August 2025

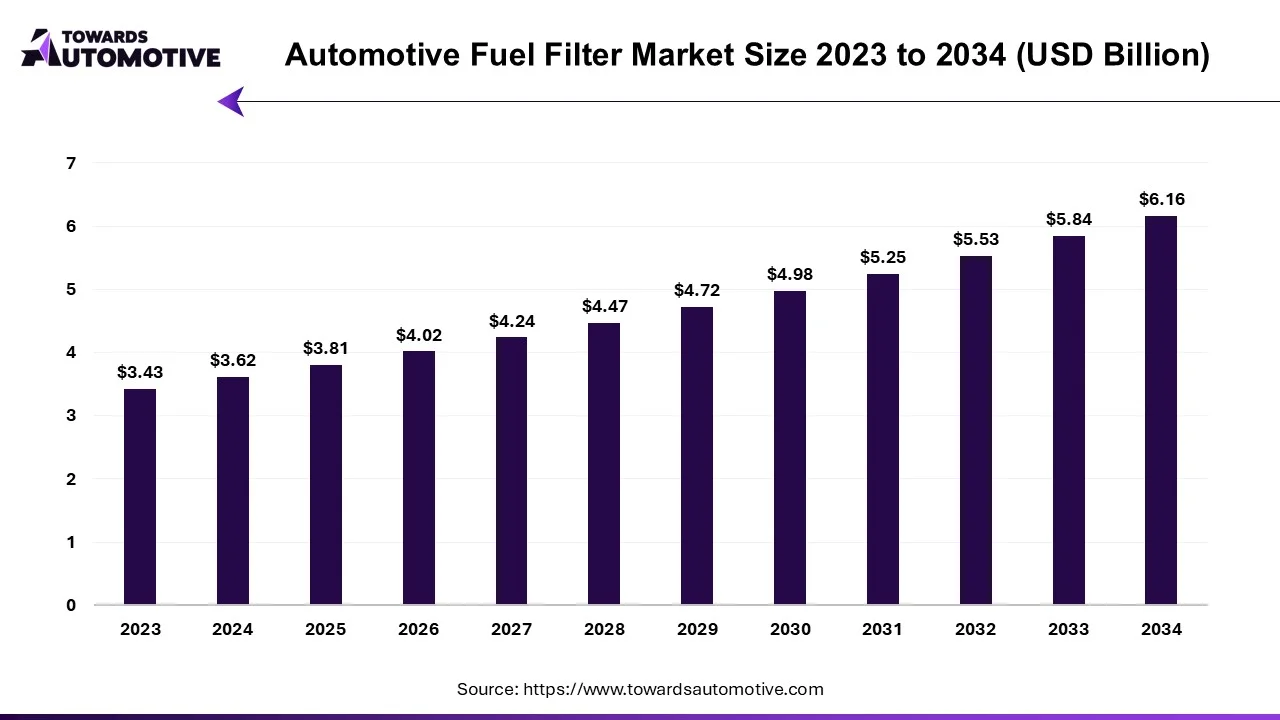

The automotive fuel filter market is expected to increase from USD 3.81 billion in 2025 to USD 6.16 billion by 2034, growing at a CAGR of 5.46% throughout the forecast period from 2025 to 2034.

