September 2025

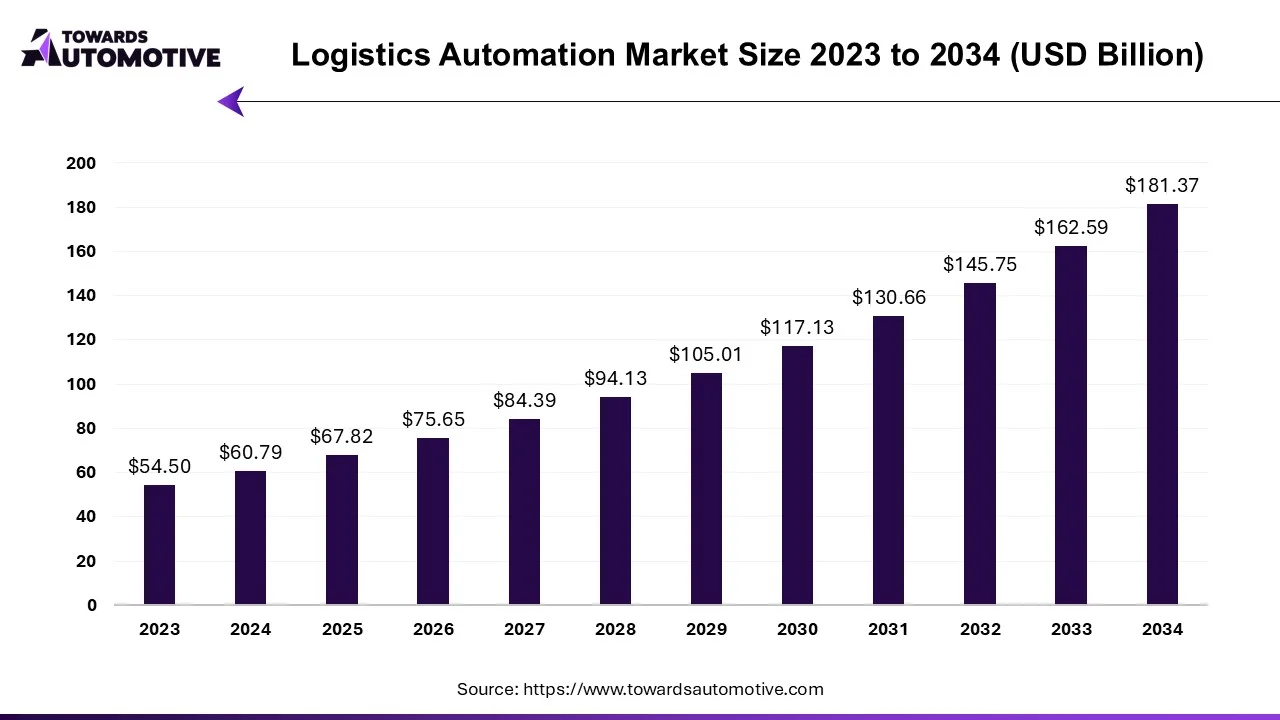

The logistics automation market is expected to increase from USD 67.82 billion in 2025 to USD 181.37 billion by 2034, growing at a CAGR of 11.55% throughout the forecast period from 2025 to 2034.

Unlock Infinite Advantages: Subscribe to Annual Membership

The logistics automation market is a crucial branch of the logistics industry. This industry deals in manufacturing and distribution of automation solutions for the logistics sector. There are numerous products developed in this sector comprising of autonomous robots (AGV, AMR), automated sorting systems, automated storage and retrieval systems, conveyor systems and some others. These products are designed for operating in different types of logistics operations including sales logistics, production logistics, recovery logistics, procurement logistics and some others. It finds applications in numerous end-user sectors consisting of retail & e-commerce, healthcare, automotive, aerospace & defense, electronics & semiconductors and some others. This market is expected to rise significantly with the growth of the robotics industry across the globe.

| Metric | Details |

| Market Size in 2024 | USD 60.79 Billion |

| Projected Market Size in 2034 | USD 181.37 Billion |

| CAGR (2025 - 2034) | 11.55% |

| Leading Region | North America |

| Market Segmentation | By Component, By Function, By Logistics Type, By Organization Size, By Software Application, By Vertical and By Region |

| Top Key Players | Dematic (Kion Group AG); Daifuku Co., Ltd.; TGW Logistics Group; KNAPP AG; Kardex; Mecalux, S.A.; Honeywell International Inc.; |

The major trends in this market consists of autonomous robots, rapid integration of advanced technologies in modern warehouses and collaborations.

