August 2025

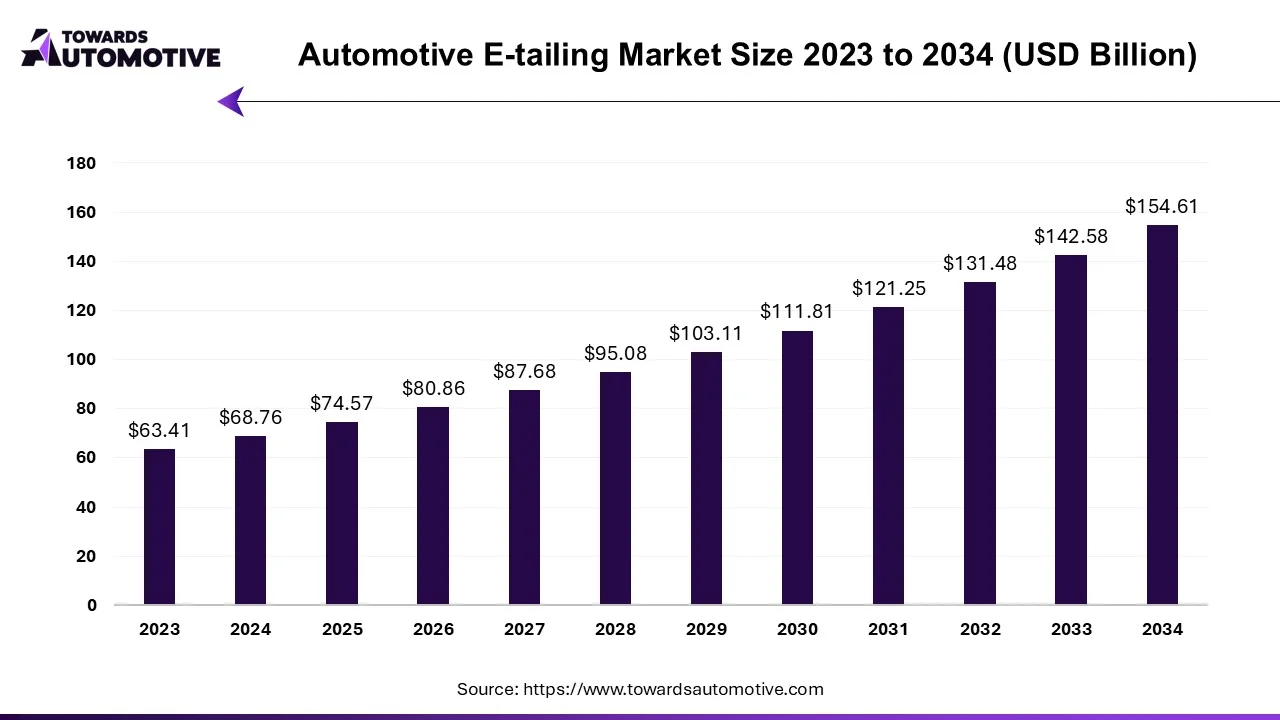

The automotive E-tailing market is forecasted to expand from USD 74.57 billion in 2025 to USD 154.61 billion by 2034, growing at a CAGR of 8.44% from 2025 to 2034.

Unlock Infinite Advantages: Subscribe to Annual Membership

The automotive e-tailing market is a prominent branch of the e-commerce industry. This industry deals in delivering automotive parts through online platforms. There are various types of automotive components available in online-platforms including electrical products, engine components, infotainment, interior accessories, tires and some others. These components are labelled as counterfeit products and branded products. The rising demand for infotainment systems to cater the needs of the passenger vehicles has boosted the market expansion. This market is expected to rise significantly with the growth of the automotive industry around the world.

| Metric | Details |

| Market Size in 2024 | USD 68.76 Billion |

| Projected Market Size in 2034 | USD 154.61 Billion |

| CAGR (2025 - 2034) | 8.44% |

| Leading Region | North America |

| Market Segmentation | By Component, By Product Label, By Vehicle Type and By Region |

| Top Key Players | Amazon.com Inc., Alibaba Group Holding Limited, AutoZone Inc., Walmart Inc., eBay Inc., BMW, O'reilly Automotive Inc., Delticom AG |

The major trends of automotive e-tailing market include collaborations, payment flexibility and rapid proliferation of smartphones.

