August 2025

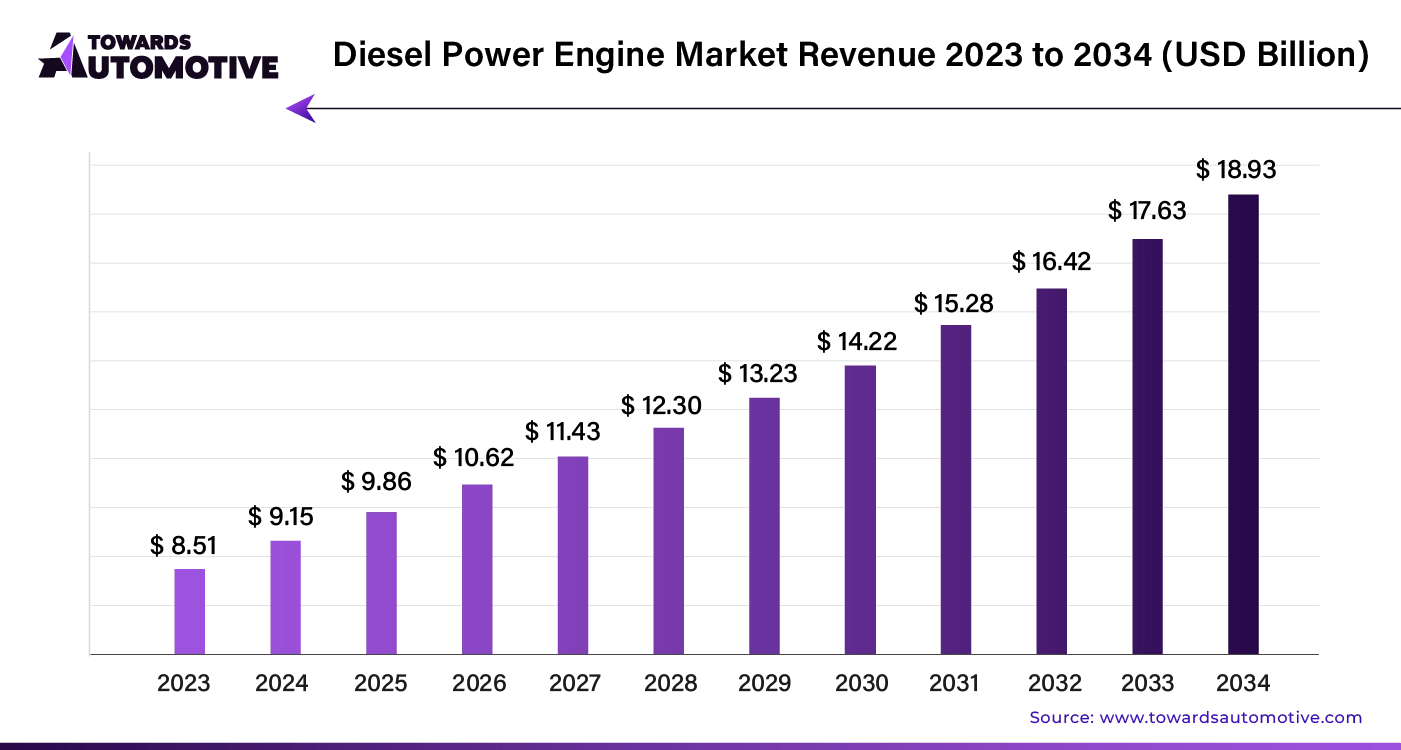

The diesel power engine market is expected to increase from USD 9.86 billion in 2025 to USD 18.93 billion by 2034, growing at a CAGR of 7.65% throughout the forecast period from 2025 to 2034. The growing investment by engine manufacturers for developing powerful diesel engines coupled with surge in demand for backup power supply is playing a vital role in shaping the industrial landscape.

Additionally, the rising trend of decentralized power generation along with numerous government initiatives aimed at developing the grid infrastructure has driven the market expansion. The integration of hybrid power systems in diesel generators is expected to create ample growth opportunities for the market players in the future.

Unlock Infinite Advantages: Subscribe to Annual Membership

The diesel power engine market is a crucial sector of the automotive industry. This industry deals in development and distribution of diesel engines across the world. These engines are designed for numerous operations including standby, prime, peak shaving and some others. It delivers various power outputs such as Up To 0.5 MW, 0.5–1 MW, 1–2 MW, 2–5 MW, above 5 MW and some others. The end-users of these engines consist of industrial, commercial, residential and some others. This market is expected to rise significantly with the growth of the heavy machineries industry in different parts of the globe.

