September 2025

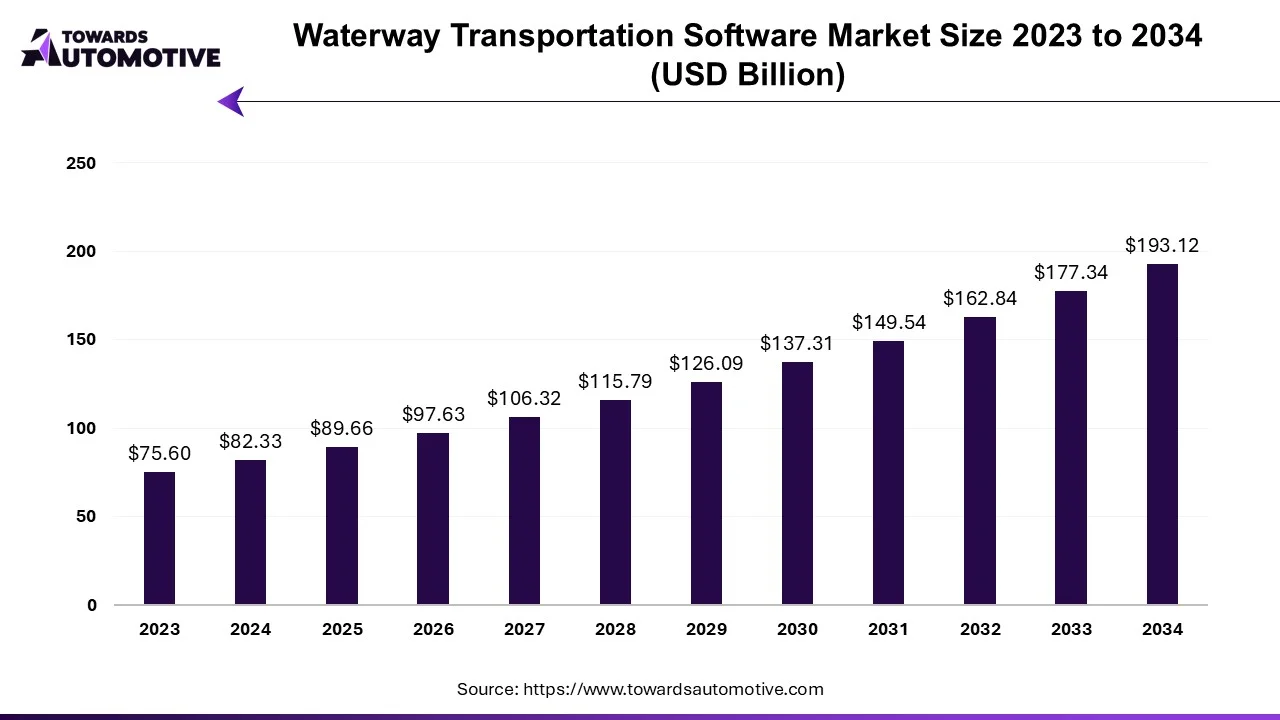

The waterway transportation software market is projected to reach USD 193.12 billion by 2034, growing from USD 89.66 billion in 2025, at a CAGR of 8.9% during the forecast period from 2025 to 2034.

The waterway transportation software market is a crucial branch of the maritime industry. This industry deals in developing advanced software for enhancing the capabilities of marine transportation. There are various types of software developed in this sector consisting of vessel tracking software, maritime software, yard management software, freight security software, ship broker software and some others. These software finds application in several sectors including fleet management, cargo tracking, port management, safety management and some others. The end-user of this sector consists of logistics companies, shipping lines, port authorities, government agencies and some others. The growing deployment of cloud-based software in modern ports for tracking vessels has contributed to the overall industrial expansion. This market is likely to experience significant growth with the rise of the software industry in different parts of the globe.

| Metric | Details |

| Market Size in 2024 | USD 82.33 Billion |

| Projected Market Size in 2034 | USD 193.12 Billion |

| CAGR (2025 - 2034) | 8.9% |

| Leading Region | North America |

| Market Segmentation | By Application, By Deployment, By Functionality, By End Use and By Region |

| Top Key Players | IBM, Cargotec, Oracle, GE Transportation, Navis, MOL |

The major trends in this market consists of integration of AI in tracking software, government investment for renovating ports and partnerships.