Unlock Infinite Advantages: Subscribe to Annual Membership

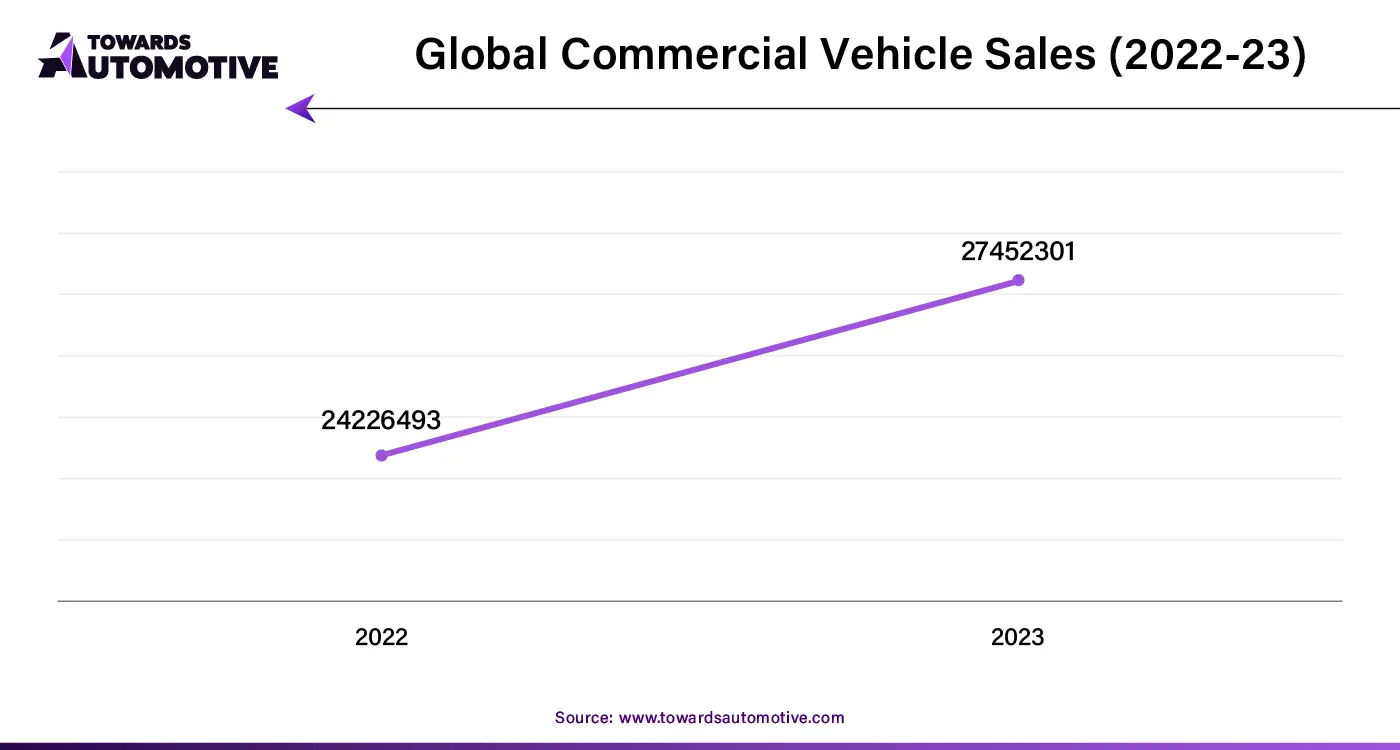

The automotive fuel filter market is a prominent branch of the automotive industry. This industry deals in manufacturing and distribution of fuel filters for the automotive industry. There are several types of filters developed in this sector consisting of diesel fuel filter and gasoline fuel filter. These fuel filters are designed for different types of vehicles including passenger cars, light commercial vehicles, heavy commercial vehicles and some others. It is available in a sales channel comprising of OEM and aftermarket. The growing use of fuel filters in commercial vehicles has boosted the industrial expansion. This market is expected to grow significantly with the rise of the automotive components sector in different parts of the globe.

| Metric | Details |

| Market Size in 2024 | USD 3.62 Billion |

| Projected Market Size in 2034 | USD 6.16 Billion |

| CAGR (2025 - 2034) | 5.46% |

| Leading Region | Asia Pacific |

| Market Segmentation | By Filter Type, By Vehicle Type, By Sales Channel, By Fuel Type and By Region |

| Top Key Players | Donaldson Company, Inc., Mahle GmbH, Fram, Bosch, Mann+Hummel, Denso Corporation, ACDelco |

The diesel fuel filters segment held a dominant share of the market. The growing sales of diesel-powered light-duty vehicles in several countries such as China, U.S., India and some others has boosted the market growth. Also, the rising demand for heavy-duty trucks from several end-users including mining, construction, aerospace and some others is further adding to the industrial expansion. Moreover, the increasing sales of diesel buses for commute purposes coupled with rapid investments by automotive components manufacturers to develop high-quality diesel filters is expected to boost the growth of the automotive fuel filter market.