The major trends in this market consists of product launches, joint ventures and business expansions.

The standby segment dominated the diesel power engine market. The growing use of standby diesel engines to act as a backup power source for providing electricity during power outages has driven the market expansion. Additionally, the increasing demand for these engines for maintaining operations in critical facilities such as hospitals, data centers, manufacturing plants and some others is playing a vital role in shaping the industrial landscape. Moreover, collaborations among engine manufacturers and power generation companies for developing advanced diesel engines is expected to drive the growth of the diesel power engine market.

The prime segment is expected to grow with a significant CAGR during the forecast period. The rising use of diesel engines as a prime mover for various applications has boosted the market expansion. Additionally, these diesel engines are generally used in remote areas, construction sites and emergency backup power, thereby driving the industry in a positive direction. Moreover, numerous advantages of prime diesel engines including superior torque and power, excellent fuel economy, robust durability and some others is expected to foster the growth of the diesel power engine market.

The 1-2 MW segment led the diesel power engine market. The growing use of 1-2 MW diesel engines for various applications such as industrial backup power, remote power supply, marine propulsion and some others has driven the market growth. Additionally, the rising application of these engines in hybrid systems for emergency power supply is playing a vital role in shaping the industrial landscape. Moreover, partnerships among diesel engine manufacturers and emergency power suppliers is expected to boost the growth of the diesel power engine market.

The 2–5 MW segment is expected to rise with a considerable CAGR during the forecast period. The rising application of 2-5 MW diesel engines for numerous applications including remote power supply and industrial backup power has boosted the market expansion. Additionally, the growing use of these engines in marine propulsion, hybrid systems and emergency power systems is playing a vital role in shaping the industrial landscape. Moreover, collaborations among engine companies and marine industry to deploy high-quality 2–5 MW engines in yachts and boats is expected to propel the growth of the diesel power engine market.

The industrial segment held the largest share of the diesel power engine market. The growing demand for high-performance diesel engines from the industrial sector has boosted the market expansion. Additionally, the deployment of heavy equipment in the mining industry coupled with rapid investment by engine manufacturers to develop high-quality engines for power stations is playing a vital role in shaping the industrial landscape. Moreover, the rising development in the oil and gas industry and chemical manufacturing sector increased the demand for diesel engines, thereby driving the growth of the diesel power engine market.

The residential segment is expected to rise with a robust CAGR during the forecast period. The growing demand for diesel generators from residential apartment to deliver backup power during load shedding has driven the market expansion. Additionally, the rising application of diesel engines to reduce the amount of electricity drawn from the grid during peak demand periods is playing a vital role in shaping the industry in a positive direction. Moreover, the surging use of diesel engines for powering numerous home appliances such as refrigerators, air conditioners, heaters, televisions, computers and some others is expected to foster the growth of the diesel power engine market.

North America dominated the diesel power engine market. The growing demand for high-performance diesel engines from the heavy-equipment industry in the U.S. and Canada has driven the market expansion. Additionally, rising investment by engine manufacturers for opening new production facilities coupled with rapid expansion of the power generation sector is playing a crucial role in shaping the industrial landscape. Moreover, the presence of various market players such as Caterpillar Inc., Cummins, Inc., John Deere and some others is expected to boost the growth of the diesel power engine market in this region.

Asia Pacific is expected to expand with the highest CAGR during the forecast period. The increasing sales of diesel trucks in numerous countries such as India, China, Japan, South Korea and some others has boosted the market growth. Additionally, rapid investment by government for deploying powerful locomotives in the railway sector coupled with rising consumer interest about marine transport is contributing to the industry in a positive manner. Moreover, the presence of numerous market players such as Hyundai Heavy Industries Co., Ltd., Kubota Corporation, Weichai Power, Doosan and some others is expected to drive the growth of the diesel power engine market in this region.

