March 2025

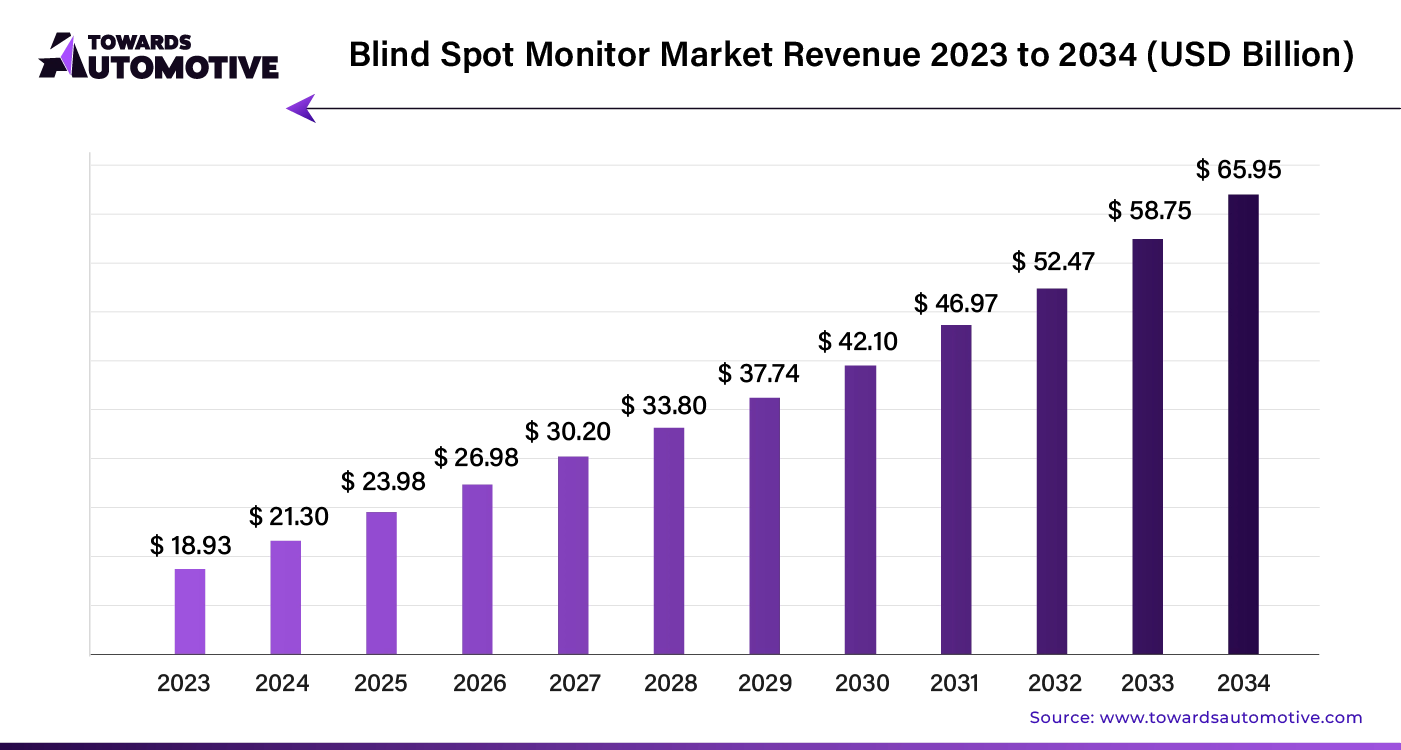

The blind spot monitor market is anticipated to grow from USD 23.98 billion in 2025 to USD 65.95 billion by 2034, with a compound annual growth rate (CAGR) of 12.5% during the forecast period from 2025 to 2034. The growing sales of luxury vehicles in developed nations coupled with rapid adoption of self-driving cars by fleet operators has boosted the market expansion.

Moreover, numerous government initiatives aimed at enhancing vehicular safety along with rising issues of traffic congestions in urban areas is playing a vital role in shaping the industrial landscape. The integration of AI and IoT in automotive blind spot monitors to enhance driving experience is expected to create ample growth opportunities for the market players in the future.

Unlock Infinite Advantages: Subscribe to Annual Membership

The blind spot monitor market is a prominent branch of the automotive industry. This industry deals in development and distribution of blind spot monitors in different parts of the world. There are several types of products developed in this sector comprising of park assist, backup camera, surround view & virtual pillar, BSD and some others. These products are integrated with different technologies including ultrasonic sensors, radar sensors and some others. It finds application in numerous types of vehicles consisting of passenger cars, light commercial vehicles, trucks and some others. This market is expected to rise significantly with the growth of the EV sector around the globe.

The major trends in this market consists of partnerships, business expansions and popularity of autonomous vehicles.

The park assist segment dominated the market. The growing use of parking assist system in luxury cars to automatically park vehicles in urban areas has boosted the market expansion. Additionally, partnerships among technology providers and automotive component manufacturers is expected to propel the growth of the blind spot monitor market.

The backup camera segment is expected to grow with a notable CAGR during the forecast period. The increasing use of backup cameras for viewing 360’ surrounding of the cars has boosted the market expansion. Also, rapid investment by automotive brands for integrating advanced cameras in modern cars is expected to foster the growth of the blind spot monitor market.

The radar sensor segment held the largest share of the market. The increasing use of radar sensors to detect objects around the vehicle and measure their distance and relative speed has boosted the market growth. Additionally, numerous advantages of these sensors including long-range detection, material penetration, reduced maintenance, object classification and some others is expected to foster the growth of the blind spot monitor market.

