October 2025

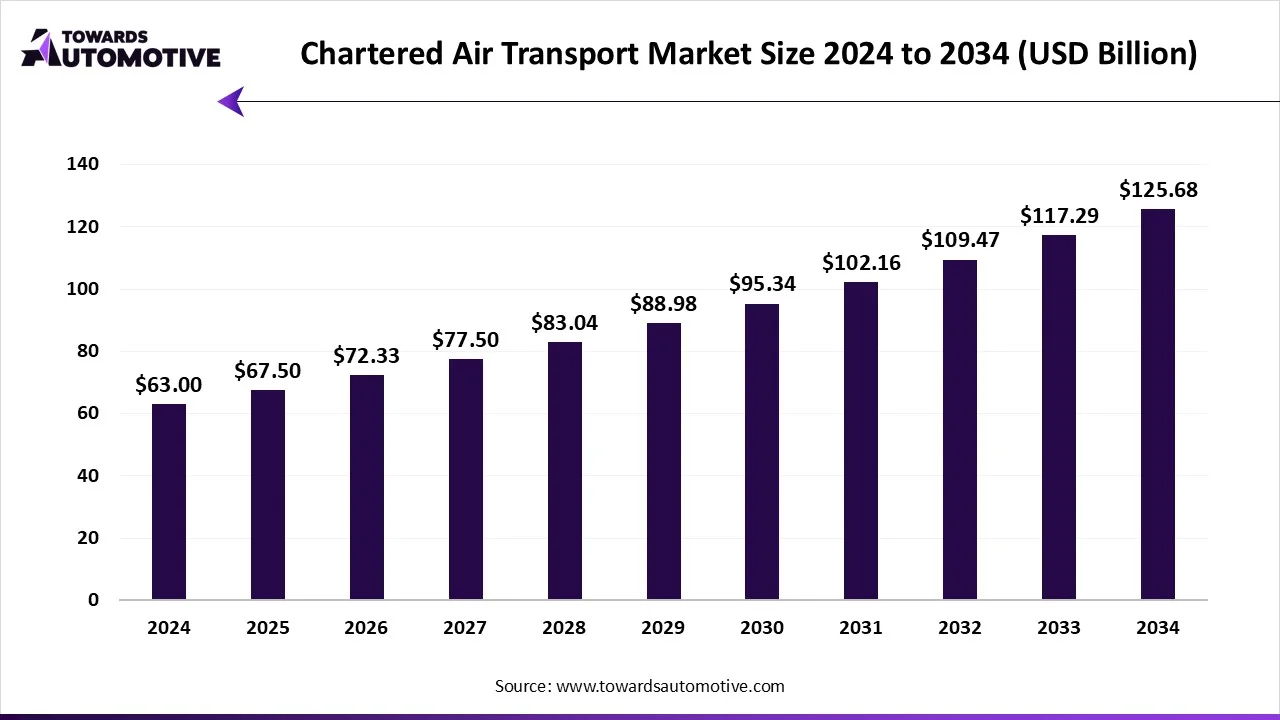

The chartered air transport market is forecasted to expand from USD 67.5 billion in 2025 to USD 125.68 billion by 2034, growing at a CAGR of 7.15% from 2025 to 2034. The charter air transport market is growing as the demand for flexible, private, and time-saving transportation options continues to grow. Corporate executives, high-net-worth individuals, and VIPs commonly use charter flights when the priority is time and privacy over scheduled commercial airlines.

The rapid globalization of business and increasing luxury travel are also factors in increasing demand for charter flights. As more people look for personal travel experiences, new models to access charter flights, such as subscription programs, make private aviation easier to access for a larger market. Advancements in aircraft efficiency and design, and new fuel efficiencies, provide greater access and affordability of charter flights with capabilities out of smaller airports, all contributing to a growing charter air transportation market.

