August 2025

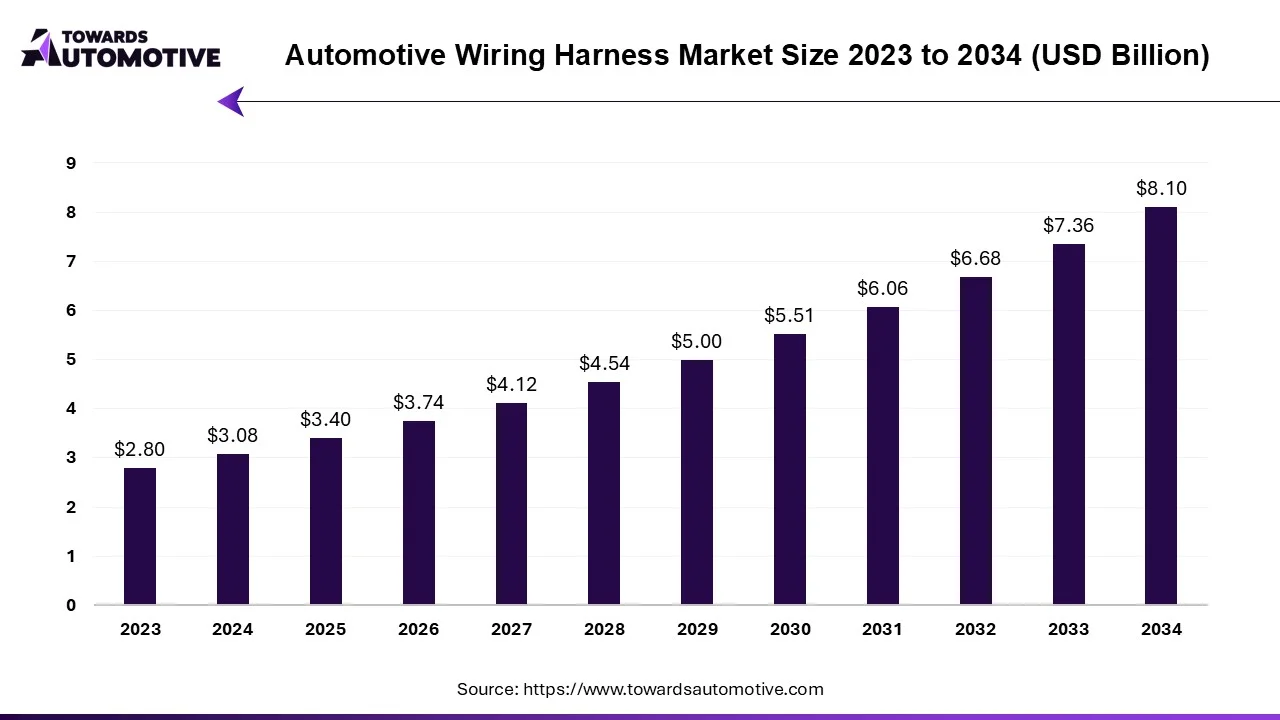

The automotive wiring harness market is forecast to grow from USD 3.40 billion in 2025 to USD 8.10 billion by 2034, driven by a CAGR of 10.14% from 2025 to 2034. The rising adoption of electric vehicles in developing nations coupled with numerous government initiatives aimed at developing the EV charging infrastructure is playing a vital role in shaping the industrial landscape.

Moreover, constant research and development related to hybrid powertrains along with rise in number of EV startups has contributed to the overall market expansion. The technological advancements in solid-state batteries as well as integration of advanced sensors in modern EVs is expected to create ample growth opportunities for the market players in the future.

