December 2025

The US auto retail & aftermarket is booming, poised for a revenue surge into the hundreds of millions from 2025 to 2034, driving a revolution in sustainable transportation. The growing demand for high-quality automotive components from the U.S. region coupled with rapid investment by aftermarket companies for opening up new retail outlets has driven the market expansion.

Additionally, numerous government initiatives aimed at enhancing the adoption of EVs along with the availability of wide range of automotive parts in aftermarket platforms is playing a prominent role in shaping the industrial landscape. The increasing use of sustainable materials for manufacturing automotive parts is expected to create ample growth opportunities for the market players in the upcoming years.

The US auto retail & aftermarket market is driven by the increasing demand for high-quality automotive tires along with technological advancements in the automotive aftermarket platforms. The US auto retail & aftermarket industry deals in providing numerous types of automotive products such as tires & wheels, batteries, brake components, lighting & electronics, engine components, exhaust systems, interior & exterior accessories and some others.

These automotive parts are delivered through a well-organized distribution channel comprising of franchise dealerships, independent repair shops & garages, specialty retailers, online platforms (e-commerce, marketplaces), wholesale distributors and some others. The end-users of aftermarket products consists of individual consumers, commercial fleets, ridesharing & mobility providers, government & institutional buyers, and some others. This industry is expected to rise significantly with the growth of the electric vehicles industry in different parts of the U.S.

| Metric | Details |

| Growth Drivers | Rising EV sales, aftermarket retail expansion, e-commerce adoption, vehicle modification trends, sustainable automotive materials. |

| Market Segmentation | By Offering, By Replacement Part Category, By Distribution Channel, By Vehicle Type, By End-Use and By Region |

| Top Key Players | AutoZone, Advance Auto Parts, O’Reilly, Genuine Parts (NAPA), LKQ, AutoNation, Carvana, Pep Boys, Monro, Mavis Tire, Tire Rack |

The major trends in this market consists of rising sales of EVs, opening of new aftermarket outlets and partnerships.

