August 2025

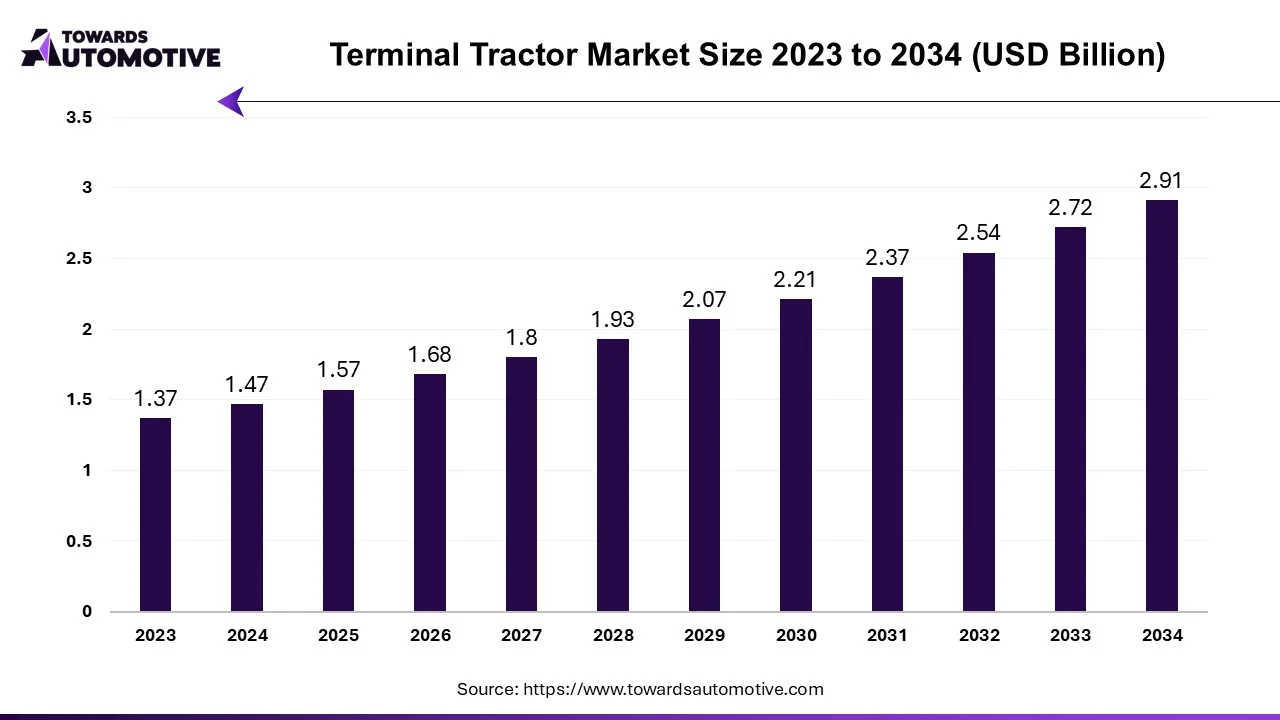

The terminal tractor market is predicted to expand from USD 1.57 billion in 2025 to USD 2.91 billion by 2034, growing at a CAGR of 7.09% during the forecast period from 2025 to 2034. The growing demand for efficient cargo handling coupled with rapid expansion of port infrastructure in several countries such as the U.S., Netherlands, Canada and some others has boosted the market growth. Additionally, the rising adoption of advanced equipment in modern ports coupled with numerous government initiatives aimed at developing the logistics sector is playing a crucial role in shaping the industrial landscape. The integration of AI and blockchain in modern trucks is expected to create ample growth opportunities for the market players in the future.

The terminal tractor market is a crucial branch of the automotive industry. This industry deals in development and distribution of terminal tractors in different parts of the world. There are several types of vehicles developed in this sector consisting of manual terminal tractors and automated terminal tractors. These tractors are powered by different types of propulsion technology including diesel, electric, hybrid and some others. It finds application in numerous sectors comprising of port terminal, distribution centers, warehouses, manufacturing and some others. This market is expected to rise significantly with the growth of the commercial vehicle industry around the globe.

The major trends in this market consists of collaborations, government initiatives and smart ports.

The diesel segment led the market. The growing demand for heavy-duty terminal tractor from the logistics sector to facilitate the movement of trailers and containers has boosted the market expansion. Moreover, numerous advantages of diesel-powered trucks including high fuel efficiency, enhanced towing capacity, superior longevity and some others is expected to drive the growth of the terminal tractor market.

The electric segment is expected to expand with a significant CAGR during the forecast period. The rising adoption of electric tractors in several countries to reduce vehicular emission has driven the market growth. Additionally, numerous government initiatives aimed at developing the EV charging infrastructure coupled with technological advancements in battery industry is expected to boost the growth of the terminal tractor market.