Chartered air transport to the commercial provision of aircraft and aircrew on a non-scheduled basis to transport passengers or cargo under charter arrangements, including ad-hoc charters, scheduled charter services, ACMI/leasing, fractional ownership, air ambulance, and specialist mission operations; covering fixed-wing and rotary-wing aircraft. It is utilized across a number of industries, including business travel, tourism, health services, transportation for government, and entertainment. The market opportunities are expansive as charter flights provide privacy, save time, and access to airports not serviced by commercial airlines. Moreover, the rising needs of business travelers, increasing wealth, and demand for luxurious, tailored travel are expanding the chartered air transport market.

| Metric | Details |

| Market Size in 2025 | USD 67.5 Billion |

| Projected Market Size in 2034 | USD 125.68 Billion |

| CAGR (2025 - 2034) | 7.15% |

| Leading Region | North America |

| Market Segmentation | By Aircraft Type, By Service Type, By Customer Type, By Range, By Booking / Commercial Model and By Region |

| Top Key Players | Gulfstream Aerospace, Bombardier (Business Aircraft), Dassault Aviation, Embraer (Executive Jets), Textron Aviation (Cessna & Beechcraft), Airbus Corporate Jets (ACJ), Boeing Business Jets (BBJ), ATR, Pilatus Aircraft, Honda Aircraft Company, Leonardo S.p.A., Robinson Helicopter Company |

The trends in the chartered air transport market are partnerships and the introduction of new charter companies.

The business jets segment dominated and captured the market with 45% and is expected to be the fastest growing segment in the forecasted period. Business jets dominated the charter air transportation market as they balance speed, comfort, and flexibility; therefore, they are commonly utilized by corporations, government officials, and high-net-worth individuals to travel regionally and internationally promptly and at their convenience. Business jets are also expected to remain the fastest-growing class of aircraft in the charter market since there is a continued rise in demand for travel that is private, flexible, and saves time. Increasing globalization, increasing business activity, and an increasing number of high-income earners motivate this rise in demand. Business jets allow executives to travel between cities and effectively attend multiple meetings on the same day. With technological upgrades in fuel efficiency, more users are also attracted to this reason, which explains the forecast and growth in projected usage in this charter market.

The on-demand/ad-hoc charter segment dominated and captured 38% of the total market share because of the unparalleled flexibility it provides. Customers are able to book flights as they see fit, without requiring long-term contracts or any obligations. The on-demand charter model fits particularly well with business and affluent travelers who desire the liberty to fly their own routes, on their own timeline, and with their selected aircraft. As a result, on-demand charter is convenient for customers who may wish to travel unexpectedly or for an unexpected reason.

The fractional ownership/membership segment is expected to witness the fastest growth rate in the forecasted period because it creates a more flexible flight experience and a price-sharing incentive with fractional ownership and membership programs. Customers don't have to purchase an entire aircraft; they can purchase a fraction of an aircraft, or they can purchase a membership that gives them access to jets at a lower price than ownership. This model is particularly attractive to travelers who fly frequently but do not have the capital to purchase an aircraft, and they want the convenience private aviation provides without the financial burden.

The corporate/business segment dominated and captured 33% of the chartered air transport market share, since companies are incentivized to use private aviation, as it is more effective than flying commercially. Businesses often need to fly quickly to finalize a deal, attend meetings across the globe, or visit one or more sites in one day. Chartered air travel minimizes delays associated with commercial airlines to ensure business executives are making maximum use of their time while traveling. Moreover, there is also a significant benefit of providing privacy during travel for sensitive discussions, which helps ensure that corporate demand continues to dominate the market.

The HNI/ VIP segment is expected to grow at the fastest rate in the chartered air transport market, due to the rising amount of personal wealth around the world. These customers enjoy flying privately for luxury, comfort, and exclusivity. Increased demand for personalized experiences, along with congested airport procedures, will only continue this trend. In addition, as the population of global wealth increases, this segment grow rapidly.

