September 2025

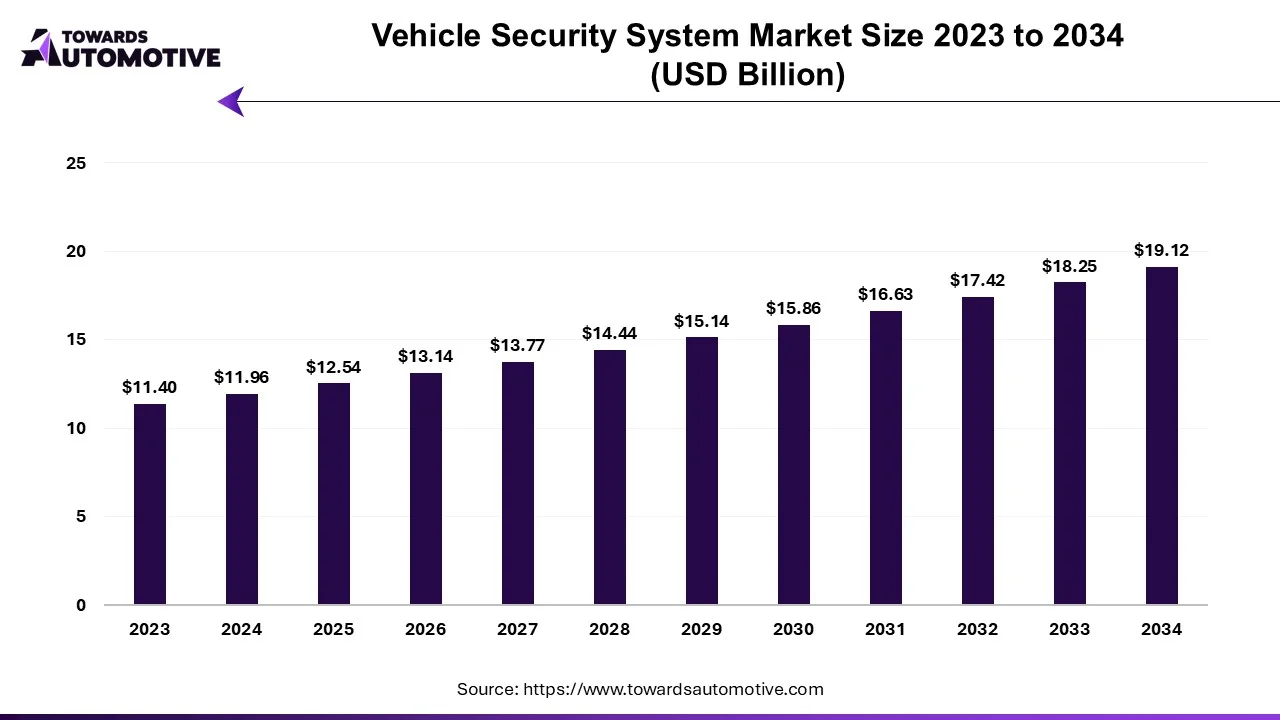

The global vehicle security system market is projected to reach USD 19.12 billion by 2034, growing from USD 12.54 billion in 2025, at a CAGR of 4.86% during the forecast period from 2025 to 2034.

Unlock Infinite Advantages: Subscribe to Annual Membership

The vehicle security system market is experiencing significant growth as the automotive industry increasingly prioritizes safety and protection against theft, vandalism, and unauthorized access. With the rise in vehicle theft, accidents, and the growing complexity of modern vehicles, there is a heightened demand for advanced security solutions that offer enhanced protection and convenience for vehicle owners. This market encompasses a wide range of technologies designed to safeguard vehicles, including electronic immobilizers, alarm systems, GPS tracking, biometric access, keyless entry systems, and advanced driver assistance systems (ADAS) that improve both physical security and data protection.

