August 2025

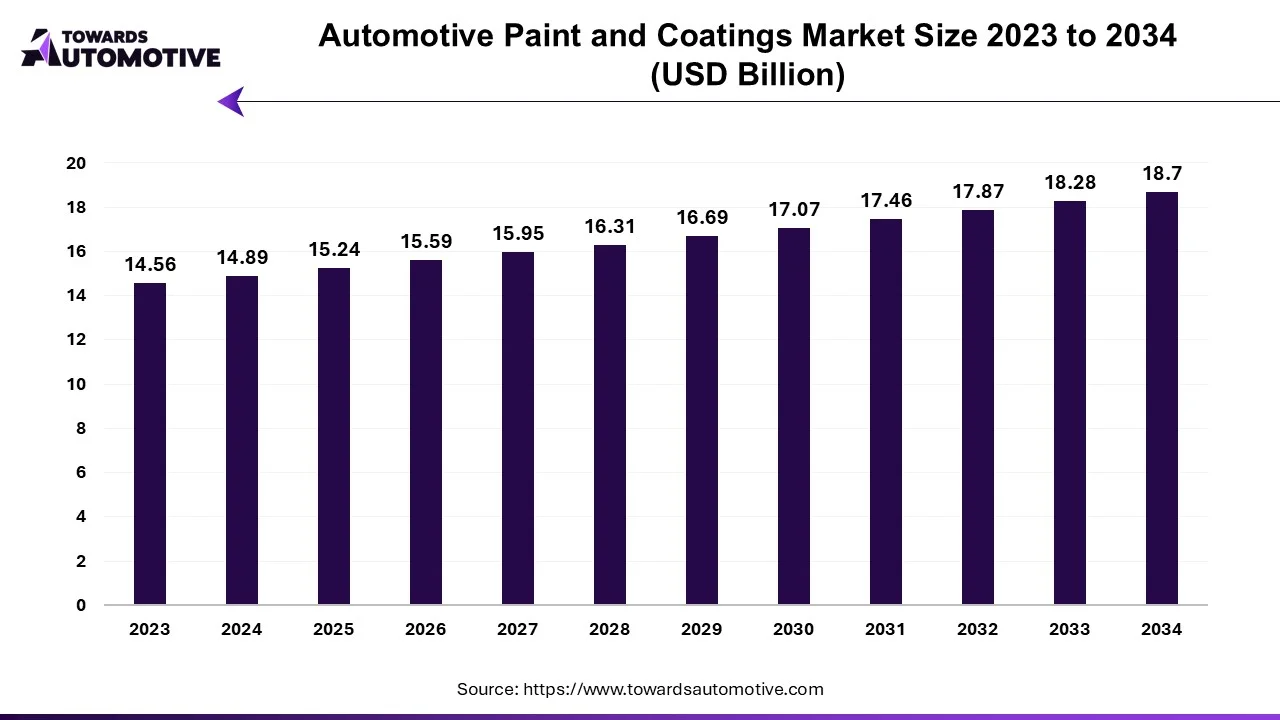

The automotive paints and coatings market is forecast to grow from USD 15.24 billion in 2025 to USD 18.7 billion by 2034, driven by a CAGR of 2.30% from 2025 to 2034. The growing interest of consumers to change colors of their vehicles to maintain uniqueness coupled with numerous subscriptions and offers provided by car detailing shops is contributing to the industrial growth.

Additionally, technological advancements in the coatings industry along with rising cases of car accidents in different parts of the world has driven the market expansion. The research and development activities related to self-healing automotive coatings as well as increasing popularity of smart coatings is expected to create opportunities for the market players in the future.

Unlock Infinite Advantages: Subscribe to Annual Membership

The automotive paints and coatings market is a crucial branch of the automotive industry. This industry deals in manufacturing and distribution of automotive paints and coatings in different parts of the world. There are numerous types of coatings manufactured in this sector comprising of primers, basecoat, clearcoat, electrocoat and some others. These coatings are manufactured using several materials consisting of polyurethane, epoxy, acrylic and some others. It is developed using numerous technologies including waterborne, solvent borne, powder, UV curved and some others. The end-users of these coatings and paints consists of light commercial vehicles, heavy commercial vehicles, passenger cars and some others. This market is expected to rise significantly with the growth of the electric vehicles industry in different parts of the world.

| Metric | Details |

| Market Size in 2024 | USD 14.89 Billion |

| Projected Market Size in 2034 | USD 18.7 Billion |

| CAGR (2025 - 2034) | 2.30% |

| Leading Region | Asia Pacific |

| Market Segmentation | By Vehicle, By Coating Type, By Technology, By Texture, By Distribution Channel, By Raw Material and By Region |

| Top Key Players | Berger Paints, Akzo Nobel, Covestro AG, BASF SE, Clariant AG |

The major trends in this market consists of rise in number of automotive workshops, popularity of functional coatings and eco-friendly paints.

The growing number of automotive workshops in several regions of the world has increased the application of different kinds of coatings and paints.

In recent times, functional coatings have gained popularity due to its capacity to protect automotive from wear and tear, corrosion, and abrasion.

The market players are constantly engaged in developing eco-friendly paints with an aim to reduce vehicular emission.

The waterborne technology segment led the market. The rising investment by paints companies for developing high-quality waterborne coatings for the automotive sector has boosted the market growth. Additionally, numerous advantages of these coatings including environmental friendliness, improved safety, and cost-effectiveness is expected to boost the growth of the automotive paints and coatings market.

The solvent borne technology segment is expected to expand with a considerable CAGR during the forecast period. The growing adoption of solvent borne coatings by electric vehicle companies has boosted the market expansion. Also, several benefits of these coatings such as superior durability, faster drying times, enhanced resistance to environmental factors and some others is expected to boost the growth of the automotive paints and coatings market.