Integration of AI in Tracking Software

The software developers have started integrating AI in maritime software to enhance tracking of large fleet of ships. For instance, in February 2025, EasyPost launched Luma. Luma is an AI-based software designed to track real-time location of ships. (Source: ShipTechnology)

Government Investment to Renovate Ports

Government of several countries such as the U.S., Sweden, India, Switzerland and some others have invested heavily to develop smart ports. For instance, in October 2024, the government of U.S. announced to invest around US$ 3 billion. This investment is done for developing the ports of this country. (Source: E2)

Partnerships

Numerous market players are partnering with each other to develop advanced software to enhance waterway transportation. For instance, in August 2024, Cosco Shipping partnered with Wallem Group. This partnership is done for developing an advanced software for enhancing ship management. (Source: SAFETY4SEA)

The fleet management segment led the waterway transportation software market. The increasing use of advanced software to manage and track fleets of ships has boosted the market expansion. Additionally, the growing demand for fleet management software from shipping companies for several functions including voyage planning, fleet tracking, crew management, fleet optimization and some others is adding to the overall industrial expansion. Moreover, the rising adoption of AI-based fleet management software by fleet operators is driving the growth of the waterway transportation software market.

The cargo tracking segment is expected to grow with the highest CAGR during the forecast period. The rising demand for advanced cargo tracking software from logistics companies has boosted the market growth. Additionally, the increasing application of these software for enhancing several applications such as real-time tracking, status updates, predictive analytics, decision making and some others is playing a vital role in shaping the industrial landscape. Moreover, the rapid deployment of AI-enabled cargo tracking software in logistics carriers has driven the growth of the waterway transportation software market.

The logistics companies segment dominated the market. The growing investment by logistics providers to integrate advanced software in shipping sector has driven the market growth. Additionally, the rising emphasis of logistics brands to deliver products internationally without any error and misplacement is further adding to the industrial expansion. Moreover, numerous market players are launching advanced software to track vessels in isolated ocean parts, thereby driving the growth of the waterway transportation software market.

The port authorities segment is expected to rise with a significant CAGR during the forecast period. The growing investment by port authorities to deploy advanced software for managing port operations has boosted the market expansion. Additionally, partnerships among port authorities and software providers to integrate advanced fleet management software in modern ports is further adding to the overall industrial expansion. Moreover, the rising cases of thefts and burglary in ports has increased the demand for safety management software, thereby driving the growth of the waterway transportation software market.