Several automotive brands are partnering with e-commerce companies to deliver automotive products online. For instance, in December 2024, Amazon collaborated with Hyundai. This collaboration is done for developing an online car selling platform (Source: Digital Commerce 360 Community)

Numerous financial institutions are providing several facilities such as BNPL (Buy Now Pay Later) and Easy EMIs for purchasing automotive parts from online platforms. For instance, in April 2024, One Fintech launched a BNPL scheme in the U.S. This new scheme enables the people to purchase automotive components conveniently. (Source: Reuters )

The growing sales of smartphones in different parts of the world has enabled people to purchase automotive components from homes. According to the India Brand Equity Foundation, the Indian smartphone export increased by 42% in 2023-24 as compared to 2022-23. (Source: India Brand Equity Foundation )

The interior accessories segment held the largest share of the market. The growing demand for leather-finished seat covers from luxury car owners has driven the market growth. Additionally, the increasing trend of wooden dashboards among mid-aged individuals along with rapid integration of ambient lights in modern vehicles is further adding to the overall industrial expansion. Moreover, the availability of various interior accessories such as dome module, center stack, instrument cluster and some others in e-commerce platforms is driving the growth of the automotive e-tailing market.

The electrical products segment is anticipated to rise with a considerable CAGR during the forecast period. The availability of wide variety of automotive electronics such as ECUs, sensors, switches, harnesses and some others in online platforms is driving the market growth. Additionally, numerous e-tailing companies have started investing heavily for stocking electronic components of old vehicles, thereby fostering the industrial expansion. Moreover, various coupons and discounts provided by e-commerce companies for purchasing automotive electronics is further boosting the growth of the automotive e-tailing market.

| 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | 2032 | 2033 | 2034 | |

| Electrical Products | 15.13 | 16.85 | 18.76 | 20.87 | 23.2 | 25.78 | 28.62 | 31.77 | 35.24 | 39.07 | 43.29 |

| Engine Components | 12.38 | 13.12 | 13.91 | 14.73 | 15.59 | 16.5 | 17.44 | 18.43 | 19.46 | 20.53 | 21.65 |

| Infotainment | 10.31 | 11.41 | 12.61 | 13.94 | 15.4 | 17.01 | 18.78 | 20.73 | 22.88 | 25.24 | 27.83 |

| Interior Accessories | 13.75 | 14.69 | 15.69 | 16.75 | 17.88 | 19.07 | 20.35 | 21.7 | 23.14 | 24.67 | 26.28 |

| Tires | 17.19 | 18.49 | 19.89 | 21.39 | 23.01 | 24.75 | 26.62 | 28.61 | 30.76 | 33.06 | 35.56 |

The branded segment dominated this industry. The growing demand for genuine automotive accessories in developed nations such as the U.S., Canada, UK, Germany, France, Italy and some others has boosted the market expansion. Also, the availability of branded automotive components in several trusted e-commerce platforms such as Amazon, Walmart, Ebay, Alibaba and some others is adding to the industrial growth. Moreover, numerous partnerships among automotive companies and e-commerce brands for delivering high-quality automotive components is expected to propel the growth of the automotive e-tailing market.

The counterfeit segment is predicted to rise with a significant CAGR during the forecast period. The increasing demand for affordable automotive components in mid-income countries such as India, Vietnam, Indonesia, Brazil and some others has driven the market growth. Additionally, the rising use of automotive replica products to maintain status in societies along with availability of a wide range of counterfeit products in online platforms is further adding to the industrial expansion. Moreover, the growing integration of counterfeit accessories in old vehicles is likely to drive the growth of the automotive e-tailing market.

