August 2025

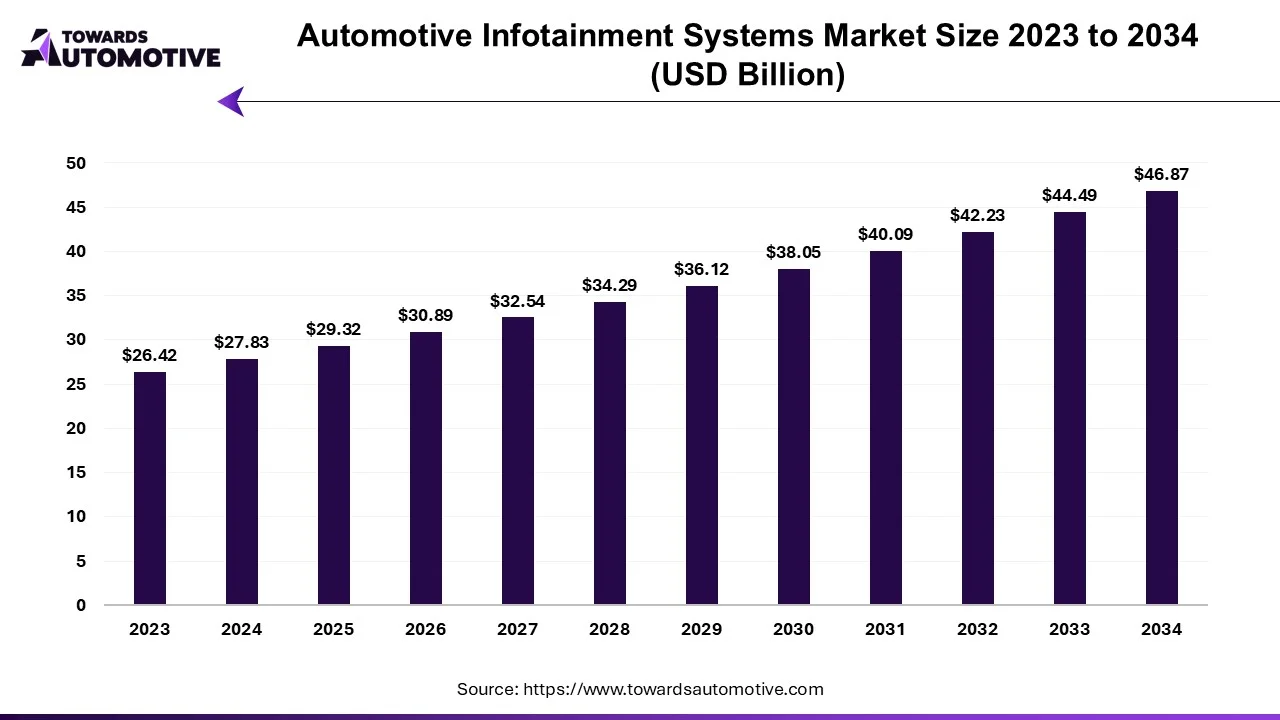

The automotive infotainment systems market is forecasted to expand from USD 29.32 billion in 2025 to USD 46.87 billion by 2034, growing at a CAGR of 5.35% from 2025 to 2034.

Unlock Infinite Advantages: Subscribe to Annual Membership

The automotive infotainment systems market is a prominent branch of the automotive industry. This industry deals in manufacturing and distribution of infotainment systems for the automotive sector. There are various types of products developed in this sector comprising of audio unit, display unit, heads-up display, navigation unit, communication unit and some others. These products are designed for different types of vehicles including passenger cars and commercial vehicles. The growing trend of integrating smart infotainment systems in electric vehicles has boosted the market expansion. This market is expected to rise significantly with the growth of the multimedia sector around the world.

Automotive Infotainment Systems Market Size, By Product Type, (USD Billion)

| 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | 2032 | 2033 | 2034 | |

| Audio Unit | 5.57 | 5.76 | 5.96 | 6.17 | 6.38 | 6.59 | 6.81 | 7.03 | 7.26 | 7.50 | 7.73 |

| Communication Unit | 5.01 | 5.31 | 5.62 | 5.95 | 6.31 | 6.68 | 7.08 | 7.50 | 7.94 | 8.41 | 8.90 |

| Display Unit | 6.12 | 6.49 | 6.89 | 7.31 | 7.75 | 8.22 | 8.71 | 9.24 | 9.80 | 10.39 | 11.01 |

| Heads-Up Display | 2.78 | 3.02 | 3.27 | 3.55 | 3.84 | 4.15 | 4.49 | 4.85 | 5.24 | 5.65 | 6.09 |

| Navigation Unit | 8.35 | 8.74 | 9.15 | 9.56 | 10.00 | 10.47 | 10.96 | 11.46 | 11.99 | 12.54 | 13.14 |

The navigation unit segment held a dominant share of the market. The increasing adoption of high-quality navigation devices in passenger vehicles has boosted the market growth. Also, the rising use of navigation units in automotives to enhance location-based services is shaping the industry in a positive direction. Additionally, the integration of advanced technologies such as AI and IoT in navigation systems is expected to propel the growth of the automotive infotainment systems market.