The growing adoption of connected and autonomous vehicles has further fueled the need for sophisticated security systems that can protect against cyber threats and unauthorized access to in-vehicle networks. As vehicles become more integrated with digital platforms, ensuring data security and protecting critical systems from cyberattacks is becoming increasingly important. Moreover, rising consumer awareness of vehicle theft and safety concerns has led to an increase in demand for intelligent and innovative security solutions. In response, automotive manufacturers and technology providers are developing next-generation vehicle security systems that integrate with mobile apps, enabling remote monitoring and control features for added peace of mind.

As the automotive industry continues to evolve, the vehicle security system market is poised to grow with the development of smart, highly integrated solutions that provide real-time monitoring, advanced encryption, and robust protection against both physical and digital threats. This market’s expansion is also supported by stricter regulatory standards and growing consumer demand for enhanced safety features in modern vehicles.

Artificial Intelligence (AI) is playing an increasingly crucial role in transforming the vehicle security system market by enhancing both physical and digital security features. AI technologies are integrated into modern vehicle security systems to offer advanced functionalities, such as intelligent surveillance, real-time monitoring, and predictive threat detection. AI-powered systems can analyze data from various sensors, cameras, and vehicle networks to identify potential security risks, such as unauthorized access attempts, abnormal vehicle behavior, or signs of theft. For example, AI-based facial recognition or biometric authentication systems allow secure access to vehicles, ensuring that only authorized individuals can operate the car.

In addition, AI enhances vehicle theft prevention through machine learning algorithms that can detect patterns in driver behavior or unusual activities, triggering automatic alerts or taking preventive actions, such as locking doors or activating an alarm. AI can also improve the accuracy and reliability of GPS tracking systems by analyzing large amounts of location data to pinpoint stolen vehicles more quickly and efficiently.

Furthermore, AI contributes to cybersecurity by protecting connected and autonomous vehicles from digital threats. As vehicles become more integrated with cloud-based systems and IoT devices, AI algorithms can detect and prevent cyberattacks, ensuring that critical in-vehicle networks and data remain secure. AI's ability to continuously learn and adapt to new threats also allows vehicle security systems to evolve, making them more robust over time. Thus, AI is playing a crucial role in the vehicle security system market is central to providing smarter, more reliable, and secure solutions for modern vehicles.