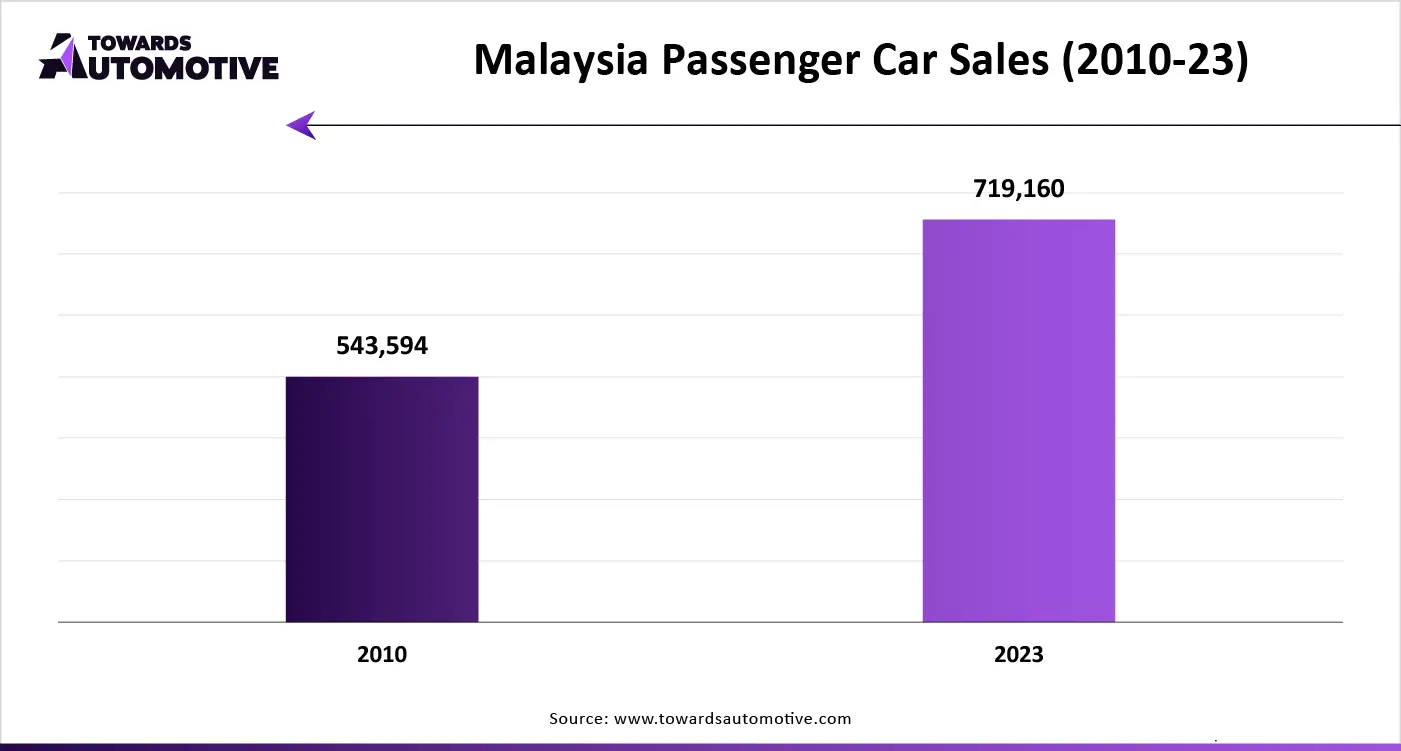

The passenger vehicle segment led the industry. The growing sales and production of passenger cars in several countries such as India, China, U.S., Canada, France, Germany, Italy and some others is driving the market expansion. Additionally, the ongoing trend of vehicle customization along with integration of superior-quality infotainment systems and HUDs in modern cars is adding to the industrial growth. Moreover, the availability of passenger car-based seat covers and electric components in online platforms is further driving the growth of the automotive e-tailing market.

The two-wheeler segment is projected to grow at a rapid pace during the forecast period. The rising demand for superbikes among youths has boosted the market growth. Also, the increasing adoption of electric bikes and electric scooters in several countries such as India, China, Singapore, UK and some others is further contributing of the industrial expansion. Moreover, the availability of numerous two-wheeler accessories such as GPS trackers, visors, seats, grab rail, seat ring, seat extender and some others is anticipated to drive the growth of the automotive e-tailing market.