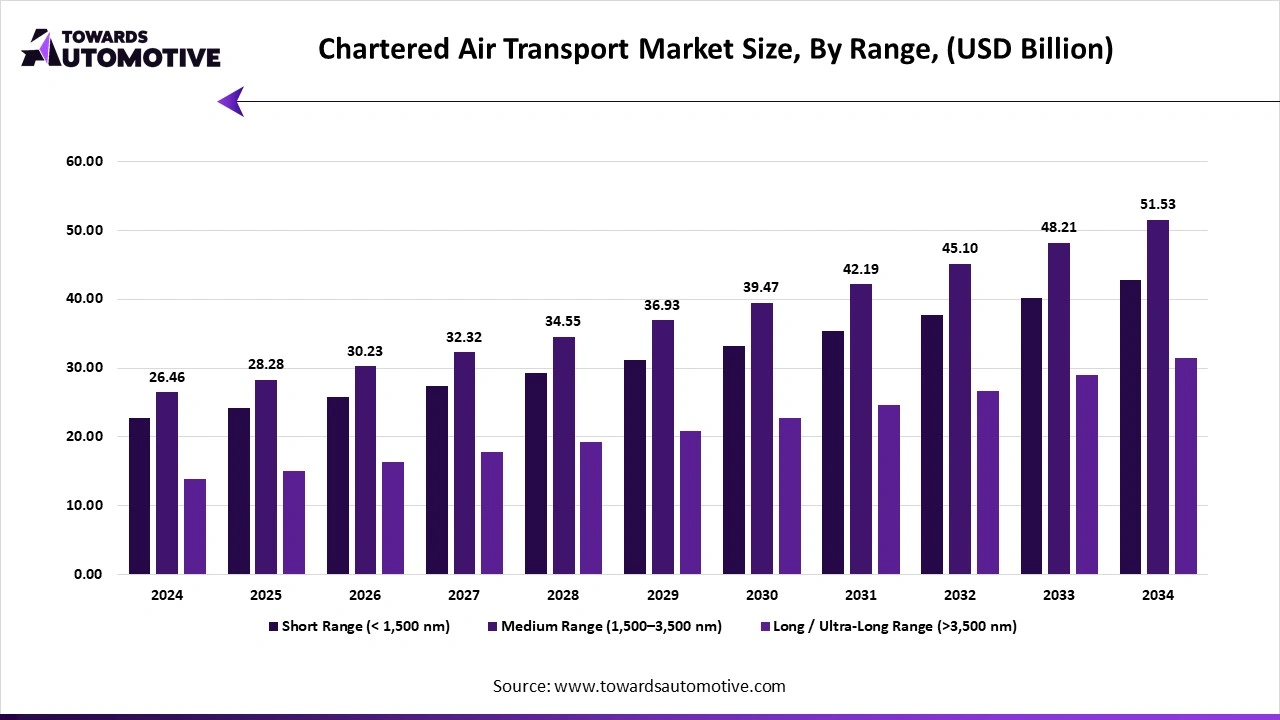

The short-range segment dominated and captured almost 37% of the total chartered air transport market, as it is ideally suited for regional business and leisure travel. Customers want to take fast flights between nearby cities when they know they can avoid the time it would take to travel by car or train. When traveling for business, executives will frequently charter a flight to attend a meeting they can return from on the same day. Because short-range charters are less expensive than long-range flights, they make them accessible to the average traveler.

The long/ultra-long-range segment is expected to grow at the fastest rate in the chartered air transport market due to growth in global business and leisure travel. Customers require that they get from continent to continent in one flight, saving them time and increasing their productivity. Customers, most frequently business leaders and high-net-worth individuals, prefer to use long-range jets to travel internationally. In addition to time savings and travel classification, long-range travel offers more space, comfort, and privacy.

The hourly/flight hour rate segment dominated and captured around 50% of the total market share because it allows for simple pricing and control. Customers are only charged for active flight time, which allows for predictable costs and management. This model also resonates with corporate clients and people who do not want a long-term commitment. It is the most flexible as it permits the user to charter the flight when they need it, without the added cost of ownership.

The per-seat/subscription programs segment is expected to grow at the fastest rate in the chartered air transport market, as it is more affordable and shares the cost. Clients can purchase a seat on a shared private flight as opposed to chartering an entire private jet. This adds value, as private aviation becomes more accessible to a larger market. Subscription models can provide regular flyers with predictable costs but still maintain guaranteed access to flights. The value of luxury experience makes this model especially attractive to a new segment of the market, who are less concerned with ownership and more about access.

