October 2025

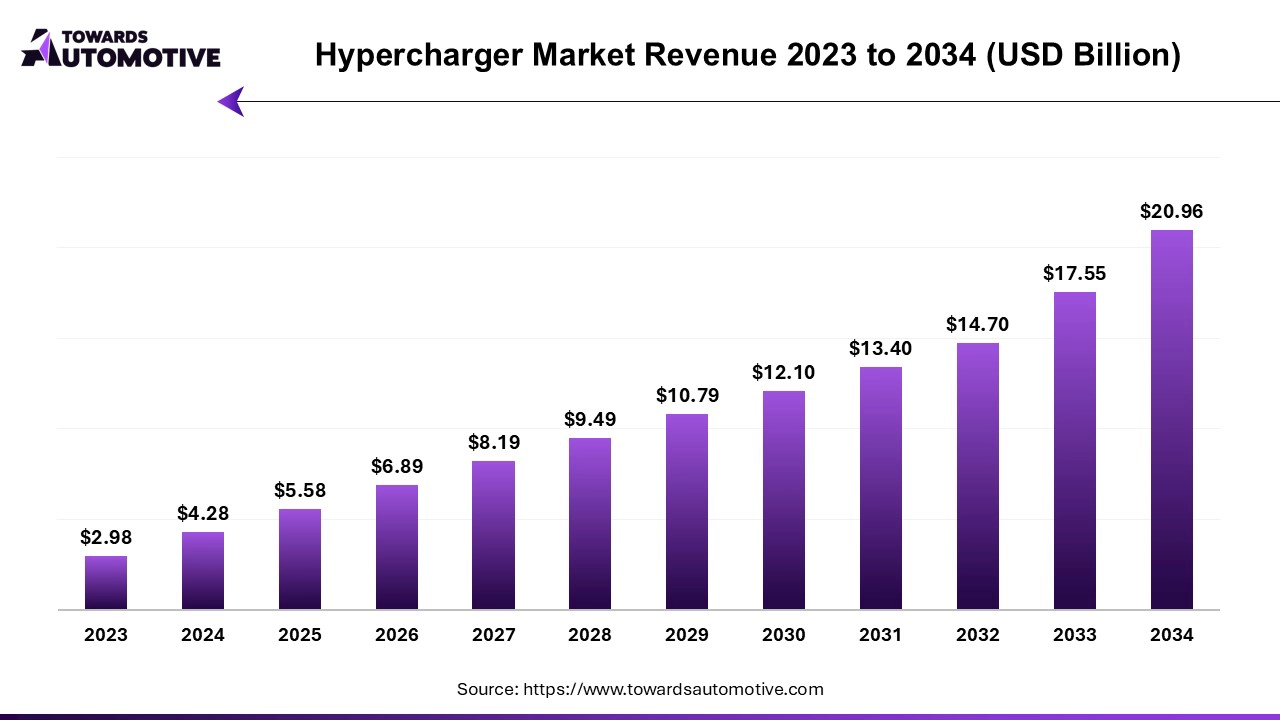

The hypercharger market is projected to reach USD 20.96 billion by 2034, growing from USD 5.58 billion in 2025, at a CAGR of 19.40% during the forecast period from 2025 to 2034.

The hypercharger market is a prominent segment of the electric vehicle industry. This industry deals in manufacturing and distribution of hyperchargers across the world. These chargers are integrated with different types of connectors including CCS, CHAdeMO and some others. It delivers a wide range of charging speed consisting of 50-150kW, 150-350 kW, above 350 kW and some others. The end-users of these chargers comprise of retail and convenience, public charging, fleet and commercial. The rising sales of electric vehicles has contributed to the overall industrial expansion. This market is expected to rise significantly with the growth of the automotive industry around the globe.

The major trends in this industry consists of partnerships, innovations and government initiatives.

