October 2025

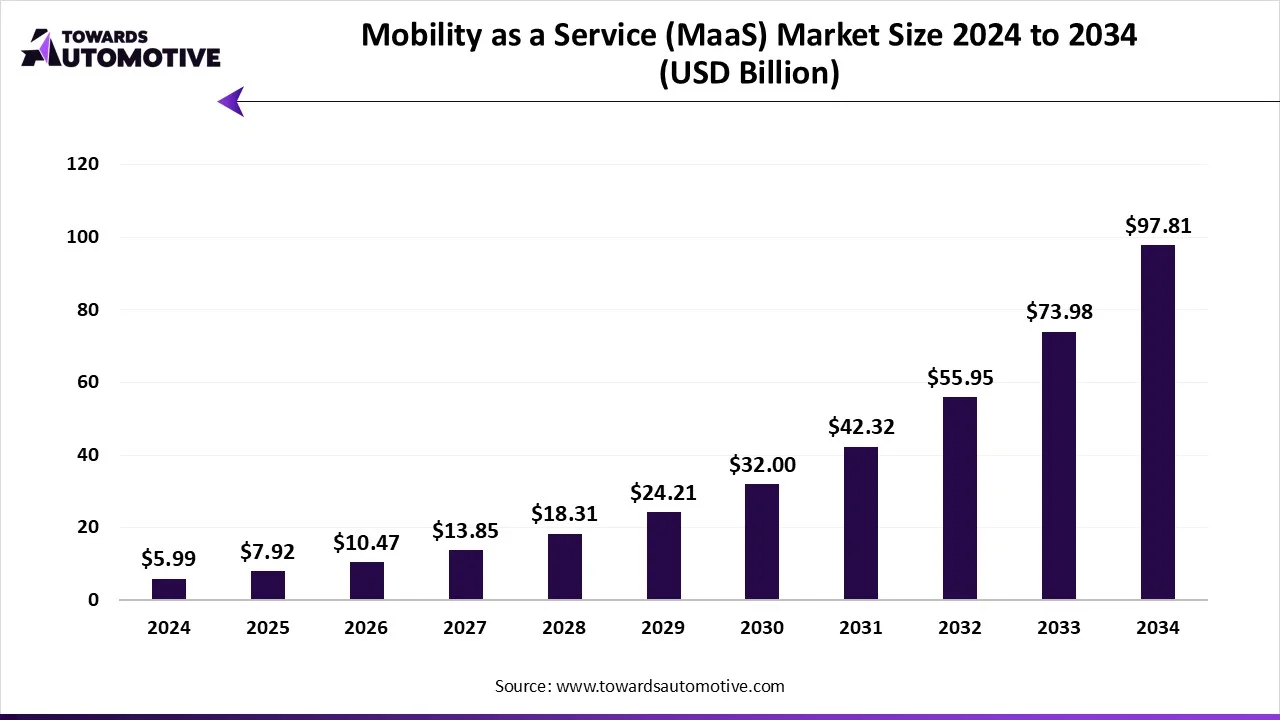

The mobility as a service (MaaS) market is projected to reach USD 97.81 billion by 2034, expanding from USD 7.92 billion in 2025, at an annual growth rate of 32.22% during the forecast period from 2025 to 2034.

The rising popularity of e-mobility services in developed nations coupled with rise in number of car rental providers globally has boosted the market expansion. Additionally, rapid adoption of bike sharing services in developing nations along with numerous government initiatives aimed at promoting public transportation is playing a vital role in shaping the industrial landscape. The integration of AI and data analytics in MaaS platforms is expected to create ample growth opportunities for the market players in the future.

Unlock Infinite Advantages: Subscribe to Annual Membership

The mobility as a service (MaaS) market is a prominent branch of the automotive industry. This industry deals in providing mobility services around the world. There are numerous types of services delivered by this sector comprising of ride-hailing, car sharing, bike sharing, bus sharing, micro-mobility and some others. These services are operated using various modes of transportation including public transit, private vehicles, micro-mobility, air mobility and some others. The end-users of this sector consist of individuals, enterprises, government/municipalities and others. It finds application in personal mobility, corporate mobility, public sector mobility and some others. This market is expected to rise significantly with the growth of the car rental sector in different parts of the globe.

