July 2025

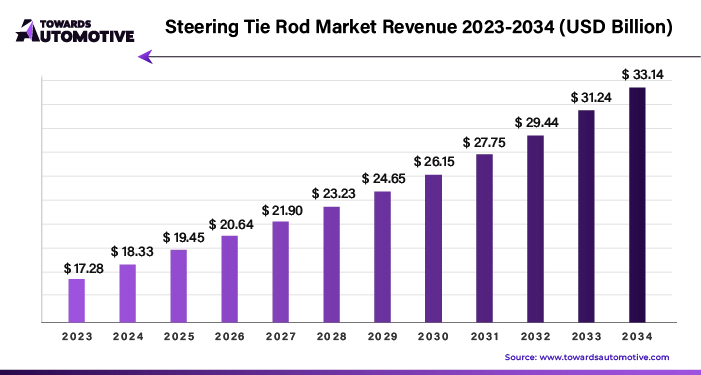

The steering tie rod market is set to grow from USD 19.45 billion in 2025 to USD 33.14 billion by 2034, with an expected CAGR of 6.1% over the forecast period from 2025 to 2034.

The steering tie rod market is poised for substantial growth in the coming years, with significant opportunities emerging in South Asia and Pacific, East Asia, and Latin America. This growth is driven by an increasing demand for vehicles and advancements in automotive technology. This report delves into the factors contributing to this growth, regional market dynamics, and future projections. The automotive market valued at USD 4,070.19 billion in 2023, is experiencing growth and is projected to surpass USD 6,678.28 billion by 2032, with a significant CAGR of over 5.66%.

East Asia

East Asia is anticipated to be a dominant player in the steering tie rod market throughout the forecast period. The region is expected to command around 38.1% of the market share by 2034. Several factors contribute to East Asia's leading position:

South Asia and Pacific

South Asia and Pacific are also expected to present significant growth opportunities for the steering tie rod market. The rising demand for vehicles in these regions is fueled by:

Latin America

Latin America is set to experience notable growth in the steering tie rod market. Key drivers include:

The integration of Artificial Intelligence (AI) is poised to revolutionize the Steering Tie Rod market by driving innovation, improving efficiency, and enhancing product quality. AI technologies, including machine learning and data analytics, enable manufacturers to optimize the design and production processes of steering tie rods. Through advanced simulation models and predictive analytics, AI can predict wear and failure patterns, leading to more durable and reliable components.

Furthermore, AI-driven automation in manufacturing enhances precision and reduces human error, resulting in high-quality products with consistent performance. AI also facilitates real-time monitoring and diagnostics, allowing for proactive maintenance and minimizing downtime in automotive systems.

In addition, AI can assist in market analysis by identifying trends, consumer preferences, and competitive dynamics, helping companies to make informed decisions and tailor their products to meet market demands. The use of AI in steering tie rod technology promises to streamline operations, reduce costs, and ultimately contribute to significant market growth as the automotive industry continues to evolve and prioritize innovation.

The supply chain for the steering tie rod market is a complex network involving multiple stages and stakeholders. It starts with raw material suppliers who provide essential components like steel or aluminum. These materials are then transported to manufacturers who specialize in producing steering tie rods. These manufacturers are crucial in converting raw materials into finished products using advanced machinery and quality control processes.

Once produced, the steering tie rods are distributed through a network of wholesalers and distributors. These intermediaries play a vital role in managing inventory and ensuring that products reach various automotive manufacturers and repair shops efficiently. Distribution channels can vary, including direct sales to OEMs (Original Equipment Manufacturers) or through aftermarket suppliers.

To manage the supply chain effectively, companies rely on robust logistics and inventory management systems to track products from production to end-user delivery. This coordination helps minimize delays and reduce costs. Additionally, market trends, such as increasing demand for electric vehicles, can impact supply chain strategies, prompting adjustments in production and distribution to meet evolving market needs.

The steering tie rod is a critical component in automotive steering systems, ensuring the vehicle's wheels turn in unison with the steering wheel. Its main components include the inner tie rod, which connects to the steering rack or gearbox, and the outer tie rod, which connects to the steering knuckle. The assembly allows for precise control and alignment of the wheels.

Various companies contribute to the steering tie rod market ecosystem through their specialized roles. Manufacturers such as Delphi Technologies and TRW Automotive design and produce high-quality tie rods, focusing on durability and performance. They invest in research and development to enhance product features and meet evolving industry standards. Suppliers like SKF and NTN provide essential components and materials, ensuring the tie rods' reliability and longevity.

Aftermarket companies, including MOOG and Mevotech, offer replacement parts and upgrades, catering to a wide range of vehicle makes and models. They play a crucial role in maintaining vehicle performance and safety by providing high-quality alternatives to original equipment parts.

Together, these companies drive innovation, improve vehicle handling, and contribute to the overall efficiency of the steering tie rod market.

