September 2025

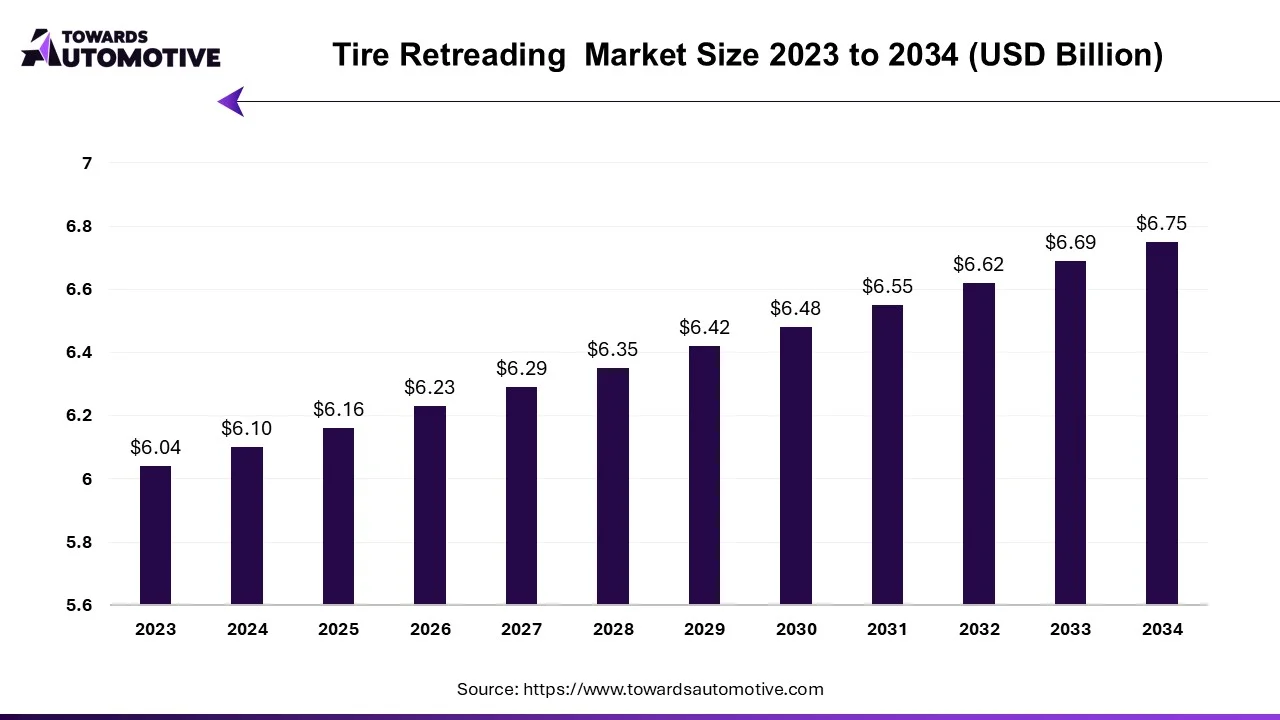

The tire retreading market is forecast to grow from USD 6.16 billion in 2025 to USD 6.75 billion by 2034, driven by a CAGR of 1.02% from 2025 to 2034.

Unlock Infinite Advantages: Subscribe to Annual Membership

The tire retreading market is a crucial branch of the automotive industry. This industry deals in delivering tire retreading solutions in different parts of the world. There are several types of tires manufactured in this sector comprising of radial tires, bias tires, solid tires and some others. These tires are developed using numerous processes including pre-cure process and mold-cure process. It finds application in different types of vehicles such as commercial vehicles and off-highway vehicles. The growing use of retread tires in commercial vehicles is driving the market in a positive direction. This market is anticipated to rise significantly with the growth of the tire manufacturing sector around the globe.