The ultrasonic sensor segment is expected to rise with a considerable CAGR during the forecast period. The growing use of ultrasonic sensors to detect objects and measure distances at low speeds, for enhancing safety and convenience has boosted the market expansion. Also, numerous benefits of these sensors including accuracy, cost-effectiveness, versatility, reliability and some others is expected to boost the growth of the blind spot monitor market.

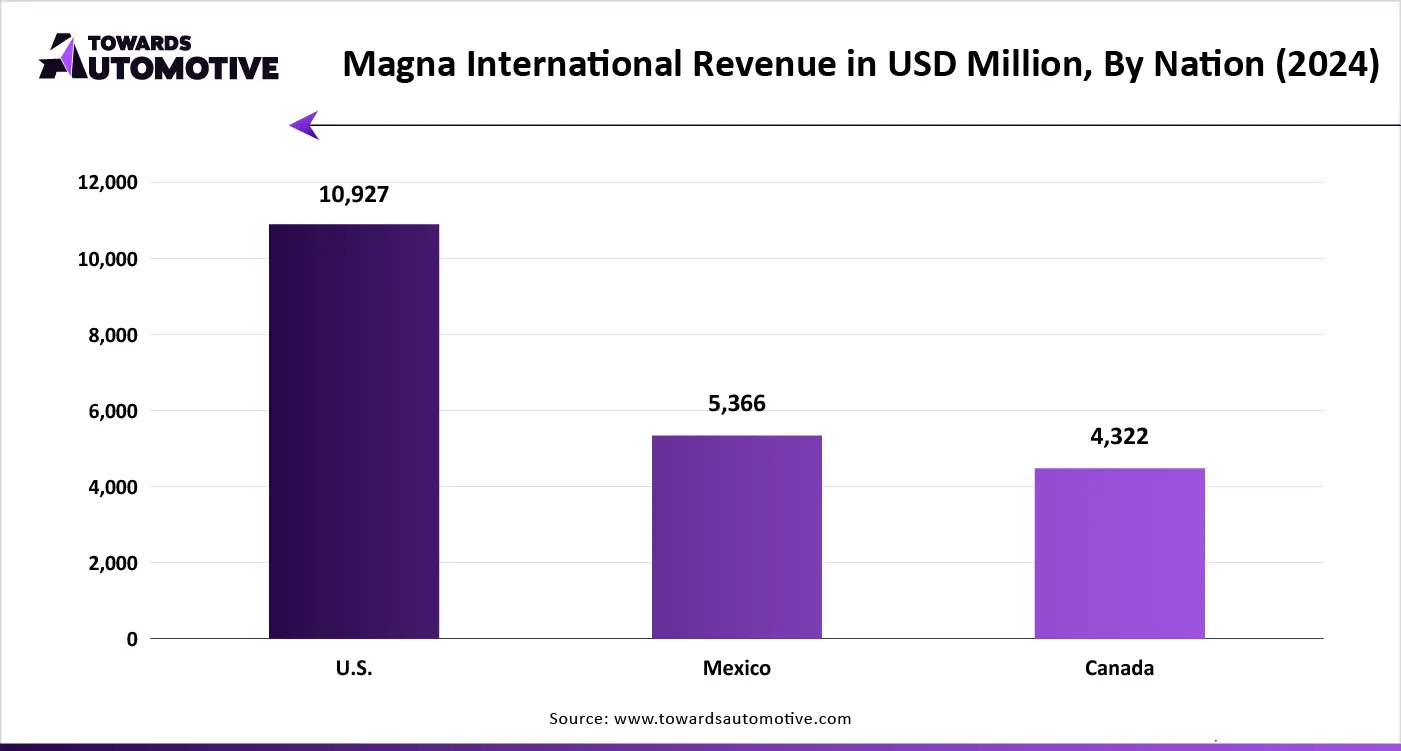

North America led the blind spot monitor market. The increasing adoption of electric vehicles in the U.S. and Canada to reduce vehicular emission has boosted the market expansion. Additionally, rapid investment by automotive brands such as Ford, General Motors, Tesla and some others for integrating advanced sensors in modern cars coupled with numerous government regulations aimed at mandating ADAS in vehicles is playing a vital role in shaping the industrial landscape. Moreover, the presence of various market players such as Sensata Technologies, Texas Instruments, Preco Electronics and some others is expected to boost the growth of the blind spot monitor market in this region.

Europe is expected to grow with a significant CAGR during the forecast period. The growing demand for luxury cars in various countries such as Germany, France, UK, Italy and some others has driven the market expansion. Additionally, rapid investment by government for strengthening the V2V infrastructure coupled with rise in number of automotive startups is contributing to the industry in a positive manner. Moreover, the presence of several market players such as Continental AG, Autoliv, ZF, Valeo Group, Veoneer, and some others is expected to propel the growth of the blind spot monitor market in this region.

The blind spot monitor market is a highly competitive industry with the presence of several dominating players. Some of the prominent companies in this industry consists of Valeo, Denso Corporation, ZF Friedrichshafen AG, Magna International, Inc., Bosch, Continental AG, Hella KGaA Hueck & Co., Delphi Technologies PLC, Mobileye and some others. These companies are constantly engaged in developing blind spot monitors and adopting numerous strategies such as business expansions, joint ventures, launches, acquisitions, partnerships, collaborations and some others to maintain their dominance in this industry.

By Product Type

By Technology

By Vehicle Type

By End User

By Region

March 2025

March 2025

February 2025

February 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us