The port terminal segment dominated the market. The growing use of yard trucks in ports for moving semi-trailers and containers has driven the market expansion. Additionally, numerous government initiatives aimed at developing the port infrastructure is expected to propel the growth of the terminal tractor market.

The distribution centers segment is expected to expand with the fastest CAGR during the forecast period. The rising application of shunt trucks in distribution centers for enhancing loading and unloading process has boosted the market growth. Moreover, the deployment of smart equipment in modern warehouses to maintain the supply-chain operations is expected to foster the growth of the terminal tractor market.

The manual segment dominated the market. The growing demand for manual terminal tractors in logistics sector for handling goods in warehouses has boosted the market expansion. Additionally, high precision and superior adjustability provided by manual equipment as compared to automated equipment is driving the growth of the terminal tractor market.

The automated segment is expected to grow with a considerable CAGR during the forecast period. The rising adoption of automated terminal tractors in modern ports to enhance material handling capabilities has boosted the market expansion. Also, the absence of skilled operators in several parts of the world coupled with technological advancements in automated machineries is expected to foster the growth of the terminal tractor market.

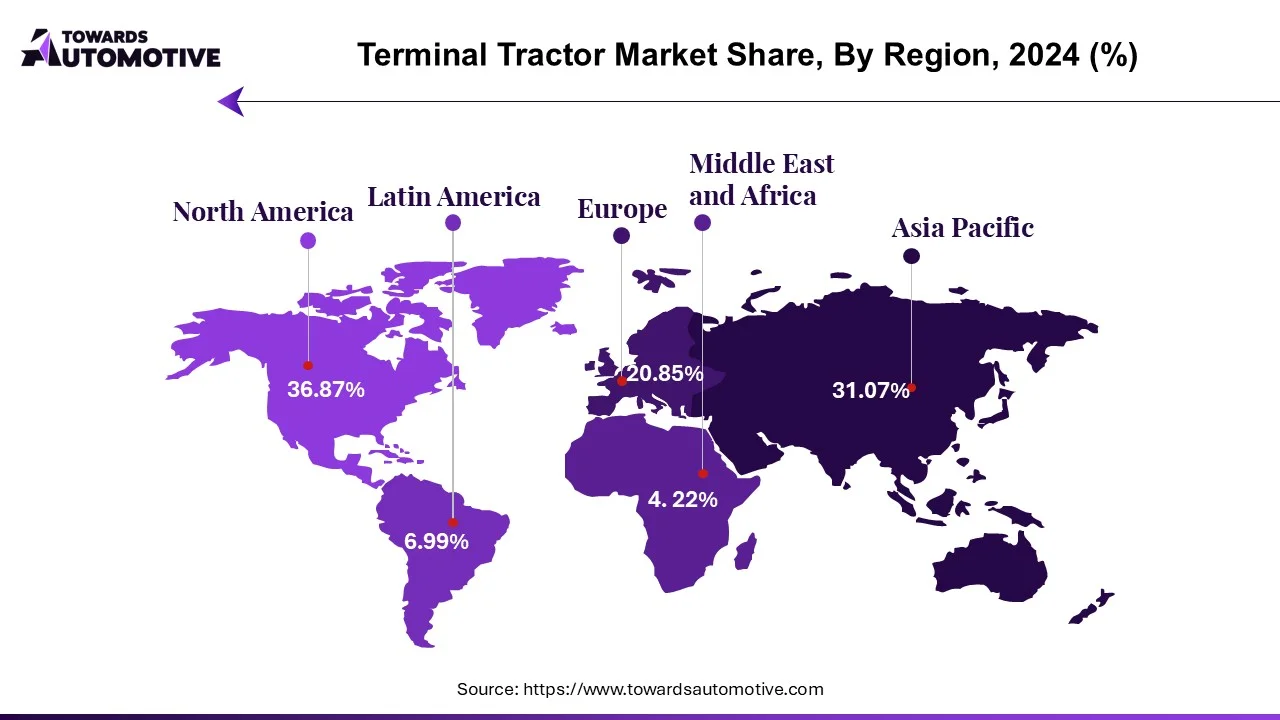

North America led the terminal tractor market. The growing adoption of electric terminal tractors in the U.S. and Canada to reduce emission has boosted the market expansion. Additionally, rapid growth of the e-commerce sector along with numerous government initiatives aimed at developing the port infrastructure is playing a vital role in shaping the industrial landscape. Moreover, the presence of several market players such as Hyster-Yale Materials Handling, Outrider Technologies, Inc, TICO Tractors and some others is expected to propel the growth of the terminal tractor market in this region.