(Source: https://www.oica.net/wp-content/uploads/Light-Commercial-Vehicles-2024.pdf)

| Metric | Details |

| Market Size in 2024 | USD 6.10 Billion |

| Projected Market Size in 2034 | USD 6.75 Billion |

| CAGR (2025 - 2034) | 1.02% |

| Leading Region | Asia Pacific |

| Market Segmentation | By Type, By Vehicle Type, By Tire Type and By Region |

| Top Key Players | Goodyear Tire and Rubber Company, KRAIBURG Austria GmbH & Co. KG, Marangoni S.p.A., Michelin, Rethread (Pty) Ltd |

Business Expansion

Several market players are opening up new tire retreading facilities to cater the needs of the commercial vehicle owners. For instance, in April 2024, Continental opened a new tire retreading center in South Carolina. This new center is inaugurated to deliver a wide range of retread tire to fleet operators of the U.S. (Source: AftermarketNews)

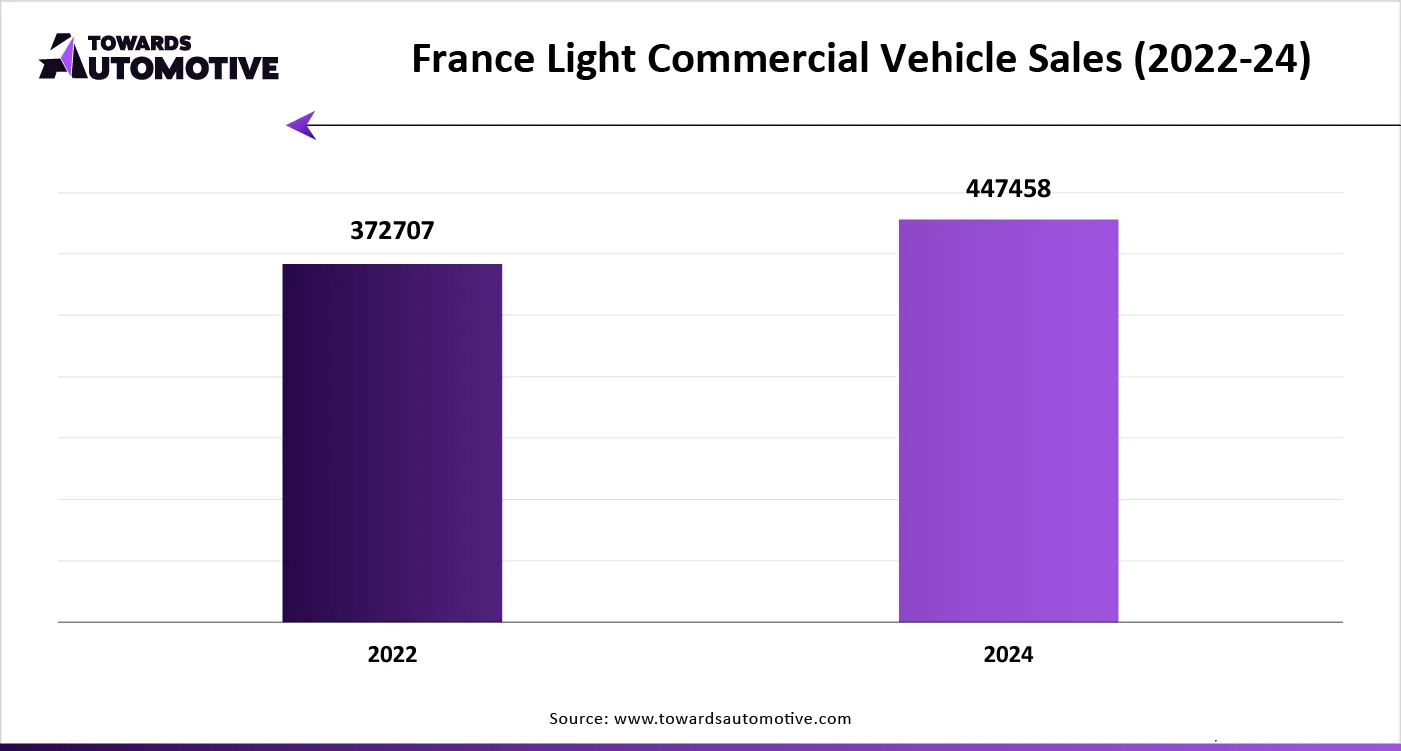

Increasing Sales of Commercial Vehicles

The demand for commercial vehicle is increasing rapidly which in turn increases the demand for retread tires for managing heavy-duty operations. According to the OICA, around 1103076 light commercial vehicles were registered in Canada during 2024. (Source: OICA)