The passenger cars segment held the largest share of the industry. The growing demand for luxury cars in developed nations such as France, Germany, the U.S., Italy and some others has driven the market expansion. Additionally, rising interest of passenger car owners to maintain their car on regular basis is expected to propel the growth of the automotive paints and coatings market.

The light commercial vehicles segment is expected to grow with a significant CAGR during the forecast period. The rising sales of LCEVs in developing nations including India, Vietnam, Thailand and some others has contributed to the market growth. Also, increasing cases of road accidents encountered by light commercial vehicles has driven the growth of the automotive paints and coatings market.

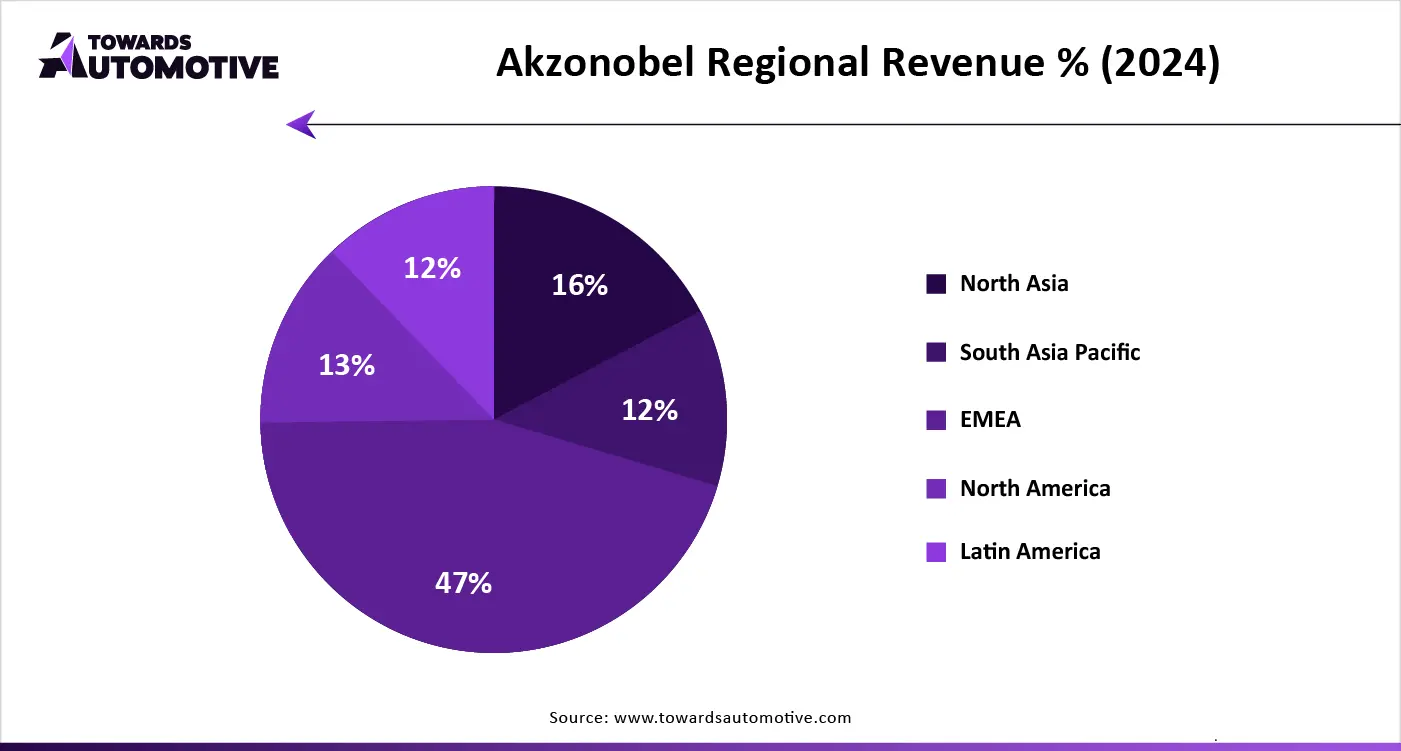

Asia Pacific led the automotive paints and coatings market. The rising production and sales of commercial vehicles in several countries such as India, Japan, China, South Korea and some others is contributing to the market expansion. Additionally, rapid investment by public sector entities in paints industry coupled with rise in number of automotive workshops has driven the industrial growth. Moreover, the presence of several market players such as Berger Paints, Nippon Paint, PPG Paints and some others is expected to boost the growth of the automotive paints and coatings market in this region.

North America is expected to rise with a significant CAGR during the forecast period. The growing production of electric vehicles in the U.S. and Canada has boosted the market growth. Additionally, rapid investment by several automotive companies such as Tesla, Ford, Rivian, Buick and some others for opening new manufacturing facilities coupled with ongoing trend of car modification is adding to the industrial expansion. Moreover, the presence of several automotive paint brands such as Axalta Group, The Sherwin-Williams Company, Eastman Chemical Company and some others is driving the growth of the automotive paints and coatings market in this region.

The automotive paints and coatings market is a highly fragmented industry with the presence of several dominating players. Some of the prominent companies in this industry consists of Berger Paints, Akzo Nobel, Covestro AG, BASF SE, Clariant AG, and some others. These companies are constantly engaged in manufacturing paints and coatings for the automotive sector and adopting numerous strategies such as partnerships, launches, collaborations, joint ventures, acquisitions and some others to maintain their dominance in this industry.

By Vehicle

By Coating Type

By Technology

By Texture

By Distribution Channel

By Raw Material

By Region

August 2025

August 2025

August 2025

August 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us