Several EV charging providers are partnering with restaurant chains for expanding EV charging network in different parts of the world. For instance, in December 2024, Ionna partnered with Sheetz. This partnership is done for establishing around 50 EV charging stations across the U.S. (Source: Babcox Media Inc)

Numerous market players are constantly engaged in developing cost-effective EV chargers to enhance profitability of fleet owners. For instance, in May 2025, SolarEdge Technologies, Inc., launched a solar-powered EV charger. This charger is expected to reduce the EV charging cost by 70%. (Source:Business Wire, Inc.)

Government of several countries such as India, U.S., UK, Germany and some others are announcing new initiatives to develop the EV charging infrastructure. For instance, in February 2025, the government of UK announced to invest around 65 million euros. This investment is done for deploying EV superchargers across the UK region.(Source: Motorsport)

| Rank | Manufacturer (hardware) | 2024 share (%) |

| 1 | ABB E-mobility | 12–15 |

| 2 | Alpitronic (Hypercharger) | 10–13 |

| 3 | Tesla (Supercharger hardware sold to third parties + NACS DC hardware) | 9–12 |

| 4 | Kempower | 6–8 |

| 5 | Siemens eMobility (incl. Heliox) | 5–7 |

| 6 | Delta Electronics | 4–6 |

| 7 | Star Charge (Xingxing) | 4–6 |

| 8 | TELD (Qingdao Teld) | 4–5 |

| 9 | Autel Energy | 3–5 |

| 10 | EVBox | 2–4 |

| 11 | Blink Charging (hardware) | 2–3 |

| 12 | Others (Tritium*, Ekoenergetyka, Wallbox, Alfen, FLO, etc.) | 17–24 |

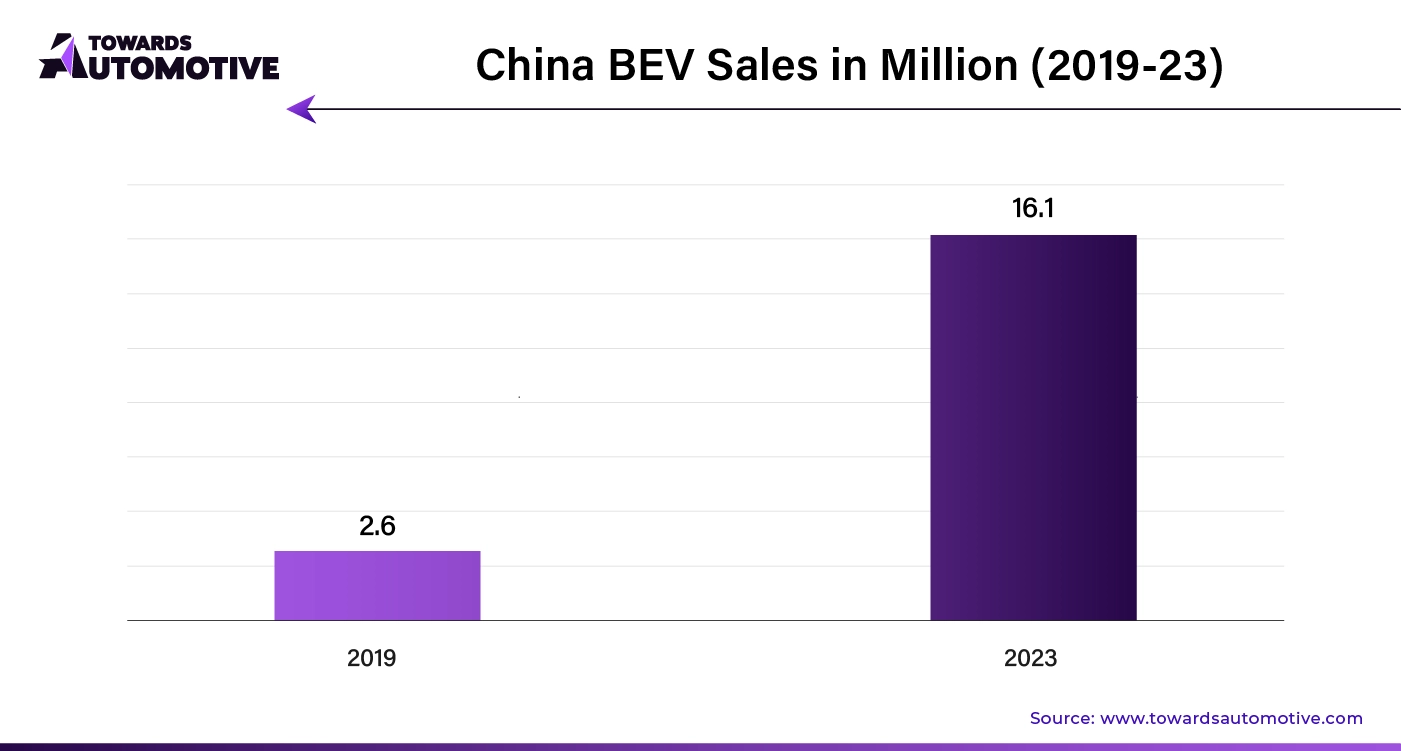

The passenger cars segment dominated this industry. The growing demand for luxury EVs in several countries such as France, Italy, U.S., India and some others has boosted the market growth. Additionally, the rising sales and production of passenger EVs in China has increased the demand for hyperchargers, thereby driving the market growth. Moreover, numerous partnerships among passenger car manufacturers and charging providers to deploy fast-chargers is expected to boost the growth of the hypercharger market.

The commercial vehicle segment is predicted to rise with a significant CAGR during the forecast period. The growing sales and production of commercial vehicles in several countries such as Japan, Canada, China and some others has boosted the market growth. Also, the rapid adoption of electric trucks by e-commerce brands for lowering emission along with the increasing sales of LCEVs is contributing to the overall industrial expansion. Moreover, the deployment of electric buses in various developed nations such as UK, Germany, U.S., and some others is anticipated to propel the growth of the hypercharger market.

