August 2025

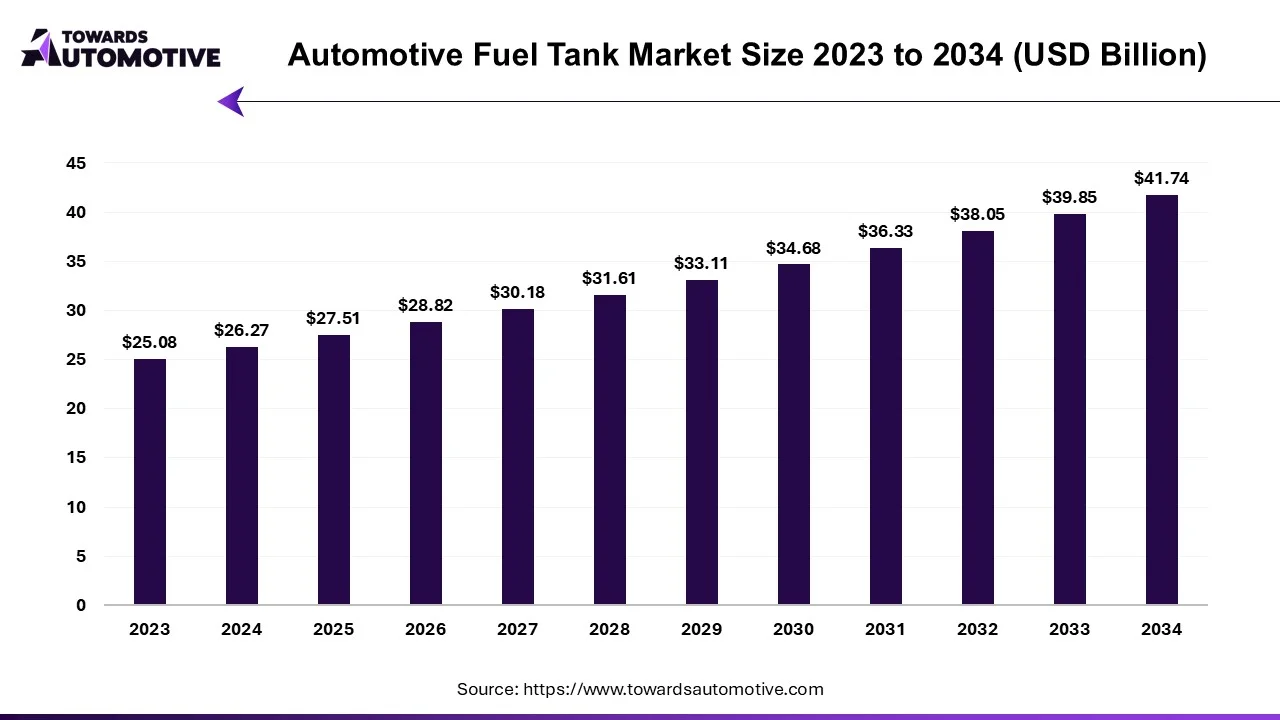

The global automotive fuel tank market is projected to reach USD 41.74 billion by 2034, growing from USD 27.51 billion in 2025, at a CAGR of 4.74% during the forecast period from 2025 to 2034.

Unlock Infinite Advantages: Subscribe to Annual Membership

The automotive fuel tank market is a critical segment of the global automotive industry, providing essential solutions for fuel storage and delivery in vehicles. Fuel tanks are integral components, designed to safely store fuel and ensure its efficient supply to the engine, thereby influencing vehicle performance and safety. The market has witnessed significant growth due to the rising production and demand for passenger and commercial vehicles worldwide. Factors such as advancements in fuel tank materials, increasing focus on fuel efficiency, and stricter emission regulations are driving innovation in this market. Manufacturers are developing lightweight and durable fuel tanks using materials like high-density polyethylene (HDPE), aluminum, and composites to reduce vehicle weight and enhance fuel efficiency.

In addition, the market is adapting to evolving automotive trends, such as the growing adoption of alternative fuels like compressed natural gas (CNG), liquefied petroleum gas (LPG), and hydrogen. These fuels require specialized tanks that ensure safety and compatibility. Moreover, hybrid vehicles, which blend traditional internal combustion engines with electric systems, rely on compact and efficient fuel storage solutions, further expanding the market’s scope.

Technological advancements in manufacturing processes, including blow molding and rotational molding, have enabled the production of innovative fuel tank designs with improved durability and safety features. With an increasing emphasis on sustainability, safety, and performance, the automotive fuel tank market is poised for continued growth and development.

AI plays a transformative role in the automotive fuel tank market by enhancing design, manufacturing, quality control, and predictive maintenance. By leveraging machine learning algorithms and advanced data analytics, manufacturers can optimize fuel tank designs for improved efficiency, durability, and safety. AI-driven simulations and modeling enable engineers to test various materials, shapes, and features under diverse conditions, reducing the need for physical prototypes and accelerating development cycles.