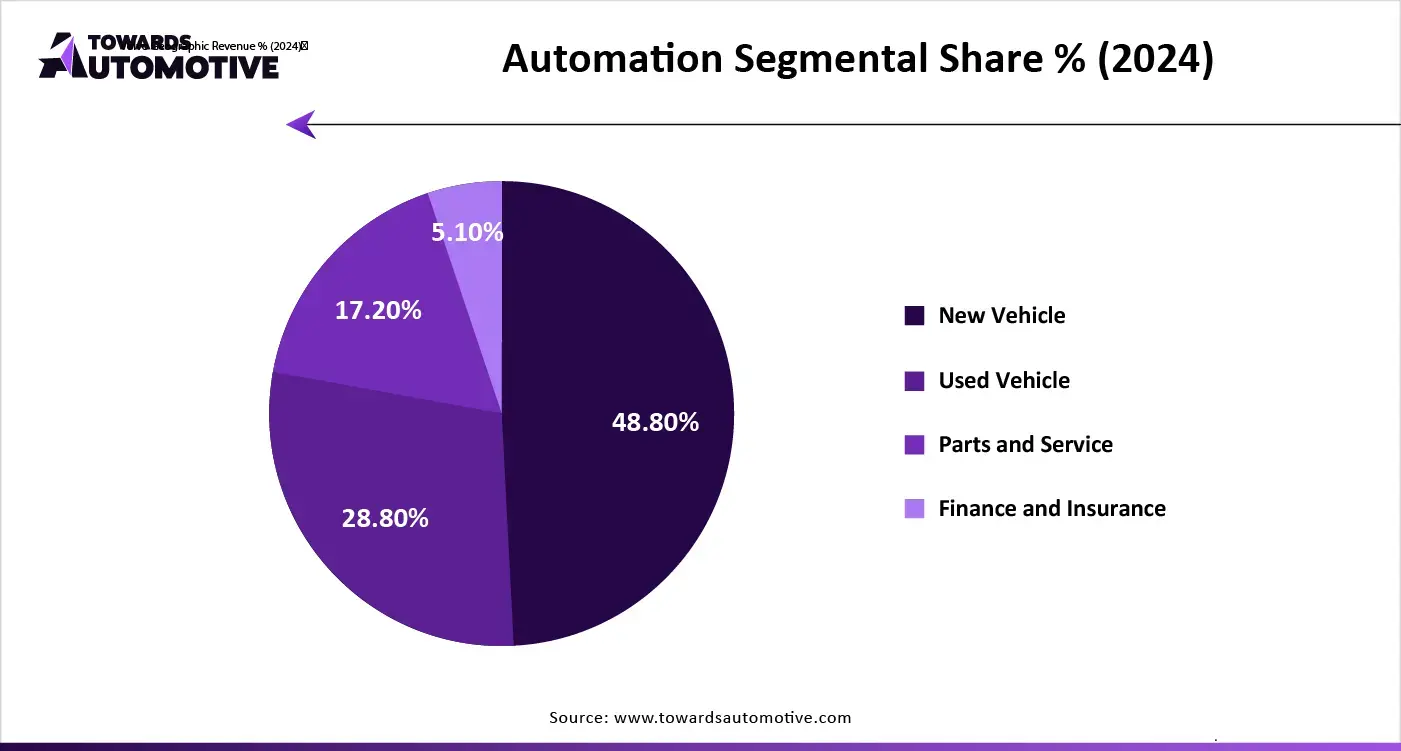

The vehicle sales (new & used) segment dominated the market with a share of around 50%. The growing demand for used luxury cars in the U.S. among the HNIs has boosted the market growth. Additionally, rapid investment by second-hand dealers for opening up new retail outlets coupled with increasing emphasis of consumers to purchase imported vehicles is playing a vital role in shaping the industrial landscape. Moreover, the increasing demand for EVs from fleet operators of the U.S. region is expected to drive the growth of the US auto retail & aftermarket market.

The digital retail platforms & e-commerce segment is expected to expand with the highest CAGR during the forecast period. The growing preference of consumers to purchase automotive parts from several online platforms including Ebay, Amazon, Walmart and some others has driven the market expansion. Additionally, the increasing adoption of smartphones along with surging popularity of e-commerce platforms is contributing to the industry in a positive manner. Moreover, rising focus of aftermarket companies for launching new websites to cater the needs of automotive consumers is expected to boost the growth of the US auto retail & aftermarket market.

The tires & wheels segment led the market with a share of around 28%. The growing demand for radial tires from SUV owners coupled with availability of wide range of tires in several online platforms has driven the market growth. Also, the rising consumer preference towards vehicle modification coupled with surging focus of tire manufacturers to sell their products through aftermarket platforms is playing a vital role in shaping the industrial landscape. Moreover, partnerships among wheel cap manufacturers and automotive aftermarket companies is expected to propel the growth of the US auto retail & aftermarket market.

The EV batteries & electronics segment is expected to rise with the highest CAGR during the forecast period. The increasing sales of EVs in the U.S. region has increased the demand for high-quality batteries, thereby driving the market expansion. Also, the availability of low-cost batteries in the aftermarket outlets coupled with rapid investment by startup companies for opening up new production centers is contributing to the industry in a positive manner. Moreover, the rising adoption of e-commerce platforms allow consumers to purchase different types of electronic components for EVs that in turn is expected to boost the growth of the US auto retail & aftermarket market.

The passenger cars segment led the market with a share of around 60%. The increasing sales of passenger vehicles in the U.S. has increased the demand for aftermarket parts, thereby driving the market growth. Additionally, the growing preference of HNIs for purchasing luxury interior parts for vehicles from aftermarket platforms coupled with availability of passenger car electronic components in aftermarket outlets is playing a vital role in shaping the industrial landscape. Moreover, the increasing adoption of passenger EVs for lowering vehicular emission is expected to drive the growth of the US auto retail & aftermarket market.

The light commercial vehicles (LCVs) segment is expected to grow with the highest CAGR during the forecast period. The growing application of light commercial vehicles (LCVs) in several industries such as logistics, construction, e-commerce and some others has boosted the market growth. Also, the rising preference of fleet operators to integrate aftermarket trackers in their vehicles for tracking real time updates coupled with availability of various LCV parts in online platforms is contributing to the industry in a positive manner. Moreover, the increasing use of high-quality aftermarket electronics in LCVs for enhancing the vehicular capabilities is expected to foster the growth of the US auto retail & aftermarket market.