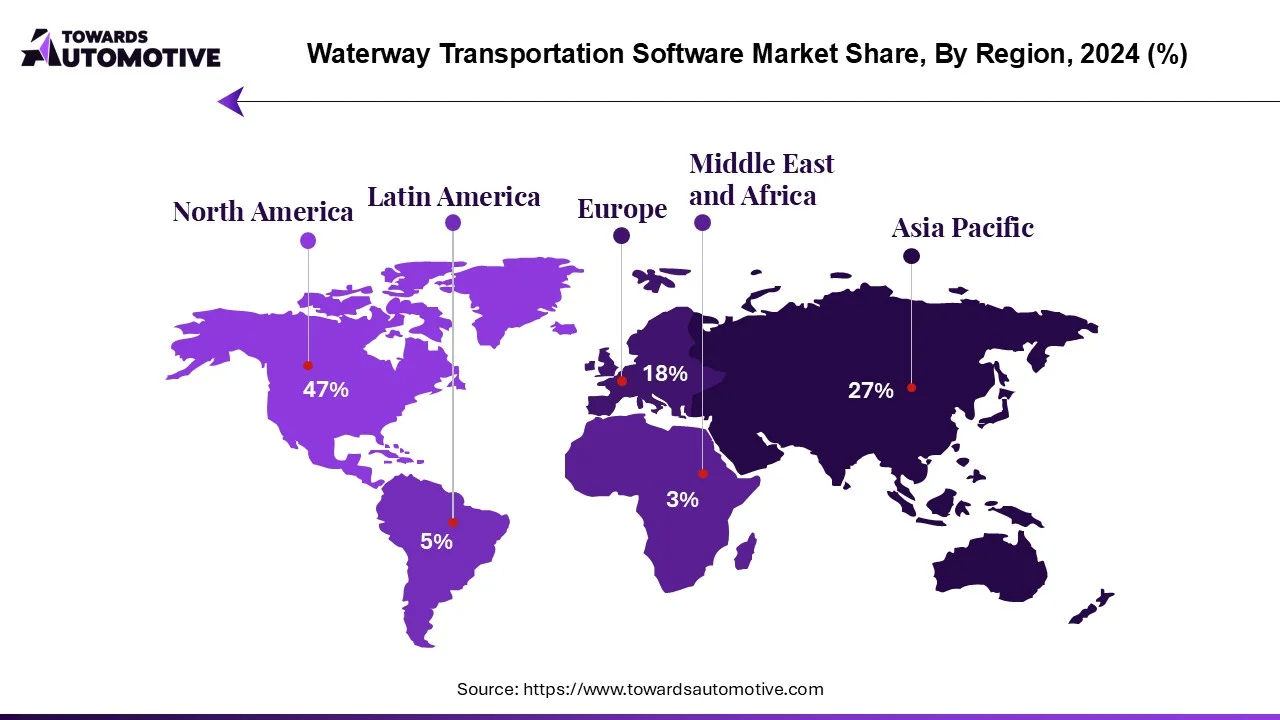

North America led the waterway transportation software market. The growing adoption of electric yachts among high-net worth individuals (HNIs) in the U.S. and Canada has boosted the market expansion. Additionally numerous government initiatives aimed at developing the port infrastructure coupled with rapid deployment of cloud-based fleet management software in modern ports is further adding to the industrial growth. Moreover, the presence of several market players such as IBM, Oracle, cruisePAL and some others is expected to propel the growth of the waterway transportation software market in this region.

U.S. dominated the market in this region. The integration of advanced port management software in modern ports along with rapid investment by government for enhancing the maritime transportation sector has driven the market growth. Additionally, the growing cases of cargo thefts coupled with rapid growth of the e-commerce sector has contributed to the industrial expansion.

Asia Pacific is expected to rise with the fastest CAGR during the forecast period. The rising development in the water transportation sector coupled with rapid integration of advanced technologies such as AI and IoT in fleet operations has driven the market growth. Also, the growing investment by government of various countries such as India, China, Japan, South Korea and some others for developing the maritime sector is contributing to the industrial expansion. Moreover, the presence of numerous water transportation software companies such as Samsung, Fresa Technologies, Vinova Pte Ltd and some others is expected to drive the growth of the waterway transportation software market in this region.

China is the major contributor in this region. In China, the market is generally driven by the rising export of electronic goods and automotive components to different parts of the world. Additionally, the rapid investment by shipping companies for developing smart ports is further contributing to the overall industrial expansion.

