Halal Logistics Market Strategic Analysis & Growth Opportunities

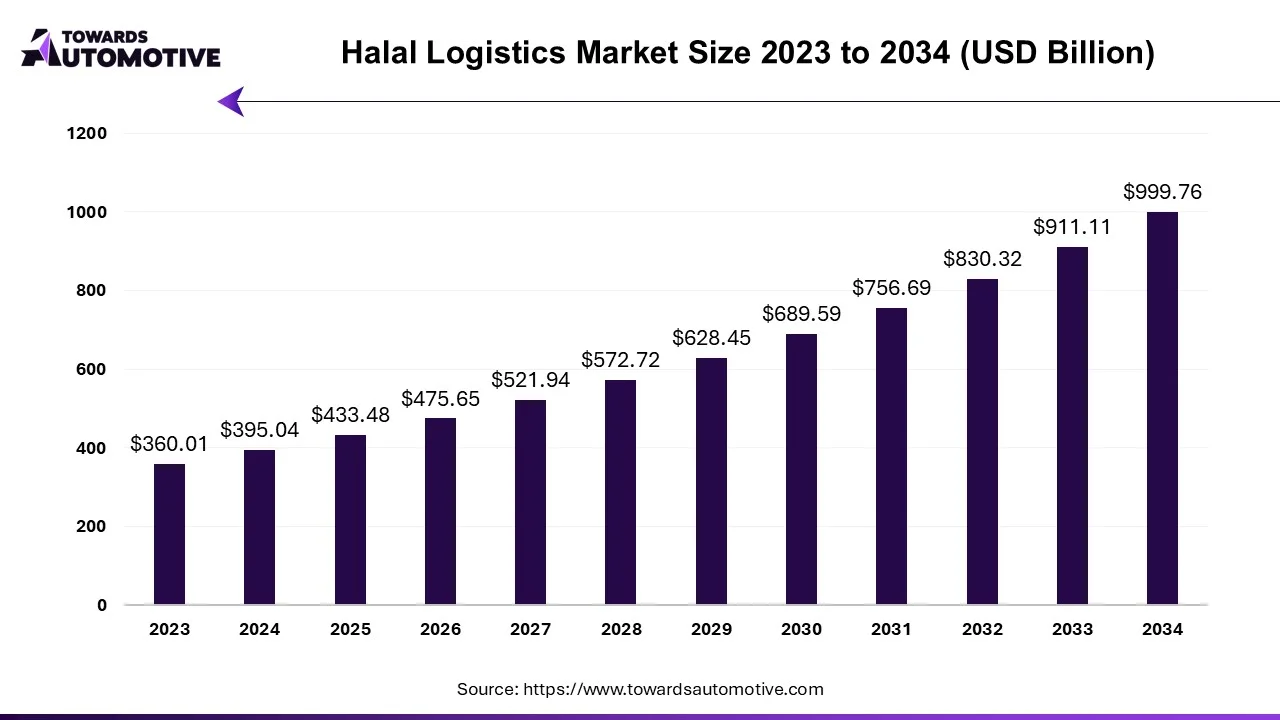

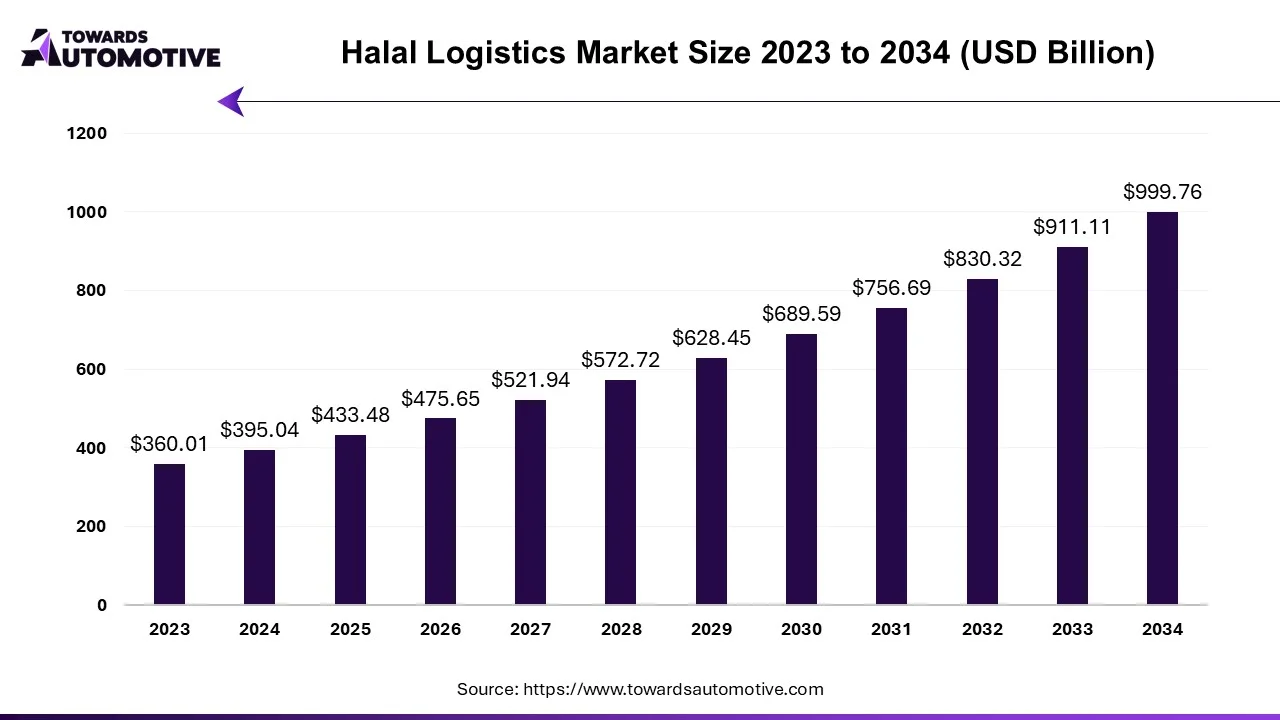

The halal logistics market is forecast to grow at a CAGR of 9.73%, from USD 433.48 billion in 2025 to USD 999.76 billion by 2034, over the forecast period from 2025 to 2034.

Introduction

The halal logistics market is an important segment of the logistics industry. This industry deals in providing logistics services for transporting halal products across the world. There are various components of this industry comprising of storage, transportation, monitoring components, software and services. These services are used by several end-user industries consisting of food and beverages, pharmaceuticals and nutraceuticals, cosmetic/personal care, chemicals and some others. The growth of the food and beverage industry around the world has contributed to the industrial expansion. This market is expected to rise significantly with the growth of the e-commerce industry around the globe.