Asia Pacific is expected to rise with the highest CAGR during the forecast period. The rising application of terminal tractors in the logistics sector across China and South Korea has driven the market expansion. Additionally, rapid investment by government for strengthening the EV charging infrastructure along with deployment of smart machineries in modern ports is positively contributing to the industry. Moreover, the presence of several market players such as Shenzhen Reach Forklift Co., Ltd, SAIC Group Corporation, Sany Group and some others is expected to drive the growth of the terminal tractor market in this region.

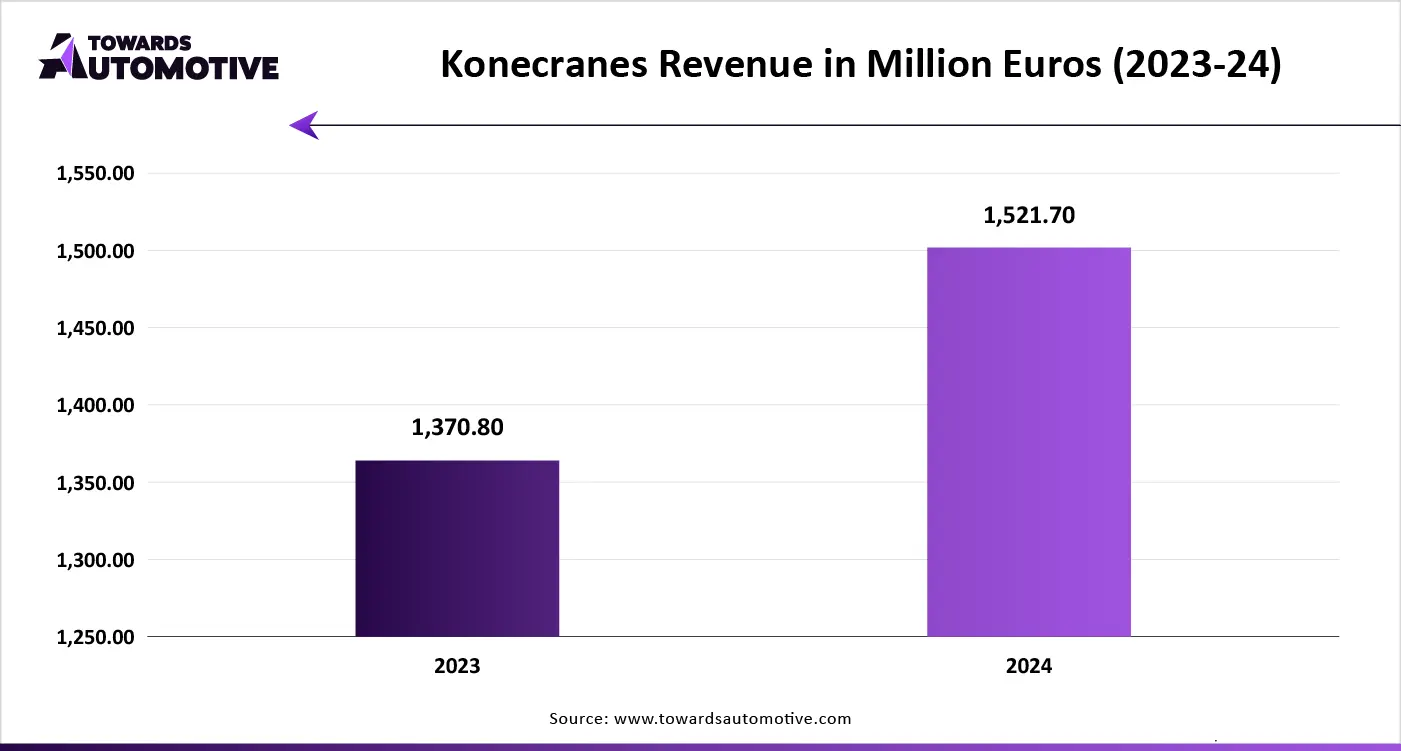

The terminal tractor market is a highly competitive industry with the presence of several dominating players. Some of the prominent companies in this industry consists of CVS Ferrari; MAFI Transport-System; Kalmar; Konecranes; Terberg Group; Sany Group; Hyster-Yale Materials Handling; TICO Tractors; Mol CY; Capacity Truck; Outrider Technologies, Inc.; Fernride and some others. These companies are constantly engaged in developing terminal tractors and adopting numerous strategies such as business expansions, launches, acquisitions, joint ventures, collaborations, partnerships, and some others to maintain their dominance in this industry.

By Drive Type

By Propulsion

By Tonnage

By Vehicle Type

By Application

By Region

August 2025

August 2025

June 2025

June 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us