In the manufacturing process, AI-powered systems enhance precision and reduce waste. Automated inspection tools equipped with AI identify defects in fuel tanks during production, ensuring high-quality output and minimizing recalls. These systems can detect cracks, deformations, or welding issues more accurately and efficiently than traditional methods. Additionally, AI streamlines supply chain management by predicting material needs, optimizing inventory levels, and reducing production downtime.

AI also supports the integration of advanced sensors within fuel tanks, enabling real-time monitoring of fuel levels, temperature, and pressure. This data can be analyzed to predict potential issues, such as leaks or wear and tear, allowing for proactive maintenance and improved safety. In alternative fuel applications like CNG or hydrogen, AI assists in developing robust storage solutions by analyzing the unique requirements of these fuels.

As the automotive industry moves toward sustainability, AI plays a critical role in designing lightweight fuel tanks and enabling the transition to hybrid and alternative fuel vehicles. Its ability to enhance innovation, improve efficiency, and ensure safety positions AI as a key enabler of growth and evolution in the automotive fuel tank market.

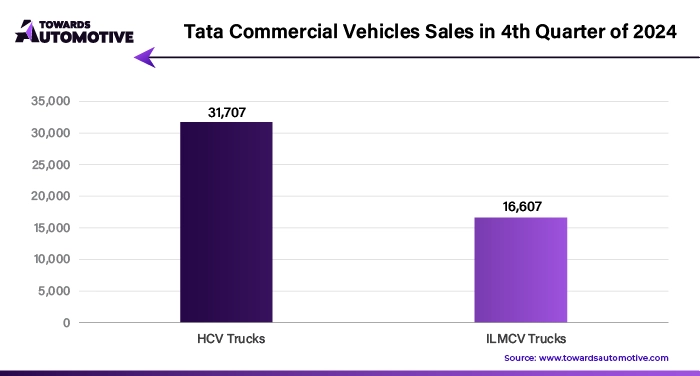

The increasing sales of commercial vehicles are a major driver of the automotive fuel tank market. As the demand for transportation and logistics services grows, the need for commercial vehicles such as trucks, buses, and delivery vans rise significantly. These vehicles typically require larger, more robust fuel tanks to support long-distance operations and ensure operational efficiency. The rise in e-commerce and global trade further accelerates the need for efficient cargo and goods transportation, leading to greater demand for commercial vehicles, thereby increasing the demand for automotive fuel tanks.

Additionally, the expansion of the logistics sector, particularly in emerging markets, boosts the requirement for heavy-duty vehicles that can handle larger fuel loads. This trend is reflected in the growing production and sales of commercial vehicles, with manufacturers focusing on developing more fuel-efficient and durable tanks to meet the needs of this expanding market. With the increasing focus on fuel efficiency and the rise of alternative fuels like compressed natural gas (CNG) and electric fuel systems, fuel tank designs are evolving, creating opportunities for manufacturers to innovate and offer advanced solutions. Thus, the growth in commercial vehicle sales continues to directly impact the automotive fuel tank market, driving the demand for high-capacity, cost-effective, and eco-friendly fuel storage solutions.

The automotive fuel tank market faces significant restraints, including the rising adoption of electric vehicles (EVs), which eliminate the need for traditional fuel tanks. Increasing regulatory pressure to reduce emissions has accelerated the shift toward EVs, impacting fuel tank demand. Additionally, fluctuating raw material prices, particularly for metals and plastics, pose challenges to cost management for manufacturers. Technological advancements in alternative propulsion systems, such as hydrogen and hybrid vehicles, further disrupt traditional fuel tank demand, creating uncertainties for market growth.

The use of carbon fiber composites in the automotive fuel tank market presents significant opportunities due to their numerous benefits in terms of strength, weight reduction, and durability. Carbon fiber composites are much lighter than traditional materials like steel, which helps reduce the overall weight of vehicles, contributing to improved fuel efficiency and better performance. As automakers continue to focus on producing more fuel-efficient and environmentally friendly vehicles, the demand for lightweight materials like carbon fiber composites is increasing. These composites are also resistant to corrosion, which enhances the durability and longevity of fuel tanks, reducing maintenance costs and increasing the vehicle's lifespan. Furthermore, carbon fiber’s ability to withstand high-pressure conditions makes it an ideal material for advanced fuel tanks, especially in hybrid and electric vehicles, where the integration of innovative fuel systems is crucial. The lightweight nature of carbon fiber composites also contributes to better vehicle handling and stability, aligning with the growing demand for performance-oriented vehicles. As regulations surrounding fuel efficiency and emissions become stricter, automakers are turning to carbon fiber composites as a solution to meet these standards while maintaining vehicle safety and performance. These benefits position carbon fiber composites as a key growth driver in the automotive fuel tank market, creating new opportunities for manufacturers to develop advanced, high-performance fuel tanks that cater to the evolving needs of the automotive industry.

The passenger cars segment led the industry. The passenger cars segment plays a significant role in driving the growth of the automotive fuel tank market, owing to the sheer volume of production and sales of these vehicles globally. Passenger cars, including sedans, hatchbacks, and compact SUVs, account for the majority of automotive production, creating substantial demand for fuel tanks as a critical component. The growing adoption of personal vehicles, particularly in developing economies, further amplifies this demand. Rising urbanization and increased disposable income levels have led to higher passenger car ownership, contributing directly to the fuel tank market's expansion.

