September 2025

The rolling stock market is projected to reach USD 82.53 billion by 2034, expanding from USD 53.11 billion in 2025, at an annual growth rate of 5.02% during the forecast period from 2025 to 2034. The growing adoption of railways in the logistics sector for transporting goods from one region to another coupled with rapid investment by government for developing the railway infrastructure has driven the market expansion.

Additionally, technological advancements in the locomotive industry along with rising demand for sustainable transportation solutions is playing a prominent role in shaping the industrial landscape. The research activities related to autonomous trains is expected to create ample growth opportunities for the market players in the future.

Unlock Infinite Advantages: Subscribe to Annual Membership

The rolling stock market is a prominent segment of the railway industry. This industry deals in production and distribution of railway vehicles in different parts of the world. There are several types of vehicles manufactured in this sector comprising of locomotives, metro, high-speed trains, tramway, passenger railroad cars and some others. These vehicles are equipped with different components including pantograph, axle, wheelset, traction motor, auxiliary power system, air conditioning system, passenger information system, position train control, brakes, gearboxes, train control systems and some others. It is used by passenger rail operators and freight rail operators. This market is expected to rise significantly with the growth of the locomotive sector around the globe.

The major trends in this market consists of government initiatives, popularity of electric trains and partnerships.

The rapid transit segment dominated the market. The growing adoption of rapid transit system in urban areas for transporting large number of people has boosted the market expansion. Additionally, numerous advantages of these transit systems including reduced travel times, lower congestion, improved air quality and some others is expected to foster the growth of the rolling stock market.

The locomotive segment is expected to expand with a significant CAGR during the forecast period. The rising demand for powerful locomotives from the railway operators to enhance the transportation capabilities has boosted the market expansion. Moreover, rapid investment by rolling stock companies for developing electric locomotives is expected to boost the growth of the rolling stock market.

The pantograph segment led the market. The growing use of pantograph in electric locomotives for collecting electric currents from contact wires has boosted the market expansion. Additionally, the rising adoption of double-arm pantographs in Trams such as KTM-5 and KTM-8 is expected to foster the growth of the rolling stock market.

The traction motor segment is expected to rise with a notable CAGR during the forecast period. The increasing use of traction motors in modern trains for converting electrical energy into mechanical energy has boosted the market expansion. Additionally, numerous advantages of traction motors including high starting torque for rapid acceleration, efficient regenerative braking capabilities, reduced maintenance and some others is expected to drive the growth of the rolling stock market.

The freight application segment held the highest share of the market. The growing adoption of freight trains by the logistics sector for transporting goods from one city to another has boosted the market expansion. Additionally, partnerships among freight operators and locomotive manufacturers for developing heavy-duty freight locomotive is playing a vital role in driving the growth of the rolling stock market.

The passenger application segment is expected to grow with a considerable CAGR during the forecast period. The increasing interest of consumer to adopt railways for travelling long-distances due to its cost-effectiveness and enhanced comfort has boosted the market expansion. Moreover, numerous government initiatives aimed at developing the passenger railway infrastructure is expected to propel the growth of the rolling stock market.

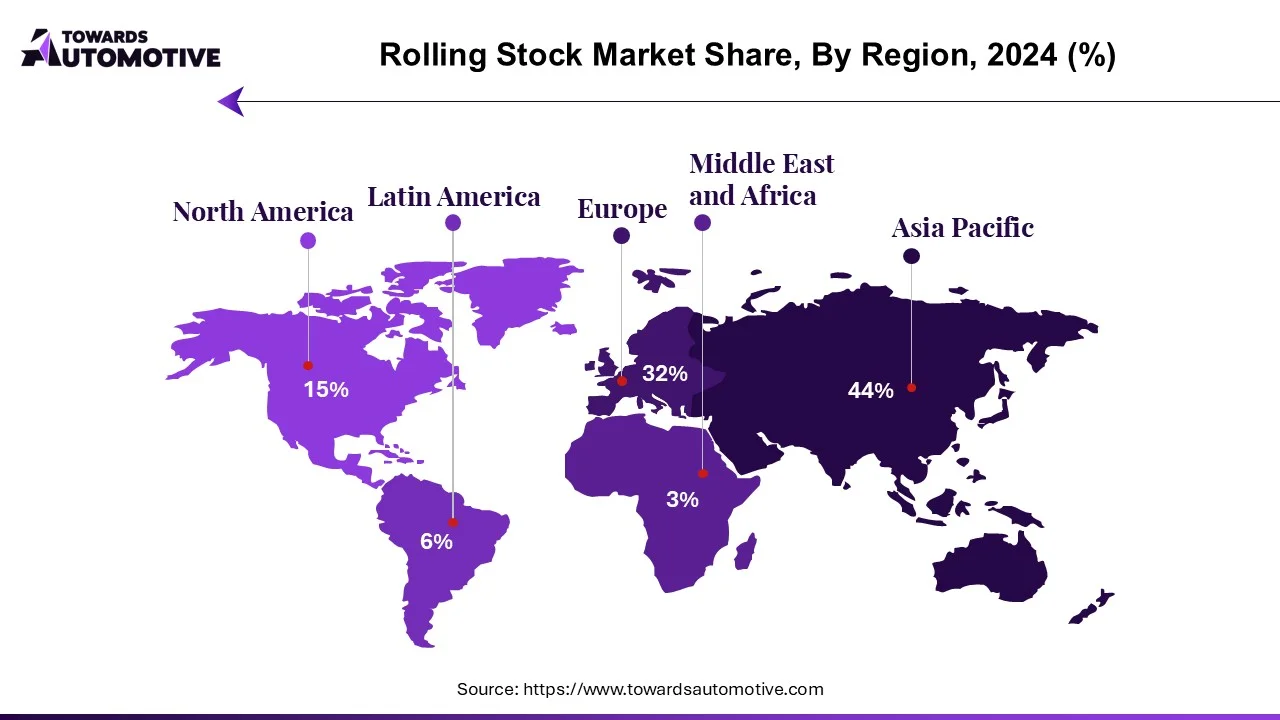

North America dominated the rolling stock market. The rising adoption of electric trains in the U.S. and Canada with an aim to reduce vehicular emission has boosted the market expansion. Additionally, numerous government initiatives for deploying advanced locomotives in the railway sector coupled with growing investment by locomotive brands for construction new production centers is playing a vital role in shaping the industrial landscape. Moreover, the presence of various market players such as Ge Transportation, Wabtec Corporation, Bombardier and some others is expected to drive the growth of the rolling stock market in this region.

