September 2025

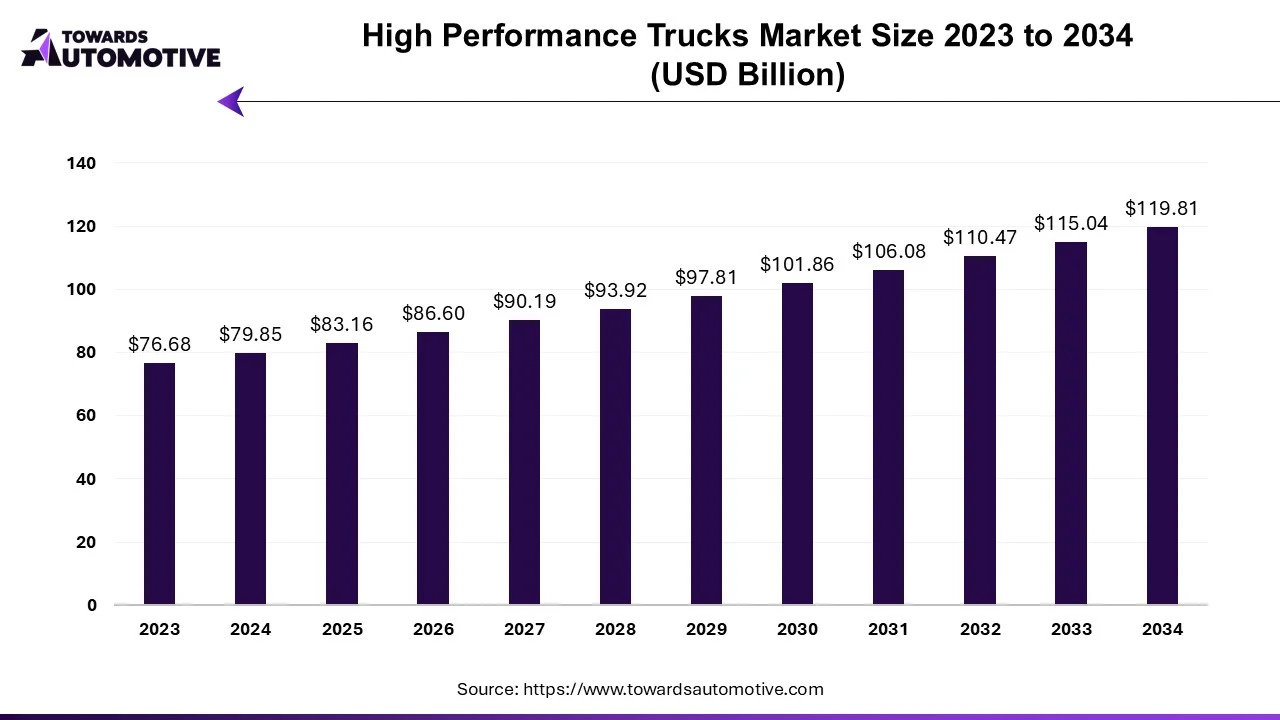

The high performance trucks market is anticipated to grow from USD 83.16 billion in 2025 to USD 119.81 billion by 2034, with a compound annual growth rate (CAGR) of 4.14% during the forecast period from 2025 to 2034.

Leading players in the automotive market, such as Ford Motor and General Motors, are introducing high-performance electric trucks to meet consumer demand. These electric trucks boast powerful electric engines and premium interior features including touch screens, leather seats, and panoramic glass.

For instance,

The expansion of infrastructure is expected to stimulate economic growth and alleviate poverty. The integration of economies on a global scale encompasses various sectors such as railways, transportation, ports, energy, and airports, necessitating the development and management of infrastructure. Consequently, the construction industry's growth has fueled demand in the truck market, particularly for vehicles supporting increased business activities.

Rivian, backed by Amazon and Ford, is a notable entrant in the electric truck market with its R1T model. Equipped with a 180-kilowatt-hour battery pack providing a 400-mile range, this 700-horsepower pickup was originally slated for release in 2020 but faced delays due to transmission issues, now set for 2021.