The heads-up display segment is likely to rise with the fastest CAGR during the forecast period. The rising demand for enhancing the cabin experience of vehicles has boosted the market expansion. Additionally, the increasing adoption of HUDs in modern cars for enhancing several applications such as speed assessment, navigation, safety alerts and some others is further playing a vital role in shaping the industrial landscape. Moreover, the integration of augmented reality (AR) in HUDs and rapid advancements in micro-display technologies is projected to drive the growth of the automotive infotainment systems market.

The OEM fitted segment held the largest share of the market. The growing demand for genuine infotainment systems among the consumers of passenger cars has boosted the market growth. Additionally, numerous partnerships among automotive OEMs and infotainment manufacturers to develop advanced infotainment systems is likely to shape the industrial landscape. Moreover, the increasing adoption of OEM-based infotainment systems in luxury cars is likely to drive the growth of the automotive infotainment systems market.

The aftermarket segment is anticipated to witness rapid growth during the forecast period. The growing demand for affordable infotainment systems in developing countries such as India, Vietnam, Indonesia and some others has driven the market expansion. Also, the rise in number of automotive detailing centers along with numerous offers and discounts provided by aftermarket sector is contributing significantly to industrial expansion. Additionally, various partnerships and collaborations among market players to launch advanced infotainment systems is likely to boost the growth of the automotive infotainment systems market.

The passenger cars segment dominated this industry. The growing sales and production of passenger vehicles in different parts of the world has boosted the market expansion. Also, the rising consumer preference towards android-based car infotainment systems along with launches of various infotainment systems designed for passenger cars is further contributing to the industrial growth. Moreover, the rapid integration of AI-enabled infotainment systems in luxury vehicles for enhancing the traveling experience of passengers is anticipated to propel the growth of the automotive infotainment systems market.

The commercial vehicle segment is predicted to rise with a considerable CAGR during the forecast period. The growing adoption of LCEVs in several industries such as logistics, construction, retail, agriculture and some others has boosted the market growth. Also, the rising sales of autonomous trucks in developed nations has increased the demand for advanced infotainment systems, thereby fostering the industrial expansion. Moreover, the increasing use of superior audio-systems in luxury buses to enhance the traveling experience of passengers is expected to drive the growth of the automotive infotainment systems market.

Automotive Infotainment Systems Market Size, By Region, (USD Billion)

| 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | 2032 | 2033 | 2034 | |

| Asia-Pacific | 10.57 | 11.22 | 11.93 | 12.66 | 13.43 | 14.26 | 15.14 | 16.06 | 17.06 | 18.10 | 19.22 |

| Europe | 6.12 | 6.41 | 6.70 | 7.01 | 7.34 | 7.67 | 8.03 | 8.40 | 8.78 | 9.19 | 9.61 |

| Latin America | 2.23 | 2.36 | 2.50 | 2.65 | 2.81 | 2.98 | 3.16 | 3.35 | 3.55 | 3.76 | 3.98 |

| Middle East & Africa | 2.23 | 2.32 | 2.41 | 2.51 | 2.61 | 2.71 | 2.82 | 2.93 | 3.04 | 3.16 | 3.28 |

| North America | 6.68 | 7.01 | 7.35 | 7.71 | 8.09 | 8.49 | 8.90 | 9.34 | 9.80 | 10.28 | 10.78 |

