October 2025

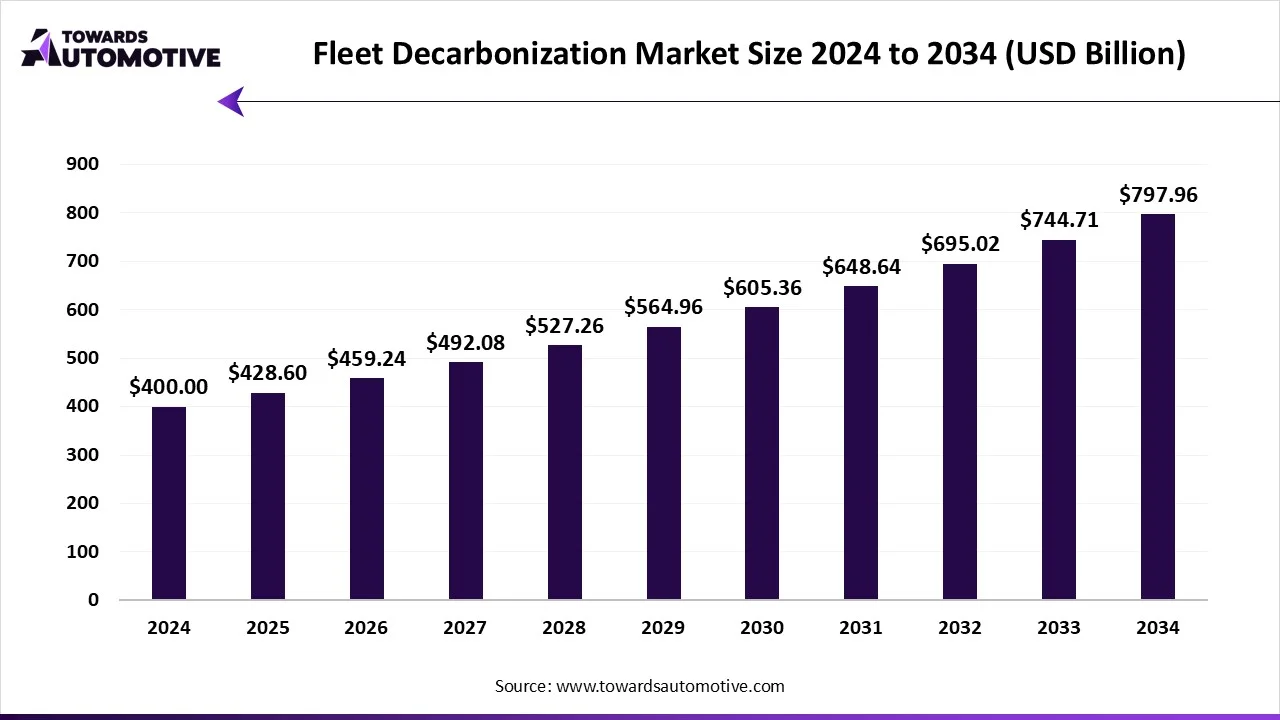

The fleet decarbonization market is projected to reach USD 797.96 billion by 2034, expanding from USD 428.6 billion in 2025, at an annual growth rate of 7.15% during the forecast period from 2025 to 2034. The rising focus of government for lowering CO2 emission along with technological advancements in the EV sector has boosted the market expansion.

Additionally, rapid deployment of electric buses by municipalities in urban areas coupled with growing consumer awareness related to the benefits of EVs is playing a prominent role in shaping the industrial landscape. The integration of AI and advanced telematics in fleet management platforms is expected to create ample growth opportunities for the market players in the upcoming days.

Fleet decarbonization is a process of eliminating GHG emission from vehicle fleets of any company. The fleet decarbonization industry deals in providing advanced solutions for lowering vehicular emission in different parts of the world. There are several types of services provided by this sector consisting of fleet electrification services, charging infrastructure deployment, hydrogen refueling infrastructure, fleet management & telematics, consulting & advisory services, and some others. It is designed to the needs of different types of vehicles including light commercial vehicles (LCVs), medium commercial vehicles (MCVs), heavy commercial vehicles (HCVs), buses & coaches and others.