The gasoline fuel filters segment is likely to rise with a considerable CAGR during the forecast period. The growing demand for high-performance sports cars in different parts of the world has boosted the market expansion. Also, surge in demand for economic vehicles in mid-income countries such as India, Vietnam, Indonesia and some others has further increased the demand for gasoline fuel filters, thereby driving the industrial growth. Moreover, numerous partnerships among automotive companies and fuel filter companies for developing superior-quality gasoline filters is further anticipated to drive the growth of the automotive fuel filter market.

The passenger car segment held the largest share of the market. The rising demand for luxury SUVs among the people living in western nations such as UK, France, Germany, U.S., Canada and some others is driving the market growth. Also, the increasing sales of affordable hatchbacks in mid-income countries such as India and Vietnam has further played a significant role in shaping the industry in a positive direction. Moreover, several collaborations among passenger vehicle manufacturers and fuel filter companies to develop a wide range of oil filters is projected to foster the growth of the automotive fuel filter market.

The light commercial vehicle segment is anticipated to witness the fastest growth during the forecast period. The rising demand for LCVs from logistics sector for transporting different items such as fruits, vegetables, white goods and some others is driving the market growth. Also, the growing adoption of these vehicles in several sectors including retail, e-commerce, FMCG, and some others has contributed to the industrial expansion. Moreover, numerous automotive companies such as BAIC Motor Corporation Ltd., Dongfeng Motor Corporation, Ford Motor Company and some other are developing several light commercial vehicles to cater the needs of the consumers is further accelerating the growth of the automotive fuel filter market.

The OEM segment dominated this industry. The rising demand for genuine automotive products among consumers has boosted the market expansion. Also, rapid investment by OEMs for opening new service centers for delivering superior servicing experience to automotive owners has contributed to the industrial expansion. Moreover, the availability of diesel filters and petrol filters in OEMs is expected to foster the growth of the automotive fuel filter market.

The aftermarket segment is predicted to rise with a notable CAGR during the forecast period. The rising demand for customized automotive accessories among youths has boosted the market expansion. Additionally, the rise in number of car detailing centers along with availability of customized automotive filters in several online platforms such as Amazon, Walmart, Alibaba and some others is playing a vital role in shaping the industrial growth.

Asia Pacific held the highest share of the automotive fuel filter market. The growing sales of passenger vehicles in countries such as India, China, Japan, South Korea and some others has boosted the market growth. Also, the rising demand for diesel-powered heavy-duty trucks from several industries such as mining, construction, oil and gas, and some others is playing a vital role in shaping the industrial landscape. Moreover, the presence of several automotive brands such as Tata Motors, Suzuki, Mahindra, Toyota, Mitsubishi, SAIC and some others is expected to drive the growth of the automotive fuel filter market in this region.

China dominated the market in this region. The rising sales and production of vehicles in China is a major driver of this industry. Also, the availability of essential raw materials required for manufacturing fuel filters along with abundance of skilled labor force is further adding to the industrial expansion. Moreover, the presence of several market players such as Jiangxi Sange Filter Manufacturing Co., Ltd, Hebei Purefine Auto Parts Co., Ltd., Dongguan Seahorse Filter Co., Ltd. and some others is driving the market growth in this nation.

North America is expected to grow with a significant CAGR during the forecast period. The growing demand for hybrid luxury cars in nations such as the U.S. and Canada has contributed to the industrial expansion. Additionally, increasing trend of diesel-powered SUVs among off-roading enthusiasts coupled with technological advancements in automotive sector is playing a vital role in shaping the industry in a positive direction. Moreover, the presence of various fuel filter manufacturing brands such as Cummins Inc., K&N Engineering, Inc., Parker Hannifin Corporation and some others is likely to propel the growth of the automotive fuel filter market in this region.

U.S. is the major contributor of the market in this region. In U.S., the market is generally driven by the rising sales of gasoline-powered vehicles along with rapid integration of advanced technologies such as AI and IoT in automotive sector. Moreover, the presence of several automotive giants such as Ford, Chevrolet, GMC and some others is further adding to the overall industrial expansion.

