September 2025

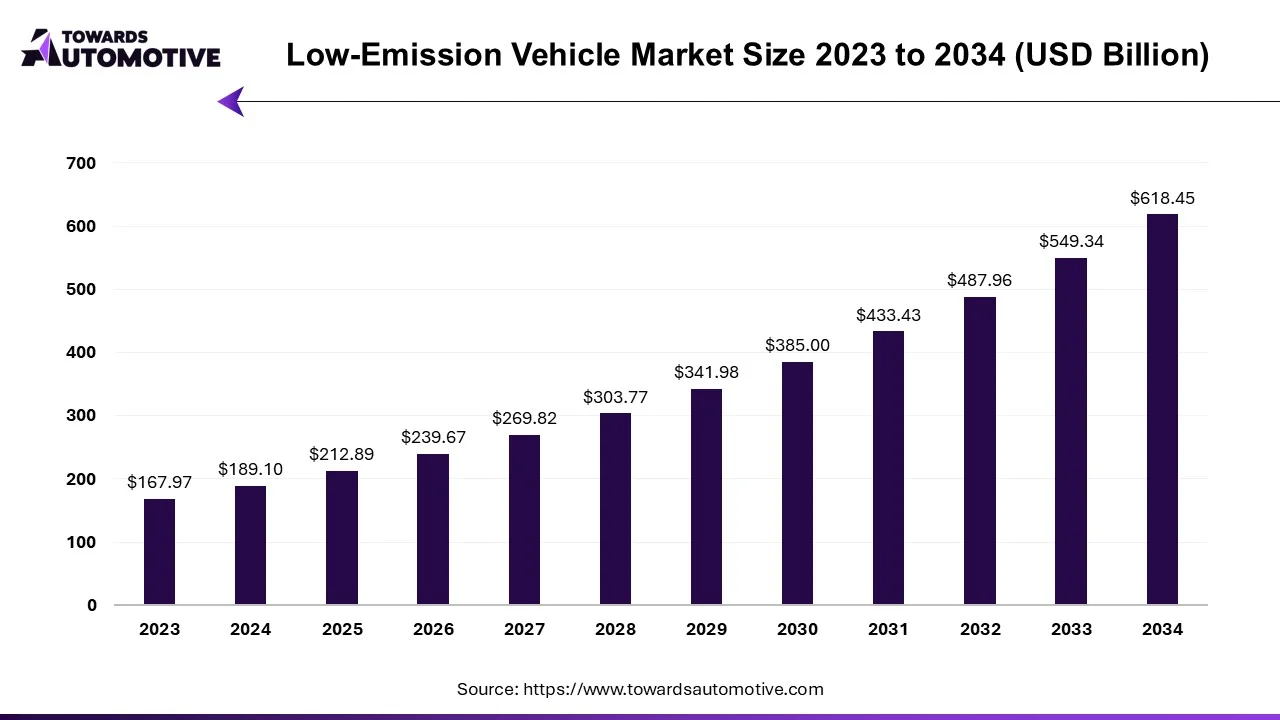

The low emission vehicle market is forecasted to expand from USD 212.89 billion in 2025 to USD 618.45 billion by 2034, growing at a CAGR of 12.58% from 2025 to 2034.

Unlock Infinite Advantages: Subscribe to Annual Membership

The low emission vehicle market is a prominent branch of the automotive industry. This industry deals in manufacturing and distribution of low emission vehicles in different parts of the world. There are several types of vehicles developed in this sector comprising of hybrid electric vehicles, battery electric vehicles, plug-in-hybrid vehicles, fuel-cell electric vehicles and some others. These vehicles are powered by different types of fuels consisting of electric, hydrogen, biodiesel, ethanol and some others. The growing adoption of electric vehicles for lowering emission has boosted the market expansion. This market is expected to rise significantly with the growth of the hybrid vehicles industry around the globe.