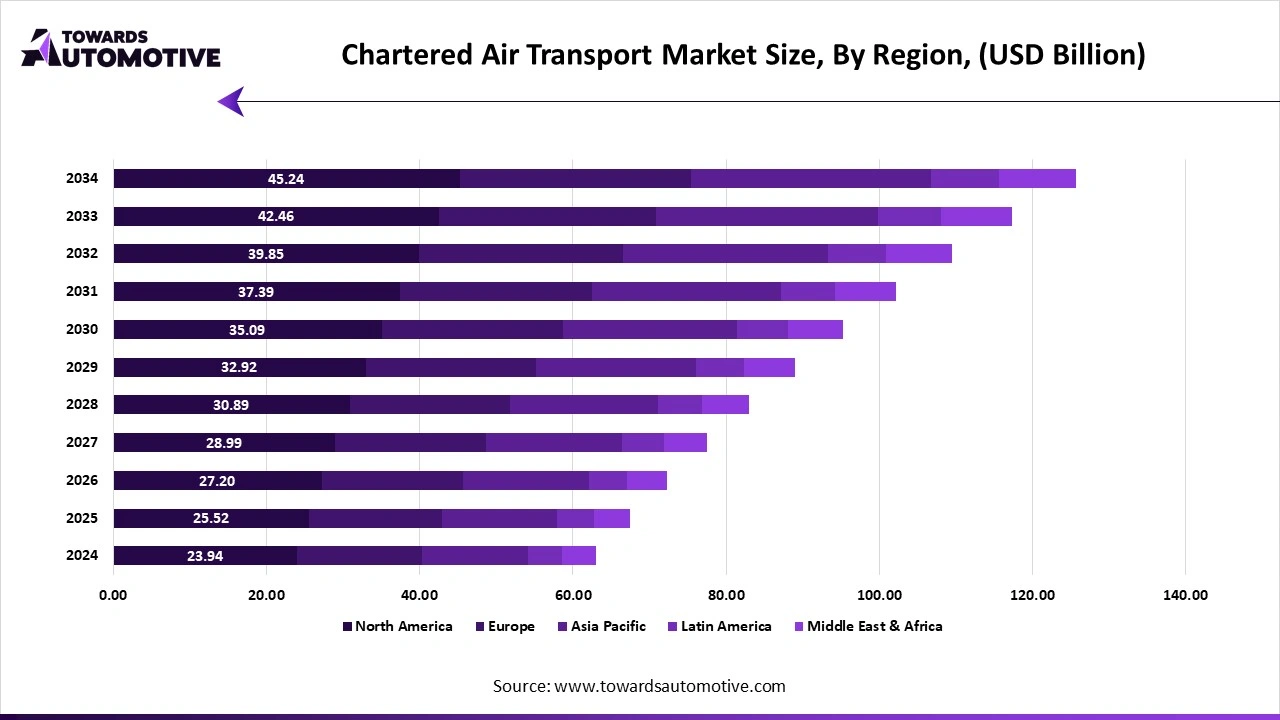

North America dominated and captured almost 40% of the chartered air transport market. The chartered air transport market is dominated by North America due to its key size, reputation, and demand from both business and leisure travelers. North America has a robust airport infrastructure, an abundance of chartered air transport fleets, and a large number of high-income air travelers who appreciate the benefits of flexible and private air travel in the marketplace. In countries such as the U.S. and Canada, both private jets and air taxis are widely used for short- and mid-length trips. Potential growth opportunities in the region include existing regional interest in developing sustainable aviation fuels and electric aircraft, and a desire to make use of smaller airport infrastructure. North American chartered air transport will continue to dominate the global market as it has the existing infrastructure, air travel demand, and a large number of wealthy travelers.

The U.S. dominated the North American chartered air transport market. It has the largest fleet of private jet charter aircraft, the highest number of charter companies, and a large proportion of highly wealthy travelers who have the opportunity to use chartered aircraft transportation. The benefits of chartered air transport and private jets are a clear preference for business executives when they desire to travel faster and traverse the airspace with greater timing flexibility. Moreover, the U.S. also has a healthy investment focus for the development of greener aviation fuels and electric aircraft, which will all present positive growth opportunities.

The Asia-Pacific region is growing the fastest in the chartered air transport market. Increased wealth in countries such as China, India, and Southeast Asia will support demand for charter travel, including luxury and corporate travel. This travel segment is also growing for tourism to key tourism hotspots, such as the Maldives, Thailand, and Bali. In addition, the region also has countries working to build up their aviation infrastructure, and airport development efforts will be impactful in increasing accessibility of chartered services. Due to the large population, customer base, and rising incomes, the Asia Pacific region is certainly a growing market opportunity.

China has the highest share of the Asia Pacific chartered air transport market. China is also seeing a significant increase in the wealthy population, and because of its strong economy, there is a high demand for private travel in China. Executives will continue to use chartered air travel as a quick way to link together large geographical regions, and tourists will use chartered air to fly into luxury destinations. In addition, investments by the Chinese government in airport development and aviation technology advancements make private chartered air travel more accessible to all. Key opportunities in the country are corporate travel, sustainable aviation, and medical flight transportation. With sustained economic growth, China is expected to remain the largest chartered air settlement in the Asia Pacific region.

India is an important developing country in the business and chartered air transport market. Its developing economy and increasing upper middle class create new demand for business, intergovernmental/executive, and luxury travel. Special occasions such as weddings and events also contribute to the use of charter. The Indian government is expanding its regional airports, which will facilitate the use of chartered air services from those cities. With greater income levels and rural migration to urban centers, India's presence in the chartered air transport market is expected to grow at a considerable rate.

