December 2025

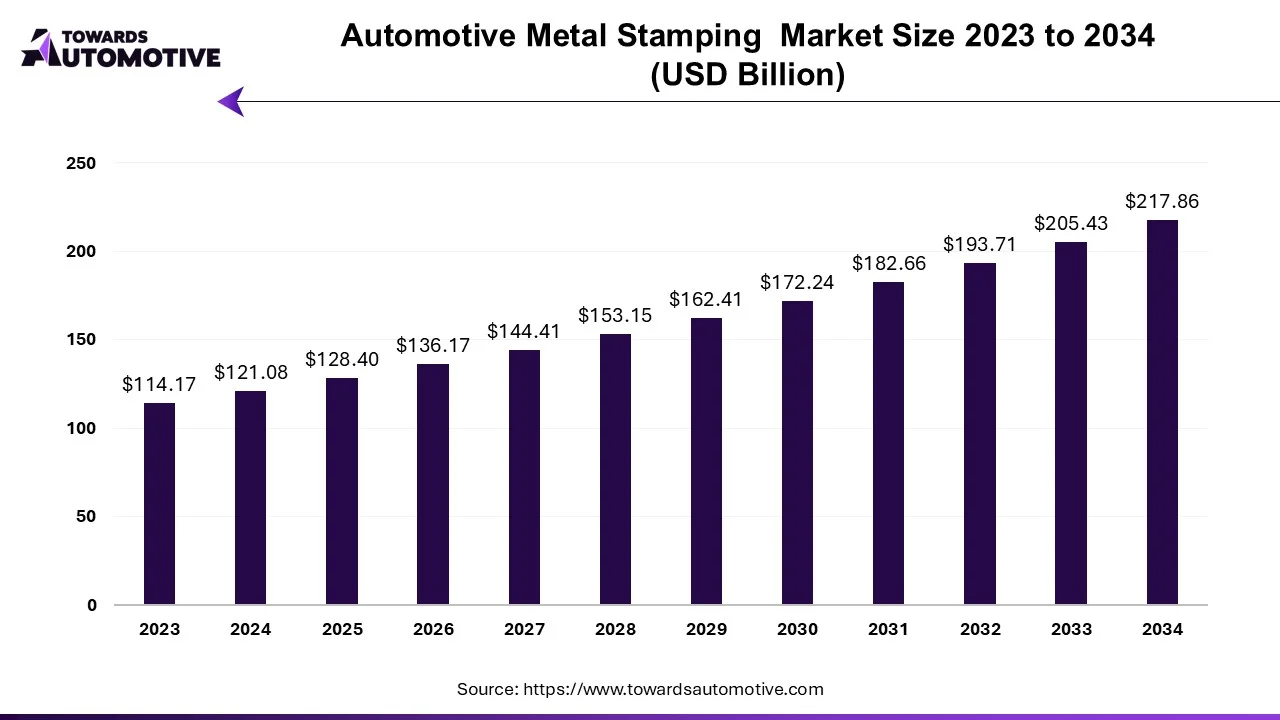

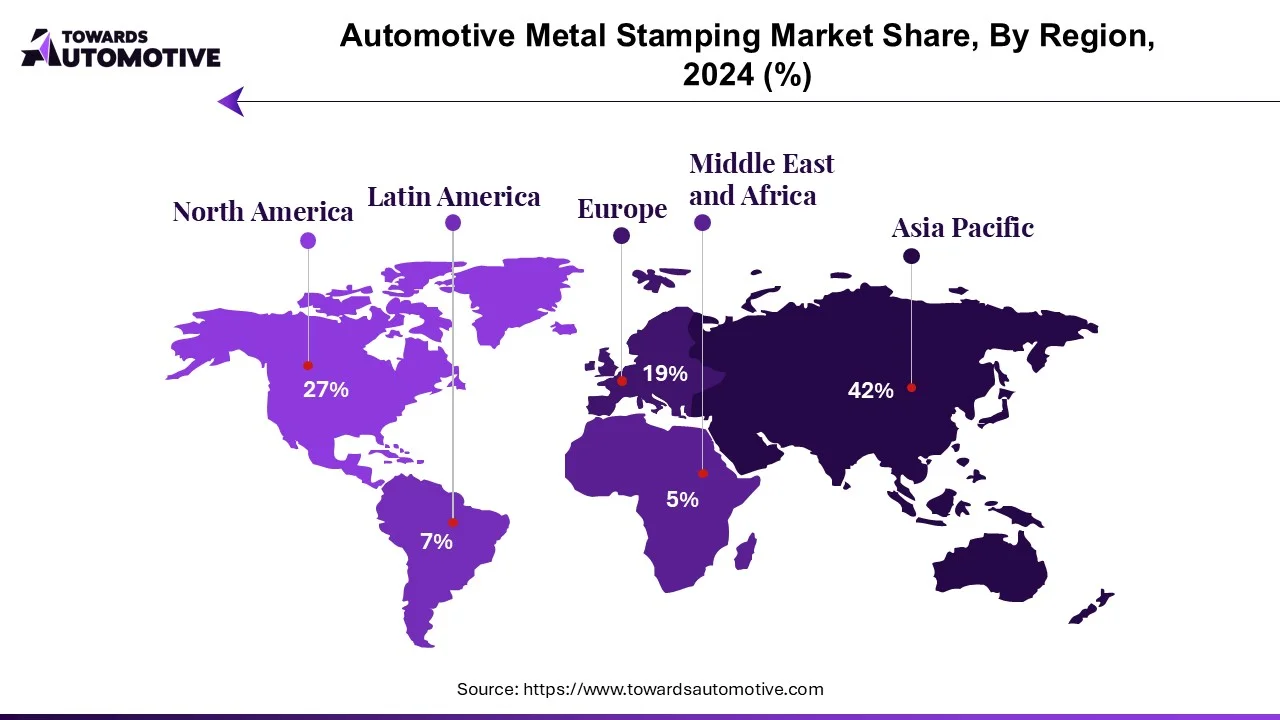

The automotive metal stamping market will expand from USD 128.40 billion in 2025 to USD 217.86 billion by 2034 (CAGR 6.05%). The report quantifies demand by process (blanking largest; bending fastest; embossing; coining; flanging; others) and application (passenger cars lead; LCVs; HCVs fastest; recreational). Regional splits cover Asia Pacific (dominant), North America (significant CAGR), Europe, Latin America, and MEA. Competitive benchmarking profiles Gestamp, Magna, Martinrea, Shiloh, CAPARO, CIE Automotive/MAHINDRA CIE, American Industrial, D&H Industries, Tempco, Goshen Stamping, Kenmode, plus automaker captive stamping (Ford, GM, Nissan, Stellantis). Value-chain mapping traces steel/aluminum coil/blank supply dies/tooling press lines (progressive/transfer/hot) sub-assemblies (BIW, chassis, closures) OEMs/aftermarket, with trade intelligence on sheet/coil flows, stamped sub-assemblies, and export corridors (APAC NA/EU; NA tri-country). Supplier scorecards summarize footprints, certifications (IATF 16949), utilization, and 2024–2025 EBITDA bands.

Automotive metal stamping is a manufacturing process that involves using a press to apply pressure to a metal sheet, causing it to deform and take on the desired shape. Blanking (cutting out the desired shape), punching (creating holes), bending, and embossing are some techniques used in the process. The process is widely used to manufacture a wide variety of automotive parts such as engine, interior, transmission components, and body panels.

Strong vehicle sales in the domestic and international markets, technological advancements in the automotive industry, sectoral vehicle demand, and economic growth due to the automotive industry are some of the drivers of this industry. Increased vehicle production leads to increased adoption of automotive metal stamping to produce efficient and cost-effective stamped parts.

The increasing electric vehicle (EV) adoption significantly impacts the automotive metal stamping industry due to the requirement for high-performance, lightweight, and durable vehicle components. EVs need robust and lightweight battery enclosures which fuels the demand for metal-stamped busbars that effectively distribute power throughout the vehicle. Long-lasting drivetrain and chassis parts are produced using metal stamping. The increased demand for automotive components leads to greater competition among stamping manufacturers, resulting in collaboration and innovation to meet market needs.

The increased demand for lightweight materials is driving the automotive metal stamping industry. Lightweight as well as strong vehicle components are created using metal stamping, leading to better fuel economy and reduced vehicular emissions. The use of stamped lightweight materials such as aluminum and high-strength steel in the production of vehicle components helps to lower the automotive component weight. The production of intricate automotive components with high structural integrity is possible using metal stamping.

