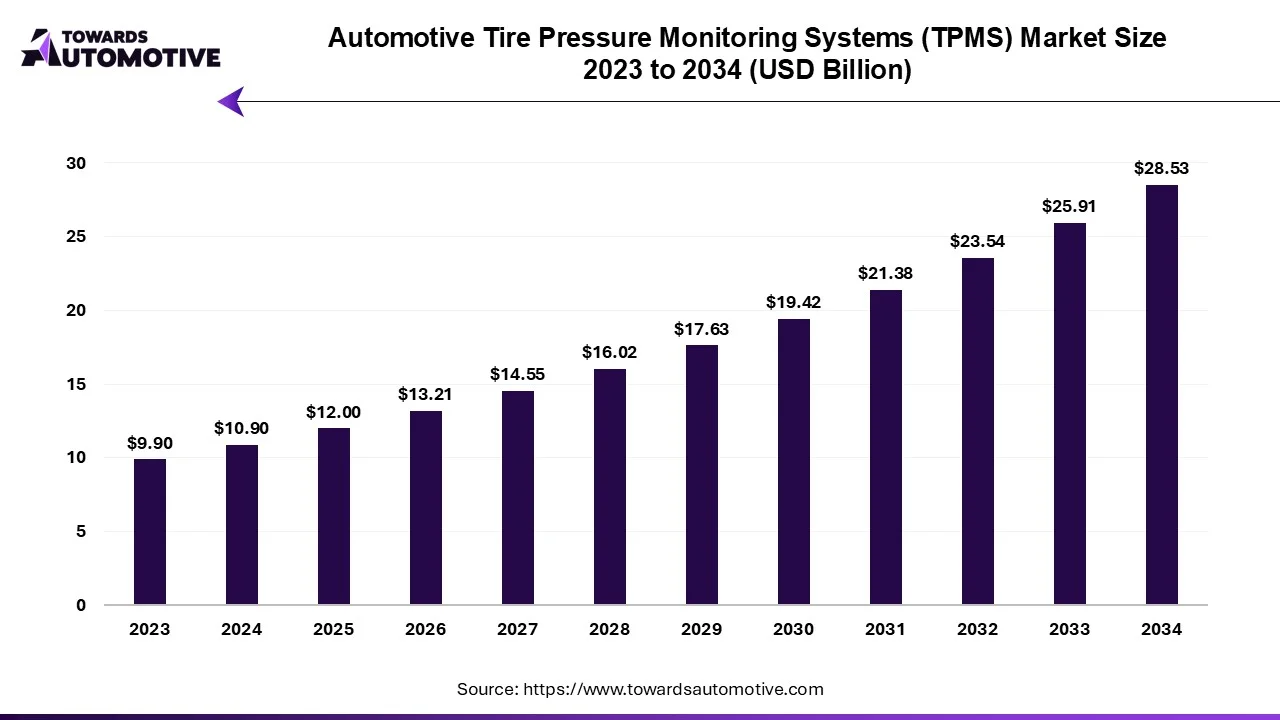

The global automotive tire pressure monitoring system market is forecast to grow from USD 12.00 billion in 2025 to USD 28.53 billion by 2034, driven by a CAGR of 10.10% from 2025 to 2034.

Unlock Infinite Advantages: Subscribe to Annual Membership

The automotive tire pressure monitoring system (TPMS) market has experienced significant growth due to its crucial role in enhancing vehicle safety, performance, and fuel efficiency. TPMS is an advanced system that continuously monitors the air pressure within a vehicle’s tires and alerts the driver when a tire is under-inflated, thereby preventing potential tire-related accidents, improving vehicle handling, and increasing tire lifespan. In response to rising concerns about road safety, various regulatory bodies, particularly in North America and Europe, have made TPMS mandatory in new vehicles. These regulations, including the TREAD Act in the United States, which requires all light vehicles to be equipped with TPMS, have contributed significantly to the market's expansion.

The growing demand for fuel-efficient vehicles and electric vehicles (EVs) further drives the TPMS market, as maintaining optimal tire pressure plays a crucial role in reducing fuel consumption and maximizing driving range. The increasing consumer awareness of vehicle safety, coupled with the rise in vehicle production and sales worldwide, has further fueled the adoption of TPMS. Additionally, technological advancements, such as direct TPMS, offer real-time tire pressure data and enhanced accuracy, making them a preferred choice for both automakers and consumers.

As global automotive markets continue to evolve, innovations in TPMS technology, such as integration with advanced driver assistance systems (ADAS), will continue to drive the growth of the automotive TPMS market, making it an essential component in modern vehicles.