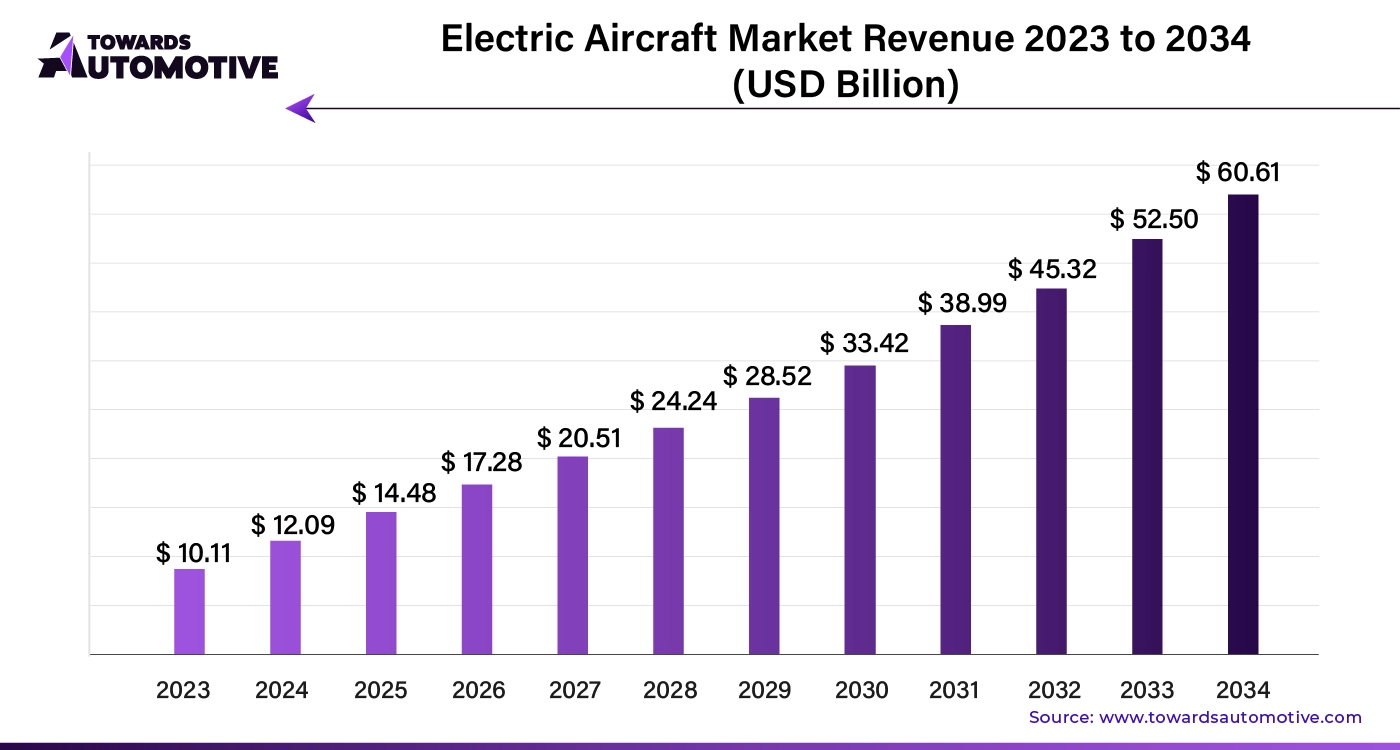

The electric aircraft market is expected to increase from USD 14.48 billion in 2025 to USD 60.61 billion by 2034, growing at a CAGR of 19.83% throughout the forecast period from 2025 to 2034. The growing adoption of eco-friendly aircrafts in developed nations coupled with numerous government initiatives aimed at lowering CO2 emission has driven the market expansion.

The electric aircraft market is a crucial branch of the aviation industry. This industry deals in manufacturing and distribution of electric aircraft in different parts of the world.