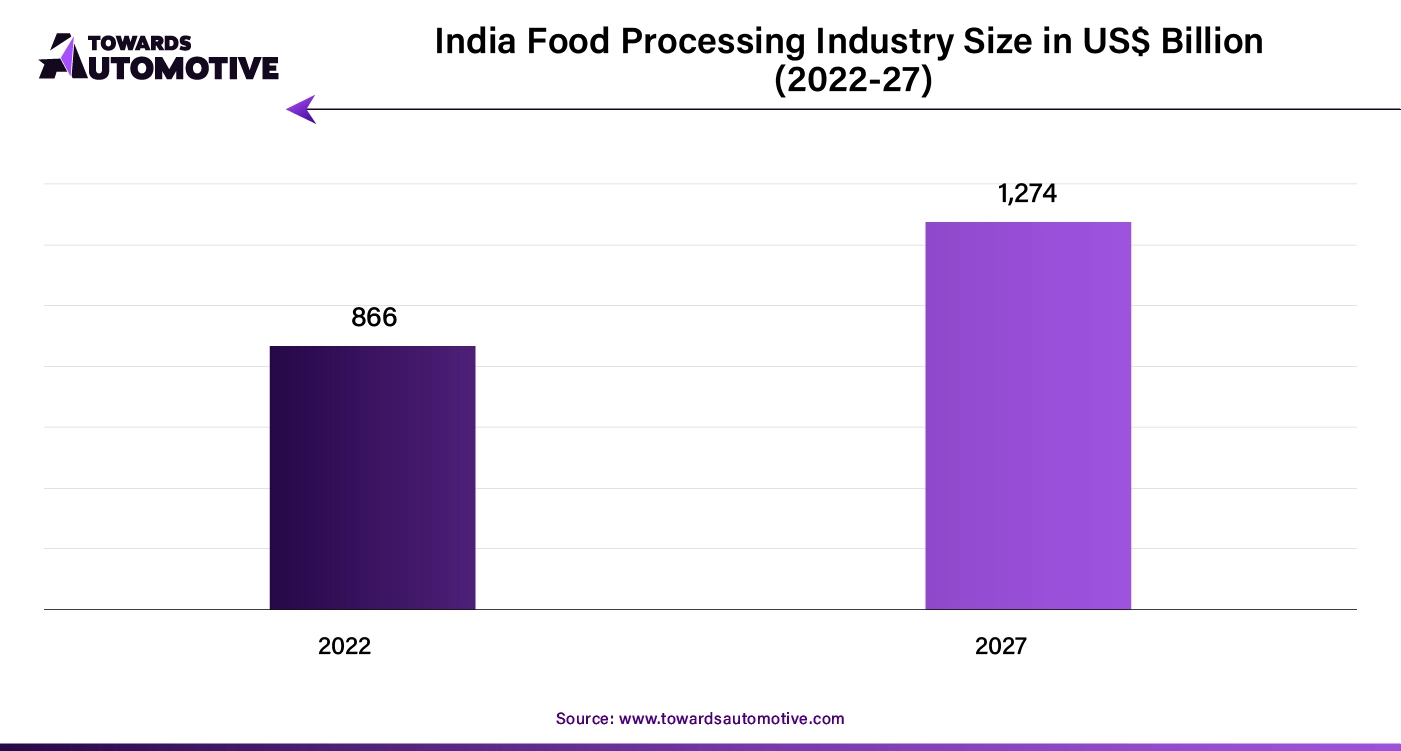

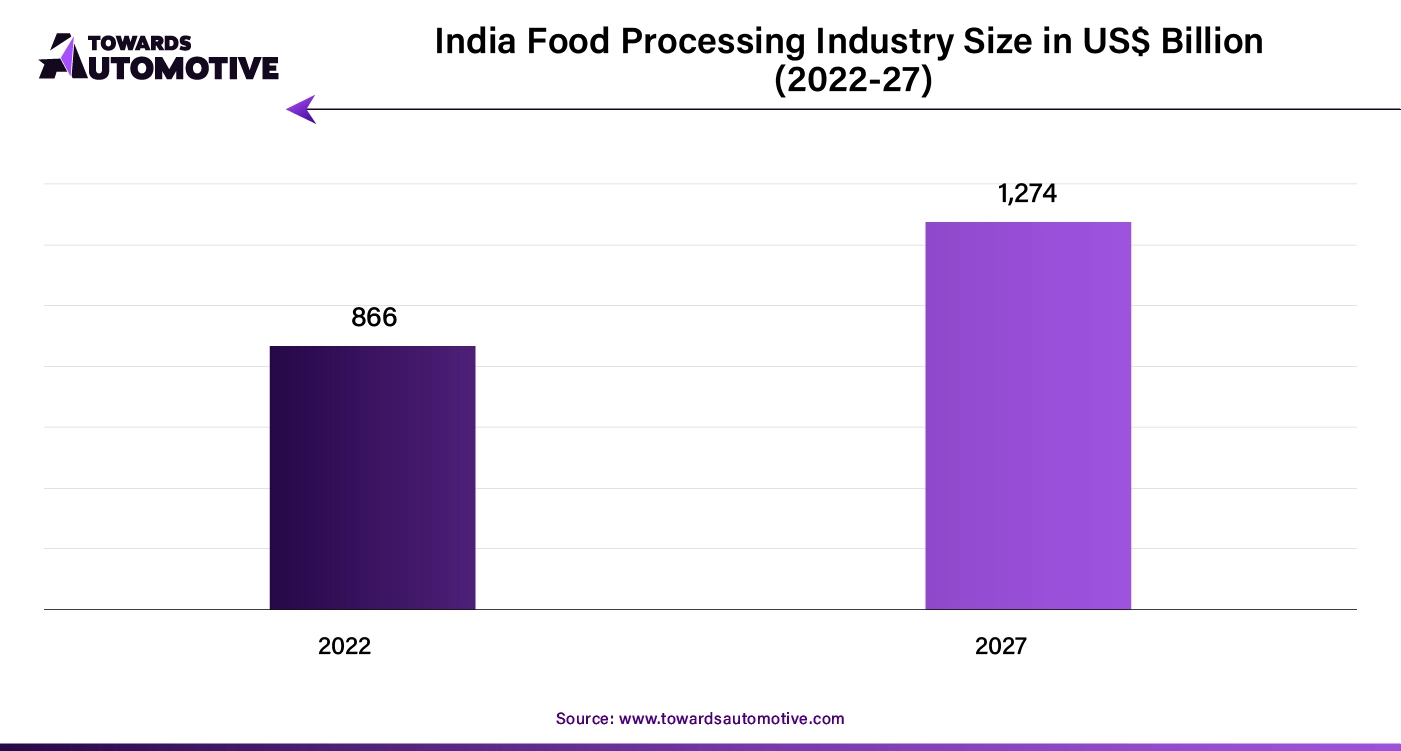

- According to the India Brand Equity Foundation, the India food processing industry size in 2022 was valued at US$ 866 billion in 2022 that is projected to reach US$ 1274 by 2027.