The 50-150 kW segment led the industry. The increasing demand for cost-effective charging solutions has increased the market growth. Also, technological advancements in EV charging system along with integration of advanced technologies such as AI and IoT in fast chargers is further contributing to the overall industrial expansion. Moreover, rapid investment by market players for developing 50-150 kW chargers to cater the needs of the commercial EVs is anticipated to foster the growth of the hypercharger market.

The 350kW segment is likely to grow with a considerable growth rate during the forecast period. The rising demand for high-capacity EV chargers from fleet operators has driven the market growth. Additionally, rapid investment by EV charging companies for deploying 350 kW chargers in highway rest stops to charge several vehicles simultaneously is further adding to the industrial expansion. Moreover, numerous government initiatives aimed at deploying fast charging networks in different parts of the world has fostered the growth of the hypercharger market.

The public charging segment held the largest share of the industry. The rise in number of personal EV owners in different parts of the world has fostered the market growth. Additionally, the growing demand for fast chargers among EV owners to match their daily schedule is further adding to the industrial expansion. Moreover, numerous incentives provided by EV charging providers to grab maximum consumer attention has bolstered the growth of the hypercharger market.

The fleet and commercial segment is projected to rise with the highest CAGR during the forecast period. The rising adoption of EVs by fleet operators to lower their operational costs and enhance profitability has boosted the market expansion. Additionally, numerous market players are developing fast-chargers to cater the needs of electric buses and electric trucks, thereby driving the industrial growth. Moreover, numerous collaborations among fleet operators and charging companies to deploy fast chargers is anticipated to propel the growth of the hypercharger market.