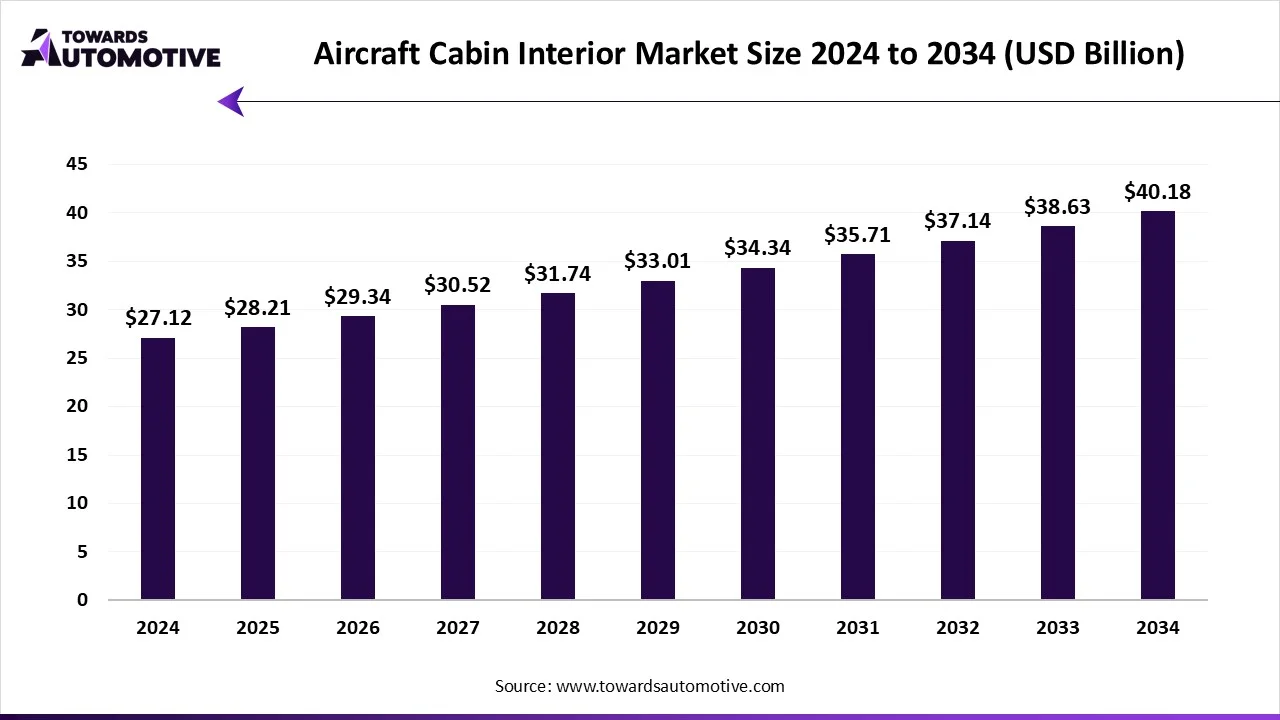

The aircraft cabin interior market is forecast to grow from USD 28.21 billion in 2025 to USD 40.18 billion by 2034, driven by a CAGR of 4.01% from 2025 to 2034. The increasing sales of aircrafts in different parts of the world coupled with rapid deployment of hybrid planes by airline companies has boosted the market expansion. Additionally, technological advancements in the aviation sector along with growing investment by market players for opening new production facilities is playing a vital role in shaping the industrial landscape. The rising use of sustainable materials for manufacturing aircraft interiors is expected to create ample growth opportunities for the market players in the future.

The aircraft cabin interior market is a crucial sector of the aerospace industry. This industry deals in manufacturing and distribution of interior materials for aircrafts around the world. There are several types of products developed in this sector comprising of seating systems, cabin lighting, in-flight entertainment & connectivity (IFEC), galleys & lavatories, cabin panels & partitions, stowage bins & overhead compartments, windows & windshields, flooring & carpets, cabin management systems and some others.