Meanwhile, major industry players are expanding their manufacturing facilities to accommodate the production of new electric vehicle models. For instance, Ford commenced construction of a new production facility in Dearborn, Michigan, in September 2020, aimed at manufacturing the electric F-150. The Rouge Electric Vehicle Center, with an investment of nearly $700 million, will produce both the F-150 Power Boost hybrid and the all-electric F-150. Ford's commitment extends to investing approximately $11.5 billion to introduce 10 to 15 electric models by 2022. The global push for emission standards, particularly focusing on electric vehicles, is anticipated to further drive growth in the automotive market.

In 2019, trucks comprised over 15% of total vehicle sales in the United States. Consumers seeking performance trucks prioritize factors like size and power. Moreover, there's a rising trend in the luxury truck segment within the U.S. market.

High-performance trucks continue to dominate American sales, offering reliability and encountering less competition. Despite the challenges posed by COVID-19, retailers reported robust third-quarter sales in the U.S. In line with market demand, Hyundai announced a $410 million investment in 2019 to expand its Montgomery factory. Currently producing the Santa Fe SUV, Sonata, and Elantra sedans, the plant will commence production of the Santa Cruz pickup truck in 2021.

For instance,

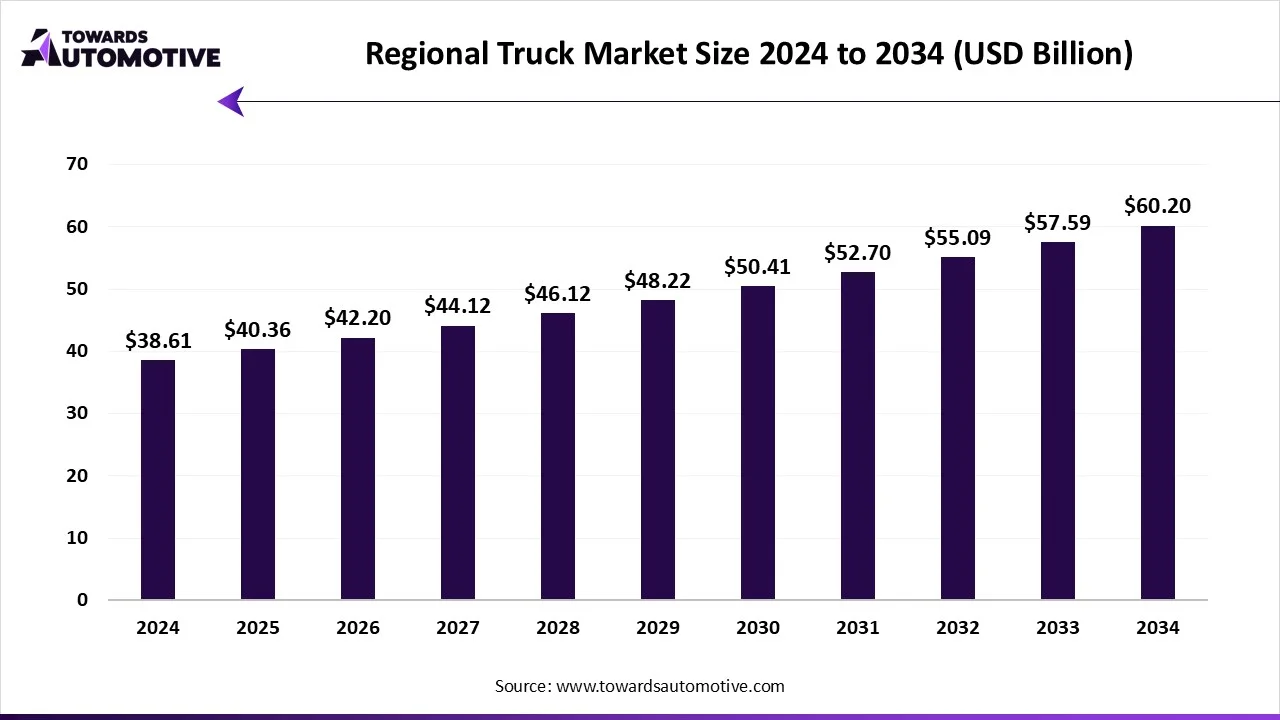

The regional truck market is forecast to grow from USD 40.36 billion in 2025 to USD 60.2 billion by 2034, driven by a CAGR of 4.53% from 2025 to 2034. The rapid growth of the e-commerce sector in developed nations such as the U.S., Canada, France, Germany and some others has increased the demand for heavy-duty trucks, thereby driving the market expansion.