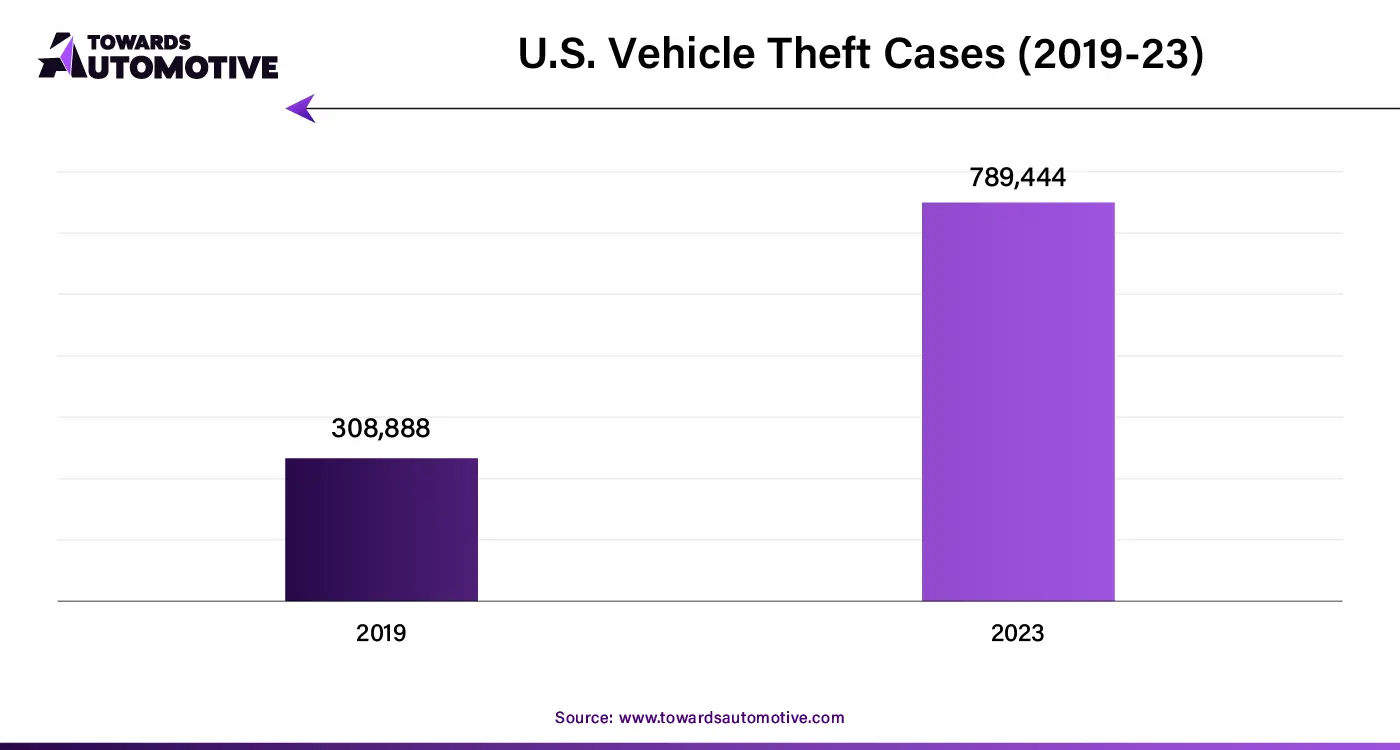

The rise in vehicle theft cases has become a significant driver of growth in the Vehicle Security System Market, as consumers and fleet operators increasingly seek advanced solutions to protect their vehicles from theft and vandalism. Vehicle theft rates have been rising globally, prompting a growing demand for reliable and effective security technologies. In regions like North America and Europe, where vehicle theft is a growing concern, vehicle owners are turning to sophisticated security systems, such as GPS tracking, alarms, immobilizers, and remote monitoring solutions, to safeguard their vehicles. These security systems not only deter theft but also aid in the recovery of stolen vehicles, further enhancing their appeal.

The increase in vehicle theft is also driving the adoption of advanced technologies like biometric authentication, keyless entry, and facial recognition, which offer higher levels of security compared to traditional lock-and-key systems. These technologies provide convenience while simultaneously offering enhanced protection against unauthorized access. The growing threat of cyberattacks and data breaches in connected vehicles has added another layer to the issue, prompting the need for robust cybersecurity measures to protect against potential hacking and digital theft.

Furthermore, the rise in vehicle theft is encouraging the development of more integrated and automated security solutions, such as vehicle tracking systems linked to mobile apps. This allows owners to monitor their vehicles in real time and take immediate action if a theft is detected. As theft incidents continue to rise, the demand for advanced vehicle security systems increases, thereby driving the expansion of the market.

The vehicle security system market faces several restraints, including the high cost of advanced security technologies, which may limit adoption, especially in emerging markets. Complexities in integrating new security systems with existing vehicle platforms also pose challenges, leading to higher installation and maintenance costs. Additionally, the rise of sophisticated cyber threats presents a significant concern, as connected vehicles become vulnerable to hacking and data breaches, requiring constant updates and robust cybersecurity measures. Furthermore, consumer reluctance to adopt new technologies due to privacy concerns and a lack of awareness can also hinder market growth.