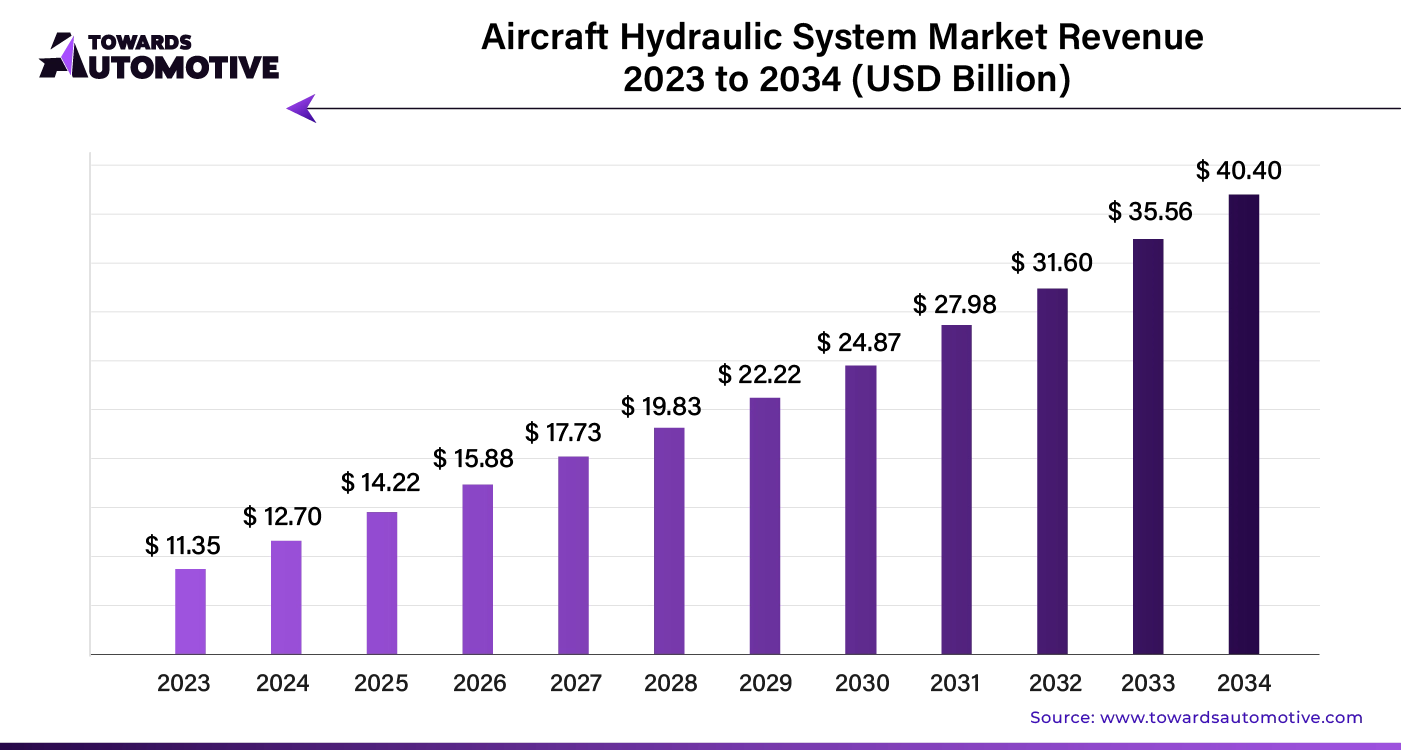

The global aircraft hydraulic system market size is calculated at USD 12.70 billion in 2024 and is expected to be worth USD 40.40 billion by 2034, expanding at a CAGR of 11.90% from 2023 to 2034.

The demand for aircraft hydraulic systems is driven by the need for highly reliable systems, higher power-to-weight ratios, and reduced cooling costs due to the low heat generated. However, the market faces challenges from high maintenance costs and the significant weight of these systems.

| January 2025 | Announcement |

| Evan Kaye, Founding Partner, FlyJetr. | Our mission is to revolutionise private jet travel. As the market evolves, we are dedicated to democratising luxury jet travel. By integrating advanced technology with personalised service, FlyJetr crafts luxury travel experiences tailored to the unique preferences of today’s travellers in the evolving landscape of private aviation. |

| January 2025 | Announcement |

| Lau Shek Yau, chairman and executive director of CN Logistics | We are honoured to collaborate with Wuhan Financial Holdings and Hubei International Logistics to promote Ezhou’s external trade exchanges and build a business ecosystem that benefits the society across multiple industries and regions. Bolstered by its strategic location, Ezhou has become the hub for China’s e-commerce and logistics industries. On the grand day of departure, we witnessed the efficient processing capabilities of Ezhou Huahu Airport, which completed all aspects of customs clearance, cargo loading, and takeoff in a short time. |

| December 2024 | Announcement |

| Ryan Goepel, President and CFO of GlobalX. | We are thrilled to partner with ATB Aviation to launch this joint venture in Asia Pacific, marking an important step in the global expansion of our innovative charter and ACMI flight model. With significant untapped potential in the Asia Pacific market, we are committed to ensuring the success of this joint venture. GlobalX’s knowledge and operational excellence, combined with the proven talent and expertise of our partners at ATB Aviation, will establish a strong foundation for a successful new airline. |

| October 2024 | Announcement |

| Colin Williams, managing director at Skytrail. | We're delighted to launch this unique partnership with Fly4 and Pro Sky, working closely together to maximise the potential for the Fly4 fleet in the charter market. Skytrail have one of the most experienced charter sales teams in the industry, and alongside Pro Sky's innovative solutions we have created a very exciting collaboration. |