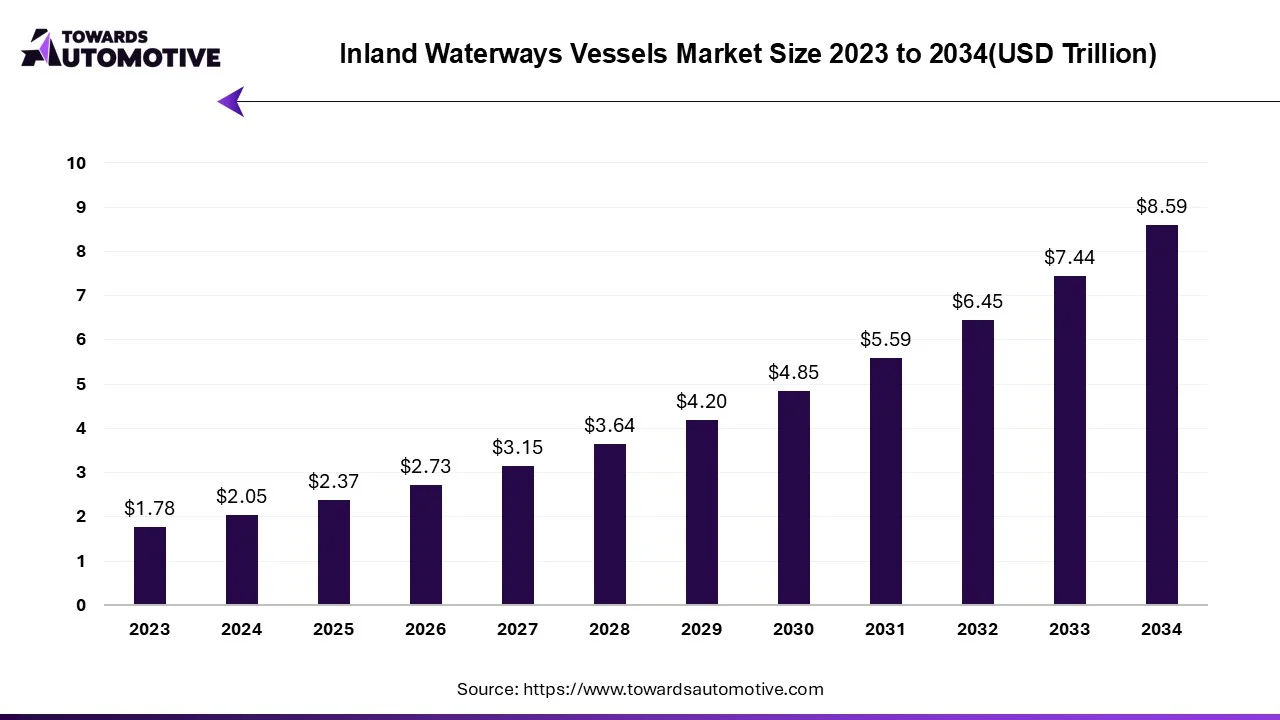

The inland waterways vessels market is projected to reach USD 8.59 trillion by 2034, expanding from USD 2.37 trillion in 2025, at an annual growth rate of 15.38% during the forecast period from 2025 to 2034. The rising awareness of water transportation among the people coupled with numerous government initiatives aimed at strengthening the maritime sector is playing a vital role in shaping the industry in a positive direction.

Additionally, rapid investment by shipbuilding companies for developing advanced vessels for the military sector along with growing development in the e-commerce industry is significantly contributing to the industrial landscape. The rejuvenation activities related to the Inland waterways as well as increasing demand for electric vessels from the logistics sector is expected to create ample growth opportunities for the market players in the upcoming days.

The inland waterways vessels market is a prominent branch of the marine industry. This industry deals in manufacturing and distribution of boats and ships in different parts of the world. There are several types of vessels developed in this sector comprising of freight vessels, tugboats, work boats, ferries and some others. These vessels are powered by different types of fuels consisting of LNG, LSFO, diesel oil, HFO, biofuel and some others. It finds applications in several sector including military, logistics and some others. The rapid investment by public entities for strengthening the ship-building infrastructure is playing a vital role in shaping the industrial landscape. This market is expected to rise significantly with the growth of the water transportation sector around the globe.