The major trends in this market consists of partnerships, joint ventures and popularity of e-mobility services.

The ride-hailing segment dominated the market. The popularity of ride-hailing services has increased rapidly due to the growing use of smartphones, thereby driving the market expansion. Additionally, rapid investment by fleet operators to deploy electric vehicles for operating ride-hailing services coupled with rise in number of car rental startups is playing a vital role in shaping the industrial landscape. Moreover, the availability of ride-hailing apps in Play Store and Apps Store is expected to boost the growth of the mobility as a service (MaaS) market.

The micro-mobility services segment is expected to expand with the highest CAGR during the forecast period. The rising adoption of e-bicycles and electric mopeds by urban dwellers to reduce vehicular emission has driven the market growth. Additionally, rapid deployment of electric bikes by fleet operators in congested areas coupled with increasing popularity of e-scooter sharing services is playing a crucial role in shaping the industry in a positive manner. Moreover, numerous advantages of micro-mobility services including low emission, reduced traffic congestion, improve air quality, increased accessibility and some others is expected to foster the growth of the mobility as a service (MaaS) market.

The journey planning solutions segment led the market. The demand for journey planning solutions has grown rapidly as it allows users to find the most efficient way for traveling between two or more locations, thereby driving the market expansion. Additionally, the popularity of several journey planning solutions such as Citymapper, Rome2rio, Google Maps and some others is also contributing to the industry in a positive manner. Moreover, the increasing consumer interest to visit isolated areas coupled with advancements in satellite navigation services is expected to foster the growth of the mobility as a service (MaaS) market.

The payment engines segment is expected to grow with the fastest CAGR during the forecast period. The increased demand for highly secured payment engines to lower the risk of fraudulent activities has boosted the market growth. Additionally, the rapid adoption of blockchain-enabled payment engines by ride-sharing companies for providing additional security to passengers is further adding to the industry in a positive manner. Moreover, the integration of biometric authentication technology in advanced payment engines is expected to drive the growth of the mobility as a service (MaaS) market.

The public transit segment held the largest share of the market. The growing investment by government of several countries such as Germany, UK, Canada, the U.S. and some others for developing the public transport infrastructure has boosted the market expansion. Also, the deployment of electric buses and hybrid trains to lower vehicular emission is contributing to the industry in a positive manner. Moreover, numerous advantages of public transit including reduced air pollution, lower carbon footprint, reduced noise pollution, reduced congestion and some others is expected to boost the growth of the mobility as a service (MaaS) market.

The micro-mobility segment is expected to grow with the fastest CAGR during the forecast period. The increasing use of e-scooters in urban areas to mitigate traffic congestion has boosted the market growth. Additionally, rapid investment by EV startups to develop e-bikes and electric velomobiles for enhancing the traveling experience is contributing to the industry in a positive way. Moreover, the rise in number of bike sharing platforms in different parts of the world is expected to propel the growth of the mobility as a service (MaaS) market.

The B2C (business to consumer) segment dominated the industry. The increasing focus of ride-sharing companies for delivering affordable transportation solutions to consumers has driven the market expansion. Also, rapid investment by mobility service providers to deploy different range of vehicles to allow consumers for selecting cars according to their budget is accelerating the industry in a positive direction. Moreover, the growing consumer preference to adopt e-ride hailing services with an at reducing vehicular emission is expected to boost the growth of the mobility as a service (MaaS) market.

The B2G (business to government) segment is expected to expand with the highest CAGR during the forecast period. The rising emphasis of government for deploying eco-friendly vehicles in public transit to reduce C02 emission has driven the market growth. Additionally, rapid investment by government for purchasing high-quality buses and passenger trains to enhance public traveling is playing a vital role in shaping the industrial landscape. Moreover, partnerships among government entities and fleet operators to launch affordable mobility services is expected to proliferate the growth of the mobility as a service (MaaS) market.

