Armored Vehicle Market Strategic Analysis & Growth Opportunities

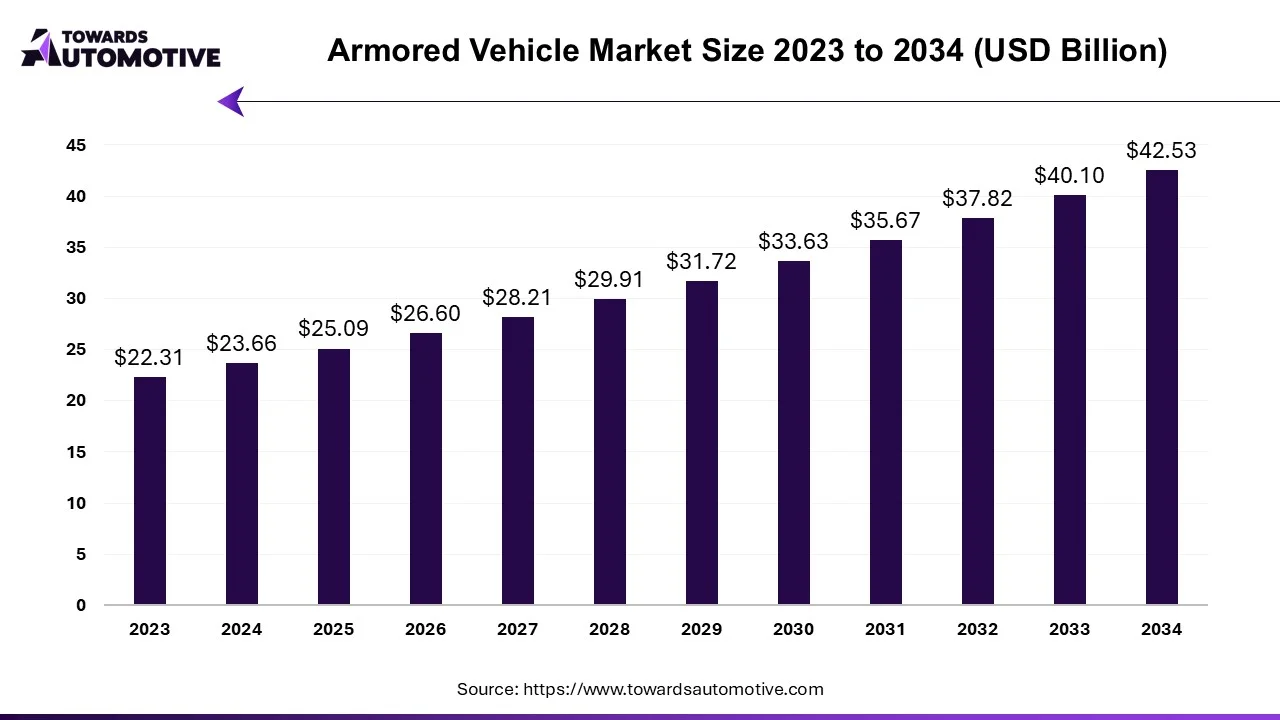

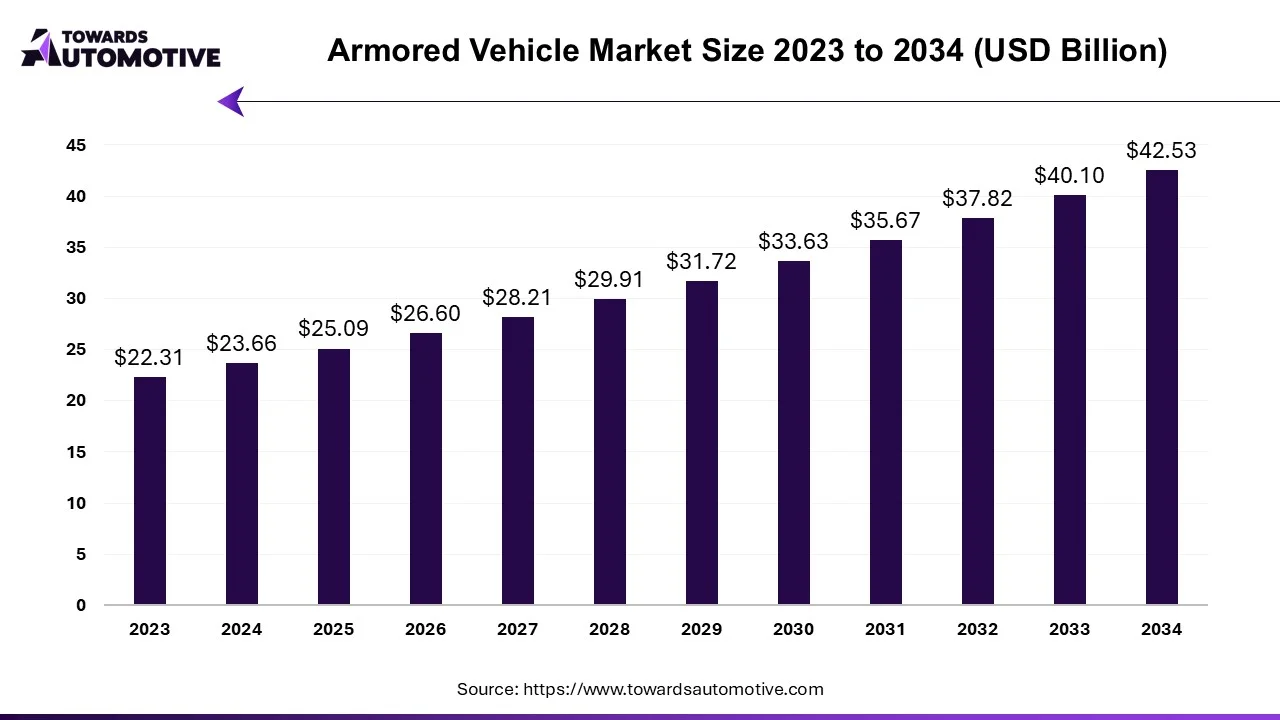

The armored vehicle market size is predicted to expand from USD 25.09 billion in 2025 to USD 42.53 billion by 2034, growing at a CAGR of 6.04% during the forecast period from 2025 to 2034.

Unlock Infinite Advantages: Subscribe to Annual Membership

Introduction

The armored vehicle market is a crucial branch of the military vehicle industry. This industry deals in manufacturing and distribution of armored vehicles in different parts of the world. There are different types of combat vehicles developed in this sector including main battle tank, infantry fighting vehicle, armored personal carriers, armored amphibious vehicles, mine-resistant ambush protected vehicles, light armored vehicles, self-propelled howitzers, air defense vehicles, armored morter carriers and some others. These vehicles are powered using electric propulsion systems and conventional fuels. The growing defense expenditure in different nations has boosted the market growth. This market is expected to rise significantly with the growth of the automotive sector around the globe.