Unlock Infinite Advantages: Subscribe to Annual Membership

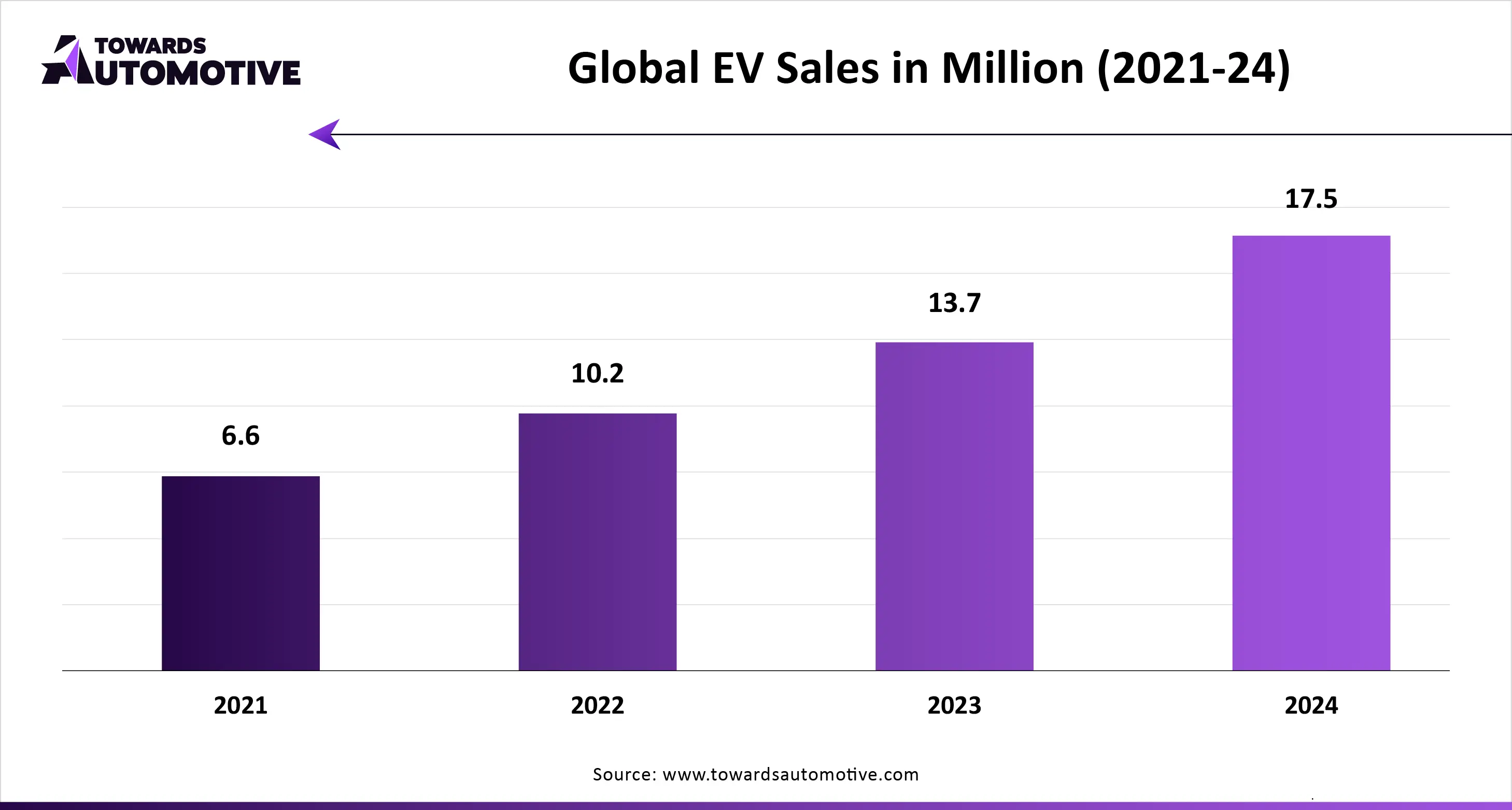

The automotive wiring harness market is a prominent segment of the automotive industry. This industry deals in manufacturing and distribution of wiring systems for the automotive sector. There are several components of wiring harness including electric wires, connectors, terminals and some others. The application of wiring harness consists of body harness, chassis harness, engine harness, HVAC harness, sensors harness and some others. These wiring solutions are designed for numerous types of vehicles such as battery electric vehicles (BEVs) and plug-in hybrid vehicles (PHEVs). The growing sales of EVs in different parts of the world has contributed to the overall industrial expansion. This market is expected to rise significantly with the growth of the electronics sector around the globe.