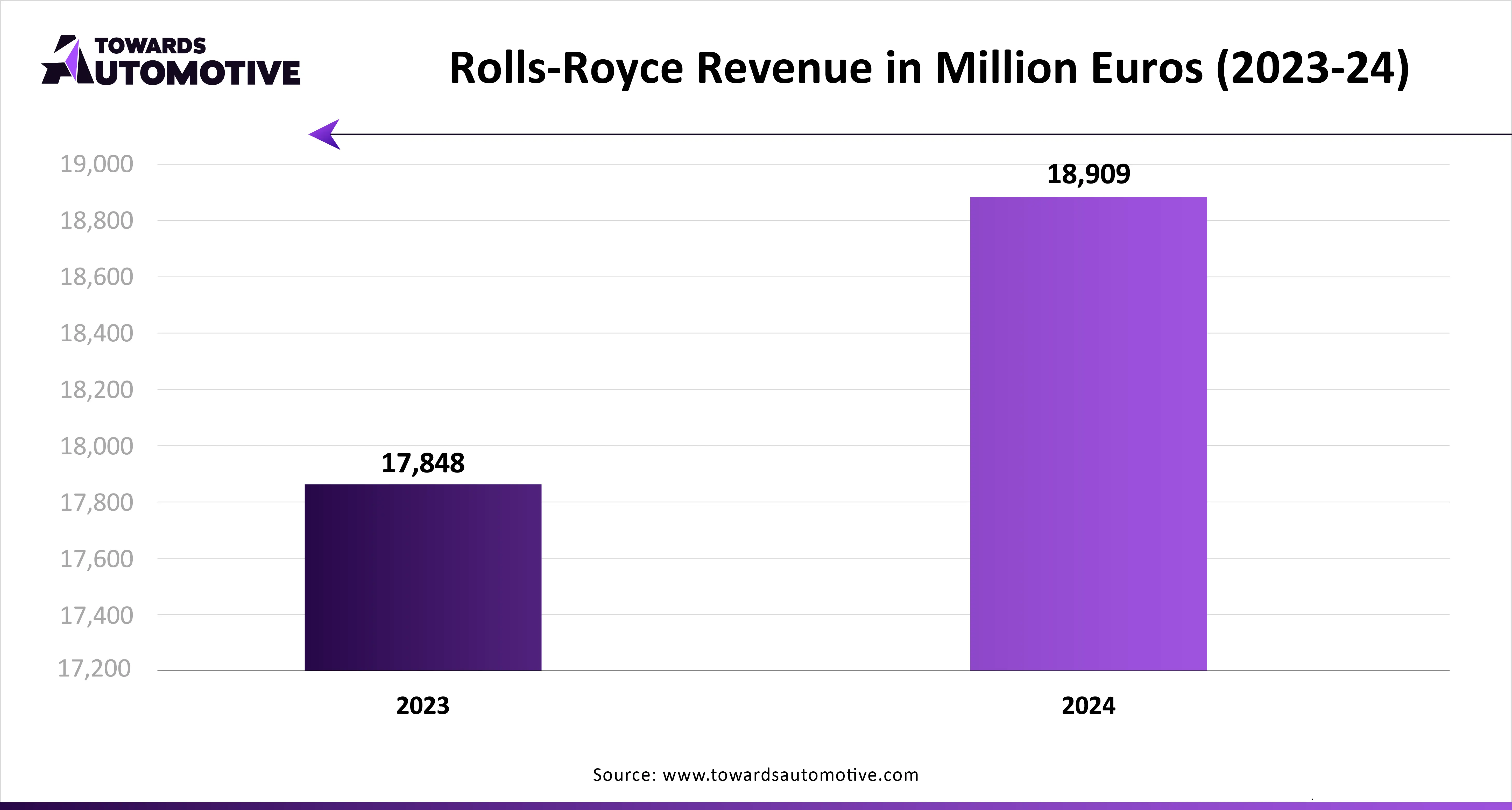

The diesel power engine market is a highly competitive industry with the presence of several dominating players. Some of the prominent companies in this industry consists of Caterpillar Inc., Cummins, Inc., MAN SE, Rolls-Royce Holdings plc., Wärtsilä Corp, Mitsubishi Heavy Industries, Ltd., Volvo Penta, Hyundai Heavy Industries Co., Ltd., Doosan, Yanmar Co., Ltd., Kubota Corporation, Kohler Co., and some others. These companies are constantly engaged in developing diesel engines and adopting numerous strategies such as acquisitions, business expansions, expansions, collaborations, launches, partnerships, joint ventures and some others to maintain their dominance in this industry.

By Operation

By Rated Power

By End-User

By Region

August 2025

July 2025

August 2025

July 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us