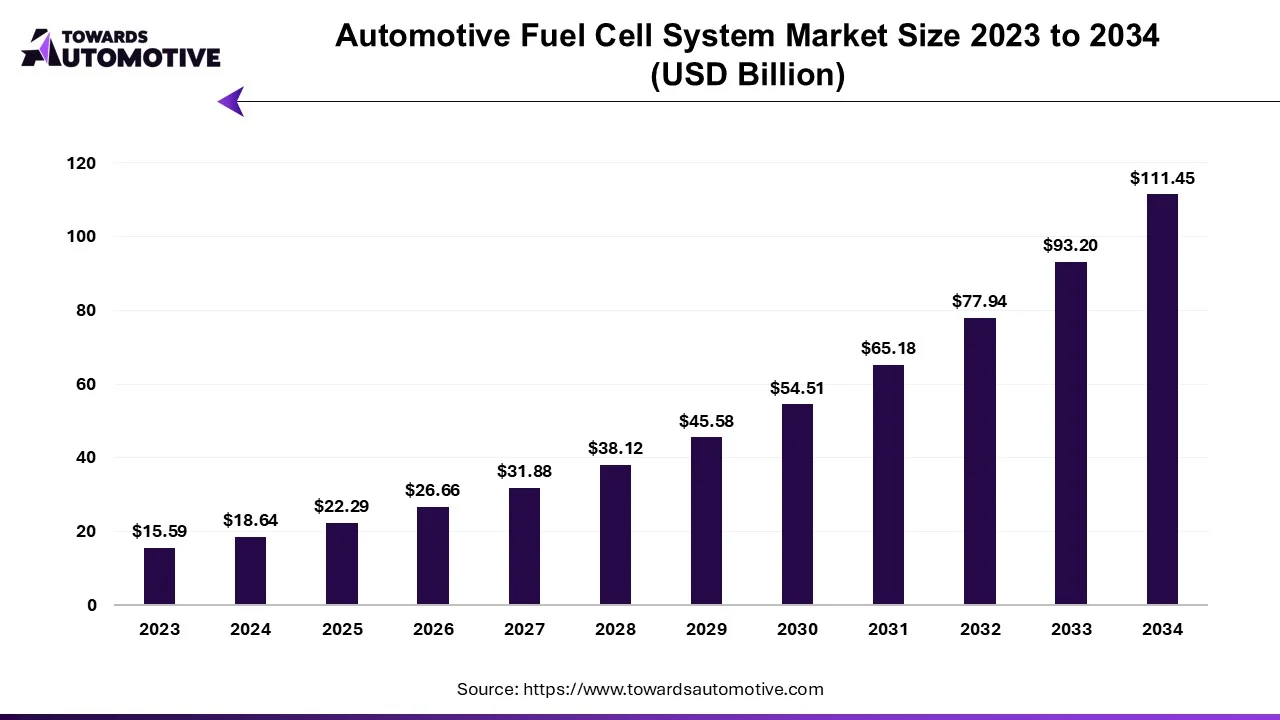

The global automotive fuel cell system market is predicted to expand from USD 22.29 billion in 2025 to USD 111.45 billion by 2034, growing at a CAGR of 19.58% during the forecast period from 2025 to 2034.

The automotive fuel cell system is a clean energy solution revolutionizing the transportation sector by offering an efficient and sustainable alternative to traditional internal combustion engines. It operates by converting hydrogen gas into electricity through an electrochemical process, producing only water and heat as byproducts. This makes fuel cell vehicles (FCVs) environmentally friendly, as they generate zero emissions while delivering long driving ranges and quick refueling times compared to battery electric vehicles (BEVs). The system typically consists of components such as a fuel cell stack, hydrogen storage tanks, and power electronics that work in synergy to provide seamless energy to the vehicle's motor. Increasing concerns over greenhouse gas emissions, rising fossil fuel prices, and global initiatives to curb air pollution have accelerated the adoption of automotive fuel cell technology.

