August 2025

The automotive relay market is forecast to grow from USD 19.52 billion in 2025 to USD 40.28 billion by 2034, driven by a CAGR of 8.38% from 2025 to 2034.

Unlock Infinite Advantages: Subscribe to Annual Membership

The automotive relay market is a significant branch of the automotive industry. This industry deals in manufacturing and distribution of relays for the automotive sector. There are various types of relays developed in this sector consisting of PCB relay, plug-in relay, high voltage relay and some others. These relays are designed for different types of vehicles including passenger vehicles, commercial vehicles and electric vehicles. It finds application in operating numerous automotive components such as engine management module, fog lights, ABS module, front and rear beam and some others. The growing application of relays in passenger cars is contributing to the industrial expansion. This market is expected to rise significantly with the growth of the electronics industry across the globe.

The PCB relay segment held a dominant share of the market. The growing use of PCB relays in vehicles for controlling flow of current between circuits has driven the market expansion. Additionally, the rising application of these relays in several automotive components including lighting systems, power windows and locks, engine management, powertrain control, safety systems, infotainment systems and some others is playing a crucial role in shaping the industrial landscape. Moreover, numerous relay companies are constantly engaged in developing advanced PCB relays for the automotive sector, thereby driving the growth of the automotive relay market.

The high voltage relay segment is likely to rise with the fastest CAGR during the forecast period. The growing sales and production of electric vehicles in different parts of the world has boosted the market expansion. Also, the rising application of high voltage relays in PHEVs and LCEVs for maintaining high-voltage DC operations is playing a vital role in shaping the industry in a positive direction. Additionally, availability of these relays in online platforms and retail outlets is further adding to the growth of the automotive relay market.

The capacitive loads segment held the largest share of the market. The growing adoption of high voltage relays for managing high electric loads has boosted the market expansion. Also, rapid investment by relay manufacturers to develop advanced relays for handling capacitive loads is further adding to the industrial expansion. Moreover, the rising use of relays in automotives for providing electrical isolation and handling of additional currents is likely to propel the growth of the automotive relay market.

The resistive loads segment is anticipated to witness rapid growth during the forecast period. The rising adoption of zero-crossing solid-state relays for managing resistive loads has boosted the market expansion. Additionally, several automotive brands are partnering with relay companies to develop advanced relays for maintaining resistive loads is playing a vital role in shaping the industrial landscape. Moreover, numerous advantages of resistive load relays including simple switching, no phase shift, constant current and some others is expected to foster the growth of the automotive relay market.

The passenger cars segment dominated this industry. The growing sales and production of passenger cars in various countries such as India, China, U.S., Japan, Germany and some others has boosted the market expansion. Also, the rising adoption of luxury vehicles among elite-class consumers along with the increasing trend of supercars among racing enthusiasts is contributing to the industry in a positive way. Moreover, numerous relay companies are investing heavily for developing advanced relays for operating several applications in passenger cars, thereby driving the growth of the automotive relay market.

The electric vehicles segment is predicted to rise with the highest CAGR during the forecast period. The rise in number of government initiatives aimed at increasing awareness about EV adoption has boosted the market growth. Also, the growing demand for sustainable transportation options coupled with rapid advancements in battery technology is further adding to the industrial growth. Additionally, several EV brands such as Tesla, Rivian, Tata Motors, BYD, XPENG, Mercedes and some others are launching new vehicles to gain utmost consumer attention, thereby boosting the growth of the automotive relay market.

Asia Pacific held the highest share of the automotive relay market. The growing production of commercial vehicles in countries such as China, India, Japan, South Korea, Australia and some others has boosted the market expansion. Also, the growing investment by global automotive components for developing advanced relays is playing a vital role in shaping the industrial landscape. Moreover, the presence of several market players such as Toshiba, Panasonic, Omron Corporation, Fujitsu and some others is likely to drive the growth of the automotive relay market in this region.

China dominated the market in this region. In China, the market is driven by the rising sales of electric vehicles coupled with availability of raw materials at cheap prices. Additionally, the technological advancements in automotive manufacturing along with presence of various car manufacturers such as BYD, XPENG, Xiaomi and some others has contributed significantly to the industry.