Artificial Intelligence (AI) plays a pivotal role in enhancing the functionality and efficiency of Automotive Tire Pressure Monitoring Systems (TPMS). AI integration allows for more accurate data processing and real-time analysis of tire pressure, enabling vehicles to not only detect under-inflation but also predict potential tire failures before they occur. By leveraging machine learning algorithms, AI can analyze historical tire pressure data, road conditions, driving behavior, and environmental factors to offer proactive maintenance suggestions, preventing costly repairs and enhancing vehicle safety.

Additionally, AI-driven TPMS can integrate seamlessly with advanced driver assistance systems (ADAS), providing drivers with predictive alerts and offering more precise control over tire maintenance. AI also allows for smarter tire pressure regulation, optimizing tire inflation levels based on driving conditions, vehicle load, and other factors, thereby improving fuel efficiency and extending tire life.

With AI’s ability to continuously monitor tire conditions, the system can also reduce the likelihood of human error, providing a higher level of safety and operational reliability. Furthermore, AI can enable real-time data sharing with connected car platforms, allowing fleet operators to track tire health across a fleet of vehicles. As AI technology continues to evolve, it is expected to further transform the TPMS market, enhancing both performance and user experience in the automotive sector.

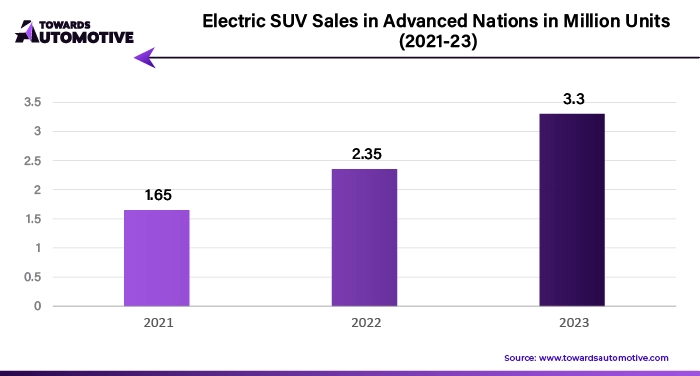

The growing demand for sport utility vehicles (SUVs) plays a significant role in driving the growth of the automotive tire pressure monitoring system (TPMS) market. As SUVs become increasingly popular worldwide, consumers are prioritizing safety, performance, and comfort, which enhances the need for advanced safety technologies like TPMS. These vehicles, due to their larger tire sizes and off-road capabilities, require more precise tire pressure monitoring to ensure optimal performance and safety. Proper tire inflation in SUVs is crucial for handling, fuel efficiency, and tire durability, making TPMS an essential feature in modern vehicles.

With the rise of consumer interest in SUVs, both for personal use and as family vehicles, the adoption of TPMS has accelerated. Regulatory requirements in regions like North America and Europe have further contributed to the integration of TPMS in new SUVs, as it is mandatory for all light vehicles, including SUVs, to be equipped with such systems. Moreover, as automakers focus on creating more fuel-efficient and eco-friendly SUVs, TPMS helps to improve fuel economy by maintaining optimal tire pressure. As SUVs continue to dominate automotive sales, especially in emerging markets, the demand for advanced TPMS technologies that ensure safety and efficiency in these larger vehicles is expected to grow steadily, supporting the expansion of the market.

The automotive tire pressure monitoring system (TPMS) market faces several restraints, including high installation costs and maintenance requirements. While TPMS is mandatory in many regions, the initial cost of integrating advanced TPMS technologies, particularly direct TPMS, can be a barrier for automakers and consumers. Additionally, sensor malfunctions or battery failures can lead to inaccurate readings, requiring costly repairs. Consumer reluctance to embrace newer systems and the complexity of integration with existing vehicle technologies also hinder market growth. Furthermore, in some regions with less stringent regulatory standards, the adoption of TPMS remains slower, limiting its overall market potential.

Smart TPMS sensors are creating significant opportunities in the Automotive Tire Pressure Monitoring System (TPMS) Market by offering advanced features and enhanced capabilities compared to traditional TPMS solutions. These sensors provide real-time data on tire pressure, temperature, and overall tire health, offering a more comprehensive view of a vehicle’s tire condition. Unlike conventional systems, smart TPMS sensors can alert drivers to potential issues before they become critical, such as slow leaks, abnormal pressure changes, or even tire wear patterns. This proactive approach to vehicle maintenance not only enhances safety but also improves the overall driving experience by preventing tire-related accidents or breakdowns.

