September 2025

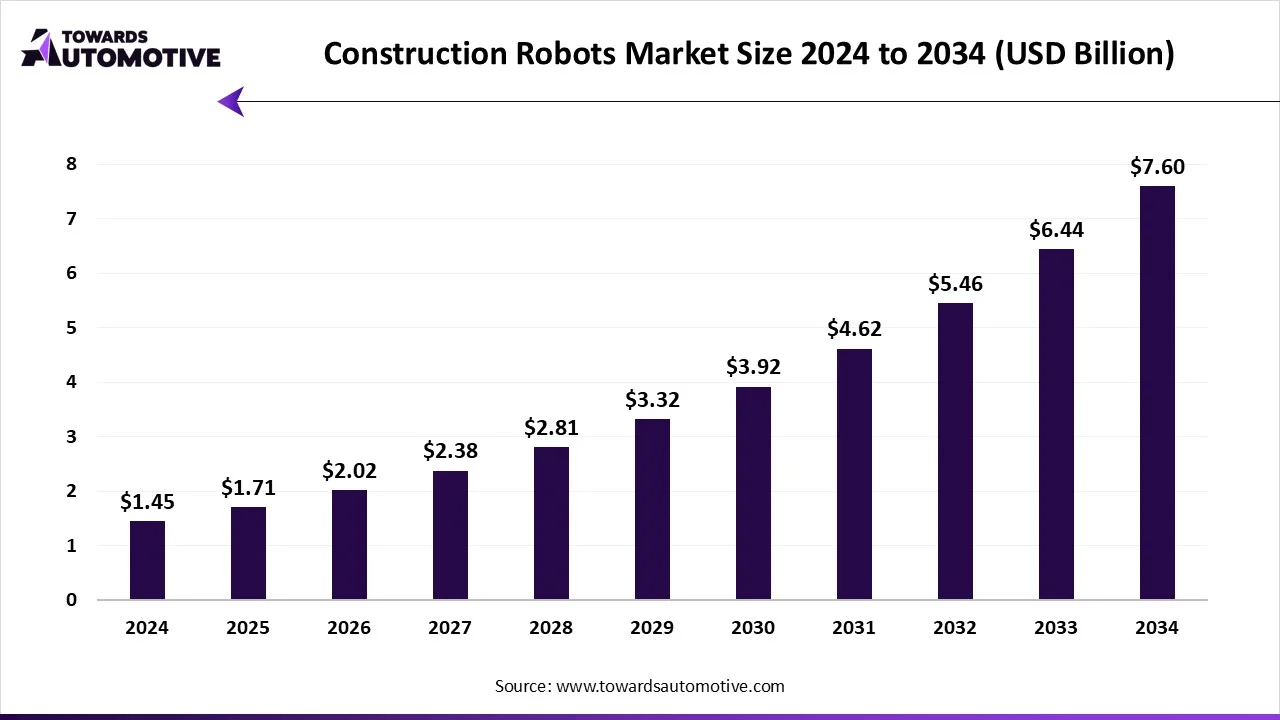

The construction robots market is expected to increase from USD 1.71 billion in 2025 to USD 7.60 billion by 2034, growing at a CAGR of 18.02% throughout the forecast period from 2025 to 2034. The increasing adoption of automated solutions in the construction sector coupled with rapid investment by public sector companies for developing construction robots has driven the market expansion.

Additionally, the growing emphasis of robotic brands for manufacturing AI-integrated robots along with numerous government initiatives aimed at developing the road infrastructure is playing a vital role in shaping the industrial landscape. The rising use of digital twins for simulation and maintenance of collaborative robots is expected to create ample growth opportunities for the market players in the future.

Unlock Infinite Advantages: Subscribe to Annual Membership

The construction robots market is a prominent sector of the robotics and automation industry. This industry deals in manufacturing and distribution of construction robots across the world. There are several types of robots developed in this sector comprising of traditional robots, collaborative robots (Cobots), autonomous mobile robots, exoskeleton robots, 3D printing robots and some others. It finds application in numerous sectors consisting of building construction, road construction, bridge & tunnel construction, demolition & deconstruction and some others. The end-users of these robots consist of residential sector, commercial sector, industrial infrastructure, public infrastructure and some others. This market is expected to rise significantly with the growth of the construction industry in different regions of the globe.

The major trends in this market consists of partnerships, rise in number of residential constructions and business expansions.

The traditional robots segment led the construction robots market. The growing deployment of traditional robots in the residential construction has driven the market expansion. Additionally, rapid investment by robotic companies for developing traditional robots to enhance construction operations is expected to boost the growth of the construction robots market.

