September 2025

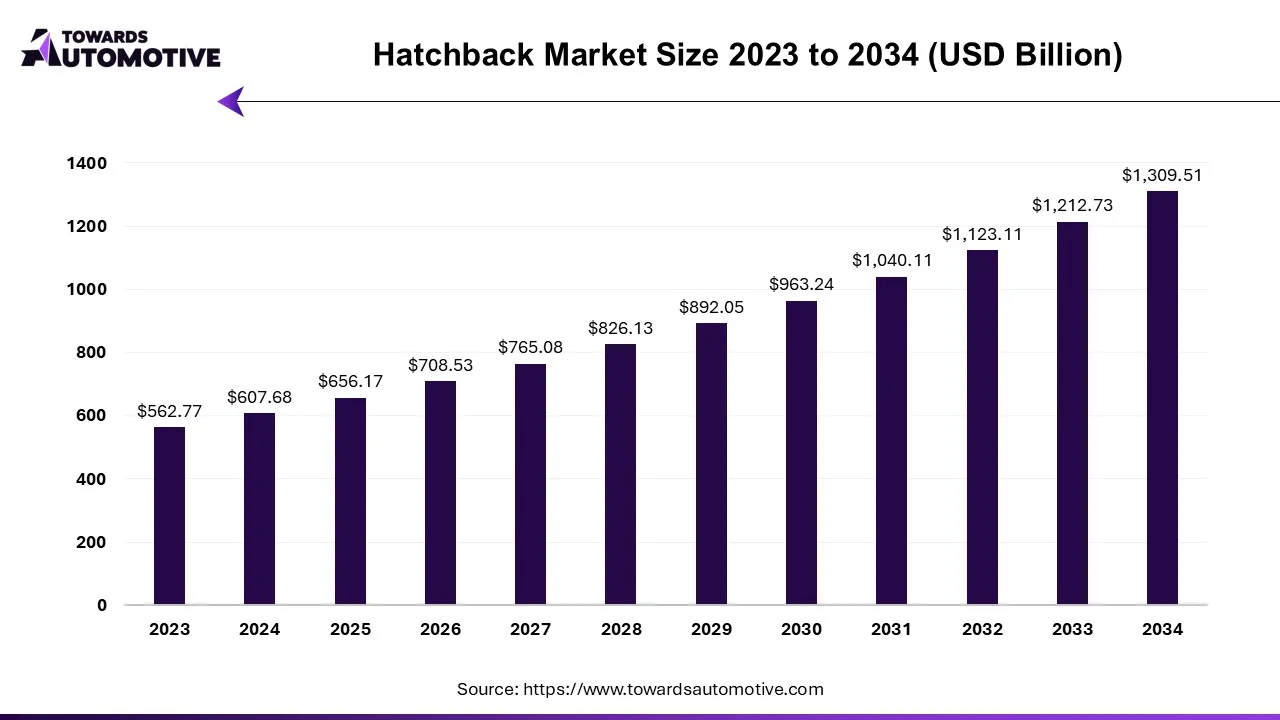

The hatchback market is expected to increase from USD 656.17 billion in 2025 to USD 1,309.51 billion by 2034, growing at a CAGR of 7.98% throughout the forecast period from 2025 to 2034. The growing demand for affordable vehicles in low-income countries along with rapid investment by EV companies to manufacture mid-ranged hatchbacks has contributed to the market expansion.

Additionally, the increasing sales of hatchbacks in India and South Korea coupled with superior mileage and enhanced performance delivered by these cars is playing a vital role in shaping the industrial landscape. The research and development activities related to solid-state batteries is expected to create ample growth opportunities for the market players in the future.

Unlock Infinite Advantages: Subscribe to Annual Membership

The hatchback market is a prominent sector of the automotive industry. This industry deals in manufacturing and distribution of hatchbacks around the world. There are different types of vehicles manufactured in this sector comprising of subcompact hatchbacks, compact hatchbacks, full-size hatchbacks and some others. These cars are powered using numerous types of fuels including petrol, diesel, hybrid and electric. It comes in various types of styling consisting of sports, luxury and economy. This market is expected to rise significantly with the growth of the EV sector in different parts of the globe.

| Metric | Details |

| Market Size in 2024 | USD 607.68 Billion |

| Projected Market Size in 2034 | USD 1,309.51 Billion |

| CAGR (2025 - 2034) | 7.98% |

| Leading Region | Asia Pacific |

| Market Segmentation | By Hatchback, By Fuel, By Style and By Region |

| Top Key Players | Honda, Hyundai, Chevrolet, Ford, Kia, Mitsubishi, Nissan, Stellantis, Toyota, Volkswagen |

The major trends in this market consists of business expansion, partnerships and EV adoption.