Additionally, smart TPMS sensors can be integrated with vehicle infotainment systems or mobile apps, allowing drivers to monitor tire health remotely and receive notifications in real-time. This level of connectivity is increasingly valued in the age of connected vehicles and smart cities, where seamless communication between systems is paramount.

As consumers demand greater safety, convenience, and performance from their vehicles, smart TPMS sensors are becoming an essential part of modern vehicles, particularly in electric vehicles (EVs) and autonomous vehicles. Their ability to monitor tire conditions continuously and provide actionable insights creates a substantial opportunity for growth in the TPMS market, as automakers and aftermarket service providers embrace these advanced technologies.

The direct TPMS segment led the industry. The direct Tire Pressure Monitoring System (TPMS) significantly drives the growth of the automotive TPMS market due to its accuracy, reliability, and advanced features. Unlike indirect TPMS, which estimates pressure through wheel speed sensors, direct TPMS uses dedicated pressure sensors installed in each tire to provide real-time, precise monitoring. This high level of accuracy has made direct TPMS the preferred choice for automakers, especially in regions with stringent safety regulations like North America, Europe, and parts of Asia-Pacific. Government mandates, such as the TREAD Act in the United States and similar regulations in Europe, have accelerated the adoption of direct TPMS in vehicles.

The rising demand for safety features in passenger and commercial vehicles further fuels this growth. Direct TPMS offers instant alerts for under-inflation, preventing tire-related accidents, improving vehicle safety, and enhancing fuel efficiency by ensuring optimal tire pressure. This aligns with the growing focus on sustainability and cost savings for consumers and fleet operators. Additionally, advancements in sensor technology have reduced costs while improving performance, making direct TPMS more accessible to automakers.

With the increasing adoption of electric vehicles (EVs) and luxury cars, direct TPMS is becoming a standard feature to optimize energy efficiency, extend battery range, and deliver enhanced driving experiences. These factors collectively position direct TPMS as a critical driver for the automotive TPMS market's growth.

The passenger vehicle segment dominated the market. The passenger vehicle segment plays a significant role in driving the growth of the automotive tire pressure monitoring system (TPMS) market. With rising consumer demand for improved vehicle safety, efficiency, and performance, automakers are increasingly integrating TPMS as a standard feature in passenger cars. Stringent government regulations mandating the use of TPMS, such as the TREAD Act in the United States and similar directives in Europe and Asia, have accelerated its adoption in the passenger vehicle segment. These regulations ensure compliance with safety standards, significantly boosting the demand for TPMS systems globally.

The growing production and sales of passenger vehicles, especially in emerging markets like China and India, are further contributing to the market’s expansion. With an increase in disposable income and urbanization, consumers are prioritizing safety features, including TPMS, to enhance their driving experience. Additionally, the rising popularity of electric vehicles (EVs) and connected cars has further increased TPMS adoption. EVs depend on precise tire pressure monitoring to optimize energy efficiency and extend driving range, making TPMS a critical component.

Moreover, TPMS helps in improving fuel efficiency by maintaining proper tire pressure, aligning with consumer demand for cost savings and reduced carbon emissions. As safety awareness and technological advancements grow, the passenger vehicle segment will remain a driving force in the automotive TPMS market.