Several robotic companies are constantly engaged in developing AGVs and AMRs for enhancing logistics operations. For instance, in March 2025, Scott Technology launched NexBot modular AGV. This AGV is designed for enhancing material handling capabilities in logistics sector. (Source: Dcvelocity

The logistics providers have started integrating advanced technologies such as AI and IoT in modern warehouses to enhance logistics efficiency. For instance, in March 2025, Gather AI launched an AI-enabled camera. This AI-based camera is designed for enhancing warehouse efficiency. (Source: Businesswire)

Several market players are collaborating with each other for developing advanced automation solutions for the logistics sector. For instance, in June 2025, NT Logistics collaborated with Qued. This collaboration is done for developing a new range of AI-based automation tools for the logistics sector. (Source: Tradingview)

The hardware segment led this industry. The growing demand for autonomous robots and automated sorting systems from the e-commerce sector has boosted the market expansion. Additionally, the rising adoption of automated storage and retrieval systems (AS/RS) and de-palletizing/palletizing systems in the logistics sector is expected to propel the growth of the logistics automation market.

The software segment is expected to rise with the fastest CAGR during the forecast period. The rapid deployment of warehouse management software in smart warehouses has driven the market growth. Also, the growing deployment of transportation management systems in the logistics sector is expected to drive the growth of the logistics automation market.

The retail and e-commerce segment dominated the market. The growing development in the e-commerce sector in different countries such as the U.S., India, UK and some others has boosted the market expansion. Additionally, rising popularity of online shopping platforms such as Amazon, Flipkart, Walmart, Ebay and some others is expected to propel the growth of the logistics automation market.

The healthcare segment is expected to rise with a significant CAGR during the forecast period. The growing adoption of automated solutions in pharmaceutical warehouses has boosted the market growth. Additionally, the deployment of advanced robots in healthcare logistics is expected to drive the growth of the logistics automation market.

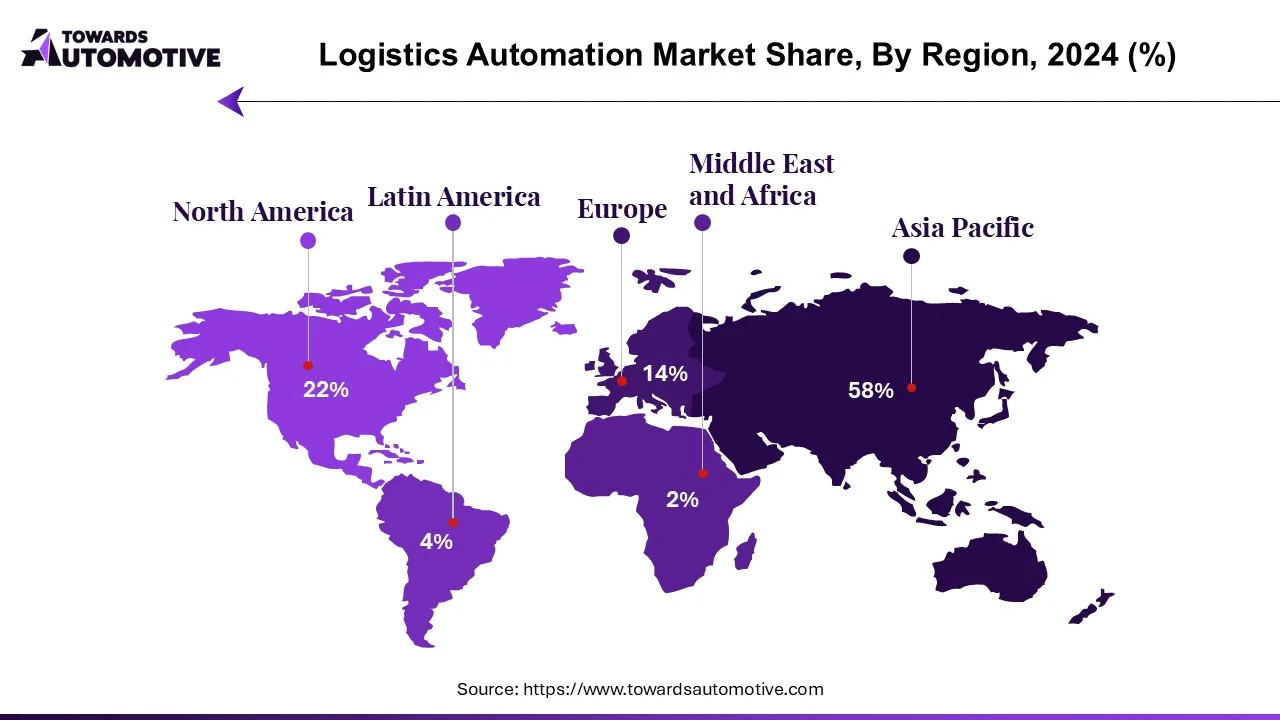

North America held the dominant position in the logistics automation market. The growing adoption of automation solutions for enhancing logistics operations of aerospace and defense sector has driven the market growth. Additionally, the presence of several market players such as Honeywell international inc., One Network Enterprises, Dematic and some others is expected to boost the growth of the logistics automation market in this region.