The franchise dealerships segment led the market with a share of around 40%. The rising focus of aftermarket companies for opening new dealerships to cater the needs of automotive consumers across the U.S. region has boosted the market growth. Also, rapid investment by automotive aftermarket companies for expanding their network in different parts of the U.S. along with increasing emphasis of aftermarket dealerships to launch new online platforms is playing a prominent role in shaping the industry in a positive direction. Moreover, partnerships among franchised dealerships and fleet operators for regular maintenance of commercial vehicles is expected to proliferate the growth of the US auto retail & aftermarket market.

The online platforms segment is expected to grow with the fastest CAGR during the forecast period. The growing preference of automotive owners to purchase car components from online platforms has boosted the market growth. Additionally, the increasing focus of e-commerce companies to launch new online platforms to cater the needs of automotive users coupled with availability of several automotive parts in online platforms is playing a prominent role in shaping the industrial landscape. Moreover, numerous offers and benefits provided by online platforms for purchasing automotive parts is expected to boost the growth of the US auto retail & aftermarket market.

The individual consumers segment dominated the market with a share of around 55%. The growing emphasis of luxury car owners to purchase aftermarket seating systems for enhancing the overall driving experience has boosted the market expansion. Additionally, the increasing focus of automotive consumers to use aftermarket products in their vehicles due to their cost-effectiveness along with surging popularity of vehicle modification among youths is playing a prominent role in shaping the industrial landscape. Moreover, the availability of wide variety of automotive parts in aftermarket platforms enables individuals allows consumers to purchase products according to their budget, thereby fostering the growth of the US auto retail & aftermarket market.

The commercial fleets segment is expected to grow with the fastest CAGR during the forecast period. The increasing focus of fleet owners to purchase GPS trackers and meters from aftermarket platforms to enhance their profit margins has boosted the market growth. Additionally, the rapid deployment of EVs by fleet operators increases the use of aftermarket batteries coupled with rapid investment by market players for opening new outlets to cater the needs of commercial users is playing a crucial role in shaping the industry in a positive manner. Moreover, partnerships among fleet owners and aftermarket companies to integrate high-quality electronic items in commercial vehicles is expected to accelerate the growth of the US auto retail & aftermarket market.

South region led the US auto retail & aftermarket market with a share of around 35%. The increasing sales of electric vehicles in various Southern states including South Carolina, Texas, Arkansas and some others has boosted the market growth. Additionally, the growing emphasis of consumers to purchase automotive products from online platforms coupled with rise in number of aftermarket workshops is playing a vital role in shaping the industrial landscape. Moreover, the presence of various market players such as Penske Automotive Group, Inc, NEXUS Automotive International, Sun Fast International LLC, O'Reilly Automotive, AutoZone and some others is expected to propel the growth of the US auto retail & aftermarket market in this region.

West is expected to grow with the highest CAGR during the forecast period. The growing demand for luxury vehicles in several Western states such as California, Colorado, Hawaii and some others has driven the market expansion. Also, rapid investment by market players for opening up new outlets along with rising popularity of vehicle modification is contributing to the industry in a positive manner. Moreover, the presence of several market players such as Bridgestone Americas, Inc, Goodyear Tire & Rubber Company, Cox Automotive Inc, Walmart Inc and some others is expected to drive the growth of the US auto retail & aftermarket market in this region.

The foundation of automotive aftermarket parts production lies in the extraction and supply of essential raw materials such as lithium, cobalt, mangesium, plastic, composites, aluminum, and graphite.

The raw materials are processed into minute components for developing numerous types of automotive parts.

Completed automotive parts are delivered to fleet operators and individual owners and some others for enhancing vehicle modification.

| August 2025 | Announcement |

| Fan Jin, global leader of Amazon Autos | We look forward to bringing the convenience of Amazon Autos to used vehicle sales. This expansion is driven by strong interest from our dealer partners. By including certified pre-owned and used vehicles, we're meeting dealer demand for broader online reach while offering customers a wider selection of high-quality vehicles to fit your budget and unique lifestyle needs. |

| March 2025 | Announcement |

| Shane O’Kelly, president and chief executive officer at Advance Auto Parts | Advance Auto Parts is on the path to accelerate store growth and focused on the fundamentals of selling auto parts. We are excited about what’s to come for Advance. Our team members are committed to providing the right parts and the right service for our PRO and DIY customers in their communities. |

