September 2025

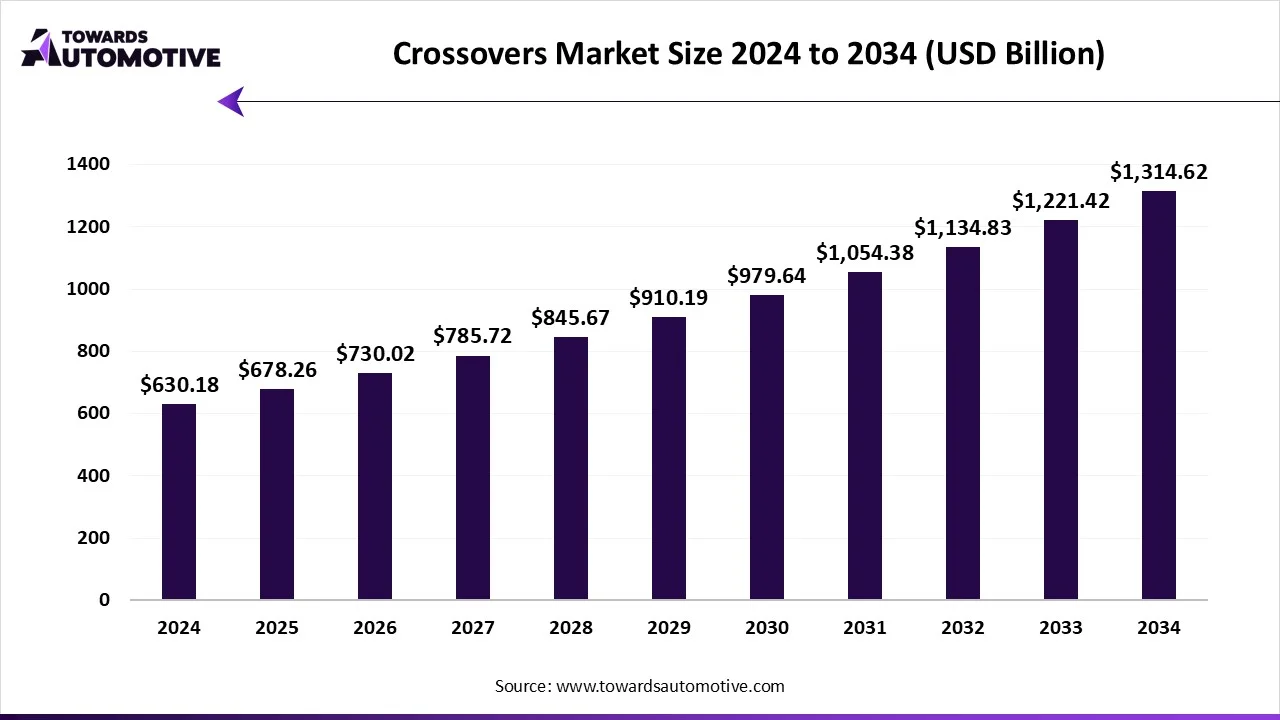

The crossovers market is predicted to expand from USD 678.26 billion in 2025 to USD 1314.62 billion by 2034, growing at a CAGR of 7.63% during the forecast period from 2025 to 2034. The growing adoption of hybrid crossovers in the U.S. and France coupled with rising use of advanced sensors in modern crossovers to enhance the driving experience has played a vital role in shaping the industrial landscape.

Moreover, rapid investment by automotive companies for developing fuel-efficient crossovers along with increasing demand for coupe vehicles in Western nations to cater the needs of small families has driven the market expansion. The integration of ADAS in crossovers to enable autonomous driving is expected to create ample growth opportunities for the market players in the upcoming days.

Unlock Infinite Advantages: Subscribe to Annual Membership

The crossovers market is a crucial segment of the automotive industry. This industry deals in manufacturing and distribution of crossovers around the world. There are several types of vehicles manufactured in this sector comprising of compact crossovers, mid-size crossovers and full-size crossovers. These vehicles are powered by different propulsion technologies including ICE and electric. It is equipped with numerous gear transmission system comprising of automatic and manual. The growing demand for affordable crossovers in developing nations has contributed to the industrial expansion. This market is expected to rise significantly with the growth of the EV sector in different parts of the globe.

| Metric | Details |

| Market Size in 2024 | USD 630.18 Billion |

| Projected Market Size in 2034 | USD 1314.62 Billion |

| CAGR (2025 - 2034) | 7.63% |

| Leading Region | North America |

| Market Segmentation | By Type, By Propulsion, By Gear Transmission and By Region |

| Top Key Players | Kia Corporation, Hyundai Motor Group, Ford Motor Company |

The major trends in this market consists of investments, partnerships and increasing demand for full-sized crossovers.