Increasing Research Activities to Enhance Vehicle Safety

The automotive industry is witnessing a surge in research and development aimed at improving the safety and performance of steering tie rods. These efforts focus on enhancing the structural load-carrying capacity and deformation resistance of steering components. As manufacturers respond to growing demand for safer, more durable vehicles, they are investing heavily in developing new products that can withstand mechanical stress under extreme conditions. This trend is driven by the increasing global demand for truck tie rod ends, which underscores the need for advancements in vehicle safety.

Shift Toward Lightweight Materials

A major trend in the steering tie rod industry is the shift toward lightweight materials. This change is driven by the automotive industry's push for greater fuel efficiency and enhanced vehicle performance. Regulatory pressures aimed at reducing carbon emissions further fuel this trend.

Manufacturers are exploring materials such as aluminum alloys, carbon fiber composites, and high-strength steel alloys to reduce vehicle weight while maintaining strength and durability. These materials offer high strength-to-weight ratios, allowing manufacturers to produce steering tie rods that are both lightweight and capable of withstanding harsh road conditions. The focus on lightweight materials is integral to meeting the growing demand for environmentally sustainable and high-performance vehicles.

Strategic Focus on Emerging Economies

Emerging economies are becoming crucial markets for steering tie rod manufacturers. The high demand for automobiles in these regions has prompted companies to form strategic partnerships and enhance their distribution networks. Low-cost labor and infrastructure in these countries allow for reduced manufacturing costs and improved supply chain efficiency.

By investing in local manufacturing facilities, companies not only contribute to the economic development of these regions but also mitigate risks associated with international trade disruptions. The rising vehicle sales in emerging markets present significant growth opportunities for steering tie rod manufacturers, who are expanding their presence to capitalize on these developing markets.

Rising Vehicle Ownership Driving Demand

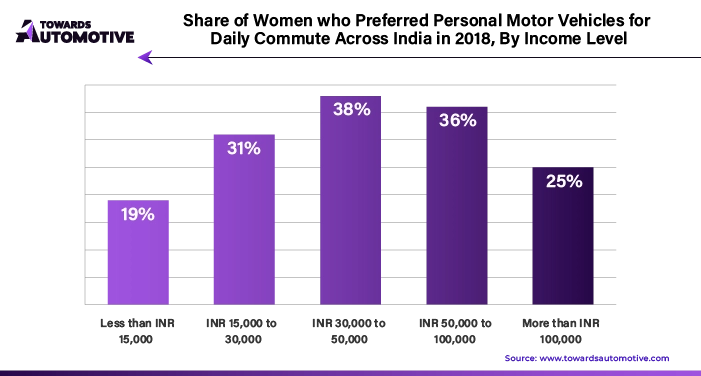

The global increase in vehicle ownership is significantly impacting the demand for reliable steering components. As more vehicles take to the roads, the need for high-quality steering tie rods becomes more critical for both new vehicle production and aftermarket replacements. For instance,

The growth in vehicle ownership is driving both initial demand for steering components and the need for maintenance and replacement parts for existing vehicles. Manufacturers are ramping up production capacities, optimizing supply chains, and introducing innovative technologies to meet this rising demand. The expanding automotive landscape presents promising opportunities for manufacturers to cater to the evolving needs of the market.

The global steering tie rod market is a dynamic sector characterized by distinct tiers of suppliers, each playing a crucial role in the automotive industry. The market is segmented into three primary tiers based on supplier size, revenue, and influence within the supply chain.

Tier 1 suppliers are the major players in the steering tie rod market, commanding a substantial portion of the market share. These companies typically have revenues exceeding USD 25 million and hold approximately 36% of the market share. They are integral to the industry, often engaging in direct business relationships with leading automobile manufacturers.

Tier 1 suppliers are recognized for their innovation, comprehensive product ranges, and robust manufacturing capabilities. Their significant resources and advanced technologies enable them to meet the rigorous demands and high standards of automobile manufacturers. They are pivotal in supplying essential and complex components that are critical to vehicle performance.

Tier 2 suppliers, with revenues ranging from USD 6 million to USD 27 million, hold about 41% of the market share. While these companies may not have the extensive reach or scale of Tier 1 suppliers, they play a vital role by providing specialized parts and components.

These suppliers are often focused on producing specific types of components or systems. They supply parts to both Tier 1 companies and original equipment manufacturers (OEMs). Their specialized expertise and product offerings help maintain the efficiency and diversity of the automotive supply chain.

Tier 3 suppliers, with product revenues up to USD 4 million, account for around 24% of the market share. This tier includes numerous smaller suppliers that provide niche, specialized parts and services. Although they may not have as extensive market opportunities, their role is crucial for the flexibility and diversity of the supply chain.

Tier 3 suppliers contribute to the industry’s adaptability by offering unique or specialized products that might not be available from larger suppliers. Their presence ensures a more comprehensive and varied supply chain, supporting the broader automotive sector with specific needs and requirements.