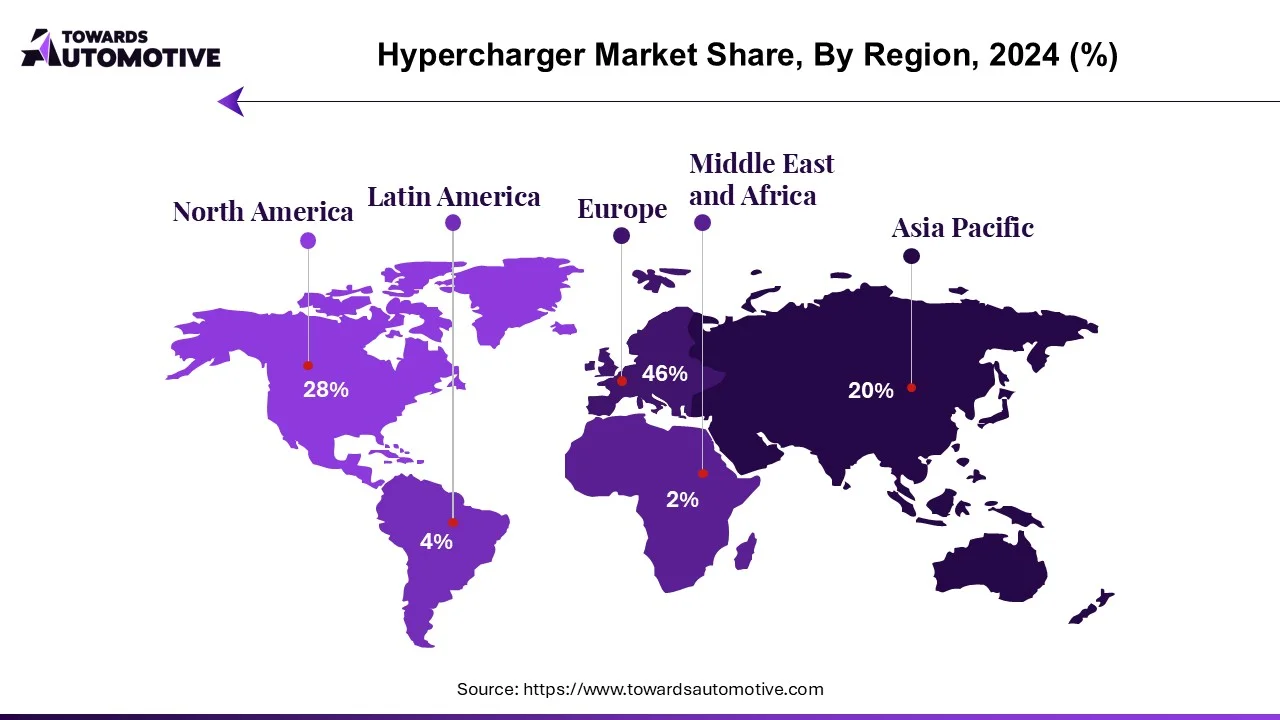

Asia Pacific held the highest share of the hypercharger market. The growing sales and production of EVs in numerous countries such as India, China, Japan, South Korea and some others has boosted the market growth. Also, numerous government initiatives aimed at developing the EV charging infrastructure along with rapid deployment of electric buses in developed cities is contributing to the overall industrial expansion. Moreover, the presence of several market players such as Tritium, Gerunsaisi, Servotech Power Systems and some others is expected to foster the growth of the hypercharger market in this region.

China is the major contributor in this region. The growing sales and production of commercial EVs along with technological advancements in EV sector has boosted the market growth. Additionally, numerous government initiatives aimed at deploying hyperchargers across this nation further contributes to the industrial growth.

Europe is expected to grow with the highest CAGR during the forecast period. The increasing demand for luxury EVs in several nations such as Germany, Italy, UK, France and some others has boosted the market growth. Also, rapid investment by government for deploying EV fast chargers coupled with rising sales of EVs has contributed to the industrial expansion. Moreover, the presence of various market players such as Alpitronic, EVBox, BP Pulse and some others is projected to drive the growth of the hypercharger market in this region.

Italy and Germany are the significant contributors in this region. In Italy, the market is generally driven by the increasing demand for EV hypercars along with presence of several hypercharger companies. In Germany, the presence of several automotive brands such as Audi, BMW, Mercedes and some others is contributing to the industrial development.

