September 2025

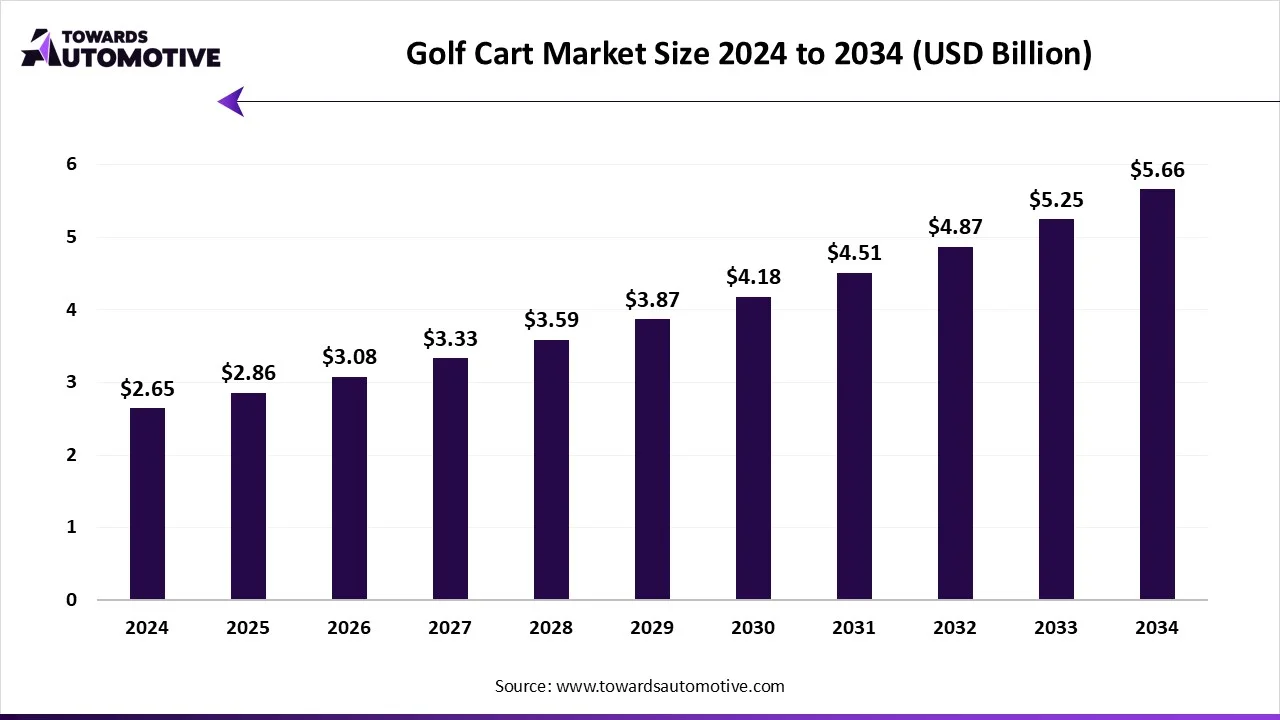

The golf cart market is projected to reach USD 5.66 billion by 2034, expanding from USD 2.86 billion in 2025, at an annual growth rate of 7.89% during the forecast period from 2025 to 2034.

Unlock Infinite Advantages: Subscribe to Annual Membership

The golf cart market covers small, motorized vehicles designed primarily to transport golfers and their equipment around golf courses. Beyond golf, these vehicles are also widely used in resorts, gated communities, airports, industrial complexes, campuses, and event venues for short-distance transportation. Golf carts are available in electric, gas-powered, and solar-powered variants, with seating configurations ranging from 2 to 8 passengers, and can be customized for commercial or recreational purposes.

To lower emissions and maintenance costs, manufacturers are concentrating more on electric and solar-powered golf carts, which are in line with sustainability objectives in the hospitality and sports industry.

Real-time tracking, digital score keeping, and GPS-enabled navigation are becoming more widely used to improve fleet management and player experience.

Due to their small size and inexpensive operating costs, carts are being utilized more and more in industrial facilities, gated communities, resorts, and urban mobility.