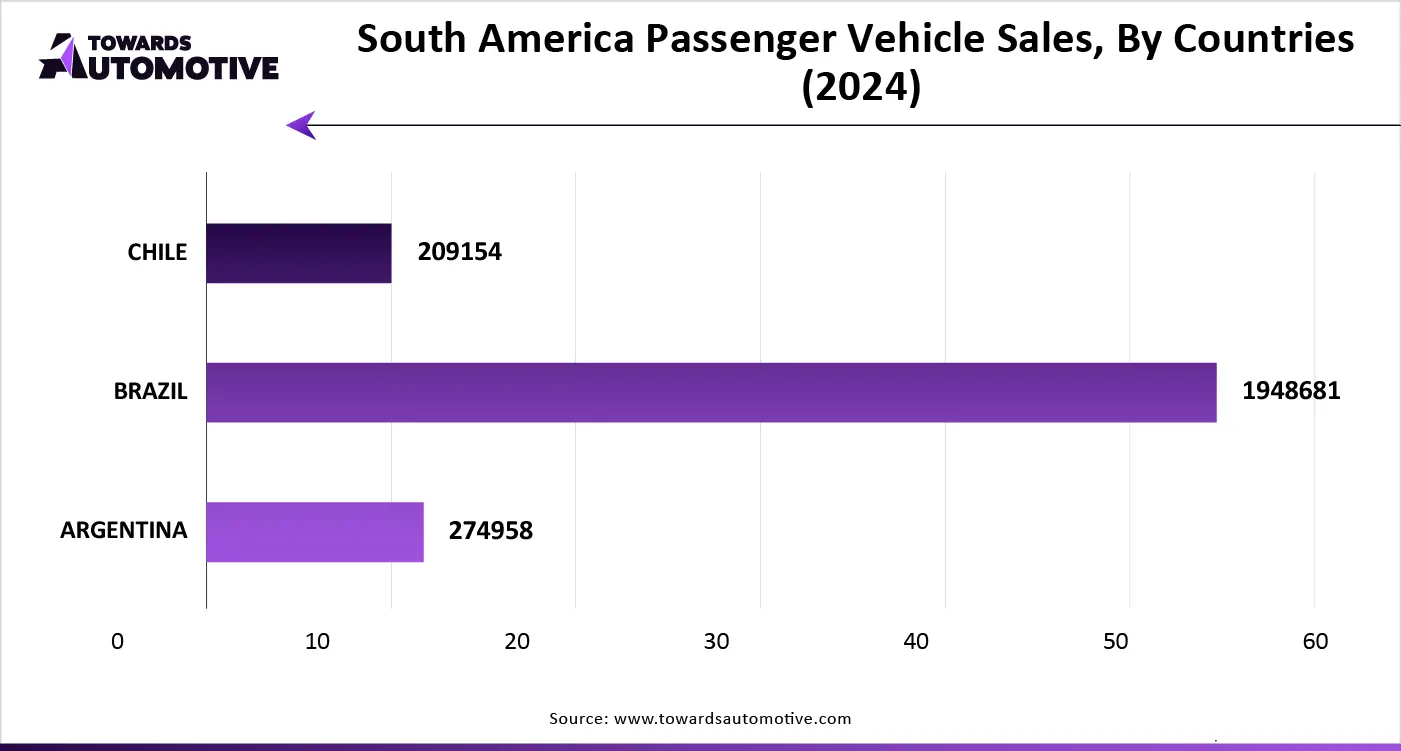

Latin America is expected to grow with the highest CAGR during the forecast period. The rising production of passenger cars in several nations such as Argentina, Brazil, Chile, Colombo and some others has driven the market growth. Additionally, the growing sales of electric vehicles and rapid proliferation of ride-sharing and car-sharing platforms is further accelerating the industrial expansion. Moreover, the presence of various automotive companies such as Agrale, Marcopolo, Busscar and some others is projected to boost the growth of the automotive relay market in this region.

The automotive relay market is a highly competitive industry with the presence of a numerous dominating players. Some of the prominent companies in this industry consists of BETA ELECTRIC INDUSTRY CO., LTD; COTO TECHNOLOGY; ABB, American Zettler, Inc. (Zettler Components, Inc.); Sensata Technologies Holdings N.V; GOOD SKY ELECTRIC CO., LTD.; IDEC Corporation; Deltrol Controls (Deltrol Corporation); Fujitsu Limited; Hella KGaA Hueck & Co. (HELLA); and some others. These companies are constantly engaged in developing relays for the automotive sector and adopting numerous strategies such as collaborations, joint ventures, acquisitions, launches, partnerships, business expansions and some others to maintain their dominant position in this industry. For instance, in October 2024, Toshiba launched TLX9152M. TLX9152M is an optical relay designed for performing several applications in electric vehicles. Also, in June 2024, Zeller launched AZSR170. AZSR170 is a high-performance relay designed for EV charging applications.

By Product

By Application

By Vehicle Type

By Region

August 2025

August 2025

August 2025

August 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us