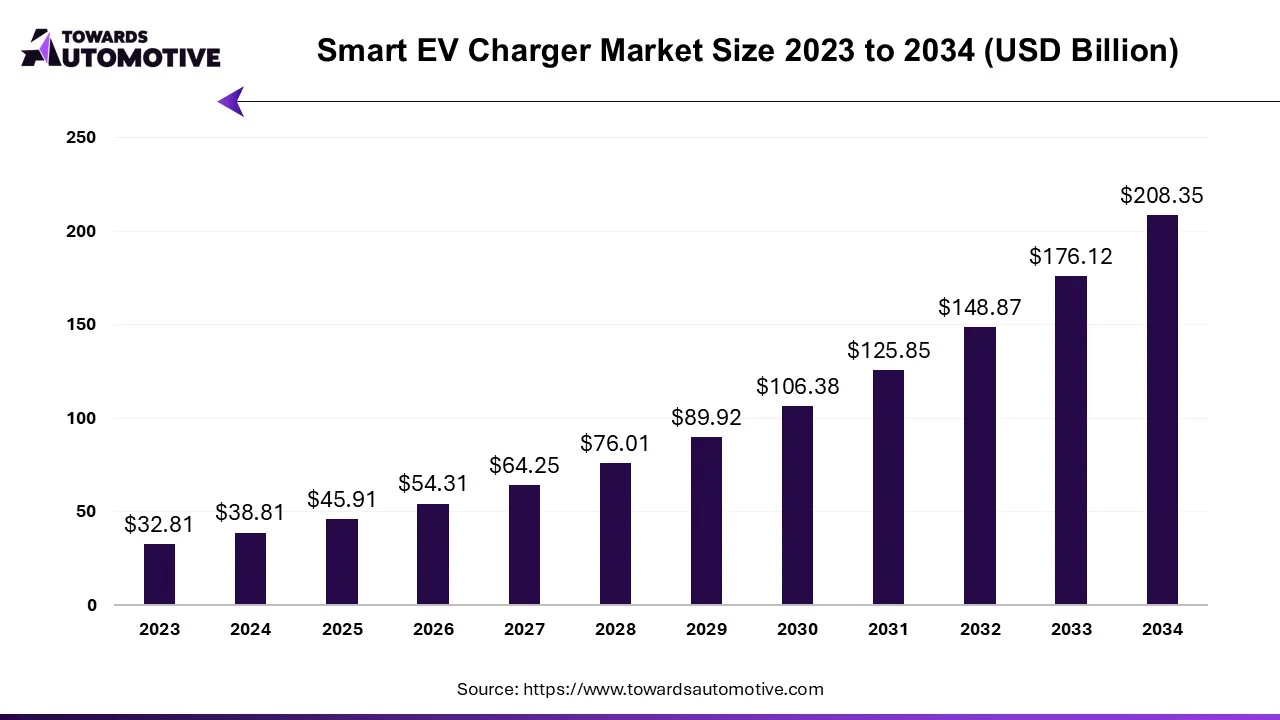

The smart EV charger market size is expected to grow from USD 45.91 billion in 2025 to USD 208.35 billion by 2034, with a CAGR of 18.3% throughout the forecast period from 2025 to 2034.

The smart EV charger market is an integral sector of the electric vehicle industry. This industry deals in manufacturing and distribution of smart EV chargers across the world. There are various types of chargers developed in this sector consisting of AC chargers, DC chargers, wireless chargers and some others. These chargers are available in several power modules comprising of low power (22 kW), medium power (23-149 kW), high power (150 kW). It finds applications in numerous end-user sector including residential, commercial and public. The rise in number of EV charging stations across the world has boosted the industrial expansion. This market is expected to rise significantly with the growth of the automotive sector in different parts of the world.