The collaborative robots (Cobots) segment is expected to grow with the highest CAGR during the forecast period. The increasing emphasis of construction companies on deploying Cobots to enhance the productivity of workers has driven the market expansion. Additionally, numerous government initiatives aimed at deploying collaborative robots in official buildings is expected to propel the growth of the construction robots market.

The material handling robots segment held the largest share the construction robots market. The growing emphasis of construction brands for deploying advanced robots to enhance material handling capabilities has boosted the market expansion. Additionally, rapid investment by robotic brands for developing material handling robots is expected to drive the growth of the construction robots market.

The demolition robots segment is expected to rise with the highest CAGR during the forecast period. The growing use of demolition robots for renovation projects has driven the market expansion. Also, rapid investment by robot manufacturers to develop high-quality demolition robots is expected to propel the growth of the construction robots market.

The semi-automated robots segment dominated the construction robots market. The growing emphasis of semi-automated robots in the construction sector has driven the market expansion. Additionally, rapid investment by robotic companies for developing numerous types of semi-automated robots is expected to drive the growth of the construction robots market.

The fully automated robots segment is expected to expand with the fastest CAGR during the forecast period. The increasing investment by robotic companies for deploying advanced robots in the construction sector has boosted the market growth. Additionally, the growing emphasis of construction companies to deploy fully autonomous robots for enhancing daily tasks in the construction sector is expected to boost the growth of the construction robots market.

The building construction segment held the largest share of the construction robots market. The rising emphasis of government for developing official-buildings has boosted the market expansion. Additionally, the rise in number of residential constructions in developed nations coupled with rapid deployment of collaborative robots in building setups is expected to drive the growth of the construction robots market.

The bridge & tunnel construction segment is expected to grow with the highest CAGR during the forecast period. The growing investment by government for developing bridges and tunnels has boosted the market growth. Also, the increasing adoption of traditional robots for constructing bridges and tunnels is expected to boost the growth of the construction robots market.

The commercial sector segment led the construction robots industry. The growing adoption of collaborative robots in the commercial sector has boosted the market expansion. Additionally, partnerships among robotics brands and commercial startups to deploy AI-based robots in the commercial sector is expected to boost the growth of the construction robots market.

The industrial infrastructure segment is expected to rise with the fastest CAGR during the forecast period. The growing investment by heavy-duty industries for deploying high-quality robots to enhance numerous operations has driven the market expansion. Also, collaborations among autonomous mobile robots (AMRs) and manufacturing industry is expected to drive the growth of the construction robots market.

North America led the construction robots market. The growing adoption of collaborative robots in the U.S. and Canada for enhancing construction operations has boosted the market expansion. Additionally, numerous government initiatives aimed at developing the building infrastructure along with rise in number of robotic startups is playing a crucial role in shaping the industrial landscape. Moreover, the presence of various market players such as Boston Dynamics, Ekso Bionics, Built Robotics and some others is expected to boost the growth of the construction robots market in this region.

U.S. is the major contributor in this region. The rise in number of residential constructions in different parts of the world coupled with rapid investment by the government for developing the construction sector has driven the market expansion. Also, the presence of several robotics startups along with technological advancements in the robotic sector is playing a crucial role in shaping the industrial landscape.

Asia Pacific is expected to rise with the highest CAGR during the forecast period. The rising sales of robots in several countries such as India, China, Japan, South Korea and some others has driven the market growth. Also, rapid investment by government for building roads and bridges coupled with technological advancements in the robotic industry is contributing to the industry in a positive manner. Moreover, the presence of several market players including Komatsu Ltd, Fujita Corporation, Fanuc, Kawasaki Heavy Industries and some others is expected to drive the growth of the construction robots market in this region.

China led the market in this region. The rising emphasis of builders to deploy robots to enhance construction activities along with technological advancements in the construction sector is contributing to the industry in a positive manner. Moreover, the presence of robotic startups coupled with availability of raw materials at low prices has driven the market expansion.

There are several types of raw materials used in the production of construction robots such as steel, copper, and carbon fiber.

Component fabrication in robots refers to the creation of mechanical and structural parts using processes such as machining, welding, and 3D printing.

Testing and Quality Control (QC) in robotics involves a systematic process to ensure robotic systems operate correctly and products inspected by robots meet predefined quality standards.