Advancements in retinal scan immobilizers are creating significant opportunities in the Vehicle Security System Market by offering enhanced security and convenience. Retinal scan technology uses unique patterns in the human eye to verify the identity of the vehicle owner, making it an incredibly secure form of biometric authentication. Unlike traditional key-based systems or even fingerprint recognition, retinal scans are extremely difficult to replicate or forge, offering a higher level of protection against theft and unauthorized access. This innovation addresses the growing demand for more secure and personalized vehicle security systems, particularly as the risk of vehicle theft increases and consumers seek cutting-edge solutions.

As the automotive industry increasingly adopts connected and autonomous vehicles, the need for advanced security technologies like retinal scan immobilizers has grown. These systems not only protect against traditional theft but also prevent cyberattacks, as they require highly personalized and biometric data that is difficult to hack. Furthermore, the integration of retinal scan systems with mobile apps and other smart technologies provides added convenience, allowing vehicle owners to access their cars with a simple eye scan rather than relying on physical keys or passwords.

The growing consumer interest in high-tech, secure, and seamless experiences, combined with the automotive industry's push toward smarter, more secure vehicles, positions retinal scan immobilizers as a key opportunity for growth in the vehicle security system market in the future.

The radio frequency segment led the industry. The radio frequency (RF) segment plays a significant role in driving the growth of the vehicle security system market by enabling more advanced, reliable, and convenient security solutions. Radio frequency technology is widely used in keyless entry systems, which have become a standard feature in modern vehicles. These systems use RF signals to allow vehicle owners to unlock and start their vehicles without the need for physical keys. The convenience and ease of use provided by RF-based systems are key factors in their widespread adoption, which directly contributes to the overall growth of the vehicle security market.

Moreover, RF technology is integral to advanced security features such as passive keyless entry (PKE) and remote engine start systems, which enhance both security and user experience. PKE systems, for instance, automatically unlock the vehicle when the authorized key fob is within range, reducing the risk of theft from traditional key-based systems. Additionally, RF technology is critical in vehicle tracking systems, where RF signals are used to pinpoint the location of a vehicle in real-time, aiding in the recovery of stolen vehicles and providing added peace of mind for vehicle owners.

RF-based technologies also play a crucial role in supporting the integration of vehicle security systems with mobile apps, enabling users to remotely monitor and control security features like alarms, immobilizers, and tracking. As the demand for connected and smart vehicles continues to grow, RF technology remains a key enabler of advanced security features, making it a major driver of the vehicle security system market.

| 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | 2032 | 2033 | 2034 | |

| Radio Frequency Identification | 0.27 | 0.30 | 0.43 | 0.35 | 0.54 | 0.63 | 0.49 | 0.39 | 0.56 | 0.79 | 0.90 |

| Ultrasonic | 10.37 | 10.88 | 11.68 | 12.29 | 12.83 | 13.16 | 13.81 | 14.34 | 14.85 | 15.23 | 15.97 |

| Others | 1.32 | 1.36 | 1.04 | 1.15 | 1.08 | 1.37 | 1.60 | 1.94 | 2.07 | 2.31 | 2.36 |

The passenger car segment dominated the market. The passenger car segment significantly drives the growth of the vehicle security system market, as it represents a substantial share of the global automotive market and is increasingly adopting advanced security technologies. The rising demand for passenger cars, coupled with growing concerns about vehicle theft, vandalism, and safety, has led to a surge in the adoption of innovative security solutions. Consumers are seeking enhanced protection for their vehicles, which are often high-value assets. This demand is accelerating the integration of sophisticated security systems, such as keyless entry, alarm systems, GPS tracking, immobilizers, and advanced anti-theft features, into passenger vehicles.

Additionally, the growing trend toward connected and smart vehicles within the passenger car segment further drives the need for robust security systems. As more passenger cars become equipped with connectivity features, such as telematics and mobile app integration, they require advanced cybersecurity measures to protect against potential data breaches and unauthorized access. The increasing popularity of autonomous and electric vehicles within the passenger car segment also drives the demand for specialized security systems, as these vehicles often come with more sophisticated technology that requires higher levels of protection.