The advanced manufacturing process in metal stamping enhances precision, reduces waste, and improves the efficiency of automotive components. Better quality parts and faster production times can be achieved by using AMP. The use of advanced materials, computerized design, manufacturing systems (CAD/CAM), and innovative techniques such as progressive die stamping and additive manufacturing (3D printing) are some of the ways to implement AMP for automotive component production. Companies such as BMW, McLaren, Ferrari, General Motors, Lamborghini, and some more utilize 3D printing in metal stamping to produce automotive components.

Robotics and automation are heavily utilized in automotive metal stamping to tackle parts, weld, and assemble automotive components, enhancing safety and minimizing human error. Robots perform tasks with precision and consistency, ensuring that automotive parts meet strict specifications. Robots efficiently load and unload metal sheets or blanks into stamping presses, and helps in speeding up the overall stamping process. Companies such as FANUC, KUKA, Yaskawa, Kawasaki, and ABB supply robotic systems to automakers such as General Motors, Ford, and Mercedes-Benz for enhancing the capabilities of stamping.

Hot stamping is an important process in the automotive industry for manufacturing lightweight, efficient, and strong vehicle components. The process involves heating a steel sheet, then forming it into a desired shape using a hot die, and rapidly cooling it to gain a high-strength, martensitic microstructure. This process allows for the creation of complex shapes and structures with high strength-to-weight ratios, making it ideal for critical parts such as vehicle pillars, roof rails, and bumper beams. Multiple key companies are utilizing hot stamping technology to produce automotive components.

Automotive Metal Stamping Market Size, By Process, (USD Billion)

| 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | 2032 | 2033 | 2034 | |

| Blanking (Dominated) | 42.38 | 44.62 | 46.98 | 49.46 | 52.08 | 54.81 | 57.7 | 60.72 | 63.91 | 67.28 | 70.8 |

| Embossing | 18.16 | 19.39 | 20.7 | 22.1 | 23.58 | 25.17 | 26.87 | 28.68 | 30.61 | 32.66 | 34.86 |

| Bending | 21.79 | 23.18 | 24.65 | 26.21 | 27.87 | 29.64 | 31.52 | 33.52 | 35.64 | 37.9 | 40.3 |

| Coining | 12.11 | 12.78 | 13.48 | 14.22 | 15.01 | 15.84 | 16.71 | 17.63 | 18.6 | 19.62 | 20.7 |

| Flanging | 14.53 | 15.54 | 16.61 | 17.76 | 18.99 | 20.3 | 21.7 | 23.2 | 24.8 | 26.5 | 28.32 |

| Others | 12.11 | 12.9 | 13.75 | 14.66 | 15.62 | 16.65 | 17.74 | 18.91 | 20.15 | 21.47 | 22.88 |

The blanking process segment holds the largest share in the automotive metal stamping industry due to the growing demand for automotive parts. Blanking presses are capable of high-speed operations, allowing rapid production cycles, especially for large-scale manufacturing. The process is highly automated and it reduces labor costs. Blanking reduces material waste by optimizing the use of metal sheets that in turn leads to a sustainable manufacturing approach. Blanking can handle different metals and complex shapes, making it adaptable for different automotive parts. The blanking process can help to provide required automotive parts as quickly as the demand rises. Feintool, TIDC India, Precision Resource, Mudhra Fine Blanc Pvt Ltd (MIM), and Majestic Auto are some of the companies that use blanking for automotive component production.

The bending process is the fastest-growing segment in the market due to its efficiency to enhance manufacturing process of automotive components. It is used to provide stiffness to the metal. Along with providing precision and consistency, the process is important for producing components such as body panels, brackets, and suspension parts. Bending, especially when used in conjunction with other stamping processes, can be a cost-effective way to produce parts in large quantities. The use of tooling and automation in bending operations also contributes to efficient production and reduces the need for labor. Gestamp, Magna International, Shiloh Industries, CAPARO, D&H Industries, Ice Industries, Inc. Tempco Manufacturing Company, Martinrea International, American Industrial Co., and some others are companies that use the bending process.

The passenger vehicle segment is dominating the market due to increasing purchasing power, urbanization, technological advancements in the automotive industry, and changing consumer preferences towards cars. Rapid economic development in emerging countries from Asia Pacific and Latin America is also driving the market. Consumer preferences are shifting towards vehicles with feature-rich options, better safety, and comfort. This trend is particularly dominant in emerging markets where rising disposable incomes and improving living standards are fueling the demand for passenger vehicles.