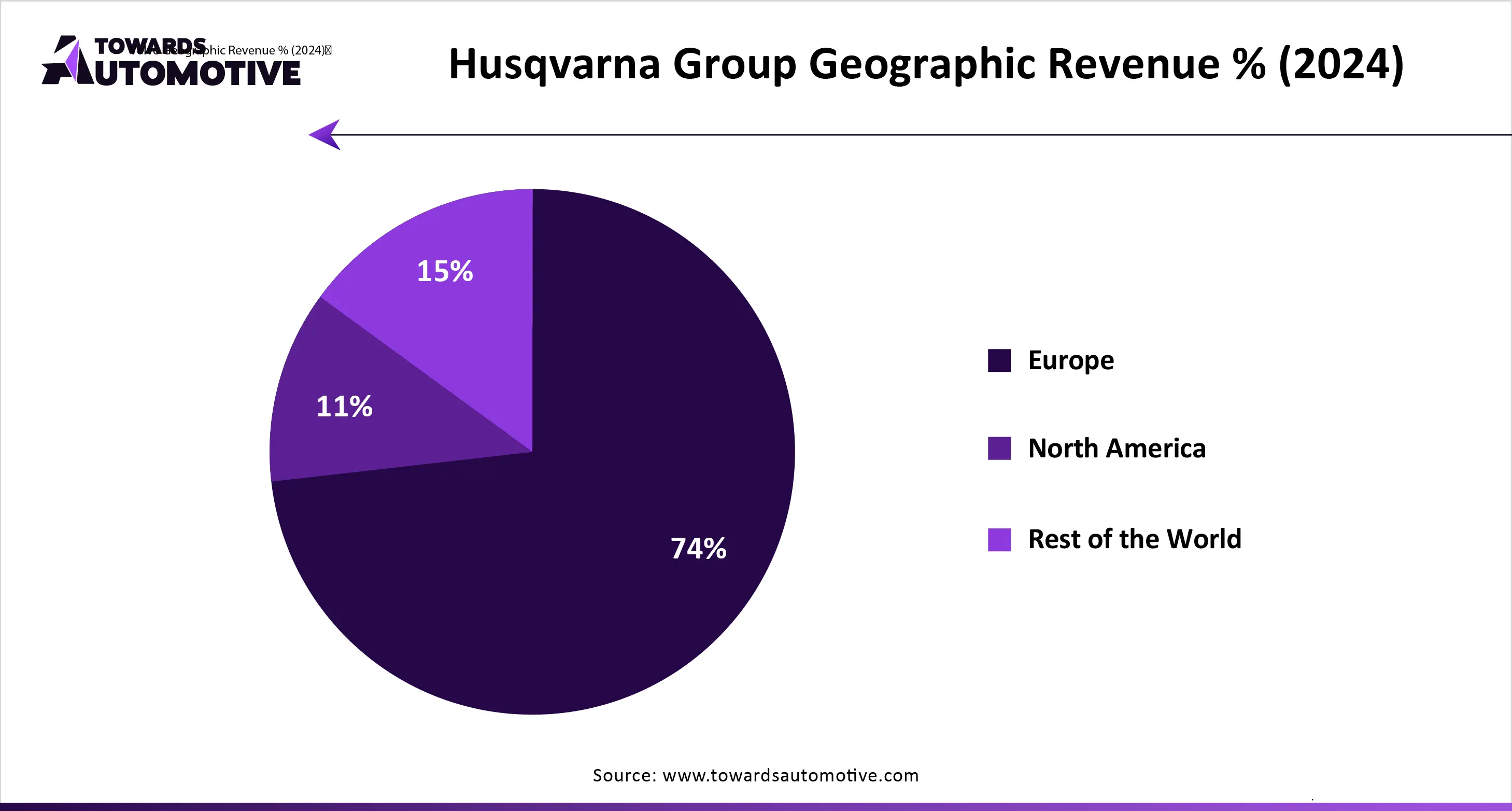

The construction robots market is a rapidly developing industry with the presence of several dominating players. Some of the prominent companies in this industry consists of Brokk AB, Husqvarna Group, Ekso Bionics, Boston Dynamics, Built Robotics, FBR Ltd (Fastbrick Robotics), Construction Robotics LLC, Conjet AB, Komatsu Ltd, Fujita Corporation, Hilti Group, Apis Cor, CyBe Construction, Advanced Construction Robotics, ABB Ltd and some others. These companies are constantly engaged in manufacturing robots for the construction sector and adopting numerous strategies such as partnerships, business expansions, acquisitions, collaborations, launches, expansions, joint ventures and some others to maintain their dominance in this industry.

By Robot Type

By Function

By Automation Level

By Application

By End-User

By Region

September 2025

September 2025

September 2025

August 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us