Several market players have started investing heavily for expanding the manufacturing output of hatchbacks in different parts of the world. For instance, in April 2025, Vinfast announced to open a new EV plant in Tamil Nadu, India. This new production facility is inaugurated to manufacture around 150000 EVs every year. (Source: Caronphone)

Numerous car manufacturers are partnering with each other to develop high-performance hatchbacks to cater the needs of the driving enthusiasts. For instance, in January 2025, Rivian partnered with Volkswagen. This partnership aims at developing a wide range of EVs in the upcoming future. (Source: electrek)

The adoption of EV has increased rapidly in various developed nations due to favorable government initiatives and increasing awareness to reduce emission. According to the Our World in Data, around 92% cars sold in Norway during 2024 were EVs.

(Source: Our World in Data)

The compact segment dominated the market. The demand for compact cars in urban areas has increased rapidly, thereby driving the market expansion. Additionally, the rising interest of consumers to purchase compact hatchbacks that delivers high-fuel efficiency and superior performance is playing a vital role in shaping the industrial landscape. Moreover, continuous research and development activities related to designing of compact hatchbacks is expected to drive the growth of the hatchback market.

The full-size segment is expected to expand with a significant CAGR during the forecast period. The growing demand for full-sized hatchbacks from the elite-class consumers has boosted the market expansion. Also, integration of advanced technologies such as AI, IoT, ADAS and some others is positively impacting the industrial growth. Moreover, the increasing for high-performance full-sized hatchbacks from the racers is expected to propel the growth of the hatchback market.

The petrol segment held the largest share of the hatchback market. The growing sales of petrol-based hatchbacks in India due to its versality and superior mileage has boosted the market expansion. Additionally, lack of EV charging networks in developing nations coupled with less maintenance associated with petrol vehicles is playing a vital role in shaping the industrial landscape. Moreover, constant efforts made by automotive companies to launch affordable hatchbacks is expected to proliferate the growth of the hatchback market.

The electric segment is expected to rise with the fastest CAGR during the forecast period. The growing demand for EVs in different parts of the world due to increasing emphasis on reducing vehicular emission has boosted the market expansion. Additionally, numerous government initiatives aimed at developing the EV charging infrastructure coupled with rapid adoption of electric hatchbacks by ride-sharing companies is contributing to the industrial growth. Moreover, rise in number of EV startups in prominent countries such as India, Vietnam, Indonesia and some others along with technological advancements in EV powertrains is expected to boost the growth of the hatchback market.

Asia Pacific led the hatchback market. The growing demand for hatchbacks in several countries such as India, China, South Korea and Japan has boosted the market expansion. Additionally, rapid investment by government for developing the EV charging infrastructure coupled with rising disposable income of the people is playing a vital role in shaping the industrial landscape. Moreover, the presence of several market players such as BYD, Mitsubishi, Maruti Suzuki, Hyundai and some others is expected to boost the growth of the hatchback market in this region.

North America is expected to expand with a significant CAGR during the forecast period. The rising demand for electric hatchbacks in the U.S. and Canada has driven the market growth. Also, numerous government initiatives aimed at rising awareness about EVs along with integration of advanced technologies such as AI and IoT in modern hatchbacks is contributing to the industrial expansion. Moreover, the presence of numerous hatchback manufacturers such as General Motors, Ford, Buick and some others is expected to propel the growth of the hatchback market in this region.

The hatchback market is a highly fragmented industry with the presence of several dominating players. Some of the prominent companies in this industry consists of Honda, Hyundai, Chevrolet, Ford, Kia, Mitsubishi, Nissan, Stellantis, Toyota, Volkswagen and some others. These companies are constantly engaged in developing hatchbacks and adopting numerous strategies such as business expansions, acquisitions, joint ventures, launches, partnerships, collaborations and some others to maintain their dominance in this industry.

By Hatchback

By Fuel

By Style

By Region

September 2025

September 2025

September 2025

September 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us