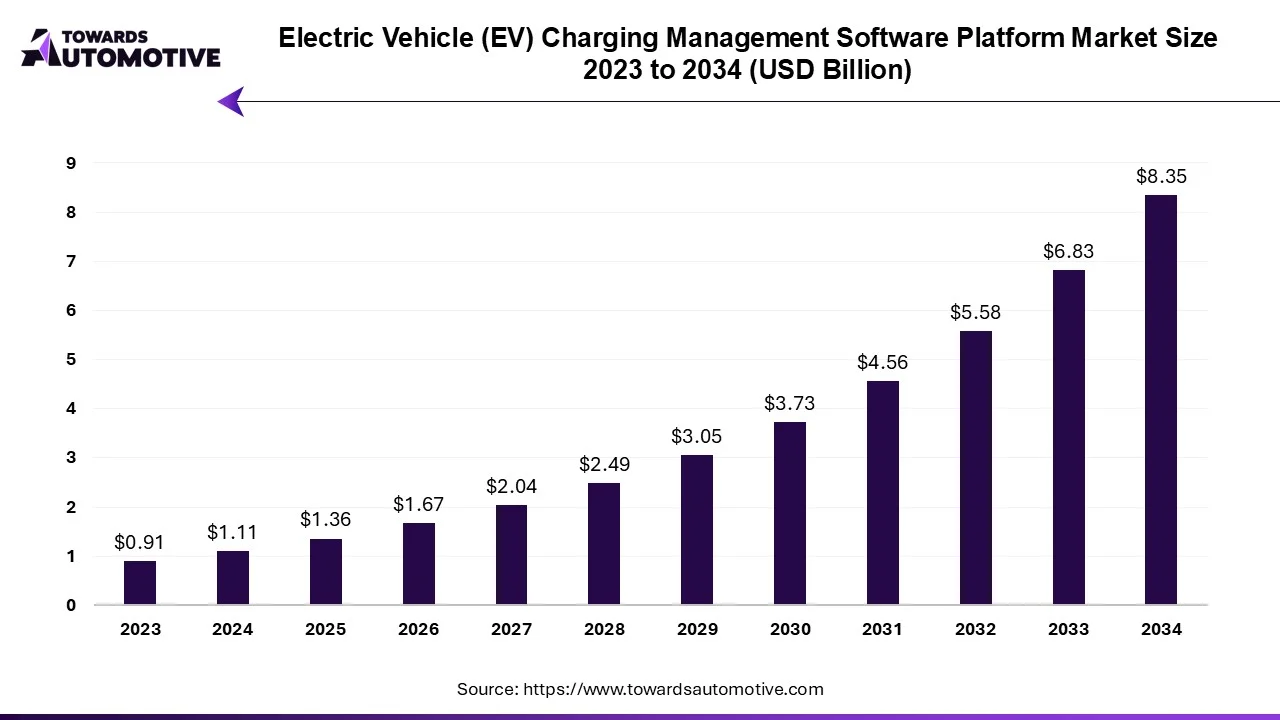

The electric vehicle (EV) charging management software platform market is forecasted to expand from USD 1.36 billion in 2025 to USD 8.35 billion by 2034, growing at a CAGR of 22.33% from 2025 to 2034.

The EV charging management software platform market is experiencing robust growth and is expected to expand significantly in the coming years, driven by the rapid adoption of electric vehicles worldwide and the growing need for efficient charging infrastructure. With the increasing demand for clean and sustainable transportation solutions, governments, businesses, and consumers are investing in electric vehicles and charging infrastructure, creating a favorable environment for the growth of the EV charging management software platform market.

The vehicle software & firmware (EREV-Specific) market is booming, poised for a revenue surge into the hundreds of millions from 2025 to 2034, driving a revolution in sustainable transportation. The growing sales of EVs in developed nations with an aim at reducing vehicular emission coupled with technological advancements in the EV manufacturing sector is playing a vital role in shaping the industrial landscape.

Moreover, numerous government initiatives aimed at rising awareness about adopting EVs along with rapid development in software industry has contributed significantly to the market expansion. The integration of AI and blockchain in automotive software is expected to create ample growth opportunities for the market players in the future.

The vehicle software & firmware (EREV-Specific) market is a prominent segment of the automotive industry. This industry deals in development and distribution of software and firmware for extending the range of electric vehicles. There are different types of software developed in this sector comprising of powertrain & energy management software, battery management system (BMS) software, embedded firmware for engine-generator control, vehicle control unit (VCU) software, thermal management software, charging management software, advanced driver assistance system (ADAS) software, infotainment & connectivity software, OTA (Over-the-Air) update software and some others.

These software are integrated by numerous providers including OEMs, tier 1 integrators, independent software vendors and some others. The end users of this sector consist of automotive OEMs, tier 1 suppliers, fleet operators, software-defined vehicle startups, telematics & mobility solution providers, and some others. It is available in a distribution channel consisting of OEMs, aftermarket, online platforms and some others. This market is expected to grow significantly with the rise of the EV industry across the globe.