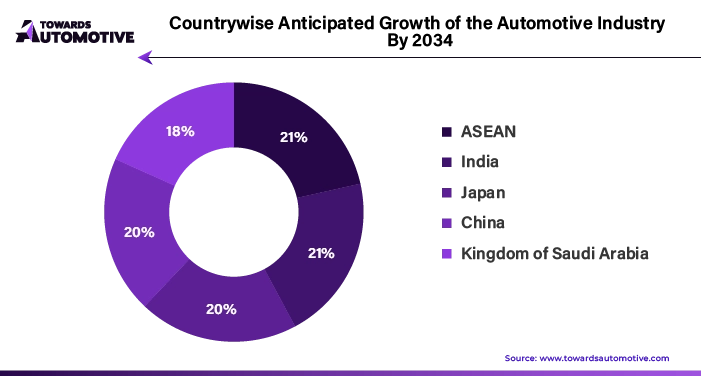

The automotive industry is witnessing robust growth across several regions, with notable increases in compound annual growth rates (CAGRs) for key countries over the next decade.

China Proactive Policies Fueling Automotive Industry Expansion

China stands out as a major player in the global automotive industry, renowned for its vast production and export capabilities. The country’s dominance is driven by several proactive government policies designed to enhance both domestic and international automotive markets.

The Chinese government has implemented numerous favorable policies to bolster automotive production. These measures not only stimulate domestic consumption but also attract substantial foreign investments. Such initiatives are part of a broader strategy to maintain and enhance China’s leading position in the automotive sector.

Additionally, China benefits from an extensive and well-integrated supply chain, which includes the availability of cost-effective raw materials and a substantial pool of affordable labor. This combination provides automotive manufacturers in China with a significant competitive advantage, enabling them to achieve lower production costs and greater operational flexibility.

India Emerging Hub for Cost-Effective Automotive Components

India is rapidly emerging as a significant player in the automotive sector, with a marked increase in vehicle production and sales. This growth is contributing to a broader market for automotive parts, including steering tie rods.

The Indian government has implemented several strategic initiatives aimed at boosting domestic manufacturing and improving infrastructure. For instance, in May 2024, the Indian government has announced a strategic auto policy to make India a global manufacturing hub for electrical vehicles. Under the policy, global companies will receive incentives to set up manufacturing plants in the country.

Notably, the “Make in India” initiative and incentives for electric vehicle (EV) manufacturing are creating a supportive environment for auto component manufacturers. These policies are attracting investments and fostering growth in the automotive sector.

India’s position as a global manufacturing hub is further reinforced by its large pool of skilled workers, cost-effective manufacturing capabilities, and enhanced logistical infrastructure. As a result, India is set to become a significant exporter of automotive components, including tie rods, through 2034.

Overall, the automotive industry in India is poised for steady growth, driven by favorable government policies, a skilled workforce, and a growing domestic market.

The automotive steering rod market is poised for significant growth, driven primarily by the demand for outer tie rods and Original Equipment Manufacturers (OEMs). This comprehensive analysis delves into the key factors shaping the market, offering a detailed forecast through 2034.

| Outer Tie Rods A Key Component in Steering Systems | |

| Segment: | Outer Tie Rods (Position) |

| Projected CAGR (2024 to 2034): | 6.2% |

Outer tie rods, an integral part of a vehicle’s steering system, are expected to witness substantial demand globally over the next decade. These components are highly susceptible to wear and tear due to their exposure to various stressors such as harsh road conditions, vehicle movement, and environmental elements like water, dirt, and debris.

During steering maneuvers, outer tie rods endure significant forces, making them prone to weakening over time. As a result, they require more frequent replacement compared to inner tie rods, which have a longer lifecycle. This frequent replacement cycle is expected to drive consistent demand for outer tie rods, boosting the market's growth at a robust CAGR of 6.2% from 2024 to 2034.

| OEMs The Backbone of Steering Rod Demand | |

| Segment: | OEM (Sales Channel) |

| Projected CAGR (2024 to 2034): | 6.0% |

OEMs are set to play a crucial role in the growth of the steering rod market, thanks to the durability and longevity of their components. Steering tie rods, designed for extended use, have a low replacement rate among vehicle owners, leading to steady demand from OEMs as automakers integrate these components into new vehicles.

Advancements in material technology, including high-strength alloys and composites, are further enhancing the strength, efficiency, and lifespan of steering parts. This aligns with the increasing demand for high-quality, reliable components across the automotive industry. As road infrastructure continues to expand and improve globally, the need for robust and durable steering rods becomes even more pronounced, reducing the frequency of replacements and thereby sustaining demand from OEMs.

By Vehicle Type

By Position

By Material

By Sales Channel

By Region

According to market projections, the global automotive headliners market, valued at USD 9.64 billion in 2024, is anticipated to reach USD 14.96 billio...

July 2025

June 2025

April 2025

March 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us