Several automotive brands are investing heavily for constructing new production facilities to increase the manufacturing output of crossovers. For instance, in June 2025, General Motors announced to invest around US$ 4 billion. This investment is done for constructing an automotive production plant in Kansas City to enhance the production capacity of crossovers in the U.S. (Source: Yahoo)

Numerous market players are partnering with each other to develop advanced crossover vehicles. For instance, in June 2025, Mullen partnered with Faissner Petermeier Fahrzeugtechnik AG. This partnership is done for launching ultra-high-performance Mullen FIVE RS EV Crossover in Germany. (Source: GlobeNewswire)

The popularity of full-sized cross has gained traction in recent times due to its enhanced features and improved driving experience. For instance, in April 2025, Huawei launched Aito M8 in China. Aito M8 is a full-size crossover equipped with 15.6-inch main screen and powered with Huawei OS4. (Source: CarNewsChina)

The compact crossovers segment dominated the market. The growing demand for compact cars has rapidly increased in developing nations due to their affordability and usability, thereby driving the market growth. Additionally, rapid investment by market players for developing compact crossovers that delivers suitable mileage and performance has positively impacted the industry. Moreover, the rising popularity of electric-based compact crossovers in different parts of the world is expected to propel the growth of the crossovers market.

The mid-size crossovers segment is expected to expand with a considerable CAGR during the forecast period. The growing demand for mid-size crossovers among corporate employes to maintain their status symbol has driven the market expansion. Additionally, the integration of modern features in these vehicles coupled with superior performance delivered by these cars is contributing to the industrial growth. Moreover, research and development related to mid-size crossovers by EV manufacturers is further expected to foster the growth of the crossovers market.

The ICE segment held the largest share of the market. The growing sales of ICE-based crossovers due to its superior performance and compatibility has driven the market expansion. Additionally, the absence of well-established EV charging stations in numerous developing nations such as India, Vietnam, Thailand and some others has enabled people to adopt ICE vehicles is contributing to the industrial growth. Moreover, rapid investment by market players to integrate powerful diesel-engines in crossovers is expected to drive the growth of the crossovers market.

The electric segment is expected to rise with the fastest CAGR during the forecast period. The increasing adoption of electric vehicles in several countries such as the U.S., UK, Germany, Singapore, China and some others has boosted the market expansion. Additionally, numerous government initiatives aimed at developing the EV charging infrastructure coupled with technological advancements in battery manufacturing sector is contributing to the industrial growth. Moreover, rapid investment by automotive companies for opening up new EV production facilities is expected to drive the growth of the crossovers market.

The manual segment led the market. The growing demand for manual cars among enthusiast drivers to enhance driving experience has boosted the market growth. Additionally, the low price of components used in manual gear systems coupled with superior power and mileage offered by manual crossovers is contributing to the industrial expansion. Moreover, the increasing sales of manual crossover vehicles in mid-income countries such as India, Vietnam, Indonesia and some others is expected to propel the growth of the crossovers market.

The automatic segment is expected to grow with a notable CAGR during the forecast period. The rising demand for premium crossovers in numerous developed nations such as UK, Germany, the U.S. and some others has boosted the market expansion. Additionally, numerous benefits of automatic gear systems including simplified operations, reduced stress, enhanced adaptability and some others is playing a vital role in shaping the industrial landscape. Moreover, the increasing sales of electric crossovers in different regions of the world is expected to drive the growth of the of the crossovers market.

North America held the highest share of the crossovers market. The rising adoption of electric vehicles in the U.S. and Canada has boosted the market expansion. Additionally, numerous government initiatives aimed at developing the EV charging infrastructure coupled with integration of advanced technologies such as AI and IoT in crossovers is playing a vital role in shaping the industrial growth. Moreover, the presence of several market players such as General Motors, Ford Corporation, Rivian and some others is expected to drive the growth of the crossovers market in this region.

U.S. dominated the market in this region. The growing popularity of mid-sized crossovers along with rapid investment by startup companies for developing the EV industry is contributing to the market expansion. Additionally, the presence of several automotive brands coupled with rise in number of EV charging stations has boosted the industrial growth.

Europe is expected to expand with a significant CAGR during the forecast period. The increasing demand for luxury crossovers in several countries such as Germany, France, UK and some others has driven the market expansion. Additionally, rapid investment by automotive brands for developing the EV industry along with technological advancements in the automotive sector is playing a vital role in shaping the industrial landscape. Moreover, the presence of several crossover manufacturing brands such as Mercedes Benz, Volkswagen, Renault and some others is expected to propel the growth of the crossovers market in this region.

