September 2025

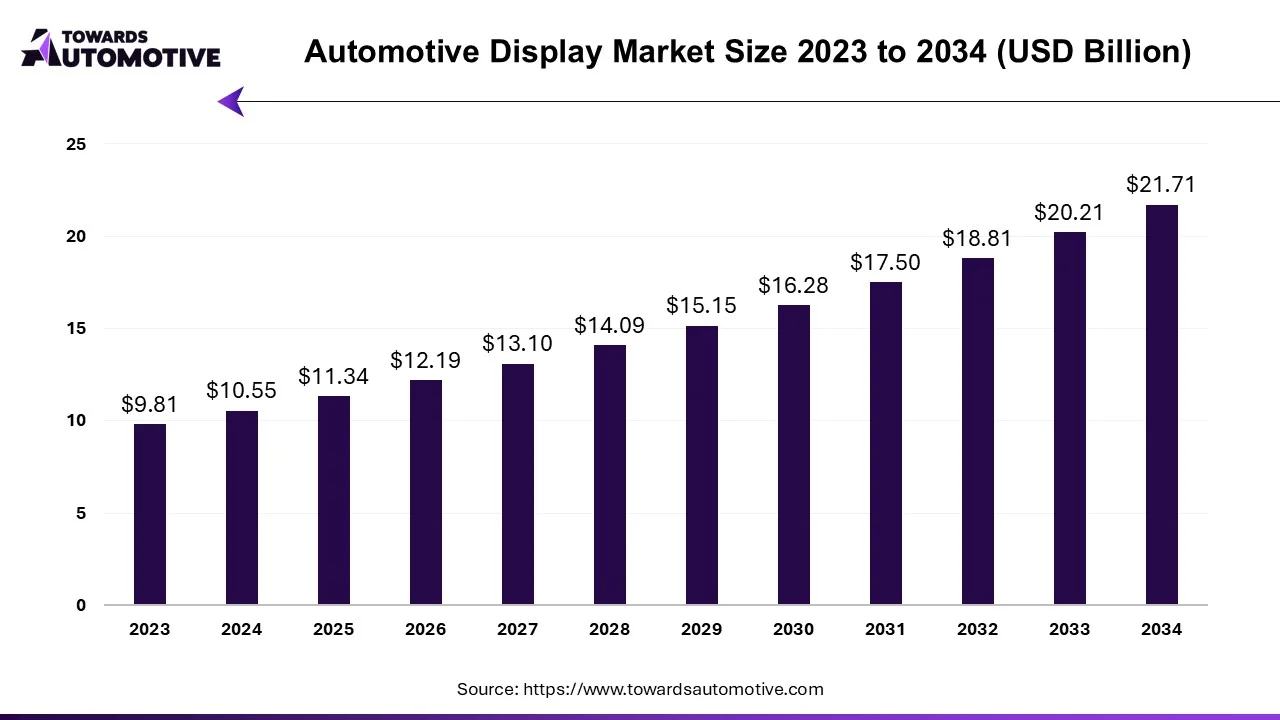

The automotive display market is predicted to expand from USD 11.34 billion in 2025 to USD 21.71 billion by 2034, growing at a CAGR of 7.51% during the forecast period from 2025 to 2034.

Unlock Infinite Advantages: Subscribe to Annual Membership

The automotive display market is a crucial sector of the automotive industry. This industry deals in manufacturing and distribution of displays for the automotive sector. There are several types of displays developed in this sector consisting of TFT LCD, PMOLED, AMOLED and others. These displays are available in different sizes in the market comprising of 3-5 inches, 6-10 inches, greater than 10 inches. It finds several applications in automotives including telematics, navigation, infotainment and some others. The growing demand for luxury cars among elite-class people has contributed to the industrial development. This market is projected to rise drastically with the growth of the automotive components industry across the globe.

In February 2025, Keuk-sang Kwon, the head of Auto Business Group at LG Display made an announcement stating that,” Based on our industry-leading proprietary technology, outstanding product competitiveness and stable supply capabilities, we will continue to present innovative solutions that provide differentiated customer value in the SDV era."

The automotive display market is a highly fragmented industry with the presence of several dominating players. Some of the prominent companies in this industry comprises of Delphi Technologies, Robert Bosch GmbH, LG Display Co. Ltd, Panasonic Corporation, Visteon Corporation, Continental AG and some others. These market players are constantly engaged in developing automotive displays and adopting several strategies such as product launches, collaborations, investments and partnerships to maintain their dominance in this industry.

By Application

By Type Outlook

By Size Outlook

By Region

September 2025

August 2025

August 2025

August 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us