Partnerships

Numerous leading companies of retread tire are partnering with each other to manufacture truck tires and bus tires. For instance, in July 2023, Marangoni partnered with Ceat. This partnership is done for delivering retreading tires to the truck owners and bus owners in India. (Source: The Times of India)

The pre-cure segment held the largest share of the market. The growing use of pre-cure tire retreading due to its cost-effectiveness and versatility has boosted the market expansion. Additionally, the rapid investment by tire companies for developing pre-cure tire retreading solutions has further driven the growth of the tire retreading market.

The mold-cure segment is anticipated to rise with a notable CAGR during the forecast period. The growing adoption of mold-cure tire retreading due to its affordability and performance has driven the market growth. Moreover, the rising use of this retreading technique in several companies such as Bridgestone, Michelin, Goodyear, Kraiburg and some others is expected to foster the growth of the tire retreading market.

The commercial vehicle segment led the market. The growing sales and production of commercial vehicles in several countries such as India, China, U.S., Germany and some others has boosted the market growth. Additionally, the rising adoption of electric buses in developed nations such as UK and France along with rapid investment by tire companies to manufacture retread tires for heavy-duty trucks is further accelerating the growth of the tire retreading market.

The off-highway vehicle segment is likely to grow with the highest CAGR during the forecast period. The increasing sales of ATVs and UTVs in various developed countries such as the U.S., New Zealand, Australia, Finland and some others has increased the demand for retread tires, thereby driving the market expansion. Moreover, the growing adoption of forklifts and cranes in the manufacturing industry along with increased use of all-terrain tires and mud-terrain tires in excavators is driving the growth of the tire retreading market.

The radial segment held the largest share of the industry. The growing use of radial tires in high-performance cars and trucks for delivering enhanced handling and improved stability is driving the market expansion. Additionally, constant research and development by tire manufacturers for developing eco-friendly radial tires is further accelerating the growth of the tire retreading market.

The bias segment is projected to grow with a considerable CAGR during the forecast period. The rising use of bias tires in tractors and buses due to their capacity of handling heavy loads is driving the market growth. Also, numerous benefits of bias tires including enhanced durability and affordability is further contributing to the growth of the tire retreading market.