These vehicles are based on different propulsion technologies including electric, hybrid, hydrogen, biofuel and some others. The end-user of fleet decarbonization solution comprises of logistics companies, public transportation authorities, corporates & enterprises, ride-hailing operators, leasing & rental companies and some others. This market is expected to rise significantly with the growth of the electric vehicle industry around the globe.

| Metric | Details |

| Market Size in 2025 | USD 428.6 Billion |

| Projected Market Size in 2034 | USD 797.96 Billion |

| CAGR (2025 - 2034) | 7.15% |

| Leading Region | North America |

| Market Segmentation | By Propulsion Type, By Vehicle Type, By Service, By Application, By End User and By Region |

| Top Key Players | Tesla Inc., BYD Company Limited, Volvo Group, Daimler Truck / Mercedes-Benz Trucks, Blink Charging, Rivian Automotive Inc., Nikola Corporation, Arrival (electric bus / van maker) |

The major trends in this market consists of partnerships, government initiatives, expansion of the EV charging network, joint ventures and rise in number of EV fleets.

| Scheme | Objective |

| PM E-Drive scheme | In May 2025, the Indian government launched the PM E-Drive scheme. Under this scheme, the Indian government is expected to install more than 72000 public EV charging stations in the country by the end of 2026. |

| Plan for Charge | In July 2025, the UK government launched Plan for Change. Plan for Change initiative is aimed at investing 63 million euros for developing the EV charging infrastructure across this nation. |

| Responsibility for Germany | In June 2025, the German government launched an initiative named ‘Responsibility for Germany’. Under this scheme, the government is likely to invest a huge capital for developing the EV industry in Germany. |

| California Electric Vehicle Infrastructure Project (CALeVIP) | In August 2025, the California government launched CALeVIP. CALeVIP is a government initiative through which an investment of around US$ 55 million will be done for developing the EV charging infrastructure across the U.S. |

| Abu Dhabi Mobility | In May 2025, the UAE government launched the Abu Dhabi Mobility Initiative. Under this scheme, the government of UAE is expected to install more than 1,000 new charging points at 400 locations across this Abu Dhabi. |

The battery electric vehicles (BEVs) segment dominated the fleet decarbonization market with a share of around 45%. The sales of BEVs has grown significantly in numerous developed nations such as the U.S. Germany, UK, Canada, Norway and some others has driven the market expansion. Additionally, rapid investment by government for strengthening the EV charging infrastructure coupled with rise in number of EV startups in developing countries is playing a prominent role in shaping the industrial landscape. Moreover, partnerships among battery manufacturers and automotive brands for developing high-quality EV batteries is expected to foster the growth of the fleet decarbonization market.

The hydrogen fuel cell vehicles (FCEVs) segment is expected to grow with the highest CAGR during the forecast period. The increasing adoption of FCEV trucks in numerous sectors such as mining, logistics, waste management and some others has driven the market growth. Additionally, rapid investment by automotive brands for advancing research activities related to hydrogen fuel cell vehicles is playing a positive role in shaping the industrial landscape. Moreover, numerous government initiatives aimed at developing the hydrogen refueling infrastructure is expected to propel the growth of the fleet decarbonization market.

The light commercial vehicles (LCVs) segment dominated the fleet decarbonization market with a share of around 40%. The growing sales of light commercial vehicles in several countries such as Germany, the U.S., China, UAE and some others has boosted the market expansion. Additionally, the rising adoption of LCEVs in various industries such as textile, food and beverage, packaging, pharmaceuticals and some others for lowering emission is playing a prominent role in shaping the industrial landscape. Moreover, rapid investment by several automotive brands such as Tata Motors, Jupiter Electric, Switch Mobility, Omega Seiki Mobility, Euler Motors and some others is expected to boost the growth of the fleet decarbonization market.

The buses & coaches segment is expected to rise with the fastest CAGR during the forecast period. The growing adoption of electric coaches by fleet operators for gaining maximum profits has driven the market expansion. Also, rapid investment by government of several countries such as India, Mexico, Germany, Canada for deploying electric buses in urban areas is contributing to the industry in a positive manner. Moreover, partnerships among bus operators and automotive brands for designing electric buses for delivering sustainable transportation solution is expected to proliferate the growth of the fleet decarbonization market.