Also, rapid investment by automotive brands for developing autonomous trucks coupled with technological advancements in the logistics sector is likely to shape the industry in a positive direction. The growing trend of shared freight services along with rapid integration of IoT and telematics for optimizing fleets is expected to create ample growth opportunities for the market players in the upcoming days.

The regional truck market is a prominent segment of the commercial vehicle industry. This industry deals in manufacturing and distribution of regional trucks across the world. These trucks are powered by different types of fuels consisting of diesel, natural gas, hybrid electric and some others. It is equipped with numerous types of axle configuration comprising of 4*2, 6*4, 6*6 and some others. There are several applications of these trucks including freight delivery, utility services, construction and mining and some others. The rise in number of residential constructions in different parts of the world has contributed to the industrial expansion. This market is expected to rise significantly with the growth of the automotive sector around the globe.

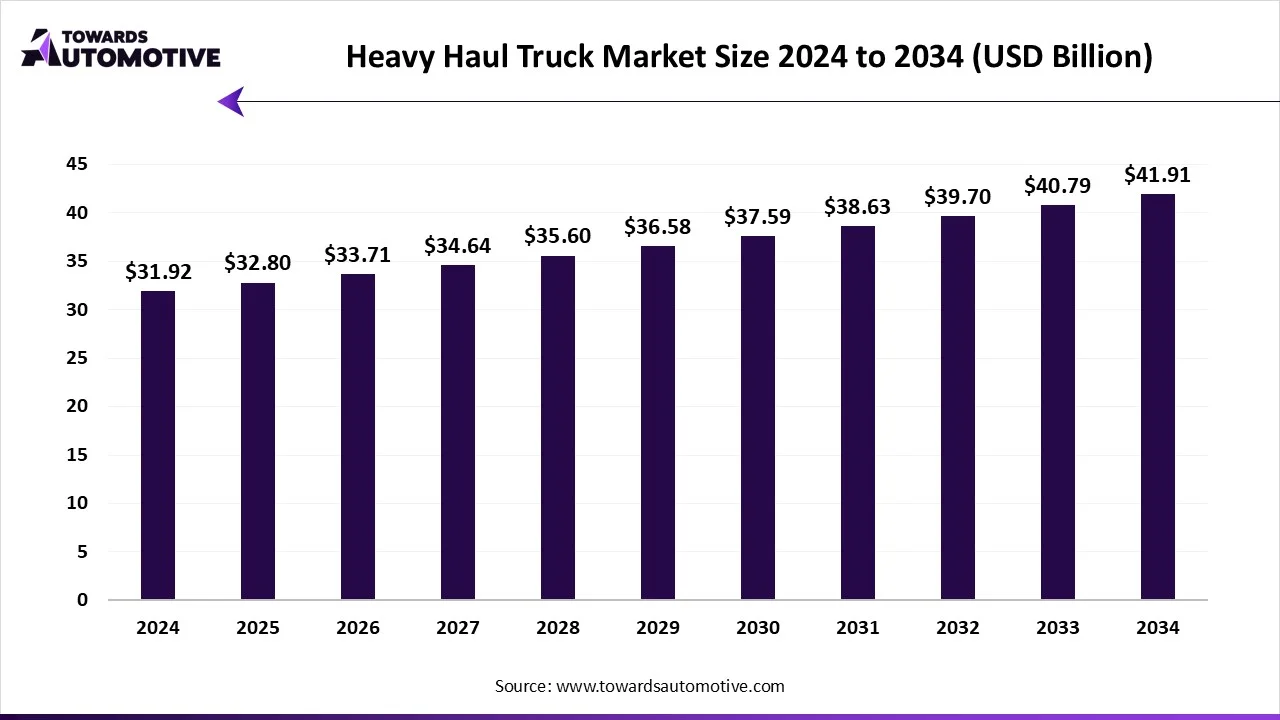

The heavy haul truck market is projected to reach USD 41.91 billion by 2034, expanding from USD 32.8 billion in 2025, at an annual growth rate of 2.77% during the forecast period from 2025 to 2034.