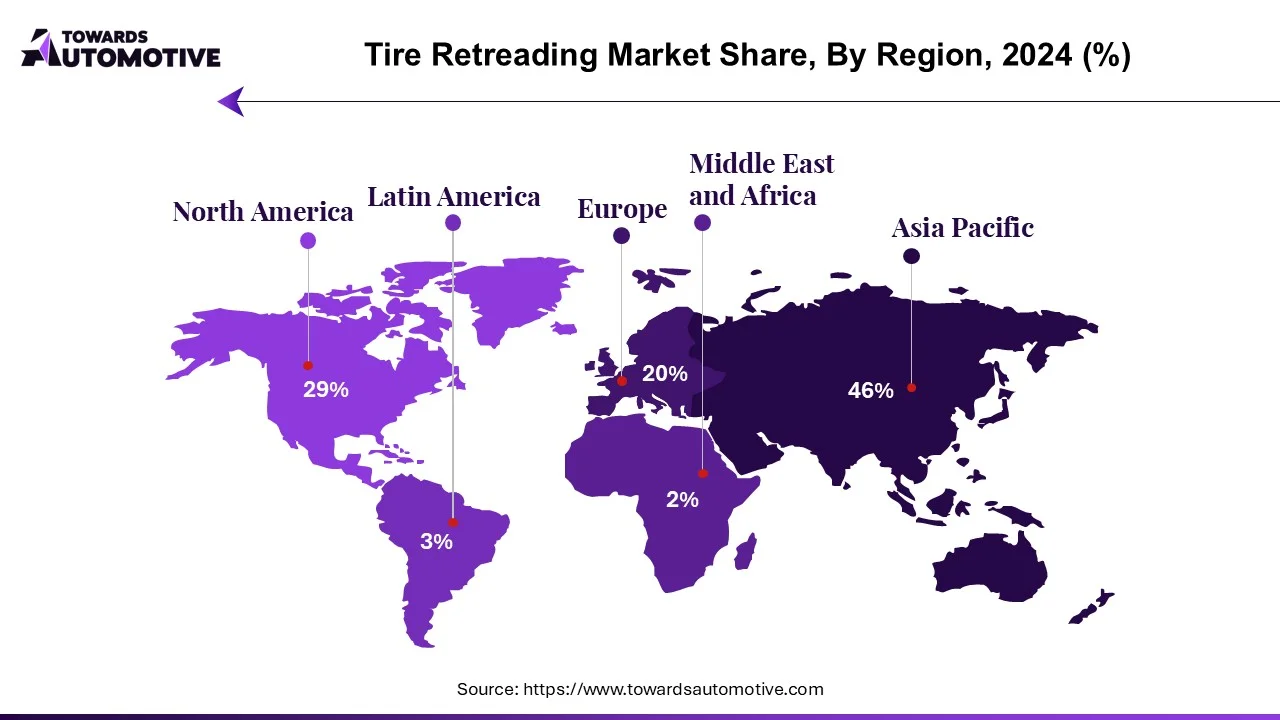

Asia Pacific held the highest share of the tire retreading market. The growing sales of heavy-duty trucks in several countries such as China, India, Japan, South Korea and some others has driven the market growth. Additionally, numerous government initiatives aimed at lowering CO2 emission coupled with the increasing demand for LCEVs is playing a vital role in shaping the industry in a positive direction. Moreover, the presence of numerous market players such as JK Tyre, Bridgestone Corporation, Sumitomo Rubber Industries, Ltd, MRF Ltd and some others is expected to propel the growth of the tire retreading market in this region.

China and India are the major contributors in this region. In China, the market is generally driven by the increasing sales of off-road vehicles for navigating unpaved roads along with technological advancements in tire manufacturing sector. China is home to several tire retreading companies such as Leshan Yalun Mold Co., Ltd., Wuhan Tyre Retreading Equipment Company, Hangzhou Zhongce Rubber Co., Ltd. and some others.

In India, the market is generally boosted by the growing adoption of electric buses coupled with rapid investment by tire companies for opening up new tire retreading centers. Additionally, the presence of various commercial vehicle manufacturers such as Tata Motors, Ashok Leyland, Mahindra, Force Motors and some others is further contributing to the industrial growth.

Europe is expected to grow with a significant CAGR during the forecast period. The growing adoption of electric trucks in numerous nations such as Sweden, Germany, France, Italy, UK and some others has boosted the market expansion. Also, the rising sales of luxury buses along with strict government regulations regarding vehicular emission is adding to the industrial growth. Moreover, the presence of various tire retreading brands such as Marangoni, Banden Plan Europa, Insa Turbo and some others is likely to foster the growth of the tire retreading market in this region.

Germany and UK contribute significantly in this region. In Germany, the market is generally driven by the rising adoption of electric trucks in the military sector along with technological advancements in tire retreading industry. Also, the presence of several tire retreading companies such as Rigdon GmbH, Reifen Hinghaus, Rösler Tyre Innovators GmbH & Co KG and some others is contributing to the overall industrial expansion.

In UK, the market is driven by the rising production of commercial vehicles along with increasing consumer awareness regarding sustainable automotive materials. Additionally, the rapid adoption of retread tires in mining equipment coupled with growing sales of heavy-duty trucks is contributing to the market growth in this nation.

The tire retreading market is a rapidly developing industry with the presence of several dominating players. Some of the prominent companies in this industry consists of Goodyear Tire and Rubber Company, KRAIBURG Austria GmbH & Co. KG, Marangoni S.p.A., Michelin, Rethread (Pty) Ltd, Southern Tire Mart, Sumitomo Rubber Industries, Ltd., TreadWright Tires, Continental and some others. These companies are constantly engaged in developing tire retreading solutions and adopting numerous strategies such as acquisitions, launches, joint ventures, collaborations, business expansions, partnerships, and some others to maintain their dominance in this industry.

By Type

By Vehicle Type

By Tire Type

By Region

September 2025

August 2025

August 2025

August 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us