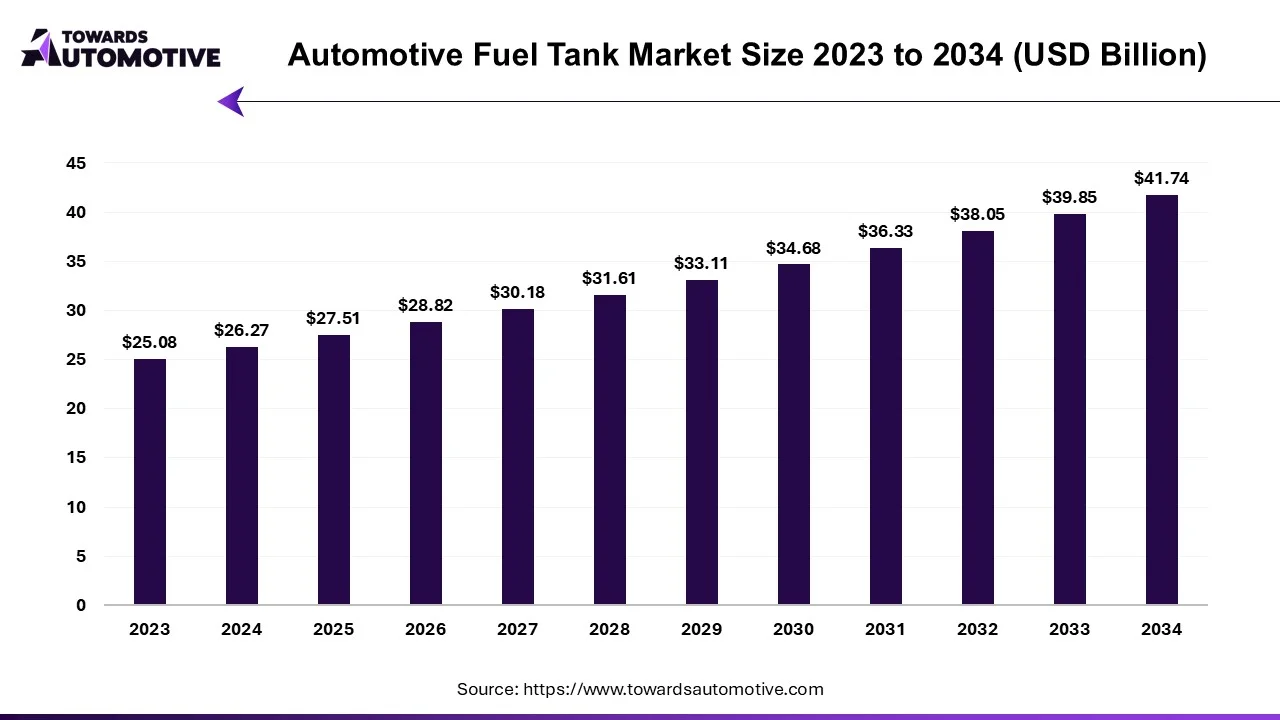

The global automotive fuel tank market is projected to reach USD 41.74 billion by 2034, growing from USD 27.51 billion in 2025, at a CAGR of 4.74% during the forecast period from 2025 to 2034.

The automotive fuel tank market is a critical segment of the global automotive industry, providing essential solutions for fuel storage and delivery in vehicles. Fuel tanks are integral components, designed to safely store fuel and ensure its efficient supply to the engine, thereby influencing vehicle performance and safety. The market has witnessed significant growth due to the rising production and demand for passenger and commercial vehicles worldwide. Factors such as advancements in fuel tank materials, increasing focus on fuel efficiency, and stricter emission regulations are driving innovation in this market. Manufacturers are developing lightweight and durable fuel tanks using materials like high-density polyethylene (HDPE), aluminum, and composites to reduce vehicle weight and enhance fuel efficiency.