Highlights of the Halal Logistics Market

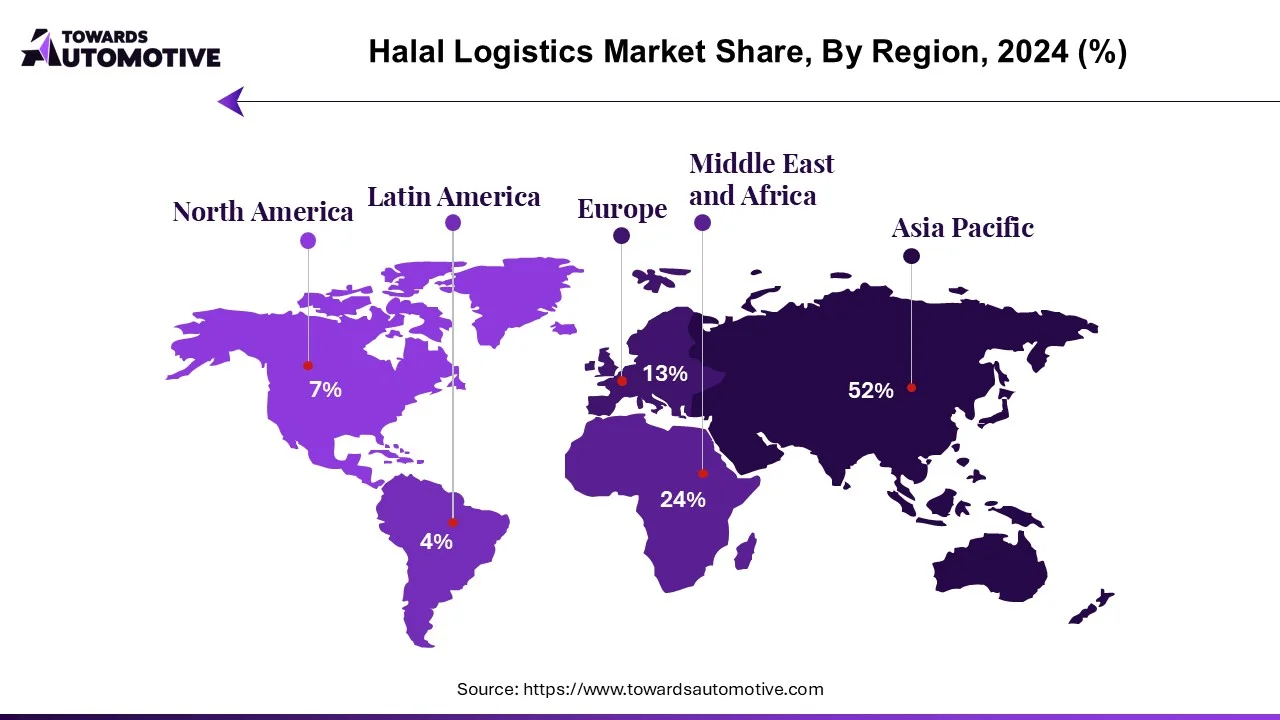

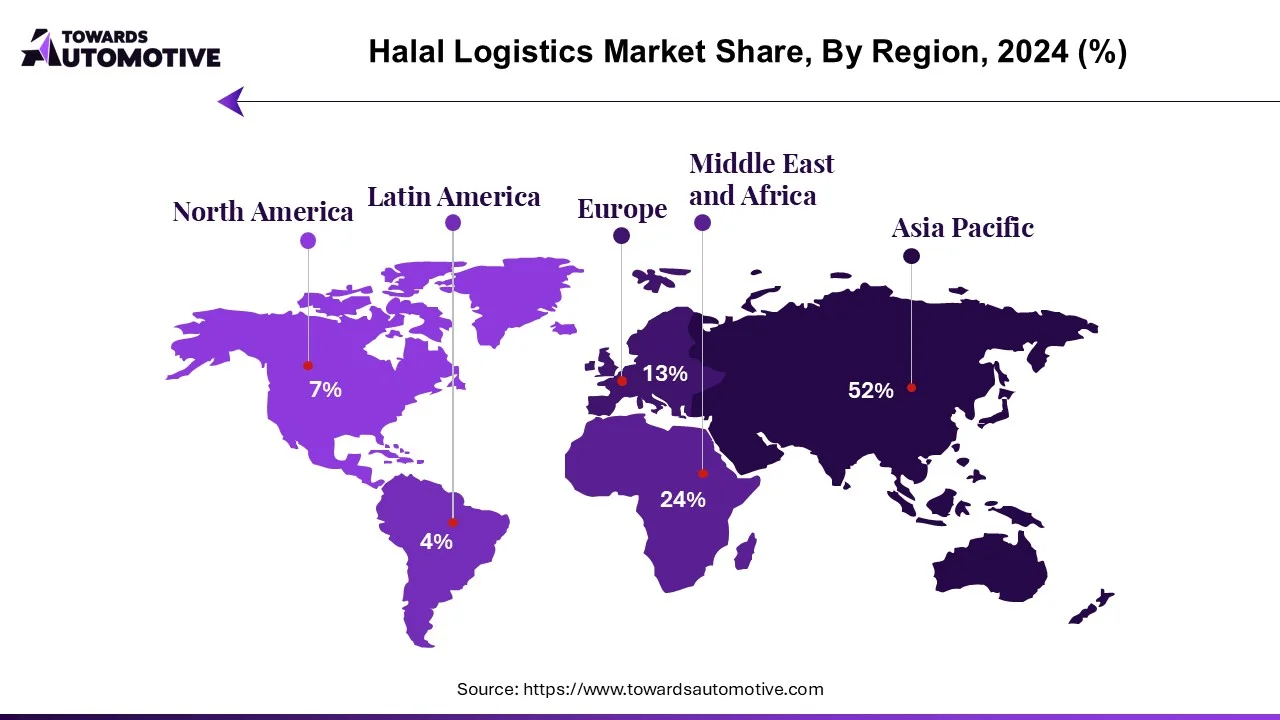

- Asia Pacific held a dominant share of the halal logistics market due to the rising Islamic population in this region.

- The Middle East and Africa is expected to grow with a significant CAGR due to several government initiatives aimed at strengthening the logistics sector in this region.

- The storage segment dominated the market due to the growing emphasis on separating halal and non-halal items.

- The food and beverages segment led the market due to the increasing demand for processed food among the people.

- According to the American Halal Foundation, the global halal market is expected to reach US$ 10 trillion in 2030.