Germany led the market in this region. In Germany, the market is generally driven by the rising demand for luxury vehicles coupled with rapid investment by automotive companies for developing crossovers. Additionally, growing adoption of electric crossovers by fleet operators to reduce vehicular emission has contributed to the market expansion.

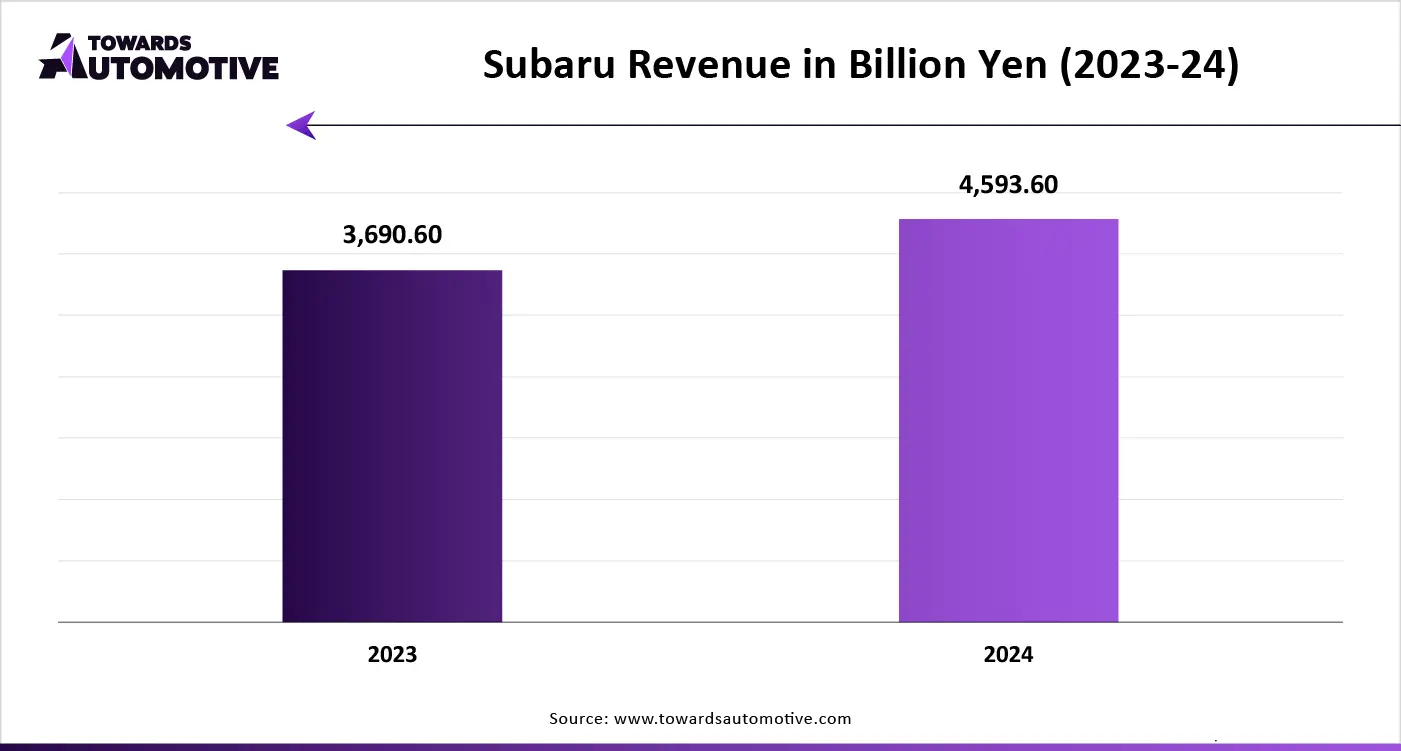

The crossovers market is a highly fragmented industry with the presence of several dominating players. Some of the prominent companies in this industry consists of Kia Corporation, Hyundai Motor Group, Ford Motor Company, Volkswagen Group, Mazda Motor Corporation, Toyota Motor Corporation, Tata Motors, Nissan Motor Co., Ltd., Mitsubishi Motors Corporation, Subaru and some others. These companies are constantly engaged in manufacturing crossovers and adopting numerous strategies such as collaborations, acquisitions, partnerships, joint ventures, launches, and some others to maintain their dominance in this industry.

By Type

By Propulsion

By Gear Transmission

By Region

September 2025

September 2025

September 2025

September 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us