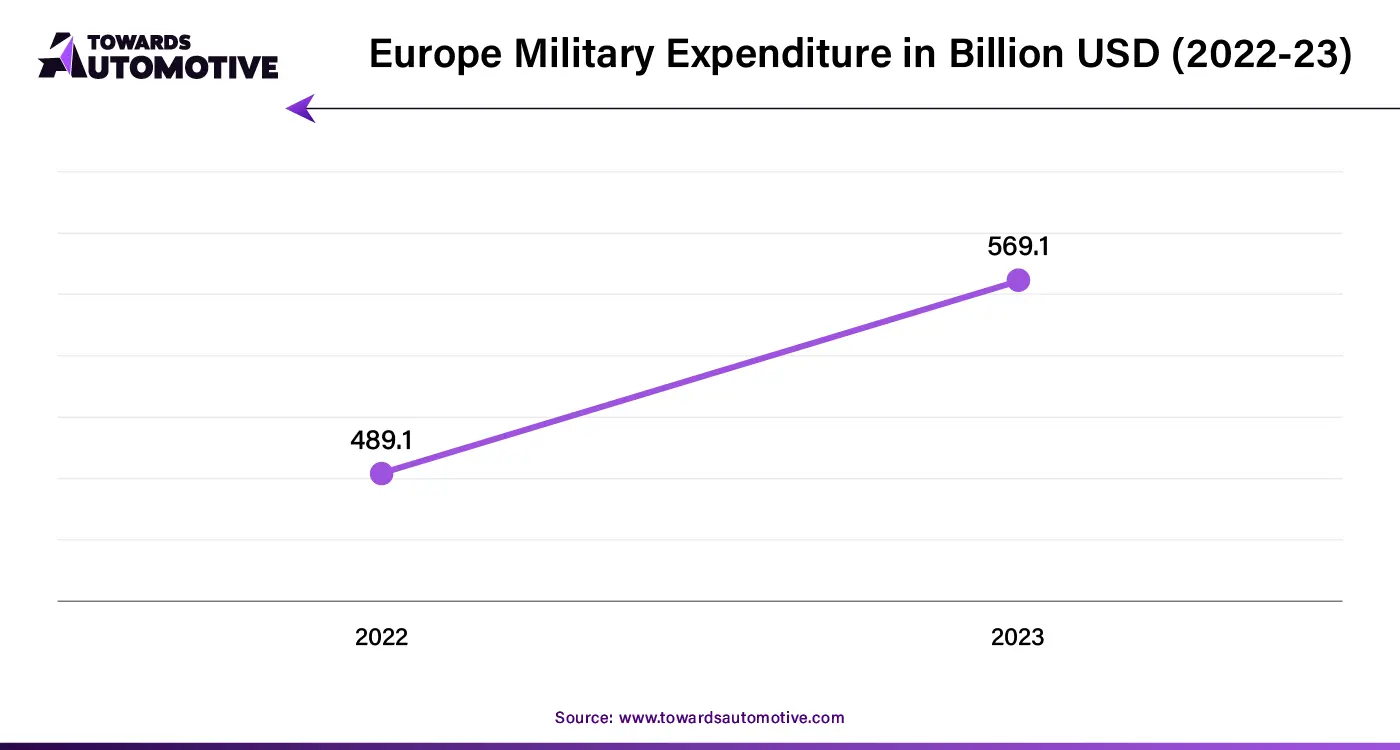

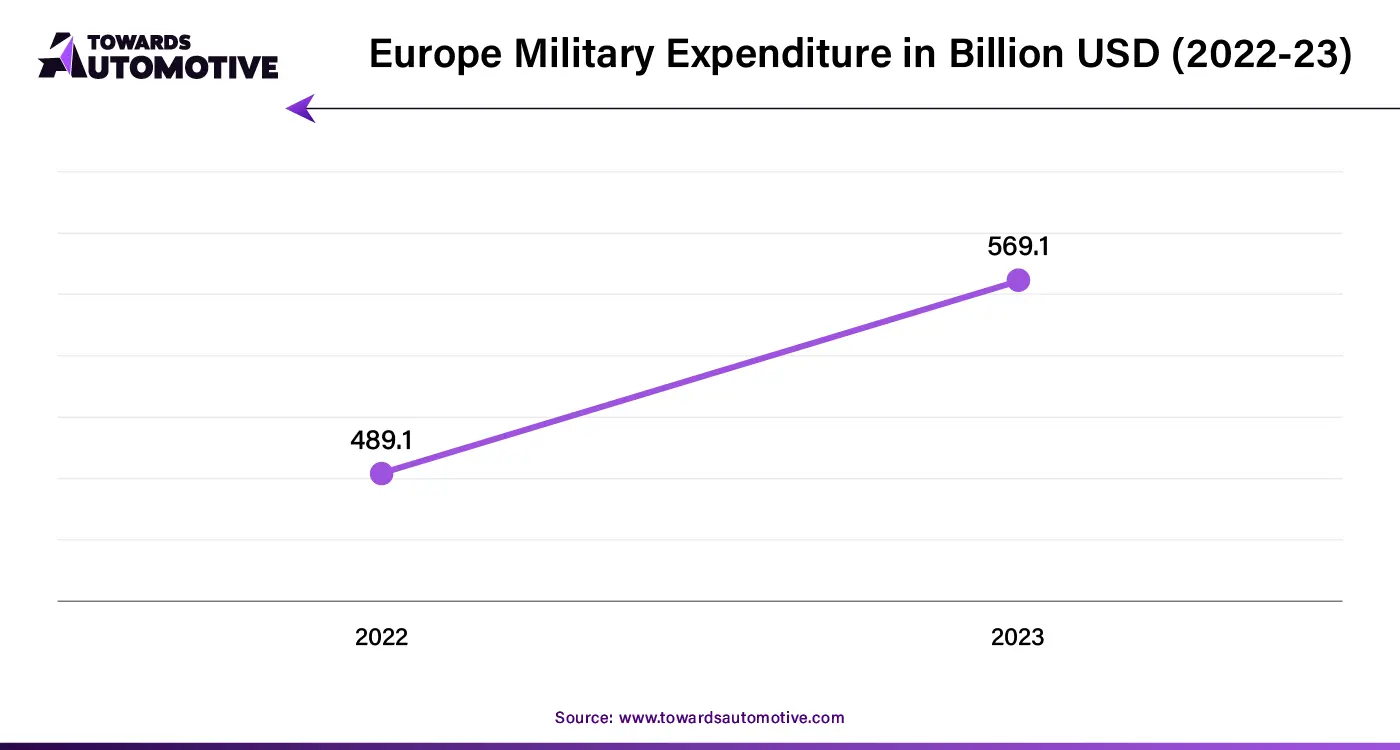

- According to the Stockholm International Peace Research Institute, the military expenditure of Europe in 2022 was US$ 489.1 billion that rose to US$ 569.1 billion in 2023.

Highlights of the Armored Vehicle Market

- North America held the dominant share of the armored vehicle market due to the rising defense expenditure in this region.

- Asia Pacific is expected to grow with the fastest CAGR due to the growing cross-border conflicts and political turmoils in this region.

- The combat vehicles segment dominated the market due to the increasing application of main battle tank and air defense vehicles in warfare zones.

- The wheeled segment led the market due to its application in troop deployment, border patrol operations and medical support for armed forces.

- According to the Jamestown Foundation, Kurganmashzavod manufactured around 463 armored vehicles during 2023.

- According to the Stockholm International Peace Research Institute, the revenues from sales of arms and military services by the 100 top companies in the industry reached US$632 billion in 2023.

- According to the Institute for Defense and Government Advancement, the U.S. government invested around US$ 5 billion for acquisition of new armored vehicles.

- According to the UK Parliament, the government has spent around 53.9 billion euros for strengthening the defense sector across the country.

Industry Leader Announcement

In February 2025, Sukaran Singh, the CEO of TASL made an announcement stating that, “The global launch of the TASL 4×4 LAMV is a major milestone in demonstrating India’s defense capabilities on the global stage.”