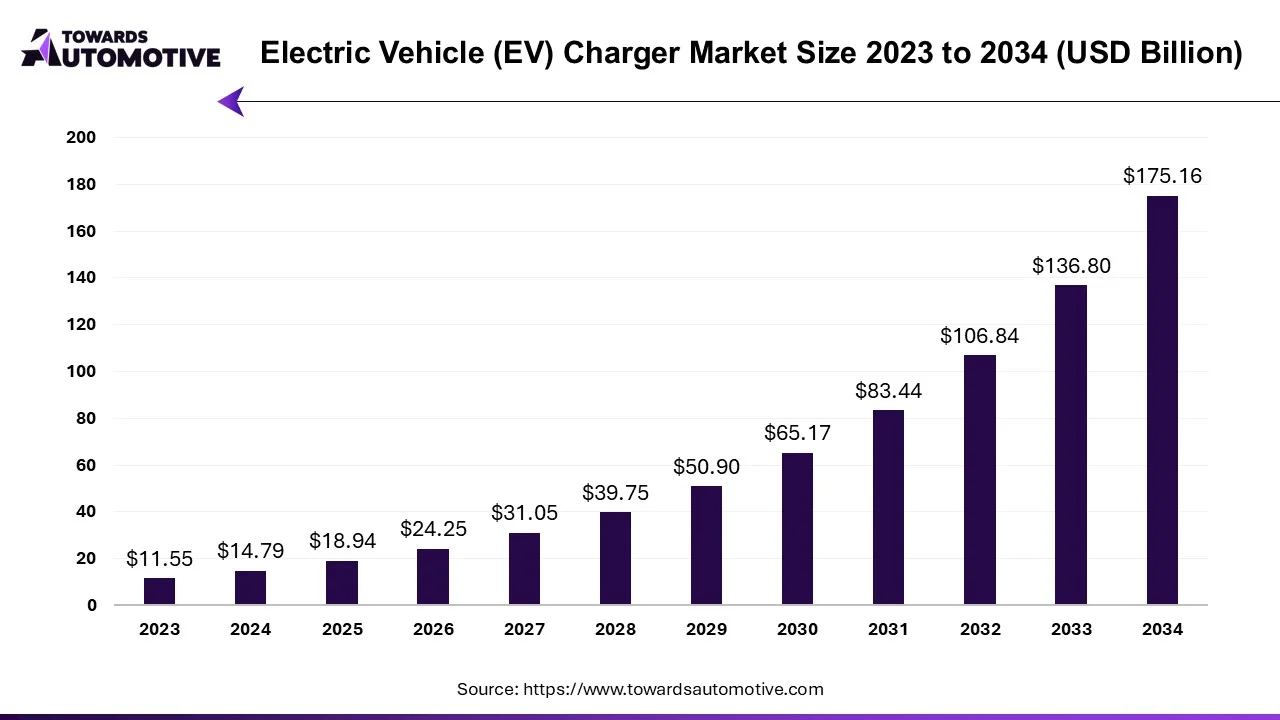

The electric vehicle (EV) charger market size is forecasted to expand from USD 18.94 billion in 2025 to USD 175.16 billion by 2034, growing at a CAGR of 28.04% from 2025 to 2034.

The electric vehicle (EV) charger market is a crucial branch of the electric vehicles industry. This industry deals in development and distribution of EV chargers across the globe. There are different types of chargers available in the market comprising of on-board charger and off-board charger. These chargers are designed for charging various types of vehicles including plug-in hybrid vehicle (PHEV), battery electric vehicle (BEV), hybrid electric vehicle (HEV). The end-users of these chargers consist of commercial users and residential users. The rise in number of EV charging stations in different parts of the world has boosted the industrial expansion. This market is expected to rise significantly with the growth of the automotive industry around the world.

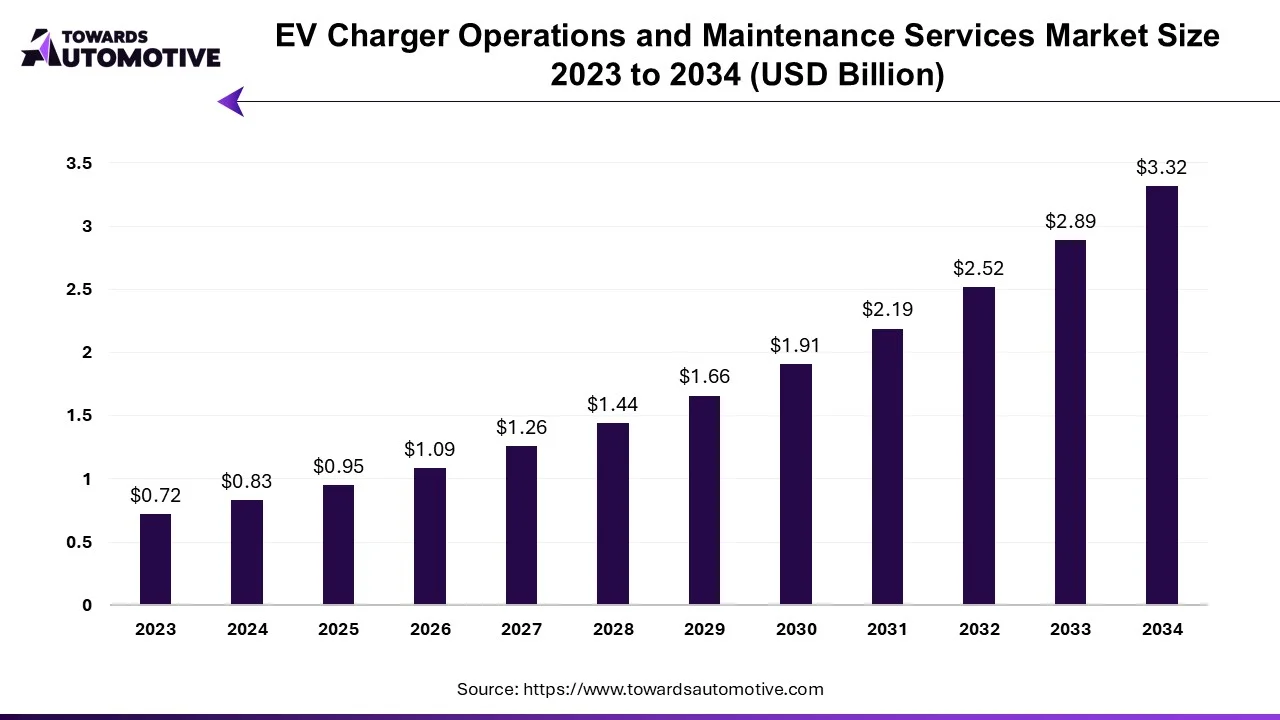

The ev charger operations and maintenance services market is forecasted to expand from USD 0.95 billion in 2025 to USD 3.32 billion by 2034, growing at a CAGR of 14.92% from 2025 to 2034.

Growth is propelled by the accelerating adoption of electric vehicles (EVs) worldwide, coupled with the increasing need for reliable and efficient charging infrastructure to support the burgeoning EV ecosystem. As the transition towards electrification gains momentum, the demand for comprehensive operations and maintenance services for EV charging stations is expected to surge, creating lucrative opportunities for market players.

One of the primary drivers of market growth is the rapid expansion of the electric vehicle market, driven by stringent emissions regulations, government incentives, and shifting consumer preferences towards sustainable mobility solutions. With an increasing number of automakers introducing electric vehicle models and governments implementing policies to promote EV adoption, the demand for EV charging infrastructure is witnessing a significant upsurge. This, in turn, fuels the need for efficient operations and maintenance services to ensure the reliability, availability, and optimal performance of EV charging stations.

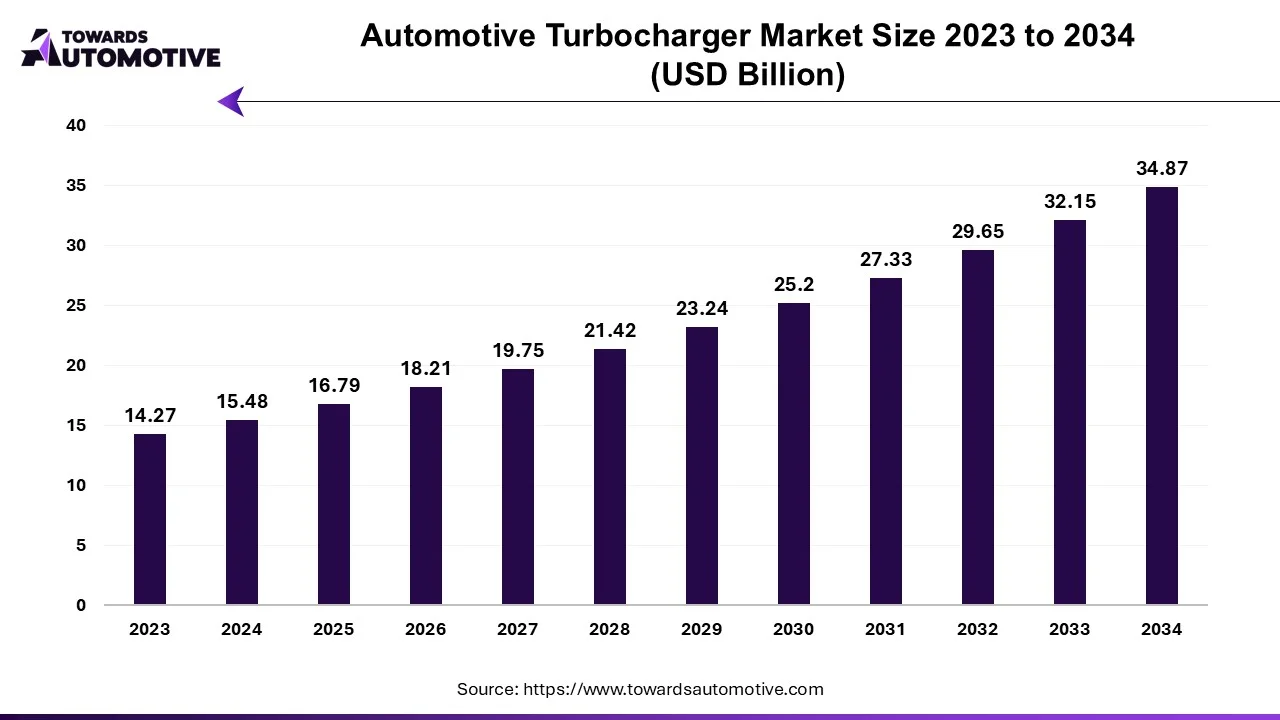

The global automotive turbocharger market is forecasted to expand from USD 16.79 billion in 2025 to USD 34.87 billion by 2034, growing at a CAGR of 8.46% from 2025 to 2034.

The automotive turbocharger market is experiencing steady growth driven by the increasing demand for enhanced engine performance, fuel efficiency, and stringent emission regulations. A turbocharger forces more air into the engine’s combustion chamber that enables smaller engines to produce more power along with improving fuel efficiency. As automakers strive to meet global environmental standards and consumer preferences for fuel-efficient vehicles, turbochargers are becoming an integral part of automotive design.

The hypercharger market is a highly competitive industry with the presence of several dominating players. Some of the prominent companies in this industry consists of ABB (Switzerland), Starcharge (China), ChargePoint (U.S.), Tesla Inc. (U.S.), FLO (Canada), Alpitronic (Italy), Xcharge (China), EVBox (Netherlands), Blink Charging Co. (U.S.), Electrify America (U.S.), Tritium (Australia), EVgo (U.S.) and some others. These companies are constantly engaged in developing hyperchargers and adopting numerous strategies such as partnerships, acquisitions, joint ventures, business expansions, collaborations, launches and some others to maintain their dominance in this industry.

By Vehicle Type

By Charging Speed

By Connector Type

By Charging Location

By End-Use

By Region

The global automotive engine components market projected at USD 83.68 billion in 2024, is expected to reach USD 130.46 billion by 2034, growing at a C...

October 2025

October 2025

October 2025

October 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us