The fleet electrification services segment led the fleet decarbonization market with a share of around 35%. The rising adoption of electric vans by fleet operators to provide sustainable transportation to passengers has boosted the market expansion. Additionally, rapid deployment of electric buses by private operators in developed nations to lower vehicular emission is playing a prominent role in shaping the industrial landscape. Moreover, partnerships among automotive manufacturers and truck fleet providers to deploy electric trucks in numerous industries such as mining, logistics, construction and some others is expected to foster the growth of the fleet decarbonization market.

The charging infrastructure deployment segment is expected to expand with the fastest CAGR during the forecast period. The growing emphasis of EV charging providers for constructing new charging stations in remote areas has boosted the market expansion. Also, numerous government initiatives aimed at developing the EV charging infrastructure is contributing to the industry in a positive manner. Moreover, rapid investment by prominent automotive brands such as Tesla, Mercedes, Tata Motors and some others for expanding the EV charging network is expected to foster the growth of the fleet decarbonization market.

The logistics & transportation segment dominated the fleet decarbonization market with a share of around 50%. The growing adoption of electric vehicles in the logistics sector for lowering vehicular emission has boosted the market expansion. Additionally, numerous government initiatives aimed at strengthening the logistics network coupled with rise in number of logistics startups is contributing to the industry in a positive manner. Moreover, collaborations among logistics companies and EV brands for deploying electric trucks in the logistics sector is expected to propel the growth of the fleet decarbonization market.

The public transit segment is expected to grow with the highest CAGR during the forecast period. The rising demand for eco-friendly vehicles from fleet operators to deliver sustainable transportation solutions in urban areas has boosted the market growth. Also, numerous government initiatives aimed at deploying electric buses in developed nations is playing a crucial role in shaping the industrial landscape. Moreover, joint ventures among automotive companies and public transit operators to deploy hybrid buses is expected to boost the growth of the fleet decarbonization market.

The logistics companies segment held the largest share of the fleet decarbonization market. The growing adoption of electric trucks in the logistics sector for lowering emission has driven the market expansion. Also, the rising use of LCEVs in mid-sized logistics enterprises coupled with rapid investment by government for developing the road infrastructure is playing a prominent role in shaping the industrial landscape. Moreover, collaborations among logistics providers and automotive companies for deploying electric vehicles for transporting goods is expected to drive the growth of the fleet decarbonization market.

The public transportation authorities segment is expected to rise with the fastest CAGR during the forecast period. The growing sales of electric buses in developed nations such as UK, the U.S., China, Germany, Canada and some others has driven the market growth. Also, rapid investment by municipal corporations for deploying hybrid buses in urban areas for lowering vehicular emission is contributing to the industry in a positive manner. Moreover, partnerships among transportation authorities and bus manufacturers to deploy electric buses in public fleets is expected to propel the growth of the fleet decarbonization market.

North America led the fleet decarbonization market with a share of around 35%. The growing sales of BEVs in the U.S. and Canada has driven the market growth. Additionally, numerous government initiatives aimed at enhancing fleet decarbonization coupled with rapid investment by EV charging providers for opening up new charging centers is playing a crucial role in shaping the industry in a positive direction. Moreover, the presence of various market players such as Rivian Automotive Inc., Tesla Inc., Proterra Inc and some others is expected to boost the growth of the fleet decarbonization market in this region.

U.S. is the major contributor in this region. The increasing adoption of PHEVs along with rapid investment by government for developing the EV charging infrastructure has boosted the market expansion. Also, the presence of various EV companies such as Tesla, Rivian, Ford, General Motors and some others is contributing to the industry in a positive manner.

Asia Pacific is expected to rise with the fastest CAGR during the forecast period. The increasing adoption of electric vehicles in numerous countries such as India, China, Japan, South Korea, Australia and some others for reducing vehicular emission has boosted the market expansion. Also, the rising government initiatives aimed at developing the EV sector coupled with rise in number of EV startups has created positive impact in the industry. Moreover, the presence of several market players such as BYD, Hitachi, Asuene APAC and some others is expected to drive the growth of the fleet decarbonization market in this region.