Competitive Landscape

The armored vehicle market is a fragmented industry with the presence of several dominating players. Some of the prominent companies in this industry comprises of BAE Systems (U.K.), General Dynamics Corporation (U.S.), Rheinmetall AG (Germany), Krauss-Maffei Wegmann GmbH (Germany), Denel SOC ltd (South Africa), IVECO DEFENCE VEHICLES (Italy), NORINCOGROUP and some others. These market players are constantly engaged in developing advanced buses for airport operations and adopting several strategies to sustain their dominant position in this industry.

.webp)

- According to the annual report of General Dynamics, the revenue of military vehicles segment in 2022 was US$ 4581 million that increased to US$ 5036 million.

Market Segmentations

By Platform

- Combat Vehicles

- Main Battle Tank

- Infantry Fighting Vehicle

- Armored Personal Carriers

- Armored Amphibious Vehicles

- Mine-Resistant Ambush Protected Vehicles

- Light Armored Vehicles

- Self-Propelled Howitzers

- Air Defense Vehicles

- Armored Morter Carriers

- Combat Support Vehicles

- Armored Supply Trucks

- Armored Command and Control Vehicles

- Repain and Recovery Vehicles

- Armored Engineering Vehicles

- Armored Ambulance Vehicles

- Armored Ammunition Carrier Vehicles

- Unmanned Armored Ground Vehicles

- Combat UAGV

- Combat Support UAGV

- Reconnaissance UAGV

- ISR UAGV

- Explosive Ordnance Disposal UAGV

By Propulsion

By Mobility

By Solution

By System

- Drive Systems

- Structures & Mechanisms

- Weapons & Ammunition Control Systems

- Countermeasure Systems

- Command & Control Systems

- Navigation Systems

- Observation & Display Systems

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

.webp)