August 2025

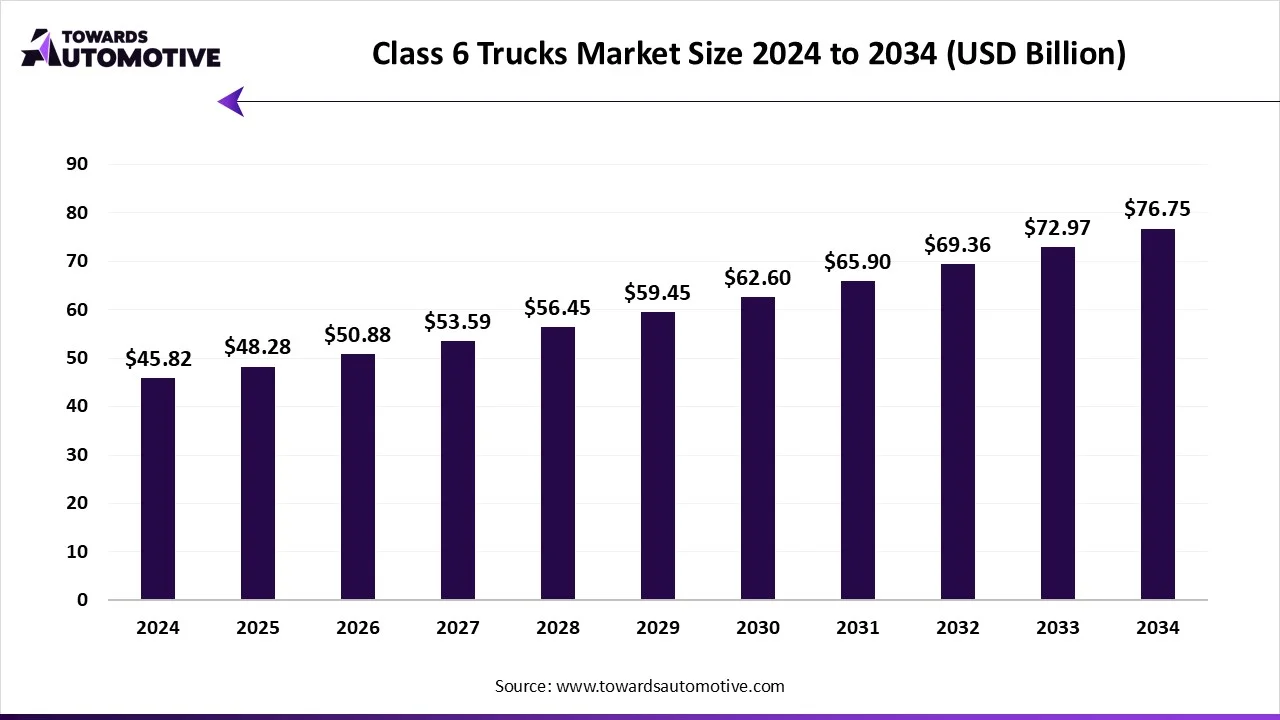

The class 6 trucks market is predicted to expand from USD 48.28 billion in 2025 to USD 76.75 billion by 2034, growing at a CAGR of 5.35% during the forecast period from 2025 to 2034. The growing demand for medium-duty trucks from the e-commerce sector in several countries such as the U.S. and France has boosted the market expansion.

Additionally, increasing sales of class 6 electric trucks in different parts of the world coupled with technological advancements in in-vehicle technology is playing a vital role in shaping the industrial landscape. The advancements in hydrogen fuel cell technology along with rapid adoption of driverless trucks in the logistics sector is expected to create ample growth opportunities for the market players in the future.

Unlock Infinite Advantages: Subscribe to Annual Membership

The class 6 trucks market is a prominent branch of the automotive industry. This industry deals in manufacturing and distribution of medium-duty trucks in different parts of the world. These trucks are powered by different types of fuel comprising of diesel, gasoline, electric and some others. It is built on numerous types of body consisting of straight trucks and tractor trucks. The applications of these trucks consist of construction, transportation, distribution, utilities and some others. The growing demand for trucks with payload capacity of around 15 tons is contributing to the overall industrial expansion. This market is expected to rise significantly with the commercial vehicles sector around the globe.

| Metric | Details |

| Market Size in 2024 | USD 45.82 Billion |

| Projected Market Size in 2034 | USD 76.75 Billion |

| CAGR (2025 - 2034) | 5.35% |

| Leading Region | North America |

| Market Segmentation | By Body Type, By Fuel Type, By Payload Capacity, By Application and By Region |

| Top Key Players | Hino Motors, MAN SE, Isuzu, Daimler Truck North America, Scania, Bharat Benz, Tata Motors |

The major trends in this market consists of partnerships, growth in the e-commerce sector and rapid adoption of hydrogen trucks.