Additionally, the evolving preferences for lightweight and fuel-efficient vehicles have prompted manufacturers to develop advanced fuel tank systems tailored to passenger cars. These tanks are increasingly made from high-density polyethylene (HDPE) or other lightweight materials to reduce overall vehicle weight and enhance fuel efficiency. Such innovations align with stringent fuel efficiency and emission regulations, driving their adoption across various passenger car models.

Furthermore, the rising popularity of electric vehicles (EVs) and hybrid cars has created a niche demand for specialized fuel tanks in hybrid passenger vehicles. These tanks are designed to integrate seamlessly with hybrid powertrains, ensuring optimal performance. As automakers continue to innovate and expand their passenger car portfolios, the demand for advanced, efficient, and durable fuel tanks will continue to grow, cementing this segment's pivotal role in the automotive fuel tank market.

The plastic segment held the largest share of the market. The plastic segment is a significant driver of growth in the automotive fuel tank market due to its numerous advantages over traditional metal fuel tanks. Plastic fuel tanks, typically made from high-density polyethylene (HDPE), have become the preferred choice for automakers because of their lightweight properties. The reduction in weight contributes to improved fuel efficiency and reduced emissions, aligning with stringent environmental regulations and consumer demand for eco-friendly vehicles. This has driven widespread adoption across various vehicle segments, particularly in passenger cars and light commercial vehicles.

Plastic fuel tanks also offer exceptional design flexibility, allowing manufacturers to create complex shapes and sizes that maximize fuel storage capacity while optimizing the use of available space within the vehicle. This adaptability is particularly advantageous as automakers develop vehicles with increasingly compact designs. Moreover, plastic tanks are corrosion-resistant, enhancing their durability and lifespan compared to metal tanks, which are prone to rust over time.

In addition, advancements in manufacturing technologies, such as blow molding, have streamlined the production of plastic fuel tanks by reducing costs and improving scalability. The growing preference for alternative fuels, such as biofuels, has further boosted the demand for plastic tanks, as they are compatible with a wider range of fuel types. As automakers and consumers prioritize sustainability, efficiency, and durability, the plastic segment continues to play a vital role in driving the growth of the automotive fuel tank market.

Asia Pacific dominated the automotive fuel tank market. The growth of the automotive fuel tank market in the Asia-Pacific (APAC) region is significantly driven by the booming automotive industry, the expansion of aftermarket services, and stringent government regulations on fuel efficiency. The rapid growth of the automotive sector in APAC, led by countries like China, India, Japan, and South Korea, has increased the demand for both passenger and commercial vehicles, directly boosting the need for advanced fuel tanks. Rising vehicle ownership, supported by urbanization, improving disposable incomes, and favorable economic conditions, has further fueled market expansion.

The region's flourishing aftermarket services also play a pivotal role. With millions of vehicles in use across APAC, the need for maintenance, repair, and replacement of automotive components, including fuel tanks, is steadily rising. The growth of organized service networks and easy availability of replacement parts ensures sustained demand for fuel tanks, especially in countries with aging vehicle fleets.

Additionally, stringent government regulations promoting fuel efficiency and emission reduction are driving innovation in fuel tank design. Authorities across APAC are encouraging the adoption of lightweight, corrosion-resistant fuel tanks made from advanced materials like plastic and composites to enhance vehicle efficiency and meet emission norms. These regulations also push manufacturers to adopt technologies that minimize fuel evaporation and leakage, further supporting market growth.

North America is expected to grow with the highest CAGR during the forecast period. The automotive fuel tank market in North America is witnessing robust growth, driven by high vehicle ownership rates, rising demand for lightweight and efficient fuel tanks, and advancements in manufacturing technology. North America boasts one of the highest per capita vehicle ownership rates globally, particularly in the United States and Canada. This extensive vehicle fleet creates consistent demand for both original equipment and replacement fuel tanks, ensuring a steady market growth trajectory. The region's strong preference for large vehicles such as SUVs and trucks further increases the demand for robust, high-capacity fuel tanks tailored to these vehicle types.

Additionally, the rising demand for lightweight and efficient fuel tanks is shaping the market. With increasing emphasis on fuel efficiency and emission reduction, automotive manufacturers are prioritizing the use of advanced materials like high-density polyethylene (HDPE) and aluminum to design lightweight fuel tanks that improve vehicle performance. These fuel tanks not only help reduce vehicle weight but also enhance fuel economy, aligning with consumer preferences and regulatory requirements.

Advancements in manufacturing technology have also been pivotal in driving growth. Innovations in blow molding and welding techniques have enabled the production of complex, high-performance fuel tanks with superior durability and leak resistance. Furthermore, the integration of sensors and fuel management systems within modern fuel tanks enhances functionality, meeting the evolving needs of automakers and consumers.

By Capacity Type

By Material Type

By Vehicle Type

By Region

August 2025

August 2025

August 2025

July 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us