Moreover, the rising consumer awareness of vehicle security risks, along with the desire for added convenience and peace of mind, is pushing automakers to prioritize advanced security features in passenger vehicles. As a result, the passenger car segment continues to be a primary driver of growth in the vehicle security system market, with automakers consistently developing new security solutions to meet consumer demands for safety and convenience.

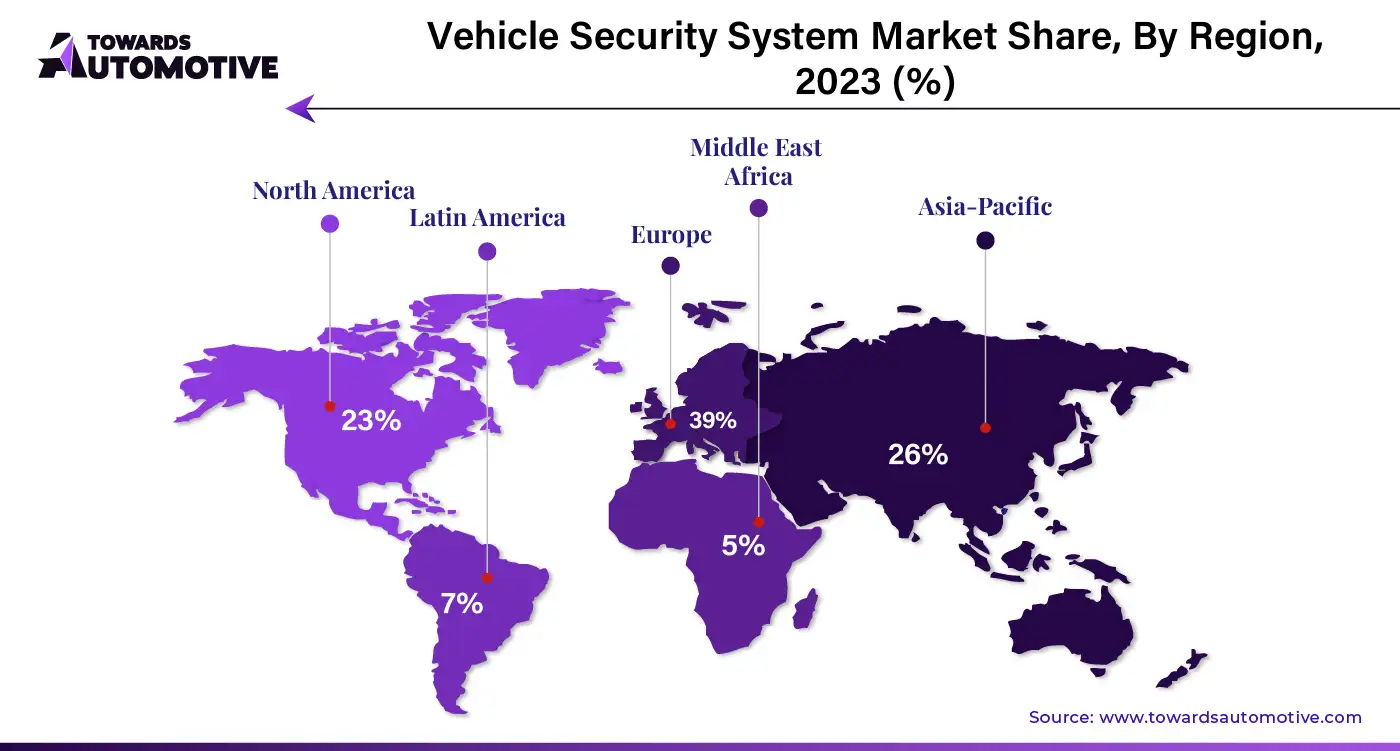

North America dominated the vehicle security system market. Rising vehicle theft and vandalism, the growing adoption of connected and autonomous vehicles, and technological advancements are key drivers of the Vehicle Security System Market in North America. Vehicle theft remains a significant concern in the region, prompting consumers and fleet operators to seek more effective security measures. As car theft rates increase, the demand for advanced security solutions, such as GPS tracking, immobilizers, and remote monitoring systems, has grown, leading to the widespread adoption of integrated vehicle security technologies.