The chartered air transport market is highly competitive. Some of the prominent players in the market are Gulfstream Aerospace, Bombardier, Dassault Aviation, Embraer, Textron Aviation, Airbus Corporate Jets (ACJ), Boeing Business Jets (BBJ), ATR, Pilatus Aircraft, Honda Aircraft Company, Leonardo S.p.A., Bell Textron, Sikorsky (Lockheed Martin), Robinson Helicopter Company, Piaggio Aerospace, Viking Air / De Havilland Canada, COMAC, Sukhoi Civil Aircraft Company (SSJ), Mitsubishi Aircraft Corporation and Airbus Helicopters. In the chartered air transport industry, companies are concentrating on expanding operational fleets, giving flexible booking models, such as extended per-seat and membership use, and advertising online to facilitate easier customer access. Many companies are enhancing luxury offerings, improving safety policies, and acquiring fuel-efficient aircraft to entice customers. Charter companies are also considering opportunities in emerging markets, medical evacuations, and sustainable aviation. The increasing interest in personalized travel, business access across borders, and sustainable aviation further expands areas for companies to grow in market share as they establish authority and marketing dominance.

| Company | About |

| Gulfstream Aerospace | The company was created in 1958. It manufactures contemporary business jets utilized in charter for both corporate and VIP clients. With very long-range and luxurious aircraft, Gulfstream helps satisfy demands for efficient, privacy, and comfortable international travel. |

| Bombardier | The company was established in 1942. It manufactures business jets which are used throughout charter aviation. Bombardier aircraft offer speed, range, and luxury, regularly preferred by corporations and affluent travelers for chartered flights domestically and internationally. |

| Dassault Aviation | The company was created in 1929. It produces Falcon business jets which serve the charter market due to their high performance, advanced technology, and exceptional comfort. Dassault jets are preferred and requested for executive travel and VIP travel; they support flexibility and long-range travel in private aviation. |

| Embraer | The company was created in 1969. It produces and manufactures executive jets which are used in charter aviation for regional and international travel. Embraer’s Phenom and Legacy series of jets are recognized for efficient, comfortable, cost-effective jets, appealing to both corporate and individual customers in the private charter jet market. |

| Textron Aviation | The company was established in 1927. It designs light and mid-size jets and turboprop aircraft for sale and sets its business apart by using the Cessna and Beechcraft brands. These aircraft are very popular for charter services because they are much lower cost, can operate in smaller airports, and provide a lot of flexibility. |

| Airbus Corporate Jets | Airbus Corporate Jets was established in 1997. It now sells corporate jet modifications of Airbus commercial airliners, specifically designed for charter and VIP use. ACJ has a line of long-range private airliners with extensive and customizable configurations that deliver comfort and luxury to customers in business and governments around the world. |

| Boeing Business Jets | Boeing Business Jets was established in 1996. It produces modified Boeing airliners for business jet use in charter and private aviation. BBJs provide an unmatched range and comfort that are very popular in the ultra-long-range charter market for VIPs and government leaders. |

| ATR | The company was established in 1981. It produces turboprop aircraft used for charter aviation, primarily for regional routes. ATR aircraft are fuel-efficient, economical, and suitable for operating on shorter runways, making them perfect for operating charter services for groups and continuing regional connectivity. |

| Pilatus Aircraft | The company was established in 1939. It builds turboprop and light jet aircraft for charter applications, such as the PC-12 and PC-24. Pilatus aircraft are popular for their versatility and efficiency, as well as for their ability to land on smaller airfields on business trips. |

| Honda Aircraft Company | Honda Aircraft Company was established in 2006. It produces the HondaJet, a light business jet used in charter operations. The HondaJet is known for its fuel efficiency, advanced design, and an emphasis on comfort, and it is used by customers who seek a cost-efficient and flexible option when using private aviation. |

| Leonardo S.p.A. | The company was established in 1948. It produces helicopters for charter operations, and the helicopters are used for corporate transportation, VIP activity, and special missions. Leonardo helicopters are fast, luxurious, and flexible, serving both business and leisure travelers in the global charter air transport industry. |

Tier 1

Tier 2

Tier 3

By Aircraft Type

By Service Type

By Customer Type

By Range

By Booking / Commercial Model

By Region

October 2025

October 2025

September 2025

October 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us