| Metric | Details |

| Market Size in 2024 | USD 189.10 Billion |

| Projected Market Size in 2034 | USD 618.45 Billion |

| CAGR (2025 - 2034) | 12.58% |

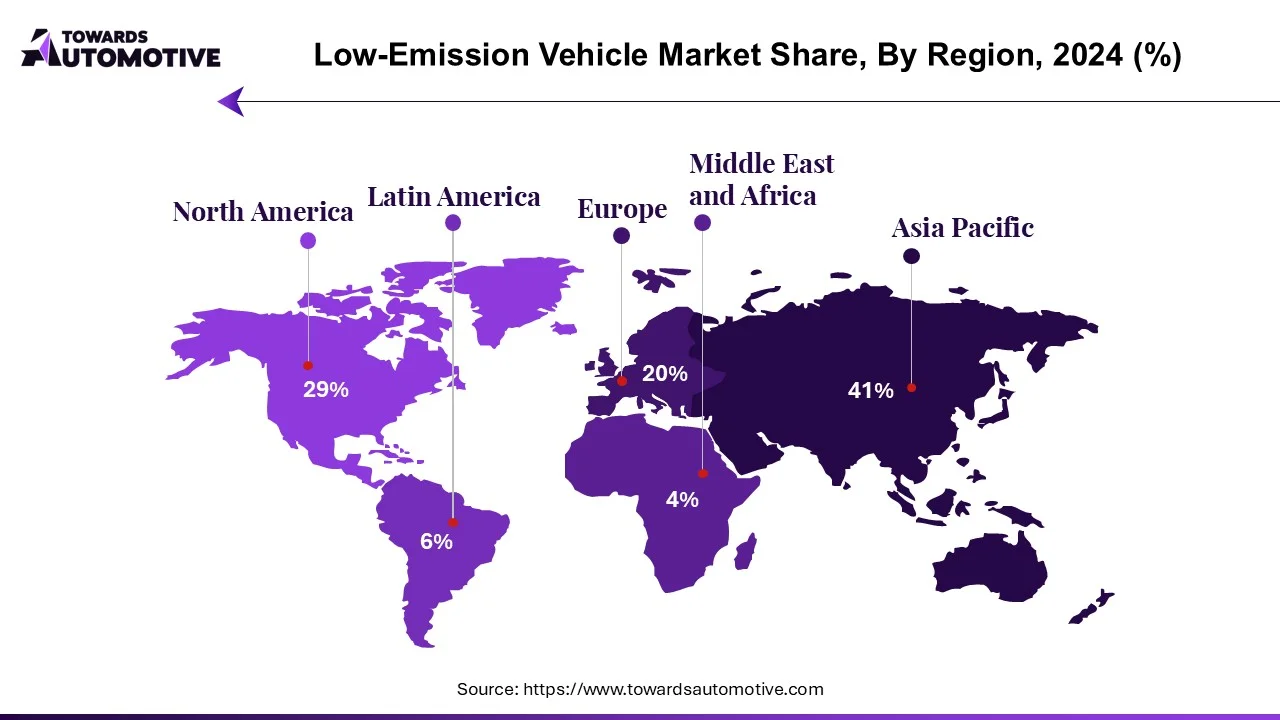

| Leading Region | North America |

| Market Segmentation | By Technology, By Vehicle Type, By Fuel Type, By Engine Type and By Region |

| Top Key Players | Porsche, Toyota, Hyundai, Honda, Audi, Mercedes-Benz, General Motors |

The major trends in this industry consists of rapid development in hydrogen infrastructure, rising sales of EVs and government initiatives.

Government of several countries are investing heavily for constructing hydrogen refueling stations to cater the needs of the ZEV consumers.