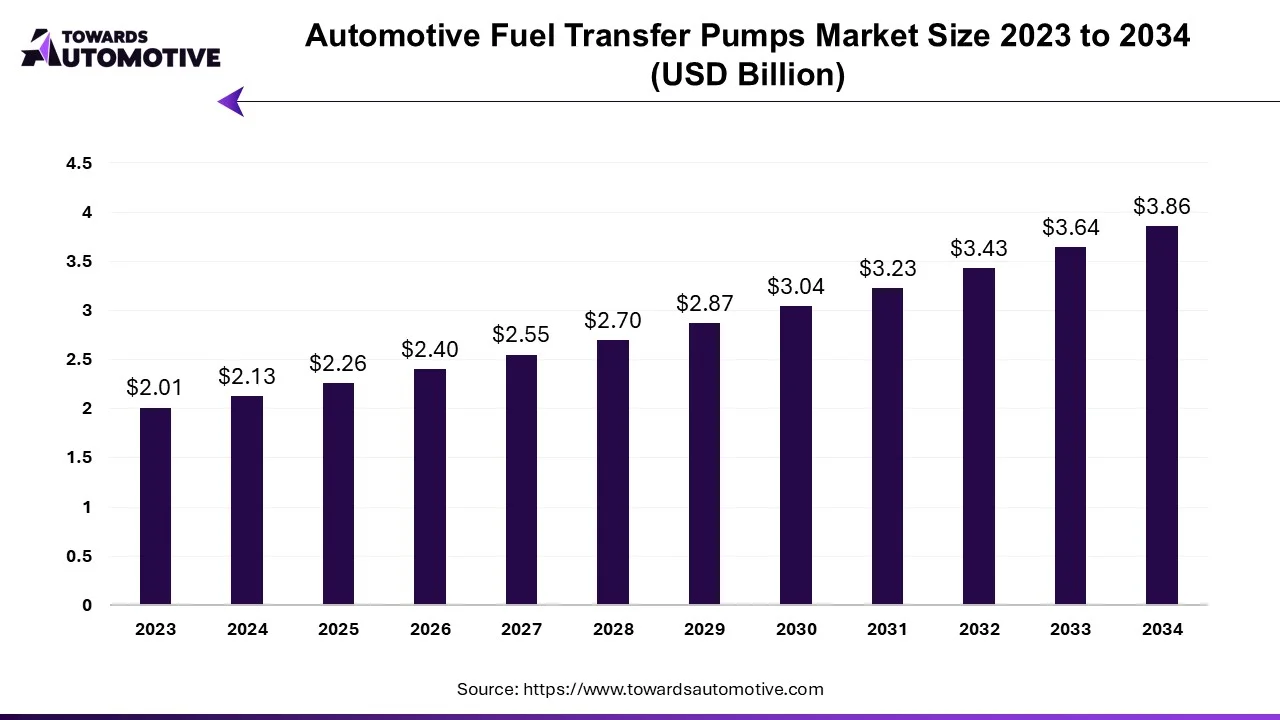

The automotive fuel transfer pumps market is predicted to expand from USD 2.26 billion in 2025 to USD 3.86 billion by 2034, growing at a CAGR of 6.13% during the forecast period from 2025 to 2034.

The automotive fuel transfer pumps market is a crucial segment of the automotive industry. This market deals in manufacturing and distribution of fuel pumps for automotives. There are various types of pumps developed in this industry comprising of fuel injection pump, fuel pump, water pump, vacuum pump and some others. These pumps are based on different technologies such as mechanical and electric. It is designed for several types of vehicles comprising of passenger vehicles and commercial vehicles. The growing demand for passenger cars has boosted the industrial expansion. This market is expected to grow significantly with the rise of the automotive components industry in different parts of the globe.