Electric golf carts- lead acid segment dominated the golf cart market in 2024, because it is widely accessible, has a lower initial cost, and is reliable due to its decades-long use as the industry standard. These battery systems are recognizable to operators and simpler to maintain in both community and golf course settings. Their established charging infrastructure and capacity to provide a sufficient range for day-to-day operations guarantee steady adoption among fleet operators and budget-conscious consumers.

Electric-lithium ion segment is growing fastest, offering improved energy efficiency, quicker charging time, and longer battery life than lead acid models. Additionally, these batteries have better power-to-weight ratios and require less maintenance, which mobility initiatives are favoring lithium-ion technology more and more as sustainability objectives and operational cost reductions become more important.

2 seater segment dominated the golf cart market due to its sustainability for traditional golf course operations, where transporting two players and their equipment remains the standard. Compact size, easy maneuverability, and lower purchase costs make 2-seater models the default choice for operators, personal users, and gated communities alike. Their dominance is also supported by wide mode availability and minimal storage requirements.

4 seater is the fastest growing segment, encouraged by growing uptake in big box stores, resorts, and residential neighborhoods. These models provide more passenger capacity without appreciably raising operating costs, making them suitable for family group transportation and applications other than golf. Demand for this category is increasing due to the growing trend of multipurpose carts for both utility and leisure.

Golf courses segment dominated the golf cart market in 2024, since carts continue to be a crucial component of course operations, offering players and their equipment quick and easy transportation. Demand is still being driven by high golf participation rates worldwide as well as continuous course improvements and renovations. The segment's dominance is further strengthened by lessening model fleet renewals and technology advancements like GPS navigation.

Commercial (reports & airports) segment is anticipated to grow at the highest CAGR due to the increasing need for quiet, eco-friendly, and compact transport solutions. Resorts employ golf carts for guest mobility, while airports use them for terminal shuttling and staff logistics. Rising tourism and infrastructure expansion projects are boosting adoption across these applications.

Golf industry operators segment is dominating the golf cart market in 2024, motivated by the sport's ongoing appeal, the growth of facilities, and the need for carts for both customer satisfaction and operational effectiveness. The segment's dominant position is also preserved by long-term service contracts with manufacturers and bulk fleet purchases.

Hospitality & tourism segment is anticipated to grow at the highest CAGR due to growing expenditures on theme parks, upscale resorts, and leisure centers that use golf carts to transport visitors. Adoption is being accelerated even more by upscale tourist destinations' emphasis on eco-friendly, peaceful, and comfortable transit options.

North America dominated the golf cart market in 2024, supported by developed golfing cultures, substantial residential community adoption, and a vast course infrastructure. Leading manufacturers are present, and golf carts are widely used for both recreational and practical transportation, which has cemented the region's dominance. The dominance is further reinforced by consistent product innovations, integration of GPS-enabled fleet management tools, and increasing adoption of lithium-ion powered carts for both golf and community transport. The demand is still being fueled by the growth of upscale resorts and retirement communities. Furthermore, consistent fleet upgrades and long-term customer loyalty are guaranteed by robust dealer networks and post-purchase assistance.

Asia Pacific is projected to grow at the fastest rate during the forecast period. Driven by growing resort and tourism infrastructure and increasing disposable incomes. Regional demand is also being increased by government programs that support sustainable mobility and the construction of upscale residential developments. Due to the environmental regulations and a focus on green transportation, electric carts are also rapidly becoming more common in the regions' airports, industrial complexes, and hospitality chains. Manufacturers are customizing models to satisfy the durability requirements of tropical climates and providing designs that can be customized to appeal to both private and business customers. Market penetration is being accelerated through partnerships between local distribution and international brands.

The golf cart market is highly competitive and innovation-driven by sector, with several well-known companies that continue to influence world trends. Club Car, Yamaha Golf Car Company, Garia Cushman Bintelli Electric Vehicles, and E-Z-GO (a Textron brand) are important businesses. These firms are putting a lot of effort into growing their lines of solar and electric-powered golf carts, incorporating cutting-edge lithium-ion battery systems and adding intelligent connectivity features for user convenience and fleet management.

To stay ahead of the competition, they are implementing tactics like solar charging integration, autonomous navigation pilots, commercial multipurpose cart designs, and regional expansion into emerging markets.

By Propulsion Type

By Seating Capacity

By Application

By End-User

By Power Source

By Region

September 2025

September 2025

August 2025

August 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us