Asia Pacific is expected to rise with the fastest CAGR during the forecast period. The increasing demand for bullet trains in several countries such as Japan, China, South Korea and some others has boosted the market expansion. Also, rapid investment by government for strengthening the railway infrastructure along with technological advancements in the locomotive industry is contributing to the industry in a positive direction. Moreover, the presence of several market players such as Hyundai Rotem Company, Kawasaki Railcar Manufacturing Co., Ltd, CRRC Corporation Limited and some others is expected to propel the growth of the rolling stock market in this region.

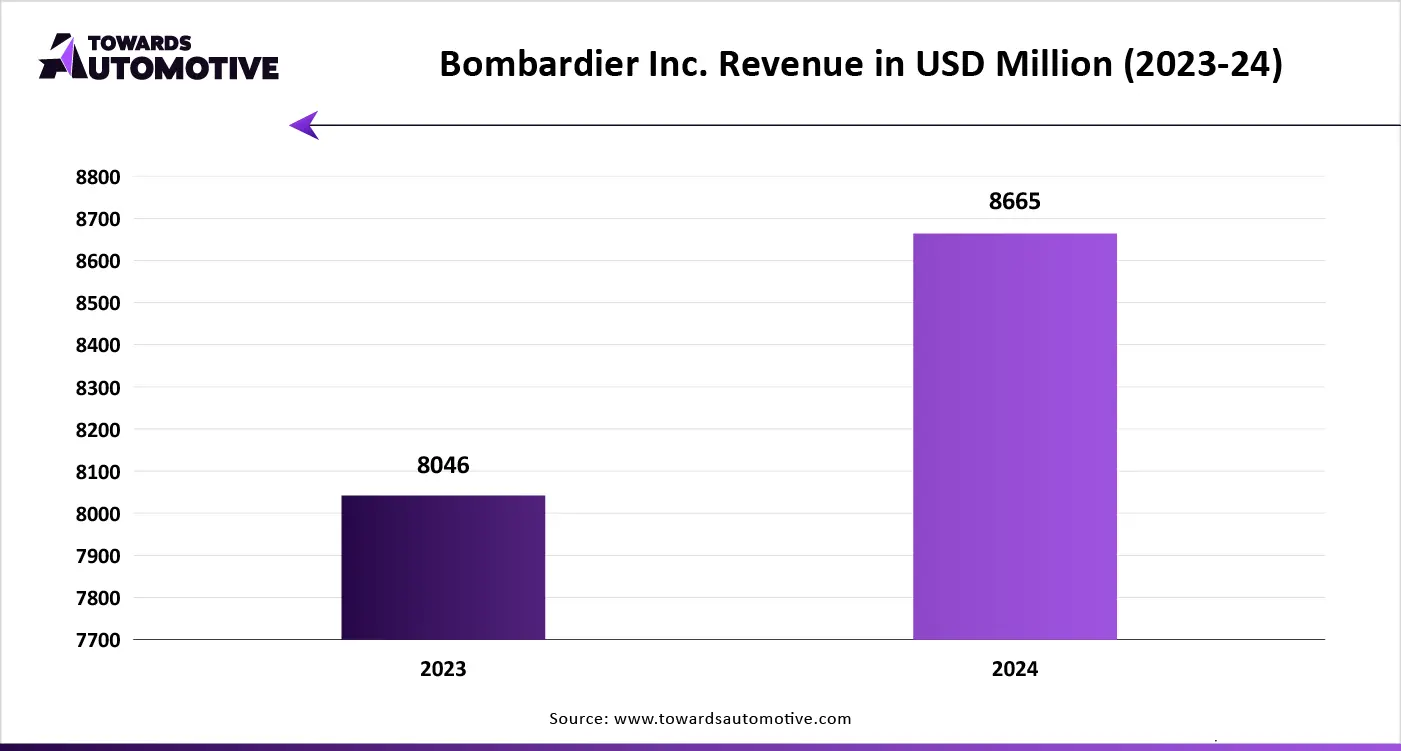

The rolling stock market is a rapidly developing industry with the presence of several dominating players. Some of the prominent companies in this industry consists of CRRC Corporation Limited (China), Hitachi, Ltd. (Japan), Hyundai Rotem Company (South Korea), Japan Transport Engineering Company (Japan), ABB (Sweden), Alstom (France), American Industrial Transport, Inc. (US), Bombardier (Canada), CAF (UK), Construcciones y Auxiliar de Ferrocarriles, S.A. (Spain), Caterpillar (US), Kawasaki Heavy Industries, Ltd. (Japan), Mitsubishi Electric Corporation (Japan), National Steel Car Limited (Canada) and some others. These companies are constantly engaged in developing rolling stocks and adopting numerous strategies such as acquisitions, business expansions, launches, partnerships, joint ventures, collaborations and some others to maintain their dominance in this industry.

By Product

By Component

By Application

By Technology

By Region

September 2025

September 2025

September 2025

August 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us