The android segment dominated the market. The growing popularity of android smartphones in developing nations has boosted the market expansion. Also, the availability of MaaS platforms in Google Play Store has enabled people to download these applications for booking cars and bikes online, thereby contributing to the industrial growth. Moreover, rapid investment by software companies to develop MaaS software for android devices is expected to boost the growth of the mobility as a service (MaaS) market.

The cross-platform/web-based segment is expected to rise with the highest CAGR during the forecast period. The increasing use of computers and laptops for booking bus and train tickets has boosted the market expansion. Also, the rising preference of consumers to book rental vehicles through online platforms is playing a vital role in shaping the industry in a positive direction. Additionally, the growing demand for web-based platforms due to its simplicity and versatility is expected to foster the growth of the mobility as a service (MaaS) market.

The personal mobility segment held the largest share of the market. The growing adoption of electric bikes and e-scooters for daily commute activities has boosted the market expansion. Additionally, numerous government initiatives aimed at providing incentives for purchasing electric vehicles coupled with rising popularity of self-driving cars is playing a vital role in shaping the industrial landscape. Moreover, the increasing demand for affordable passenger cars from developing nations is expected to foster the growth of the mobility as a service (MaaS) market.

The corporate mobility segment is expected to grow with the highest CAGR during the forecast period. The increasing emphasis of business organizations to manage the movement of employees has boosted the market expansion. Additionally, rapid adoption of electric vehicles by large corporate firms for reducing vehicular emission is contributing to the industry in a positive manner. Moreover, partnerships among fleet operators and business organizations is expected to drive the growth of the mobility as a service (MaaS) market.

The individuals segment dominated the market. The growing demand for bike sharing services from individual consumers for daily commutes has boosted the market expansion. Also, rising consumer awareness to adopt eco-friendly transportation solutions along with increase in number office-goers is contributing to the industry in a positive manner. Additionally, rapid investment by ride-sharing companies for launching individual-based car rental services is expected to propel the growth of the mobility as a service (MaaS) market.

The government/ municipalities segment is expected to expand with the highest CAGR during the forecast period. The increasing adoption of electric vehicles for operating government duties has boosted the market growth. Additionally, rapid investment by government for developing the public transport infrastructure coupled with numerous partnerships among rental companies and municipalities is playing a vital role in shaping the industrial landscape. Moreover, the growing emphasis of government for developing the railway sector is expected to foster the growth of the mobility as a service (MaaS) market.

Europe held the largest share of the mobility as a service (MaaS) market. The growing sales of e-scooters in several countries such as Germany, UK, France, Italy and some others has boosted the market expansion. Additionally, numerous government initiatives aimed at strengthening the public transport infrastructure coupled with increasing popularity of ride-hailing apps is playing a vital role in shaping the industrial landscape. Moreover, the presence of numerous market players such as Bolt Technology, Splyt Technologies, Transdev Group and some others is expected to drive the growth of the mobility as a service (MaaS) market in this region.

Germany and UK are the prominent contributors in this region. In Germany, the growing sales of e-bikes coupled with rapid investment by governmental organizations to enhance public transportation has boosted the market expansion. In UK, the increase popularity of micro-mobility services along with rise in number of EV startup companies is playing a vital role in shaping the industrial landscape.

Asia Pacific is expected to expand with the highest CAGR during the forecast period. The increasing popularity of e-hailing services in various countries such as India, China, Japan, South Korea and some others has boosted the market growth. Additionally, rapid deployment of electric vehicles by fleet operators coupled with growing consumer preference to adopt high-speed railways to travel long-distances is contributing to the industry in a positive manner. Moreover, the presence of various market players such as Didi Chuxing, Gojek, Ola and some others is expected to boost the growth of the mobility as a service (MaaS) market in this region.

China dominated the market in this region. In China, the growing popularity of autonomous cars coupled with technological advancements in the automotive sector has boosted the market expansion. Additionally, the rising sales of e-scooters as well as rapid adoption of e-mobility services is playing a vital role in shaping the industrial landscape.