The heavy haul truck market is a crucial segment of the global commercial vehicle industry. These vehicles are designed to carry heavy machinery infrastructure parts and other oversized and overweight items. Construction, mining, oil, gas, and logistics are among the industries that use them the most. There is an increasing need for dependable and high-capacity haulage solutions due to the growing demand for infrastructure development, rising investments in major construction projects, and growing energy exploration activities. Advanced telematics and driver assist systems are two examples of technological advancements that are fueling market growth.

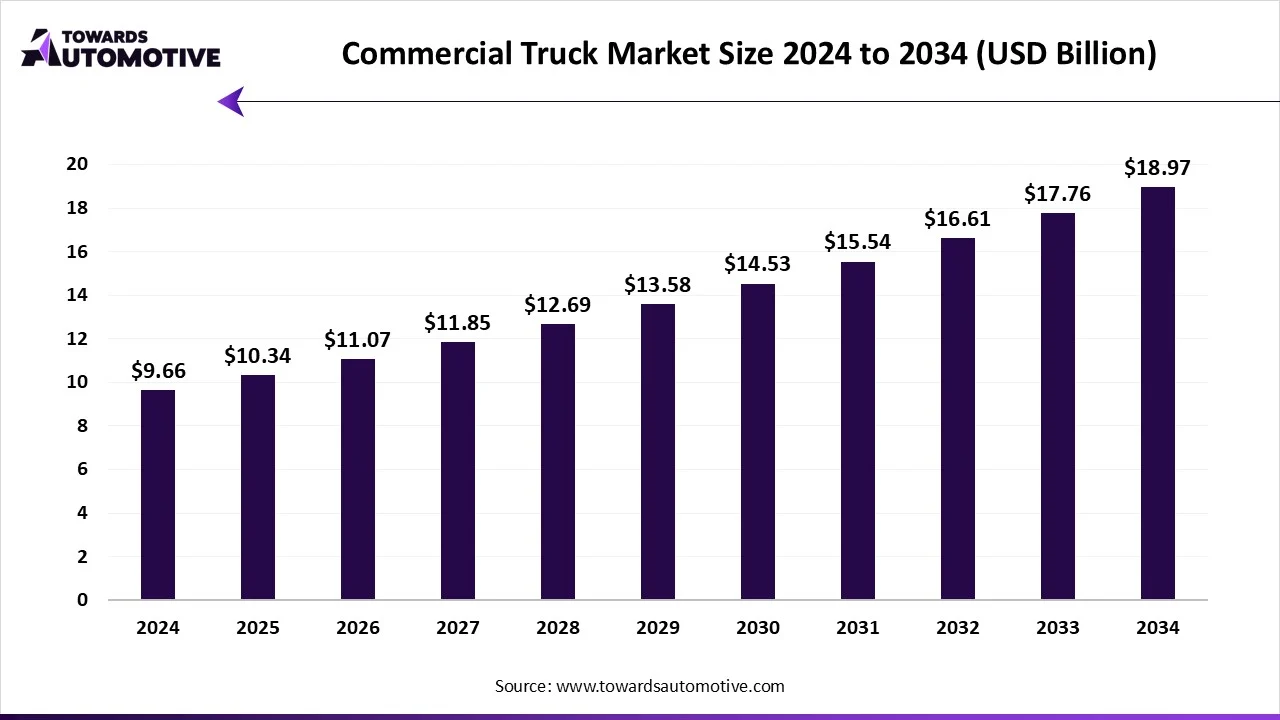

The commercial truck market is expected to increase from USD 10.34 billion in 2025 to USD 18.97 billion by 2034, growing at a CAGR of 7.03% throughout the forecast period from 2025 to 2034.

The commercial truck market is a prominent branch of the commercial vehicle industry. This industry deals in manufacturing and distribution of commercial trucks around the world. There are several types of trucks developed in this sector comprising of class 1 trucks, class 2 trucks, class 3 trucks, class 4 trucks, class 5 trucks, class 6 trucks, class 7 trucks, class 8 trucks and some others. These trucks are powered by different types of fuel consisting of diesel, natural gas, hydrogen, electric and some others. It is owned by numerous entities including fleet operator and owner operator. The commercial trucks find applications in various sectors such as freight delivery, utility services, construction & mining and some others. This market is expected to rise significantly with the growth of the automotive sector across the globe.