In addition, the rapid adoption of connected and autonomous vehicles is spurring demand for robust security systems. As vehicles become more digitally connected, they become increasingly vulnerable to cyberattacks and unauthorized access. These connected vehicles require advanced cybersecurity measures to safeguard both the physical vehicle and the sensitive data stored within. Autonomous vehicles, in particular, rely heavily on secure communication networks, making them prime targets for cybercriminals. This has created a strong market need for security systems that can detect and prevent cyber threats in real-time, further driving market growth.

Additionally, technological advancements in Artificial Intelligence (AI), machine learning, and Internet of Things (IoT) have revolutionized vehicle security systems. AI-based systems can now offer predictive threat detection, real-time surveillance, facial recognition, and automated responses to potential security breaches. IoT integration allows for seamless connectivity, enabling vehicle owners to monitor and control their security systems remotely using smartphones. These technological innovations provide enhanced protection and convenience, contributing to the growth of the Vehicle Security System Market in North America.

Asia Pacific is expected to grow with the highest CAGR during the forecast period. Government regulations and safety standards, the expansion of electric and hybrid vehicles, and growing consumer awareness of advanced security features are driving the growth of the Vehicle Security System Market in the Asia-Pacific (APAC) region. Governments across APAC are implementing stricter vehicle safety regulations, including anti-theft measures and cybersecurity standards, that are pushing automakers to integrate advanced security technologies into their vehicles. These regulations ensure that vehicles meet safety requirements, driving demand for sophisticated security systems that comply with these standards. For instance, in countries like China and Japan, regulations related to vehicle data protection and cybersecurity are becoming more stringent, prompting automakers to enhance the security of connected and autonomous vehicles.

The expansion of electric and hybrid vehicles in APAC is another key factor fueling market growth. As electric and hybrid vehicles become more popular, especially in markets like China and India, the demand for specialized security systems increases. These vehicles, being high-value assets with advanced technology, are more vulnerable to theft and cyber threats, making comprehensive security solutions essential. As a result, consumers and fleet operators are increasingly adopting security systems tailored to the unique needs of electric and hybrid vehicles.

Additionally, rising consumer awareness about vehicle safety and security concerns is driving the adoption of advanced security features. Consumers are becoming more conscious of the risks associated with vehicle theft, accidents, and digital security breaches, leading to increased demand for features such as biometric authentication, keyless entry, remote tracking, and real-time surveillance. This growing awareness is further accelerating the adoption of advanced vehicle security systems across APAC.

| 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | 2032 | 2033 | 2034 | |

| North America | 0.22 | 0.32 | 0.13 | 0.22 | 0.22 | 0.35 | 0.35 | 0.57 | 0.71 | 1.08 | 0.94 |

| Europe | 0.29 | 0.20 | 0.28 | 0.23 | 0.14 | 0.19 | 0.16 | 0.16 | 0.24 | 0.18 | 0.41 |

| Asia-Pacific | 2.88 | 3.03 | 3.10 | 3.13 | 3.44 | 3.65 | 4.00 | 4.36 | 4.63 | 4.98 | 5.61 |

| Latin America | 6.62 | 6.98 | 7.49 | 7.86 | 8.09 | 8.08 | 8.27 | 8.56 | 8.75 | 9.11 | 9.05 |

| Middle East & Africa | 1.95 | 2.01 | 2.15 | 2.35 | 2.57 | 2.89 | 3.12 | 3.01 | 3.15 | 2.98 | 3.21 |

By Technology

By Component

By Vehicle Type

By Sales Channel

By Region

September 2025

September 2025

September 2025

September 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us