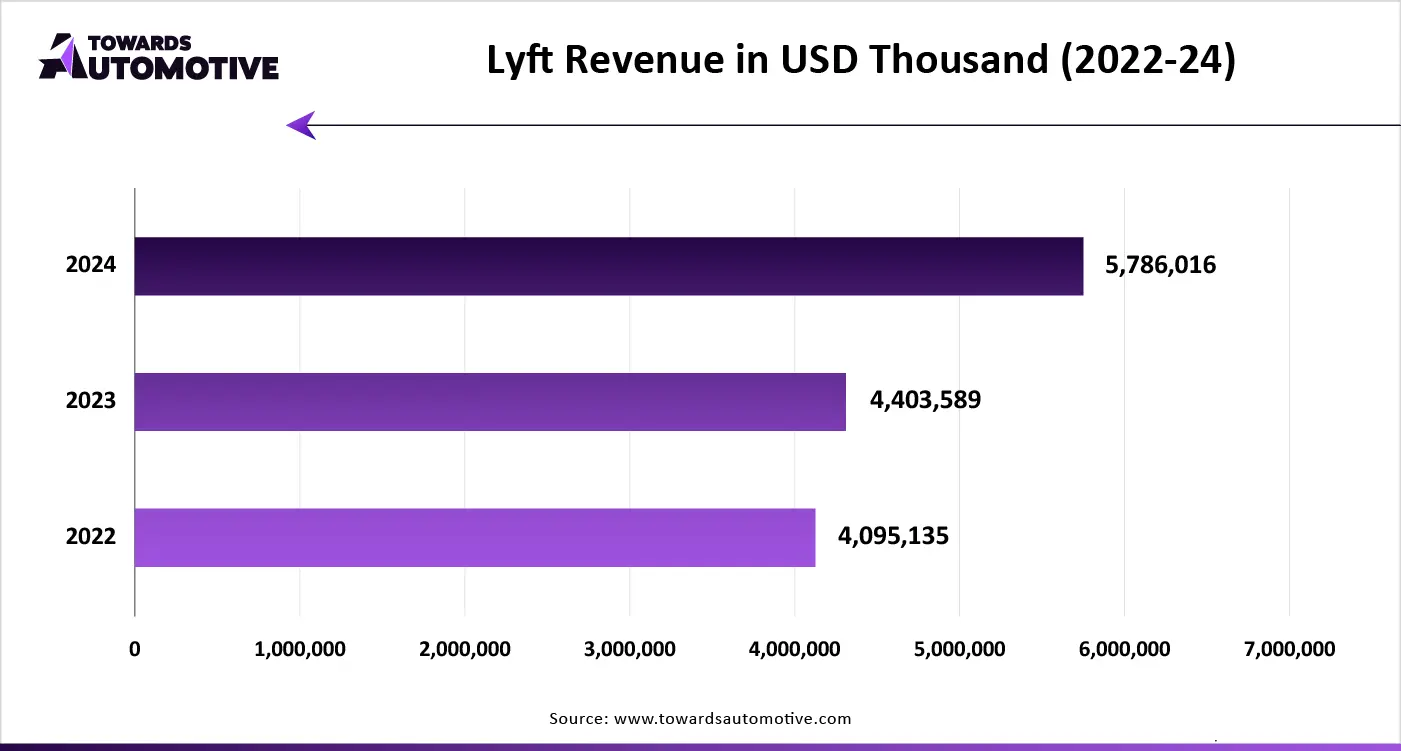

The mobility as a service market is a rapidly developing industry with the presence of several dominating players. Some of the prominent companies in this industry consists of Transdev Group, Free Now (Daimler & BMW), Grab Holdings, Didi Chuxing, Citymapper, Uber Technologies Inc., Lyft Inc., Moovit (Intel), BlaBlaCar, MaaS Global (Whim), Lime, Zipcar (Avis Budget Group), Gojek, Bolt Technology, Via Transportation, Bird Rides Inc. and some others. These companies are constantly engaged in providing mobility services and adopting numerous strategies such as partnerships, business expansions, acquisitions, collaborations, launches, expansions, joint ventures and some others to maintain their dominance in this industry.

By Service Type

By Solution Type

By Transportation Mode

By Business Model

By End-User

By Operating System Platform

By Application

By Region

October 2025

September 2025

September 2025

September 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us