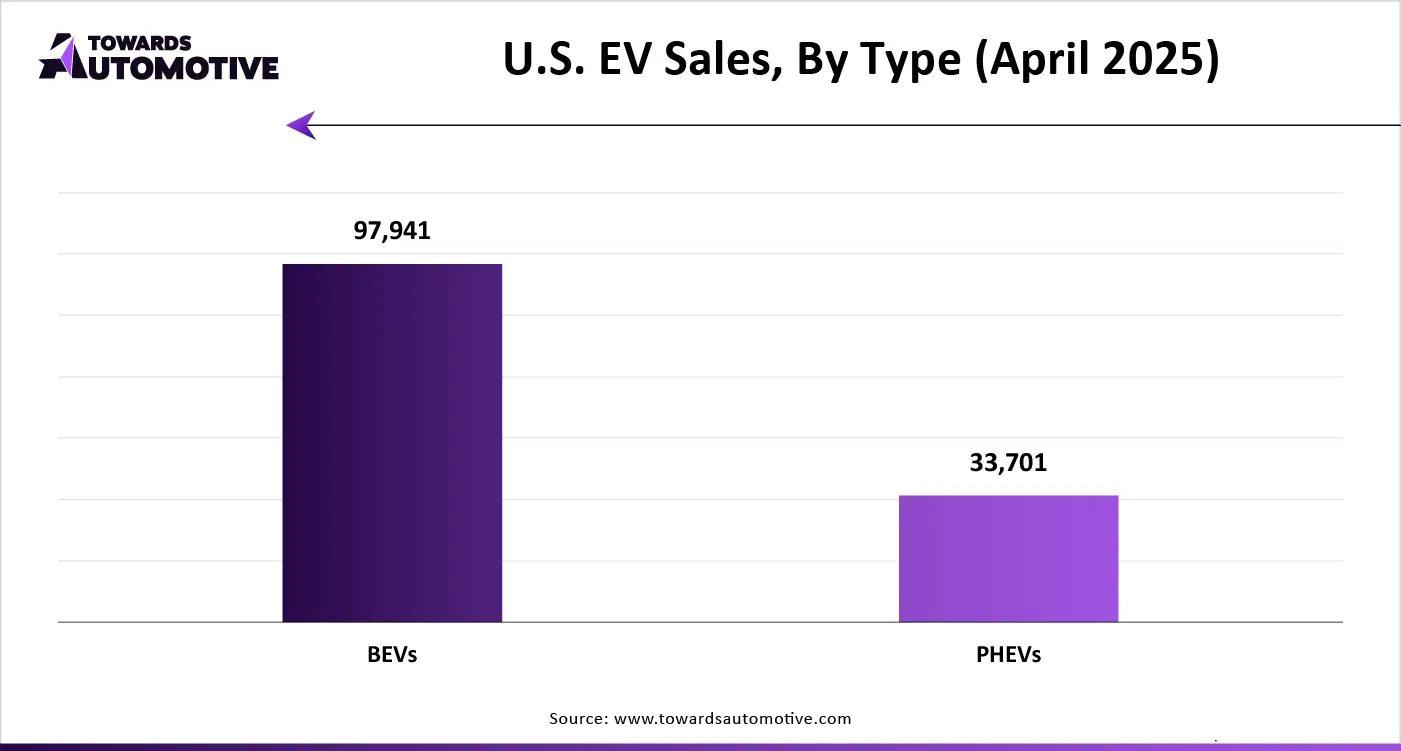

The sales of EVs has increased due to the rising awareness to reduce emission along with technological advancements in EV industry.

Numerous governments are launching new initiatives to increase the adoption of EVs and for developing the EV charging infrastructure.

The hybrid electric vehicles segment held the largest share of the market. The technological advancement in hybrid powertrains and regenerative braking has driven the market expansion. Additionally, rapid investment by automotive companies for developing hybrid vehicles along with increasing sales of PHEVs in developed nations such as the U.S., Germany, China and some others is playing a vital role in shaping the industrial landscape. Moreover, the increasing demand for emission-free that delivers superior driving range is expected to drive the growth of the low emission vehicle market.

The battery electric segment is anticipated to rise with a significant CAGR during the forecast period. The rising demand for eco-friendly transportation has increased the demand for BEVs, thereby driving the market growth. Also, the rise in number of government initiatives aimed at adopting BEVs along with rapid adoption of electric buses in developed nations such as UK, China, Italy and some others is further adding to the industrial expansion. Moreover, technological advancements in battery industry coupled with increasing deployment of electric trucks in heavy industries is projected to boost the growth of the low emission vehicle market.