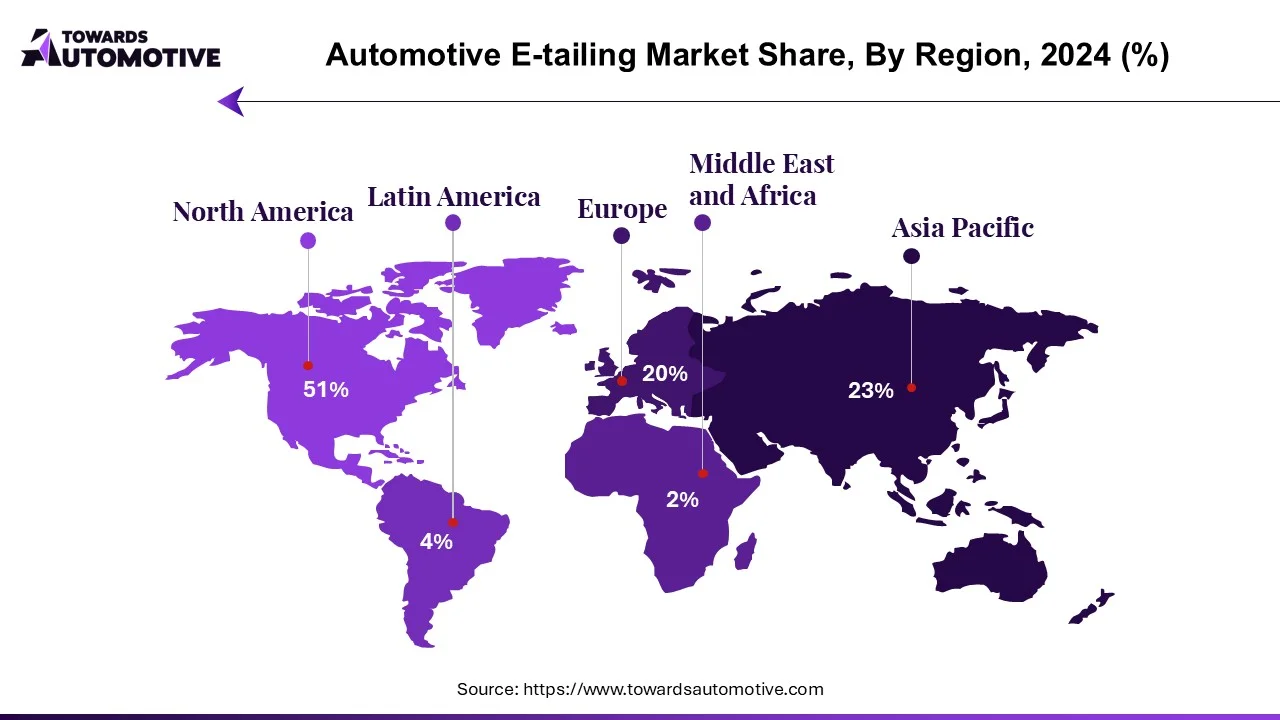

North America held the largest share of the automotive e-tailing market. The rising demand for aftermarket spoilers and power exhaust systems in countries such as the U.S. and Canada has boosted the market growth. Additionally, the growing adoption of electric vehicles has increased the demand for several replacement parts such as batteries, powertrain, sensors and some others that in turn contributes to the overall industrial expansion. Moreover, the presence of various automotive brands such as Rivian, Buick, Chevrolet, Ford and some others is further accelerating the growth of the automotive e-tailing market in this region.

U.S. dominated the market in this region. The growing demand for designer automotive interiors along with increasing consumer interest towards online shopping has driven the market growth. Additionally, the availability of well-established logistics channel coupled with the presence of several market players such as Amazon, Walmart Inc, AutoZone Inc., eBay Inc., O'reilly Automotive Inc. and some others is shaping the industry in a positive direction.

Asia Pacific is expected to grow with a significant CAGR during the forecast period. The growing sales and production of passenger vehicles in various countries such as China, India, Japan, South Korea and some others has increased the demand for automotive parts, thereby driving the market growth. Also, the increasing demand for affordable automotive parts in mid-income countries has urged people to purchase from online platforms that in turn drives the industrial expansion. Moreover, the rapid adoption of smart phones along with increased proliferation of 5G technology is further accelerating the growth of the automotive e-tailing market in this region.

China and India contribute significantly in this region. In China, the market is generally driven by the presence of well-established supply chain along with rise in number of automotive component startups. Additionally, the rapid growth in cross-border trade activities as well as technological advancements in automotive manufacturing sector is playing a positive role in shaping the industry. In India, the market is generally driven by the rapid adoption of e-commerce platforms such as Amazon, Flipkart, Tata CLiQ for purchasing automotive components. Additionally, numerous financial institutions are providing credit cards to middle-class consumers that enable them to pay in EMIs when shopping from online platforms, thereby contributing to the overall market growth.

| 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | 2032 | 2033 | 2034 | |

| North America | 15.13 | 16.33 | 17.63 | 19.03 | 20.54 | 22.17 | 23.93 | 25.83 | 27.87 | 30.08 | 32.47 |

| Europe | 13.75 | 14.84 | 16.01 | 17.27 | 18.64 | 20.11 | 21.69 | 23.4 | 25.24 | 27.23 | 29.38 |

| Asia-Pacific | 30.94 | 33.7 | 36.71 | 39.98 | 43.55 | 47.43 | 51.66 | 56.26 | 61.27 | 66.72 | 72.67 |

| Latin America | 4.81 | 5.26 | 5.74 | 6.27 | 6.85 | 7.48 | 8.16 | 8.91 | 9.73 | 10.62 | 11.6 |

| Middle East & Africa | 4.13 | 4.43 | 4.77 | 5.13 | 5.5 | 5.92 | 6.37 | 6.84 | 7.37 | 7.92 | 8.49 |

The automotive e-tailing market is a rapidly developing industry with the presence of a several dominating players. Some of the prominent companies in this industry consists of Amazon.com Inc., Alibaba Group Holding Limited, AutoZone Inc., Walmart Inc., eBay Inc., BMW, O'reilly Automotive Inc., Delticom AG, Advance Auto Parts Inc. and some others. These companies are constantly engaged in delivering automotive parts across the world and adopting numerous strategies such as business expansions, collaborations, launches, partnerships, joint ventures, acquisitions and some others to maintain their dominance in this market.

By Component

By Product Label

By Vehicle Type

By Region

August 2025

August 2025

August 2025

July 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us