The heavy commercial vehicles segment is growing at a faster pace in the automotive metal stamping market due to increasing demand for efficient transportation, the need for cost-effective logistics, increasing e-commerce, automotive infrastructure development, and rapid urbanization. They facilitate the movement of goods and materials essential for daily life, supporting various industries and public services. It is particularly important for long-distance transportation and large-scale projects.

Automotive Metal Stamping Market Size, By Region, (USD Billion)

| 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | 2032 | 2033 | 2034 | |

| North America | 27.85 | 29.4 | 31.05 | 32.78 | 34.61 | 36.54 | 38.58 | 40.73 | 43 | 45.4 | 47.93 |

| Europe | 25.43 | 26.84 | 28.32 | 29.89 | 31.55 | 33.3 | 35.14 | 37.08 | 39.13 | 41.29 | 43.57 |

| Asia-Pacific (Dominated) | 53.27 | 56.74 | 60.4 | 64.33 | 68.49 | 72.92 | 77.64 | 82.68 | 88.03 | 93.71 | 99.78 |

| Latin America | 8.48 | 9 | 9.56 | 10.15 | 10.78 | 11.45 | 12.16 | 12.91 | 13.71 | 14.57 | 15.47 |

| Middle East & Africa | 6.05 | 6.43 | 6.84 | 7.26 | 7.72 | 8.2 | 8.72 | 9.26 | 9.84 | 10.46 | 11.11 |

Asia Pacific dominated the global automotive metal stamping market due to its growing automotive industry, rapid urbanization, and industrialization. Countries such as China, Japan, and India are playing a crucial role in the market due to the high production of vehicles, penetration of EVs, heavy investment in the automotive infrastructure by automakers, R&D by key companies, and the expansion of manufacturing units. Supporting government policies and the availability of affordable labor further fuel the region's dominance. Asia Pacific primarily exports automotive components to Europe, the United States, and Africa.

China is a major player in the automotive metal stamping market due to rapid advancement in automotive technology, cost-effective manufacturing, and the presence of major companies such as Yijin Solution and Acro Metal Stamping. China exports automotive metal stamping products to countries such as the United States, Vietnam, Russia, Mexico, Hong Kong, Japan, and South Korea.

The Indian automotive metal stamping industry is growing significantly with multiple players engaged in manufacturing a wide range of parts for various vehicle segments such as Body-In-White (BIW) panels, structural parts, suspension parts, and fuel tanks for passenger vehicles and off-highway vehicles. Companies are investing heavily in advanced technology and manufacturing processes to improve product quality and lower costs. Several well-established metal stamping companies of India consists of JBM Group, KLT Automotive and Tubular Products Limited, Automotive Stampings and Assemblies Ltd (ASAL), CIE Automotive, and Mahindra CIE Automotive Limited.

North America is the fastest-growing region due to the well-established automotive industry, automotive manufacturing base, active R&D, robust supply chain network, and rise in Electric Vehicles (EVs) adoption. North America is home to major automakers such as Ford, General Motors, Stellantis, and some others.

The North American automotive supply chain is a network that connects the United States, Canada, and Mexico, with a significant focus on cross-border operations and trade. Success in the North American automotive supply chain is a result of collaboration between manufacturers, suppliers, and logistics providers. The U.S. is a key country that exports automotive metal stamped products to export destinations including Canada, Mexico, Germany, France, the UK, Japan, China, India, and South Korea. Canada is home to some key companies such as Magna International, Jefferson Metal Products, CIE Automotive, Manor Tool & Manufacturing Co, and G & M Manufacturing Corp and others.

Multiple international and domestic companies collectively hold significant share of the automotive metal stamping market. Some prominent companies are American Industrial Co., D&H Industries, CAPARO, Goshen Stamping Company, Ford Motor Company, Tempco Manufacturing Company, General Motors, Gestamp, Kenmode, Nissan Motor, FCA, AAPICO Hitech Public Company Limited, and some others. These companies are engaged in research and development to improve quality of automotive components using advanced metal stamping techniques. Some companies are collaborating and acquiring other companies for better collective outcomes.

By Process

By Application

By Region

December 2025

October 2025

October 2025

October 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us