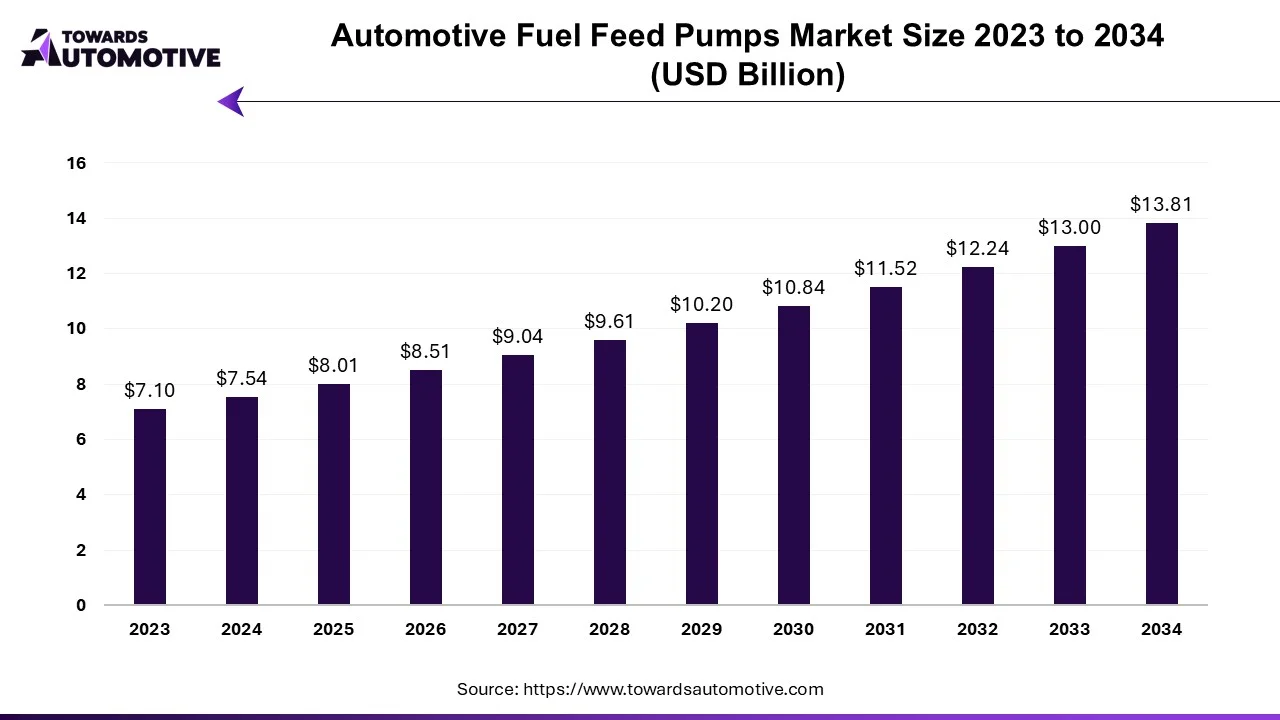

The automotive fuel feed pumps market is expected to increase from USD 8.01 billion in 2025 to USD 13.81 billion by 2034, growing at a CAGR of 6.24% throughout the forecast period from 2025 to 2034.

The automotive fuel feed pumps market is a prominent branch of the automotive industry. This market deals in manufacturing and distribution of fuel feed pumps for automotives. There are different types of fuel pumps available in the market comprising mechanical fuel pumps and electrical fuel pumps. These pumps consist of00 several components including pump assembly, fuel filter, electrical components and fuel pressure regulator. The fuel feed pumps are designed for supporting different types of fuels consisting of gasoline, diesel, ethanol, biodiesel, compressed natural gas (CNG). The growing application of fuel feed pumps in passenger vehicles has boosted the industrial expansion. This market is projected to rise significantly with the growth of the automotive component sector in different parts of the world.

The automotive fuel filter market is a rapidly developing industry with the presence of a several dominating players. Some of the prominent companies in this industry consists of Donaldson Company, Inc., Mahle GmbH, Fram, Bosch, Mann+Hummel, Denso Corporation, ACDelco, Sogefi Group, Cummins Inc., Parker Hannifin Corporation, Hengst Se, UFI Filters, and some others. These companies are constantly engaged in developing fuel filter for the automotive sector and adopting numerous strategies such as launches, partnerships, acquisitions, business expansions, collaborations, joint ventures, and some others to maintain their dominant position in this industry. For instance, in April 2023, Fram launched a new range of synthetic fuel filters. These fuel filters are designed for meeting the needs of the high-pressure automotive engines.

By Filter Type

By Vehicle Type

By Sales Channel

By Fuel Type

By Region

August 2025

August 2025

August 2025

July 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us