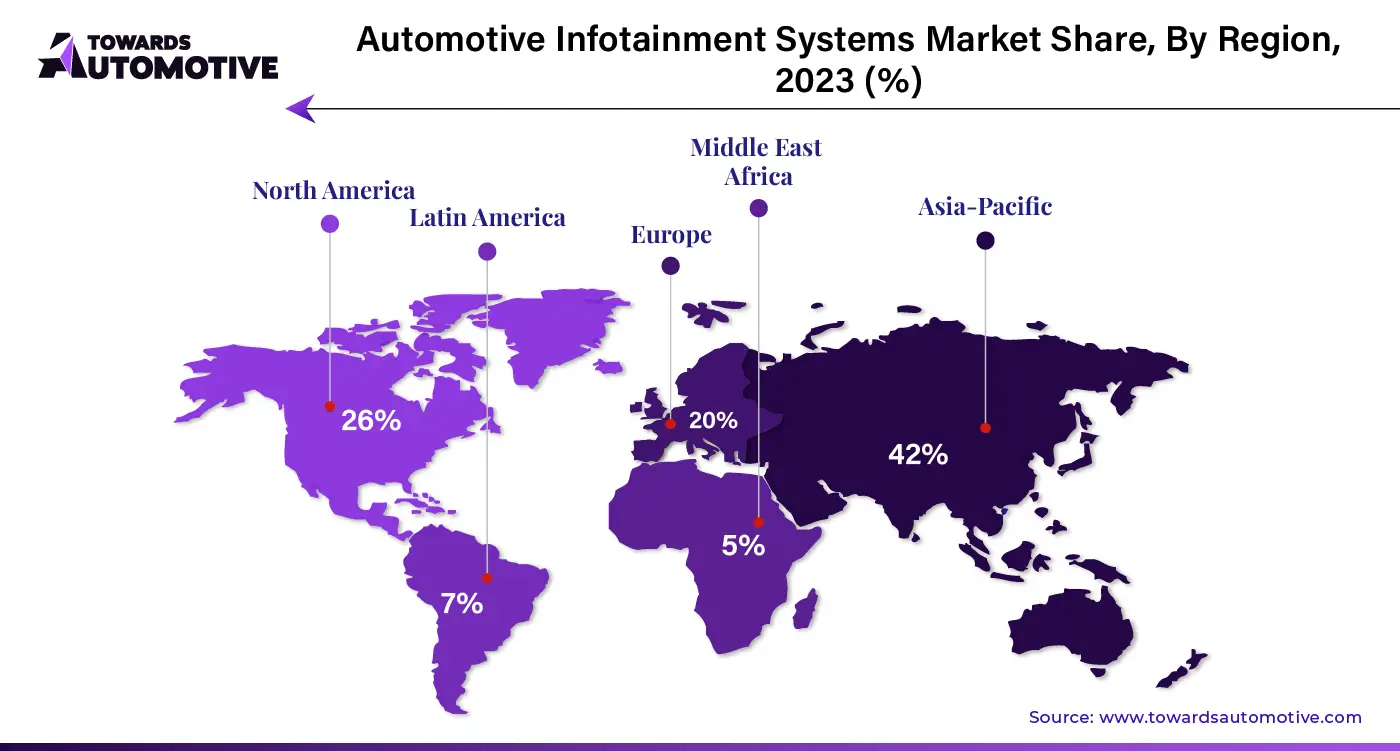

Asia Pacific held the highest share of the automotive seat market. The growing sales and production of automotives in countries such as India, China, Japan, South Korea and some others has boosted the industrial expansion. Also, the increasing adoption of electric vehicles along with rise in number of startup companies dealing in automotive components is further contributing to the market in a positive way. Moreover, the presence of several market players such as Sony, Pioneer, Hyundai Mobis, DENSO Corporation, Aisin, LG and some others is expected to boost the growth of the automotive infotainment systems market in this region.

China is the major contributor in this region. In China, the market is generally driven by the increasing sales of electric vehicles along with availability of essential raw materials. Also, rapid investment by automotive component manufacturers for developing advanced infotainment systems has further bolstered the industrial growth.

Europe is expected to grow with a significant CAGR during the forecast period. The growing adoption of luxury vehicles and sports cars in several nations such as Germany, France, UK, Italy and some others has boosted the market growth. Also, the rising preference of consumers towards vehicle modification along with increasing sales of autonomous vehicles is further adding to the industrial expansion. Moreover, the presence of various automotive companies such as BMW, Audi, Mercedes, Ferrari, Lamborghini and some others is driving the growth of the automotive infotainment systems market in this region.

Germany and UK are the major contributors in this region. In Germany, the market is generally driven by the growing production of vehicles along with technological advancements in automotive sector. In UK, the rising sales of ADAS-based vehicles coupled with increasing trend of luxury SUVs is driving the market expansion.

The automotive infotainment systems market is a highly competitive industry with the presence of a numerous dominating players. Some of the prominent companies in this industry consists of Pioneer Corporation, Continental AG, Harman International, Alpine Electronics, Denso Corporation, Panasonic Corporation, Visteon Corporation, Clarion Co., Ltd., and some others. These companies are constantly engaged in developing infotainment systems for the automotive sector and adopting numerous strategies such as acquisitions, launches, collaborations, joint ventures, partnerships, business expansions and some others to maintain their dominant position in this industry. For instance, in December 2024, Visteon announced to open a new technical center in Kolkata, India. This center is inaugurated to enhance R&D related to android-based infotainment systems. Also, in May 2025, Pioneer Corporation Ltd launched DMH-AF555BT. DMH-AF555BT is an advanced 9-inch infotainment system designed for modern vehicles.

By Product Type

By Fit Type

By Vehicle Type

By Region

August 2025

August 2025

August 2025

August 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us