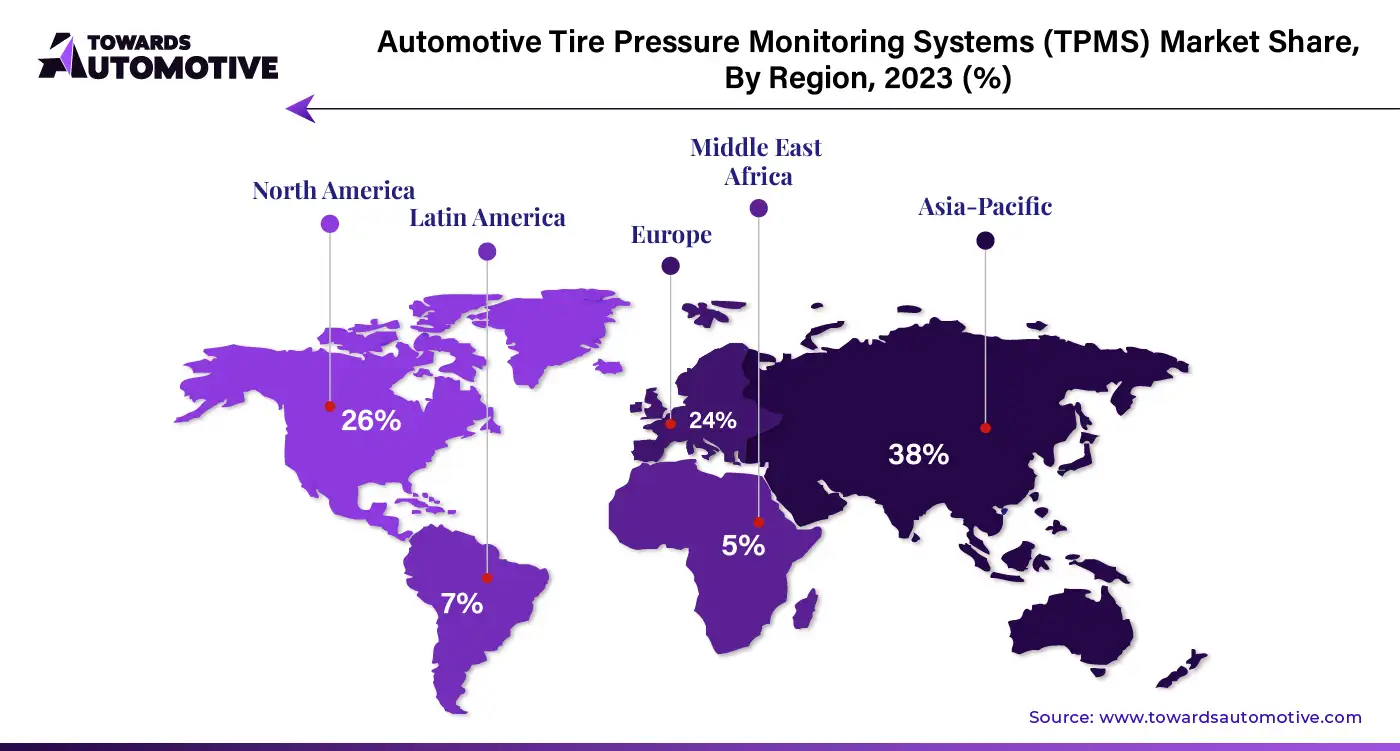

Asia Pacific dominated the automotive tire pressure monitoring system market. The automotive tire pressure monitoring system (TPMS) market in APAC is driven by several key factors, including rising vehicle production, stringent government regulations, and increasing consumer awareness about vehicle safety. The region’s booming automotive industry, particularly in countries like China, India, Japan, and South Korea, is a major driver. With APAC being the largest automotive manufacturing hub globally, the surge in vehicle production naturally boosts the demand for TPMS technology as an essential safety feature.

Government mandates regarding vehicle safety standards further drive the adoption of TPMS. For instance, regulations in countries like China and Japan require new vehicles to be equipped with TPMS, ensuring compliance with global safety norms. These policies have accelerated the deployment of both direct and indirect TPMS systems in passenger and commercial vehicles.

Moreover, increasing consumer awareness about tire safety, fuel efficiency, and vehicle maintenance is contributing to market growth. TPMS helps monitor tire pressure in real time, improving safety, reducing fuel consumption, and lowering carbon emissions, which aligns with the region's environmental sustainability goals.

Additionally, the growing penetration of hybrid vehicles in APAC is also driving TPMS adoption. These vehicles require efficient tire management to optimize battery performance, making TPMS a critical component. Combined with rising demand for advanced connected vehicles and smart technologies, the APAC region presents significant growth opportunities for the automotive TPMS market.

North America is expected to grow with a notable CAGR during the forecast period. The automotive tire pressure monitoring system (TPMS) market in North America is driven by stringent government regulations, increasing vehicle safety awareness, and the rapid adoption of advanced automotive technologies. The United States and Canada lead the region in mandating the use of TPMS in vehicles, significantly boosting market demand. For instance, the TREAD Act in the United States requires all new vehicles to be equipped with TPMS to ensure road safety, which has propelled widespread adoption across the region.

Rising consumer awareness about vehicle safety and maintenance is another critical driver. TPMS improves driving safety by preventing tire blowouts, reducing the risk of accidents, and ensuring optimal tire pressure for better vehicle handling and braking performance. With increasing emphasis on reducing fuel consumption and carbon emissions, TPMS plays a vital role in improving fuel efficiency, making it an attractive feature for consumers and fleet operators.

The region's strong adoption of electric vehicles (EVs) and connected car technologies also contributes to TPMS market growth. EVs rely heavily on optimal tire pressure to maximize battery efficiency and driving range, leading automakers to integrate advanced TPMS as a standard feature. Additionally, the growing presence of advanced driver assistance systems (ADAS) and smart automotive solutions in North America has increased the demand for direct TPMS with real-time monitoring capabilities.

By Type

By Sales Channel

By Vehicle Type

By Region

September 2025

August 2025

August 2025

August 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us