Several automotive brands are partnering with each other for developing high-quality class 6 trucks to cater the needs of the end-users.

With the rising popularity of online shopping, the demand for medium-duty trucks has increased rapidly in recent times from the e-commerce sector.

The logistics companies have started adopting hydrogen trucks with an aim to reduce vehicular emission and lessen maintenance cost.

The straight trucks segment dominated the market. The growing demand for straight trucks for transporting several items such as machine parts, electronics, food items, waste, general cargo, medicines and vaccines, building materials and some others has driven the market expansion. Additionally, the rising sales of box trucks and cube trucks in the U.S. and Canada coupled with rapid adoption of straight trucks for enhancing logistics operations is playing a vital role in shaping the industrial landscape. Moreover, numerous advantages of straight trucks including easy maneuverability, cost-effectiveness, fast loading and unloading, and some others is expected to boost the growth of the class 6 trucks market.

The tractor trucks segment is expected to expand with the fastest CAGR during the forecast period. The growing sales of conventional tractors trucks and hybrid trucks has boosted the market growth. Also, the rising demand for tractor trucks with advanced features such as autonomous driving and smart fuel management systems has driven the industrial expansion. Moreover, several benefits of tractor trucks including cost savings, enhanced safety, versatility, and some others is expected to propel the growth of the class 6 trucks market.

The diesel segment held the largest share of the industry. The growing demand for diesel-powered medium-duty trucks from the logistics sector has driven the market growth. Additionally, numerous partnerships among truck manufacturing brands to develop diesel-powered class 6 trucks is positively driving the industrial expansion. Moreover, various benefits of diesel-engines including high torque, superior fuel efficiency, enhance longevity and some others is expected to drive the growth of the class 6 trucks market.

The electric segment is expected to grow with the highest CAGR during the forecast period. The rising adoption of electric-powered medium-duty trucks from the e-commerce sector has boosted the market expansion. Also, numerous government initiatives aimed developing the EV charging infrastructure coupled with technological advancements in powertrains is playing a vital role in shaping the industrial landscape. Moreover, rapid investment by automotive brands for manufacturing EV trucks is expected to propel the growth of the class 6 trucks market.

The construction segment led this industry. The rise in number of residential constructions in different parts of the world has boosted the market expansion. Additionally, the growing investment by government of several countries such as India, UK, Germany and some others is playing a vital role in shaping the industrial landscape. Moreover, partnerships among truck manufacturers and construction companies to deploy class 6 trucks is expected to drive the growth of the class 6 trucks market.

The utilities segment is expected to rise with a considerable CAGR during the forecast period. The rising demand for advanced trucks from the utilities sector has boosted the market expansion. Additionally, collaborations among automotive brands and fleet operators is expected to propel the growth of the class 6 trucks market.

North America led the class 6 trucks market. The growing demand for class 6 trucks from several sectors including logistics, e-commerce, construction and some others has boosted the market growth. Additionally, numerous government initiatives aimed at developing the EV infrastructure coupled with rapid adoption of hydrogen trucks is playing a vital role in shaping the industry in a positive direction. Moreover, the presence of several market players such as Paccar, Kenworth, International Motors, LLC and some others is expected to propel the growth of the class 6 trucks market.

U.S. dominated the market in this region. The rise in number of residential constructions in several states such as California, Texas, Hawaii, Indiana and some others has increased the demand for medium-duty trucks, thereby driving the market expansion. Additionally, rapid adoption of hybrid trucks in the logistics sector is contributing to the overall industrial growth.

Asia Pacific is expected to expand with a significant CAGR during the forecast period. The increasing sales of straight trucks in several countries such as India, China, Japan, South Korea, Singapore and some others has driven the market expansion. Also, rapid investment by government of several countries for strengthening the hydrogen vehicle infrastructure is playing a vital role in shaping the industrial landscape. Moreover, the presence of numerous truck manufacturing brands such as Tata Motors, Mitsubishi, Hino Motors and some others is expected to drive the growth of the class 6 trucks market.