| Metric | Details |

| Market Size in 2024 | USD 3.08 Billion |

| Projected Market Size in 2034 | USD 8.10 Billion |

| CAGR (2025 - 2034) | 10.14% |

| Leading Region | Asia Pacific |

| Market Segmentation | By Component, By Application, By Electric Vehicle, By Vehicle and By Region |

| Top Key Players | Furukawa Electric Co., Ltd.; Kromberg & Schubert GmbH Cable & Wire |

The major trends in this market consists of acquisitions, business expansions and increasing sales of EVs.

Several market players are acquiring small companies to increase the manufacturing output of automotive wiring harness. For instance, in May 2025, Lear Corporation acquired StoneShield Engineering. This acquisition is done for enhancing the production output of EV wiring harness in Portugal. (Source: Stock Titan)

Numerous wiring harness brands are investing heavily for opening up new production facilities to cater the needs of the automotive sector. For instance, in August 2024, LS Cable & Systems announced to open a new manufacturing plant in Mexico. This new manufacturing facility is inaugurated to increase the production of wiring harness in this nation. (Source: AL CIRCLE)

The sales of EVs have increased rapidly in different parts of the world due to the increasing prices of gasoline and rising awareness about vehicular emission. According to the International Energy Agency, the global sales of EVs exceeded 17 million in 2024. (Source: International Energy Agency)

The battery electric vehicle (BEV) segment dominated the market. The growing sales and production of electric vehicles in the APAC region has boosted the market expansion. Additionally, numerous government initiatives aimed at strengthening the EV industry coupled with integration of high-quality batteries in modern EVs is playing a vital role in shaping the industrial landscape. Moreover, rapid investment by automotive companies to develop affordable BEVs is expected to boost the growth of the automotive wiring harness market.

The plug-in-hybrid vehicle (PHEV) segment is expected to rise with a considerable CAGR during the forecast period. The increasing demand for PHEVs in several countries such as the U.S., Germany, India, South Africa and some others has driven the industrial growth. Also, technological advancements in hybrid powertrains coupled with high-driving range offered by these vehicles is contributing to the market expansion. Moreover, the absence of well-established EV charging network in developing nations is expected to drive the growth of the automotive wiring harness market.

The terminal segment held the largest share of the market. The growing use of terminal components in EVs to enhance safety has boosted the market expansion. Also, the integration of advanced connectivity features in EVs including quick-connect terminals, crimples terminals, and waterproof terminals is further adding to the industrial growth. Moreover, rapid investment by market players for developing high-quality terminal harness is expected to drive the growth of the automotive wiring harness market.

The connector segment is expected to grow with the fastest CAGR during the forecast period. The growing adoption of connectors in modern vehicles for transferring data between different automotive components has driven the market growth. Additionally, the increasing use of advanced connectors in autonomous vehicles coupled with rapid shift towards modular connectors is contributing to the overall industrial expansion. Moreover, the rising sales of electric vehicles in different regions of the world is expected to propel the growth of the automotive wiring harness market.