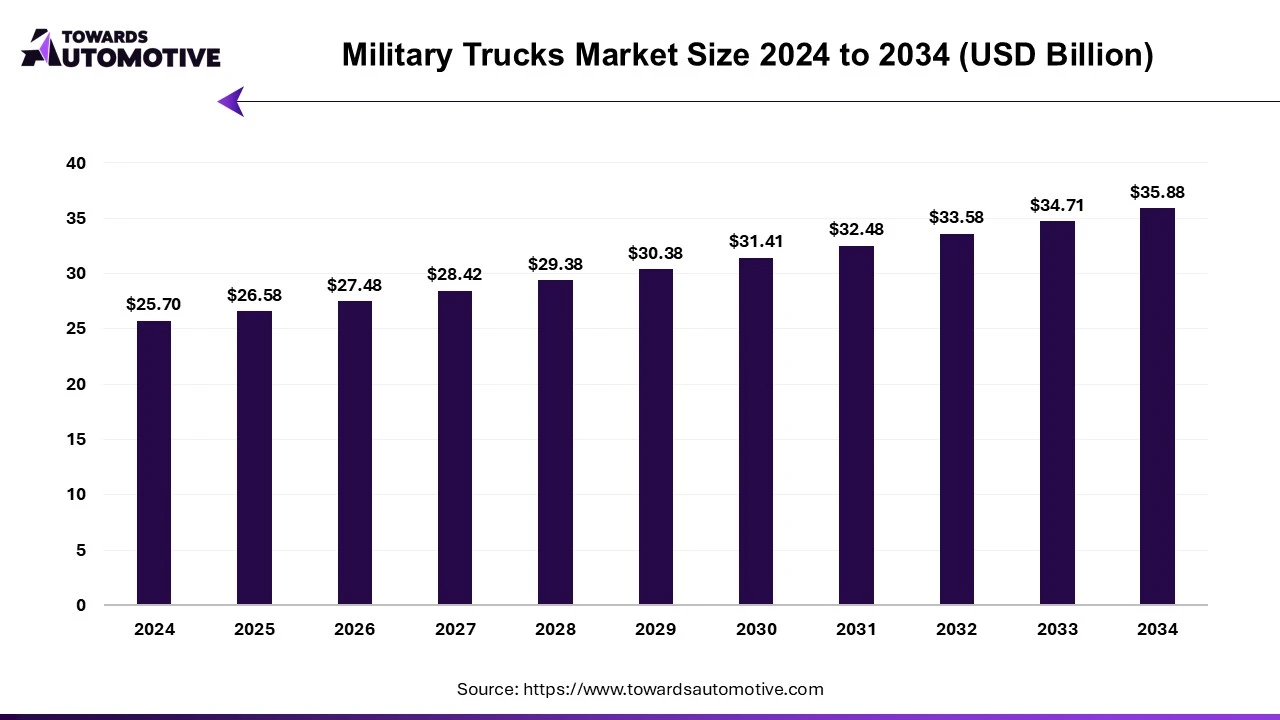

The global military trucks market size to grew to USD 26.58 billion in 2025, and is projected to reach around USD 35.88 billion by 2034. The market is expanding at a CAGR of 3.40% between 2025 and 2034.

The rising defense expenditure by government of several countries coupled with entry of new startup companies has contributed to the industrial expansion. Additionally, technological advancements in the defense sector along with rapid adoption of driverless trucks in the military sector is playing a vital role in shaping the industry in a positive direction. The research and development activities related to hybrid and electric trucks for the military sector is expected to create ample growth opportunities for the market players in the upcoming years.

The military trucks market is a crucial branch of the defense industry. This industry deals in manufacturing and distribution of military trucks in different parts of the world. There are several types of trucks developed in this sector comprising of armored trucks, cargo trucks, personnel carriers, specialized trucks and some others.

The truck market includes key players like General Motors, Ford Motor Company, Fiat Chrysler Automobiles NV, among others, both on a global and regional scale. These major players have been expanding their capacities to keep up with the growing demand.

For instance,

The high-performance trucks market report covers the current and upcoming trends with recent technological developments. The report will provide a detailed analysis of various market areas by vehicle, transmission, and propulsion type. The market share of significant high-performance truck manufacturing companies and country-level analysis will be provided in the report.

By Transmission Type

By Vehicle Type

By Propulsion Type

By Geography

September 2025

October 2025

August 2025

October 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us