China held the largest share of the market in this region. The growing investment by automotive brands for manufacturing powerful medium-duty trucks has boosted the market expansion. Additionally, the rapid growth in cross-border trade activities coupled with numerous government investment by government for developing the logistics sector is contributing to the overall industrial growth.

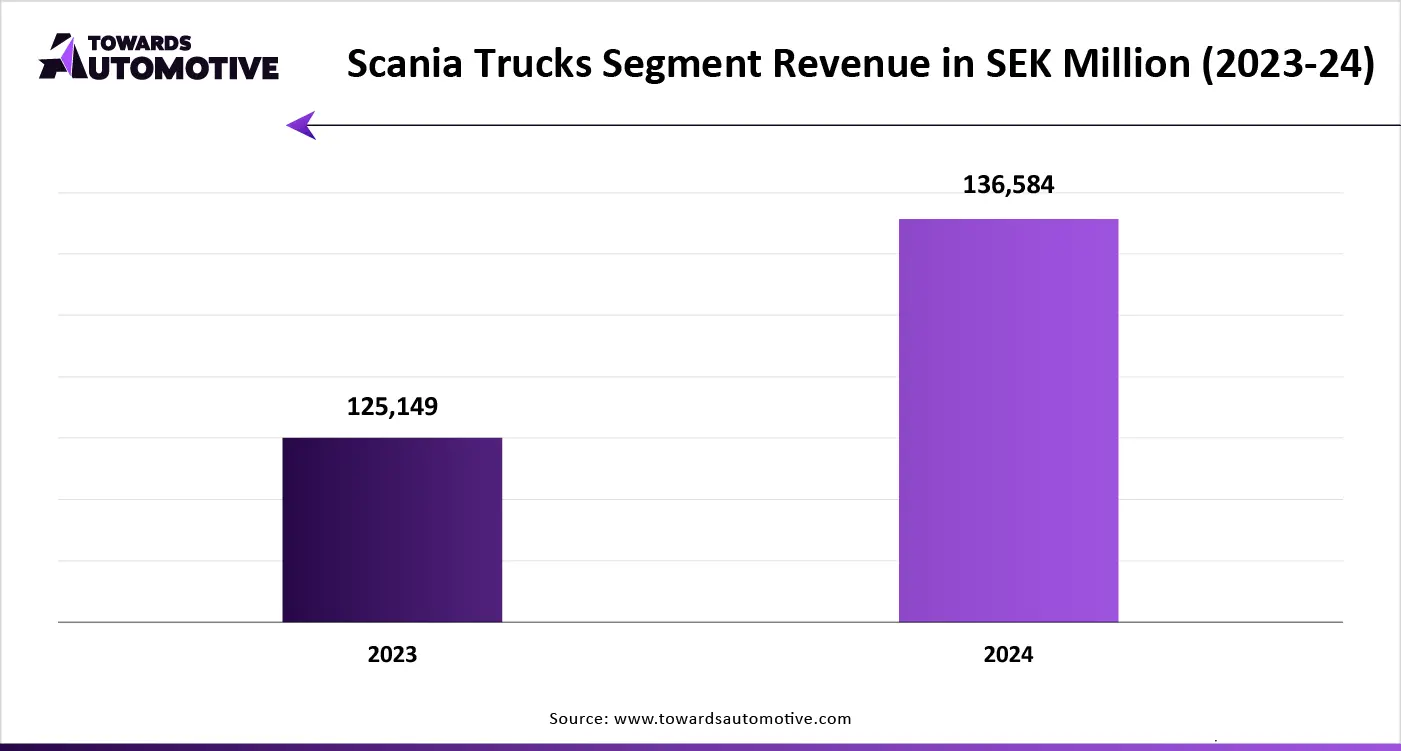

The class 6 trucks market is a highly competitive industry with the presence of several dominating players. Some of the prominent companies in this industry consists of Hino Motors, MAN SE, Isuzu, Daimler Truck North America, Scania, Bharat Benz, Tata Motors, Mitsubishi Fuso Truck and Bus Corporation, Iveco, UD Trucks, Paccar, Ashok Leyland, Renault Trucks, Volvo Trucks, and some others. These companies are constantly engaged in developing class 6 trucks and adopting numerous strategies such as joint ventures, partnerships, collaborations, launches, acquisitions, and some others to maintain their dominance in this industry.

By Body Type

By Fuel Type

By Payload Capacity

By Application

By Region

August 2025

August 2025

August 2025

August 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us