Asia Pacific is expected to grow with the fastest CAGR during the forecast period. The rising deployment of robotics solution in several industries such as automotive and electronics & semiconductor has driven the market expansion. Additionally, the presence of various market players such as Daifuku Co., Ltd, Murata Machinery, Ltd, Toshiba Corporation and some others is expected to foster the growth of the logistics automation market in this region.

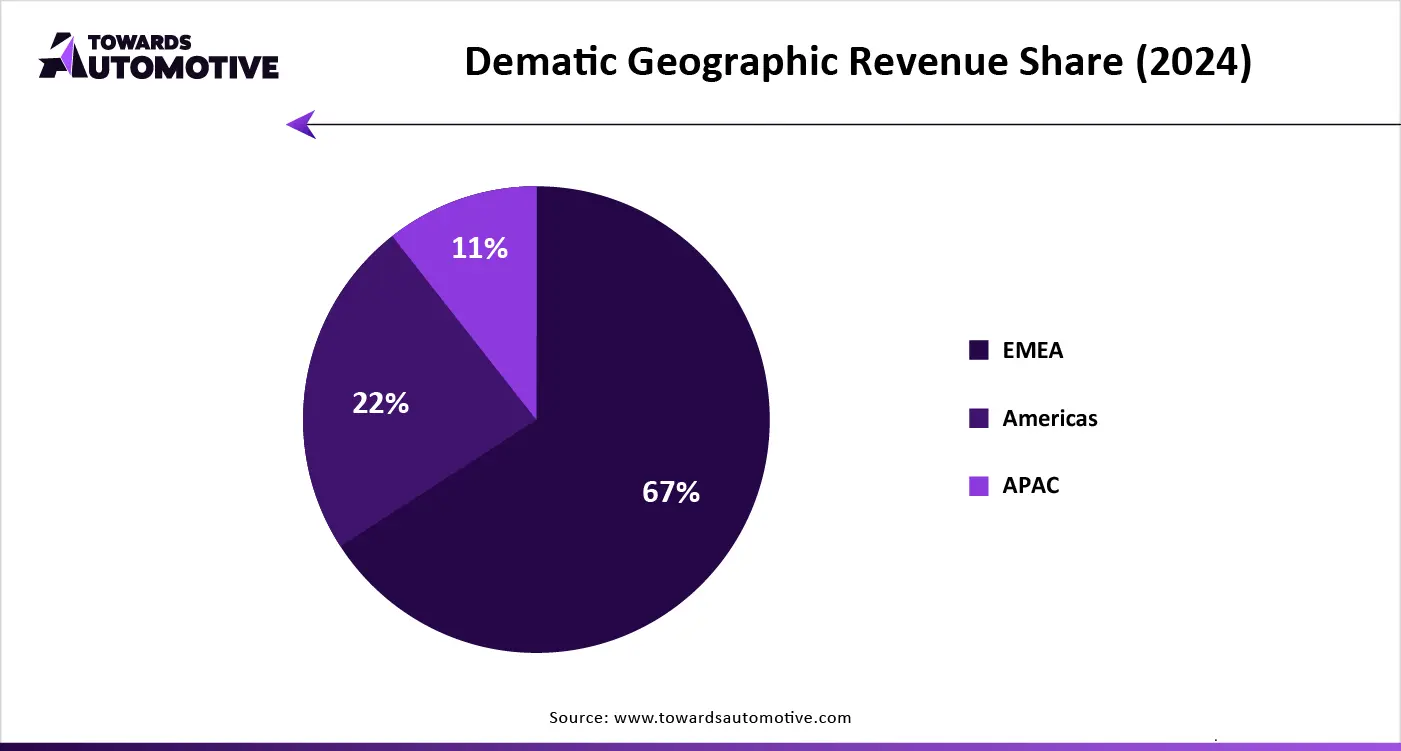

The logistics automation market is a highly fragmented industry with the presence of numerous dominating players. Some of the prominent companies in this industry consists of BEUMER GROUP; Dematic (Kion Group AG); Daifuku Co., Ltd.; TGW Logistics Group; KNAPP AG; Kardex; Mecalux, S.A.; Honeywell International Inc.; Swisslog Holding AG (KUKA AG); Murata Machinery, Ltd.; Jungheinrich AG; SSI SCHÄFER AG; Vanderlande Industries B.V.; and some others. These companies are constantly engaged in developing battery electric buses and adopting numerous strategies such as joint ventures, launches, collaborations, acquisitions, partnerships, business expansions and some others to maintain their dominance in this industry.

By Component

By Function

By Logistics Type

By Organization Size

By Software Application

By Vertical

By Region

September 2025

September 2025

September 2025

August 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us