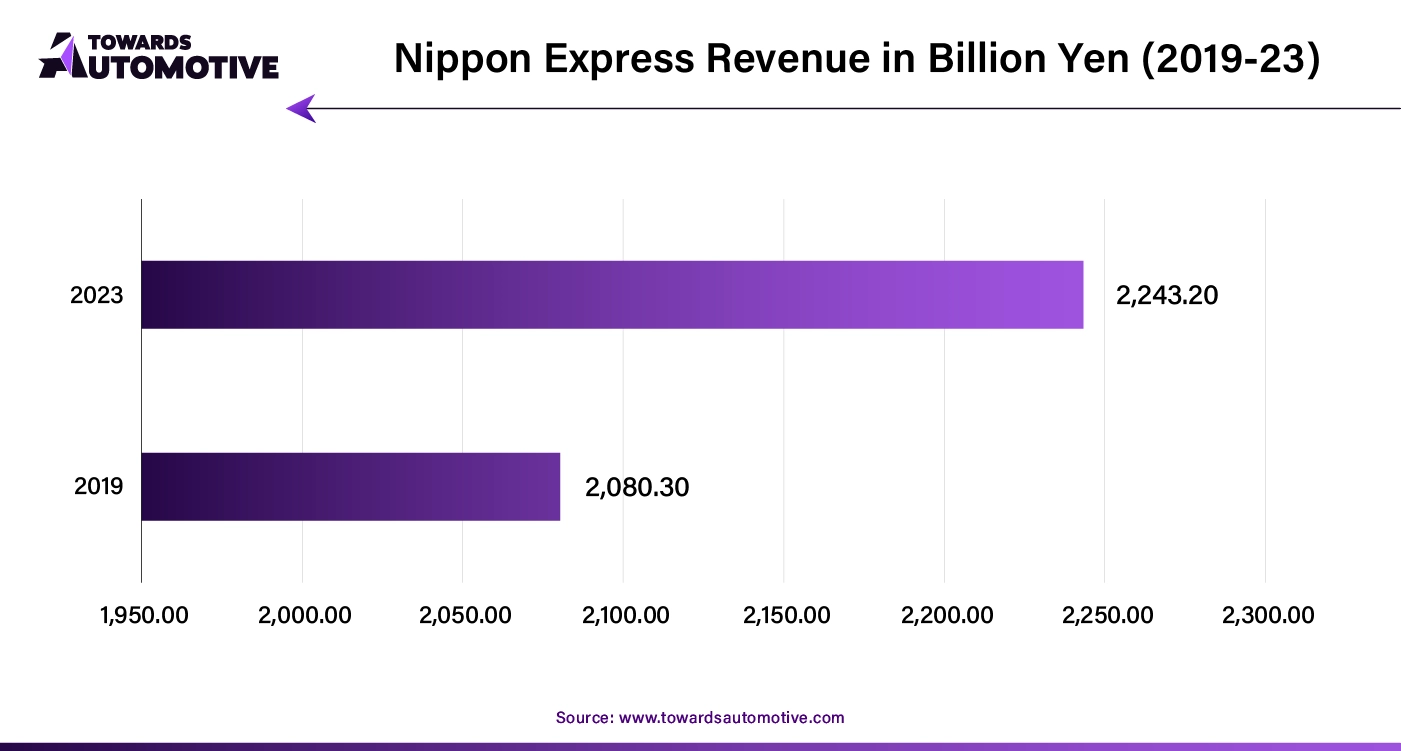

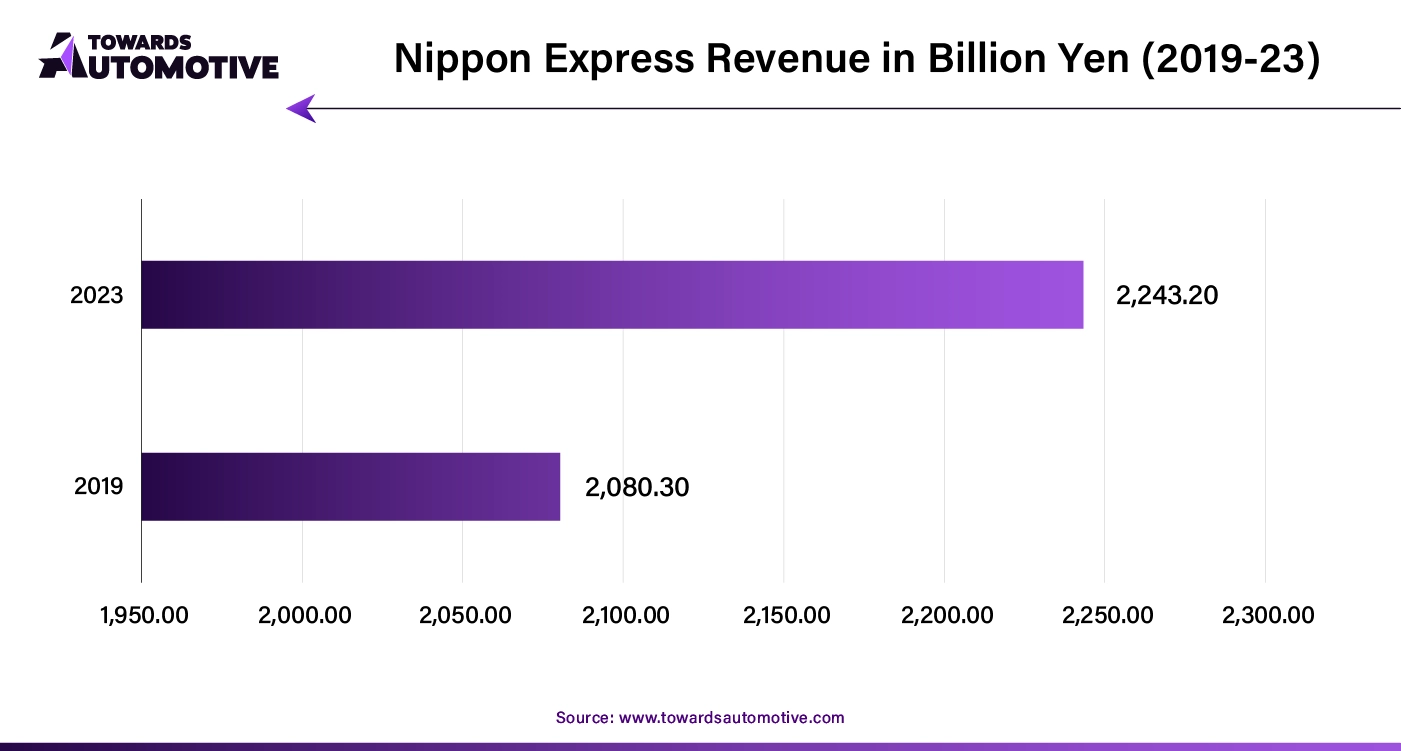

- Several logistics companies are collaborating among themselves to provide superior halal logistics services across the world. For instance, in September 2024, Nippon Expressway announced partnership with Halal Development Corporation Berhad (HDC). This partnership is aimed at boosting the halal logistics sector across Malaysia.

- According to the IDEAS organization, the global halal industry size is projected to reach US$ 528.2 billion by 2033.

- Government of several countries are announcing new rules for certifying halal-based products. For instance, in October 2024, the government of India announced new halal meat export guidelines. This new regulation is aimed at exporting halal products in several countries including Oman, Qatar, Bahrain, UAE, Saudi Arabia, Bangladesh and some others.

Industry Leader Announcement

In September 2024, Irfan Hakim, the CEO of PT Helo Logistics announced that,” As the world’s largest Muslim country in view of population, Indonesia has a great opportunity to become the centre of the global halal industry, Our services have been designed to meet the needs of our partners comprehensively, with comprehensive management to ensure fast, safe, and halal-compliant distribution.”

Competitive Landscape

The halal logistics market is a developing industry with the presence of several dominating players. Some of the prominent companies in this industry consists of Nippon Express Holdings, TIBA, MABKARGO SDN BHD, YUSEN LOGISTICS CO., LTD., TASCO, Kontena Nasional Berhad, SEJUNG SHIPPING CO., LTD. and some others. These market players are continuously engaged in providing logistics services for transporting halal items and adopting several strategies such as launches, collaborations, partnerships and some others to sustain their position in this industry.

- According to the annual report of Nippon Express, the annual revenue of the company in 2019 was 2080.3 billion yen that rose to 2243.20 billion yen in 2023.

Market Segmentations

By Component

- Storage

- Transportation

- Maritime Logistics

- Air Logistics

- Land Logistics

- Monitoring Components

- Hardware

- Sensors

- RFID Devices

- Telematics

- Networking Devices

- Software

- Services

- Installation and Integration

- Support and Maintenance

By End-use

- Food and Beverages

- Pharmaceuticals and Nutraceuticals

- Cosmetic/Personal Care

- Chemicals

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa