July 2025

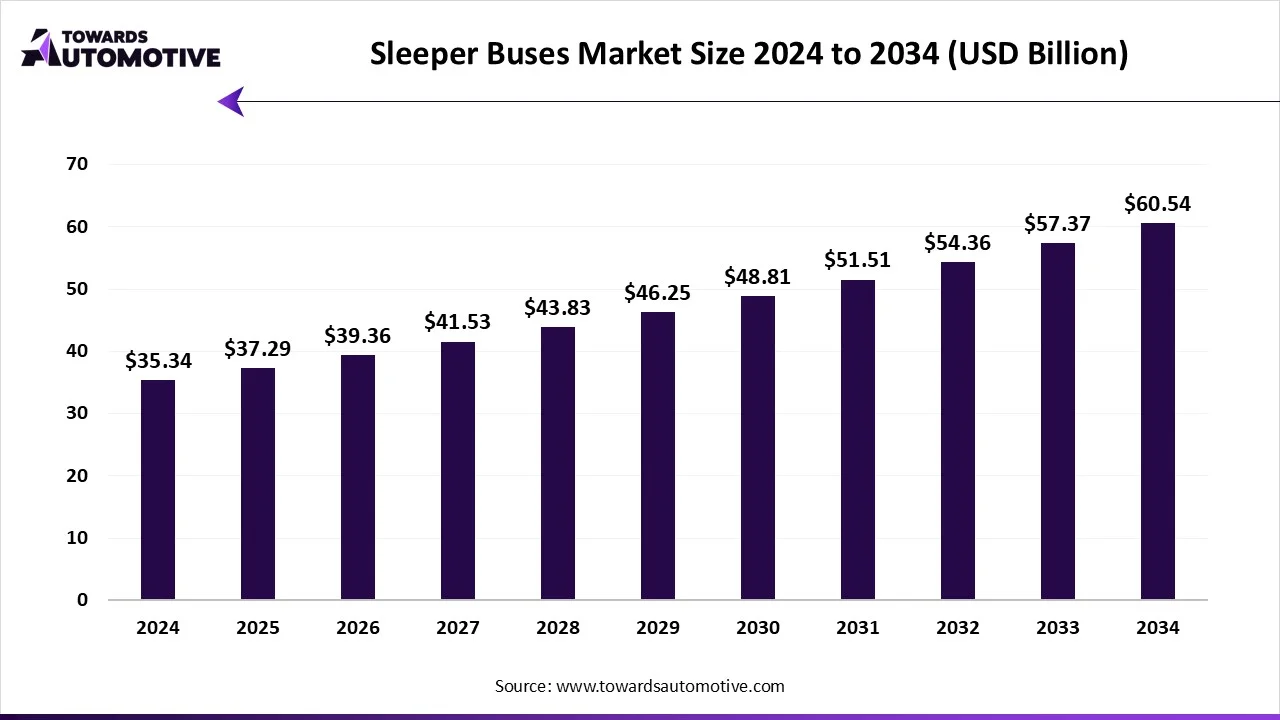

The sleeper buses market is forecast to grow from USD 37.29 billion in 2025 to USD 60.54 billion by 2034, driven by a CAGR of 5.53% from 2025 to 2034.

The sleeper buses market is a prominent sector of the automotive industry. This industry deals in manufacturing and distribution of sleeper buses in different parts of the world. These buses are designed for delivering various services including basic services and premium services. The sleeper buses are available in various lengths consisting of up to 30 feet, 30-40 feet, 40-45 feet, above 45-feet and others. It finds application in various end-use sectors comprising of tours & travels, event organizers, government and some others. The rising sales of buses in western nations has boosted the market expansion. This market is expected to rise significantly with the growth of the commercial vehicles industry around the globe.

| Metric | Details |

| Market Size in 2024 | USD 35.34 billion |

| Projected Market Size in 2034 | USD 60.54 billion |

| CAGR (2025 - 2034) | 5.53% |

| Leading Region | Asia Pacific |

| Market Segmentation | By Services, By Propulsion, By Bus Length, By End Use and By Region |

| Top Key Players | Yutong, Zhongtong Bus, Prevost, Scania, Solaris Bus & Coach, Temsa, Van Hool |

The premium/luxury segment held a dominant share of the market. The rising demand for premium buses from elite consumers has boosted the market expansion. Also, numerous fleet operators are deploying luxury sleeper buses to attract large number of travelers, thereby propelling the industrial growth. Moreover, rapid investment by automotive brands for manufacturing luxury sleeper bus along with increased consumer preference towards premium buses is further anticipated to drive the growth of the sleeper buses market.

The basic segment is likely to rise with a considerable growth rate during the forecast period. The growing demand for economical bus services along with rise in number of fleet operators is playing a vital role in shaping the industrial landscape. Moreover, the demand for affordable sleeper buses in developing nations to deliver superior traveling experience to tourist has further bolstered the market growth. Additionally, continuous research and development activities related to sleeper buses coupled with availability of bus tickets in online platforms is expected to boost the growth of the sleeper buses market.

The diesel segment held the largest share of the market. The growing sales of diesel-powered buses in different parts of the world has boosted the market expansion. Additionally, the rising adoption of diesel-powered buses to enhance long-distance traveling experience of consumers is playing a vital role in shaping the industrial landscape. Moreover, several advantages of diesel buses including superior fuel efficiency, greater durability and longevity, reliability, cost-effectiveness, low maintenance and some others is predicted to boost the growth of the sleeper buses market.

The hybrid electric segment is anticipated to witness notable growth during the forecast period. The rising sales of electric buses along with technological advancements in powertrains has boosted the market expansion. Also, the growing awareness of reducing emission in the environment coupled with rapid developments in hybrid vehicles industry is playing a crucial role in shaping the industry in a positive way. Moreover, numerous government initiatives aimed at enhancing the EV charging infrastructure is anticipated to propel the growth of the sleeper buses market.

The tours & travels segment held a significant share of the industry. The growing adoption of premium sleeper buses by fleet companies to enhance maximum consumer attraction has boosted the market growth. Also, several bus operators are deploying electric buses and hybrid buses for operating long distance commutes is playing a vital role in shaping the industrial landscape. Moreover, rise in number of tours and travels startups coupled with numerous partnerships among travelling companies and bus manufacturers is likely to boost the growth of the sleeper buses market.

The event organizers segment is predicted to rise with a significant CAGR during the forecast period. The rise in number of event management companies has increased the demand for luxury sleeper buses, thereby driving the market expansion. Additionally, numerous collaborations among event organizers and fleet operators for deploying sleeper buses to enhance travel experience is playing a vital role in shaping the industrial landscape. Furthermore, various offers and incentives provided by event organizers to attract maximum consumers is likely to drive the growth of the sleeper buses market.

Asia Pacific held the highest share of the sleeper buses market. The rise in number of bus operators in countries such as India, China, Japan, Vietnam and some others has boosted the market expansion. Additionally, the growing demand for affordable bus services coupled with availability of bus tickets in online platforms is playing a crucial role in shaping the industrial landscape. Moreover, the rising adoption of sleeper buses by government organizations along with presence of various bus manufacturers has boosted the growth of the sleeper buses market in this region.

China and India are the significant contributors of this region. In China, the market is generally driven by the rising development in the EV sector along with presence of several market players such as Zhongtong Bus and Zhengzhou Yutong Bus Co., Ltd. In India, the rising consumer preference towards luxury traveling coupled with rise in number of bus manufacturers has boosted the market growth.

Europe is expected to grow with a significant CAGR during the forecast period. The growing demand for sustainable transport solutions in countries such as UK, Germany, France, Italy and some others has driven the market expansion. Additionally, the growing adoption of sleeper buses by service providers coupled with rapid investment by different organizations for developing the road infrastructure is contributing to the industrial growth. Moreover, the presence of numerous sleeper bus companies such as Volvo and Scania is driving the growth of the sleeper buses market in this region.

Germany dominated the market in this region. The growing development in the automotive industry along with rapid investment by public sector entities for delivering superior bus services has boosted the market expansion. Moreover, the rising investment by government for strengthening the EV charging infrastructure coupled with increasing consumer interest towards adventure travelling has further contributed significantly to the industrial growth in this nation.

The sleeper buses market is a highly fragmented industry with the presence of a numerous dominating players. Some of the prominent companies in this industry consists of Yutong, Zhongtong Bus, Prevost, Scania, Solaris Bus & Coach, Temsa, Van Hool, Volvo Buses and some others. These companies are constantly engaged in developing sleeper buses and adopting numerous strategies such as partnerships, launches, acquisitions, collaborations, business expansion, joint ventures and some others to maintain their dominant position in this industry. For instance, in March 2025, Yutong Bus launched D14 (ZK6139D). D14 (ZK6139D) is a sleeper bus that can carry around 77 passengers. Also, in July 2024, Scania launched Scania K360. Scania K360 is a sleeper bus that is powered by a diesel engine which delivers superior horse power and high torque.

By Services

By Propulsion

By Bus Length

By End Use

By Region

July 2025

July 2025

July 2025

June 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us