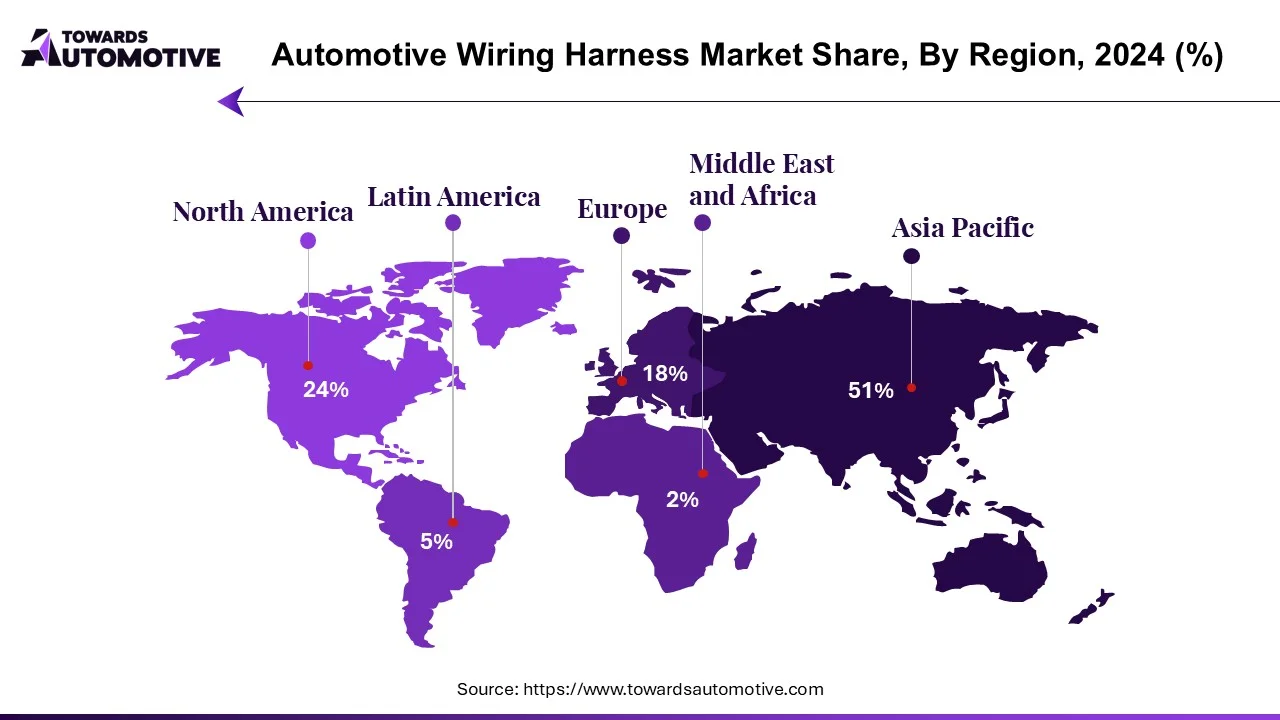

Asia Pacific led the automotive wiring harness market. The growing adoption of hybrid vehicles in several countries such as India, South Korea, Japan, China and some others has boosted the market expansion. Additionally, numerous government initiatives aimed at strengthening the EV charging infrastructure coupled with rise in number of EV startups has contributed to the industrial growth. Moreover, the presence of several market players such as Sumitomo Electric Industries, Ltd., Yazaki Corporation, Furukawa Electric Co., Ltd. and some others is expected to propel the growth of the automotive wiring harness market in this region.

North America is expected to expand with a significant CAGR during the forecast period. The rising sales of electric vehicles in the U.S. and Canada has driven the market expansion. Also, rapid investment by government for developing the EV industry coupled with increasing awareness of people to reduce vehicular emission is positively shaping to the industry. Moreover, the presence of numerous local companies such as Lear Corporation, Aptiv PLC, BorgWarner, Inc and some others is expected to propel the growth of the automotive wiring harness market in this region.

The automotive wiring harness market is a highly fragmented industry with the presence of several dominating players. Some of the prominent companies in this industry consists of Lear Corporation; Furukawa Electric Co., Ltd.; Kromberg & Schubert GmbH Cable & Wire; China Auto Electronics Group Limited (THB Group); Delphi Technologies PLC (Aptiv PLC); Sumitomo Electric Industries, Ltd.; Yazaki Corporation; Leoni AG; Spark Minda, Ashok Minda Group and some others. These companies are constantly engaged in manufacturing wiring solutions for the automotive sector and adopting numerous strategies such as joint ventures, acquisitions, partnerships, launches, business expansions, collaborations and some others to maintain their dominance in this industry.

By Component

By Application

By Electric Vehicle

By Vehicle

By Region

August 2025

August 2025

August 2025

July 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us