| August 2025 | Announcement |

| Neil Sethi, Director of U.S. Commercial Operations, Parts & Accessories at eBay | Buying a vehicle part online can feel like guesswork, but free returns let buyers purchase a part and easily send it back if it’s not right. We’re removing extra costs and uncertainty, so shoppers can tackle their vehicle projects with assurance, every time. |

| September 2025 | Announcement |

| Brandon Melton, the Product Owner,BOLT-ON TECHNOLOGY | For too long, small shops have been locked out of professional web development by cost and complexity, Pit Stop changes that overnight. Now every shop, no matter its size, can have a sleek, mobile-optimized website that drives new business and strengthens customer trust. This is the next frontier of digital presence in auto repair. |

| November 2024 | Announcement |

| Dwayne Bates,the AWA Senior Vice President of Aftermarket Sales | Agility has become key to success in the aftermarket business and this merger makes us more nimble and more flexible. Beyond opening doors to more opportunities and strengthening our alignment internally, the restructure should be seamless to our customers and suppliers. |

| March 2025 | Announcement |

| Eric Luftig, the Senior Vice President at Dorman | At Dorman, innovation drives everything we do. We're proud to bring groundbreaking solutions to the automotive aftermarket, helping consumers find the right parts when they need them most. Our commitment to empowering vehicle owners and repair professionals with quality, accessibility and reliability continues to fuel our passion for progress. |

| February 2025 | Announcement |

| Chris Battershell, the Aftermarket Vice President Region North America at ZF | ZF and its brands LEMFORDER, SACHS, TRW and WABCO have built a strong reputation over many decades for delivering high-quality, reliable aftermarket parts, and we take great pride in that. As we expand our lineup of OE-quality components in 2025, our goal is to ensure that more vehicle owners and technicians have access to top-tier parts. This is just the beginning we plan to introduce hundreds more OE-standard ZF Aftermarket parts, as well as expanded digital products and services this year |

| November 2024 | Announcement |

| Scott Turpin, the President and CEO at Aisin | This evolution in the way we do business in the global aftermarket will transform the experience for our customers, giving them access to a wider variety of parts and more comprehensive service offerings. There are many exciting developments underway at AISIN. |

| September 2024 | Announcement |

| Bill Nunnery, Senior Director, Sales and Marketing, Global Aftermarket for Dana Incorporated | Quality, velocity, and authenticity are driving vehicle performance in today’s rapidly evolving aftermarket, with customers demanding quick, responsive, and unmatched service. We’re leaning into their highest expectations with a relentless drive for continuous innovation throughout our aftermarket portfolio |

| April 2025 | Announcement |

| Hailey Long, the Director for Category Management, Pricing and Catalog for North America | One of our key priorities is making sure the right parts are available when you need them most right in that ‘sweet spot’ when certain repairs are most common. Not only does this mean first-to-market parts but also having the right parts at the right time. This approach drives value for both our customers and technicians by enhancing service readiness and market responsiveness. |

The US auto retail & aftermarket market is a rapidly developing industry with the presence of several dominating players. Some of the prominent companies in this industry consists of AutoNation, Inc., Lithia Motors, Inc., Penske Automotive Group, Inc., Advance Auto Parts, Inc., Genuine Parts Company (NAPA), CarMax, Inc., Sonic Automotive, Inc., O’Reilly Automotive, Inc., AutoZone, Inc., Bridgestone Americas, Inc., Goodyear Tire & Rubber Company, Cox Automotive Inc., Walmart Inc. (Auto Services & Parts), Amazon.com, Inc. (Auto Parts E-Commerce), eBay Motors and some others. These companies are constantly engaged in providing automotive goods to the consumers of U.S. and adopting numerous strategies such as acquisitions, collaborations, launches, partnerships, business expansions, joint ventures and some others to maintain their dominance in this industry.

In September 2025, PRT launched a new range of shock absorbers and strut assemblies in the North American aftermarket. These automotive components are designed for several vehicles including Tesla Model S and Buick LaCrosse.

Tier 1

Tier 2

By Offering

By Replacement Part Category

By Distribution Channel

By Vehicle Type

By End-Use

By Region

December 2025

October 2025

October 2025

October 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us