The passenger cars segment led the market. The growing demand for electric SUVs in the Europe and North America has boosted the market growth. Additionally, the rising adoption of affordable electric cars in mid-income countries such as India, Vietnam, Thailand and some others is further contributing to the industrial expansion. Moreover, rapid deployment of electric vehicles by ride-hailing companies for lowering emission is anticipated to propel the growth of the low emission vehicle market.

The light commercial vehicles segment is likely to grow with a notable CAGR during the forecast period. The growing demand for LCEVs from several industries such as manufacturing, energy, e-commerce and some others has boosted the market expansion. Additionally, the rising investment by numerous automotive brands for developing hydrogen fuel cell technology to cater the needs of the light commercial vehicles is contributing to the industrial growth. Moreover, rapid investment by startup companies for developing superior LCEVs is driving the growth of the low emission vehicle market.

The electric segment held the largest share of the industry. The demand for electric vehicles has increased rapidly due to rising prices of fossil fuels along with increasing awareness to reduce emission, thereby driving the market growth. Additionally, rapid investment by government of several countries such as India, U.S., UK, Germany and some others for strengthening the EV infrastructure is likely to shape the industrial landscape. Moreover, the growing sales and production of EVs in different parts of the world is further driving the growth of the low emission vehicle market.

The hydrogen segment is projected to grow with a considerable CAGR during the forecast period. The growing demand for eco-friendly transportation solution has increased the demand for hydrogen vehicles, thereby driving the market growth. Additionally, technological advancements in FCEVs coupled with rise in number of hydrogen-refueling centers is playing a positive role in shaping the industrial landscape. Moreover, the rising sales of hydrogen-powered trucks for operating heavy-duty applications is anticipated to foster the growth of the low emission vehicle market.

North America held the highest share of the low emission vehicle market. The rising sales of luxury cars based on hydrogen fuel is driving the market growth. Also, the growing production of biofuel in the U.S. and Canada along with numerous government initiatives aimed at minimizing CO2 emission has further added to the overall industrial expansion. Moreover, the presence of several market players such as Tesla, Ford, General Motors and some others is expected to propel the growth of the low emission vehicle market in this region.

U.S. dominated the market in this region. The growing demand for eco-friendly sedans along with rapid investment by government for developing the hydrogen refueling infrastructure has driven the market growth. For instance, in January 2025, the government of the U.S. announced to invest around US$ 635 million. This investment is done for developing the zero-emission electric vehicle (EV) charging and hydrogen refueling infrastructure across the U.S. (Source: Seneca Technologies Pte Ltd)

Europe is expected to grow with a significant CAGR during the forecast period. The growing demand for eco-friendly public transportation has increased the demand for electric buses, thereby driving the market growth. Additionally, rapid investment by government for developing the EV charging infrastructure coupled with upsurge in demand for hydrogen trucks is adding to the overall industrial expansion. Moreover, the presence of numerous low emission vehicle companies such as Volkswagen, Renault, Audi, Mercedes and some others is anticipated to boost the growth of the low emission vehicle market in this region.

Germany is the prime contributor in this region. The growing sales of PHEVs coupled with technological advancements in the automotive sector has driven the market growth. Also, rapid deployment of hydrogen buses along with presence of numerous automotive brands is accelerating the industrial expansion. For instance, in May 2025, Karsan announced that the Federal Motor Transport Authority of Kraftfahrt approved e-ATAK bus to operate on German roads. (Source: Bus-News)

The low emission vehicle market is a rapidly developing industry with the presence of several dominating players. Some of the prominent companies in this industry consists of FCA, Porsche, Toyota, Hyundai, Honda, Audi, Mercedes-Benz, General Motors, Renault, Volkswagen, Ford Motor, Subaru, Tesla,

and some others. These companies are constantly engaged in developing low emission vehicles and adopting numerous strategies such as acquisitions, launches, business expansions, partnerships, joint ventures, collaborations and some others to maintain their dominance in this industry.

By Technology

By Vehicle Type

By Fuel Type

By Engine Type

By Region

September 2025

September 2025

September 2025

August 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us