China and Japan are the prominent contributors in this region. In China, the market is generally driven by the growing focus of automotive brands for developing electric vehicles coupled with rapid investment by government for expanding the EV charging network. In Japan, the increasing adoption of electric trucks by logistics operators for lowering emission along with rising emphasis of automotive brands for opening up new production facilities is playing a vital role in shaping the industrial landscape.

Europe held a considerable share of the fleet decarbonization industry. The growing sales of luxury EVs in several countries such as Germany, Italy, France, UK and some others has boosted the market growth. Additionally, rapid investment by automotive brands for opening new EV production plants coupled with various government initiatives aimed at developing the EV charging network is playing a prominent role in shaping the industrial landscape. Moreover, the presence of numerous market players such as Siemens AG, ABB Ltd., Alstom SA and some others is expected to foster the growth of the fleet decarbonization market in this region.

| June 2025 | Announcement |

| Kasia Chodurek, director of business development at Aegis Energy | If we look at the history of the logistics industry, trailblazers have always played an important role in propelling it forward – from the earliest adopters of telematics to the first fleets to embrace automation. Today, we’re at another inflexion point. We need bold operators excited about leading the way in the transition to zero-emission transport. |

| May 2025 | Announcement |

| Angus Webb, the CEO of Dynamon |

We speak to fleets and often they say they want to put in place a plan for electric and other alternative fuels, but trying to find the budget for doing this is incredibly difficult. They need to speak to vehicle manufacturers, lease companies, charging providers and other stakeholders, then pull all the information into an actionable strategy. Identifying exactly how much this might cost, and pitching this to senior management, is not easy. It’s holding back decarbonisation for many, many fleets. Even once the project has been approved, there is pressure to show a return on investment and get results that can be enacted there and then. Otherwise, the process just starts all over again, or gets shelved for a few years. One of the strengths of this pricing model is that fleets can run this report on a regular basis. In the decarbonisation sector, things are changing all the time. It might be that the Decarbonisation Planning Report shows in 2025 that certain parts of the fleet are not ready for the transition. |

| April 2025 | Announcement |

| Mike Nugent, the Chief Revenue Officer at Hitachi ZeroCarbon | Our customers often don’t know where to begin, so we’ve created a seamless, people-focused offering that removes complexity and capital barriers, by integrating strategy, charge management and battery optimisation, we help businesses unlock real operational value from electrification. |

| January 2025 | Announcement |

| Jean-Marc Gales, the CEO of Wrightbus | Wrightbus has been flying the flag for zero emissions long before anyone else. Our hydrogen double-decker was the world’s first, and we have 1,700 electric buses on the road… we want to be a global mobility business, and to do this, we need to broaden our product portfolio. The quickest way to decarbonise truck and bus fleets is to electrify immediately. |

| May 2025 | Announcement |

| Faizan Ahmad, director of decarbonisation at First Bus | Sharing depot infrastructure unlocks enormous potential for commercial fleets, accelerating the shift to zero-emission transport while making smarter use of existing assets. First Bus are proud to have been pioneers in this space and further innovation and collaboration, as showcased here by our partnership with Paua, are key to building a truly integrated, low-carbon transport network. |

| April 2025 | Announcement |

| Gian Luca Erbacci, the President of Alstom Europe | The new electric interregional Coradia Stream trains for Bulgaria will contribute to more modern and sustainable transportation in the country – in line with our ambition to lead the way towards greener and smarter mobility worldwide. |

The fleet decarbonization market is a rapidly developing industry with the presence of several dominating players. Some of the prominent companies in this industry consists of Tesla Inc., BYD Company Limited, Nikola Corporation, Proterra Inc., Rivian Automotive Inc., ChargePoint Inc., Cummins Inc., Ballard Power Systems Inc., ABB Ltd., Siemens AG, Schneider Electric SE, Eaton Corporation plc, GreenPower Motor Company Inc., Enel X, Alstom SA and some others. These companies are constantly engaged in developing emission free vehicles and adopting numerous strategies such as collaborations, launches, business expansions, joint ventures, acquisitions, partnerships and some others to maintain their dominance in this industry.

Tier 1

Tier 2

Tier 3

By Propulsion Type

By Vehicle Type

By Service

By Application

By End User

By Region

October 2025

October 2025

October 2025

October 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us