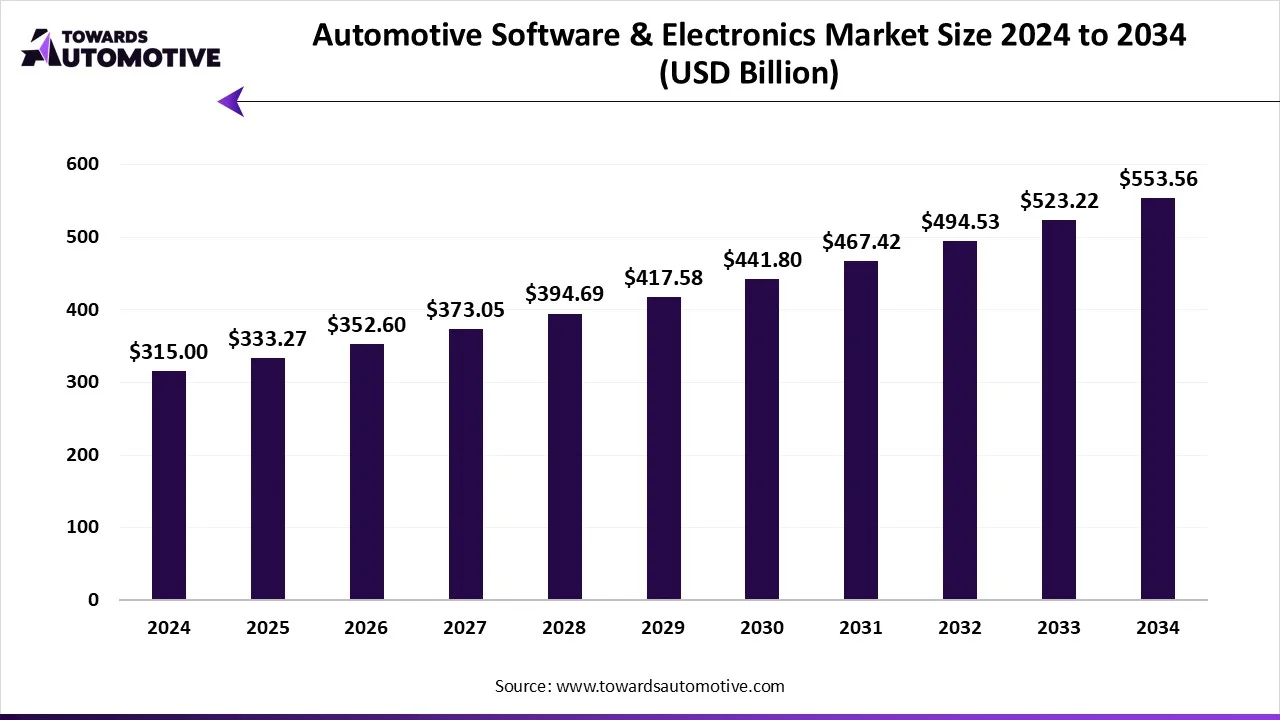

The automotive software & electronics market is set to grow from USD 333.27 billion in 2025 to USD 553.56 billion by 2034, with an expected CAGR of 5.8% over the forecast period from 2025 to 2034. The growing popularity of software-defined vehicles coupled with rapid investment by public-sector entities in the semiconductor industry is playing a vital role in shaping the industrial landscape.

Additionally, the rise in number of car rental companies along with increasing demand for driverless cars in developed nations has boosted the market expansion. The integration of AI and IoT in modern cars for enhancing the driving experience is expected to create ample growth opportunities for the market players in the upcoming days.

The automotive software & electronics market is a prominent segment of the automotive industry. This industry deals in development and distribution of software and electronics for the automotive sector. There are numerous electronic components manufactured in this sector comprising of sensors, ECUs, power electronics, connectivity modules, microcontrollers, processors, displays and some others. Also, various types of automotive software are developed in this sector consisting of ADAS & safety software, powertrain software, infotainment & connectivity software, autonomous driving software, vehicle diagnostics software and some others. These electronics and software are designed for different types of vehicles including passenger cars, light commercial vehicles, heavy commercial vehicles, electric vehicles and some others. The end user of this sector consists of OEMs, tier 1 suppliers, aftermarket service providers, fleet operators and some others. The growing use of advanced electronic systems in modern cars has boosted the market expansion. This market is expected to rise significantly with the rise of the software industry around the world.

The water transportation software market is a highly fragmented industry with the presence of numerous dominating players. Some of the prominent companies in this industry consists of Wärtsilä, IBM, Cargotec, Oracle, GE Transportation, Navis, MOL, HapagLloyd, Saab, IFFCO, Trelleborg, Kongsberg Gruppen, SAP, CMA CGM, UTS Holdings and some others. These companies are constantly engaged in developing advanced software for marine transportation and adopting numerous strategies such as joint ventures, acquisitions, collaborations, business expansions, partnerships, launches, and some others to maintain their dominance in this industry.

By Application

By Deployment

By Functionality

By End Use

By Region

September 2025

July 2025

July 2025

March 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us